M1pr Form

What is the M1PR Form

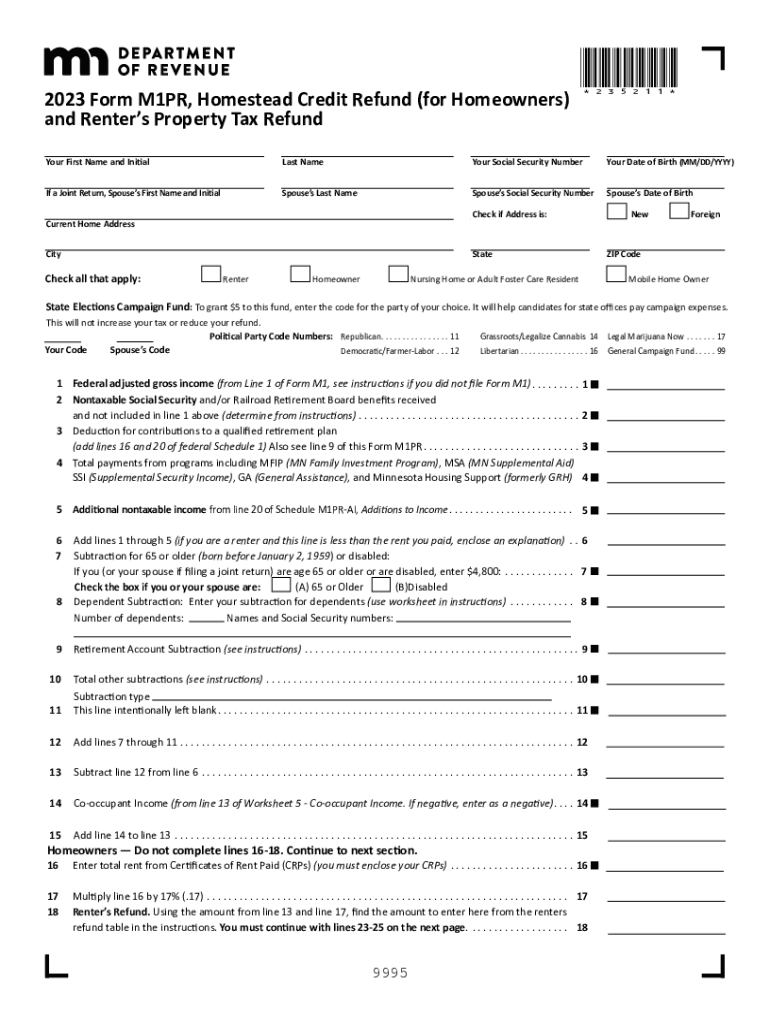

The Minnesota Form M1PR is a property tax refund application designed for renters and homeowners in Minnesota. This form allows eligible individuals to claim a refund on property taxes paid, which can significantly alleviate financial burdens. The M1PR form is specifically tailored for the 2023 tax year, incorporating updated guidelines and eligibility criteria. Understanding this form is crucial for anyone looking to benefit from Minnesota's property tax relief programs.

How to Use the M1PR Form

Using the Minnesota Form M1PR involves a straightforward process. First, gather all necessary documentation, including proof of rent paid or property taxes, and any income statements. Next, accurately fill out the form, ensuring all information is complete and correct. Finally, submit the form by the specified deadline to the Minnesota Department of Revenue. This process ensures that you can receive your refund efficiently.

Steps to Complete the M1PR Form

Completing the M1PR form requires careful attention to detail. Follow these steps:

- Obtain the form from the Minnesota Department of Revenue website or local offices.

- Fill in your personal information, including name, address, and Social Security number.

- Provide details about your rental payments or property taxes.

- Calculate your refund amount using the provided tables in the form.

- Review your form for accuracy before submitting.

Eligibility Criteria

To qualify for a refund using the Minnesota Form M1PR, applicants must meet specific eligibility criteria. Generally, you must be a resident of Minnesota and have paid rent or property taxes on a homestead during the tax year. Additionally, your income must fall within certain limits set by the state. It is essential to review these criteria to ensure eligibility before applying.

Required Documents

When completing the M1PR form, several documents are required to support your application. These include:

- Proof of rent payments or property tax statements.

- Income documentation, such as W-2 forms or tax returns.

- Identification information, including your Social Security number.

Having these documents ready will facilitate a smoother application process.

Filing Deadlines / Important Dates

For the 2023 tax year, the filing deadline for the Minnesota Form M1PR is typically set for August 15 of the following year. It is crucial to submit your application by this date to ensure eligibility for a refund. Keeping track of these important dates can help avoid any potential issues with your application.

Quick guide on how to complete m1pr form 701425312

Complete M1pr Form effortlessly on any device

Online document management has gained popularity among businesses and individuals alike. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and electronically sign your documents swiftly and without delays. Manage M1pr Form on any device using the airSlate SignNow Android or iOS applications and enhance any document-centric process today.

How to adjust and eSign M1pr Form with ease

- Obtain M1pr Form and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes just moments and carries the same legal significance as a traditional ink signature.

- Review all the information and click the Done button to preserve your changes.

- Choose your preferred method for submitting your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, laborious form searches, or mistakes requiring new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Adjust and eSign M1pr Form and ensure outstanding communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the m1pr form 701425312

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Minnesota Form M1PR 2023, and why is it important?

The Minnesota Form M1PR 2023 is a property tax refund form for homeowners in Minnesota. It's essential for eligible homeowners to file this form to receive potential tax refunds, making it crucial for financial planning. Understanding how to fill out this form correctly can help you maximize your refund.

-

How does airSlate SignNow simplify the process of submitting the Minnesota Form M1PR 2023?

airSlate SignNow provides an easy-to-use platform to complete and eSign the Minnesota Form M1PR 2023 electronically. Our solution streamlines the submission process, ensuring that your forms are filled correctly and sent securely without the hassle of printing and mailing. This saves you time and effort while maintaining compliance.

-

What features does airSlate SignNow offer for users completing the Minnesota Form M1PR 2023?

With airSlate SignNow, users can access advanced features such as templates, drag-and-drop editing, and secure eSignature capabilities for the Minnesota Form M1PR 2023. These tools enable you to fill out the form quickly and accurately, ensuring a smoother filing experience. Additionally, our platform allows for easy collaboration with other stakeholders if needed.

-

Are there any subscription fees associated with using airSlate SignNow for the Minnesota Form M1PR 2023?

airSlate SignNow offers various pricing plans tailored to different needs, making it a cost-effective solution for managing the Minnesota Form M1PR 2023. While there may be subscription fees, our plans provide excellent value given the tools and features available, which help streamline document management and eSigning. Additionally, we offer a free trial to explore our services.

-

Can I integrate airSlate SignNow with other applications when working on the Minnesota Form M1PR 2023?

Yes, airSlate SignNow offers numerous integrations with popular applications, enhancing your ability to manage tasks related to the Minnesota Form M1PR 2023. You can connect with tools like Google Drive, Dropbox, and Microsoft Office, allowing for seamless access to your documents. This integration capability helps streamline your workflow and improve efficiency.

-

What are the benefits of using airSlate SignNow for the Minnesota Form M1PR 2023?

Using airSlate SignNow for the Minnesota Form M1PR 2023 provides numerous benefits, including improved efficiency, enhanced document security, and easy access anywhere. Our platform helps reduce errors in form submission and ensures that your sensitive information is protected. These advantages can ultimately lead to a quicker and more reliable filing process.

-

Is the Minnesota Form M1PR 2023 available in multiple languages on airSlate SignNow?

Currently, the Minnesota Form M1PR 2023 is available in English. However, airSlate SignNow is continually working on ways to enhance user experience, including support for various languages in the future. This focus on accessibility ensures users can complete important documents comfortably.

Get more for M1pr Form

- Letter from landlord to tenant as notice to tenant to repair damage caused by tenant maryland form

- Letter tenant landlord notice sample form

- Letter from tenant to landlord containing notice to landlord to cease retaliatory decrease in services maryland form

- Temporary lease agreement to prospective buyer of residence prior to closing maryland form

- Letter from tenant to landlord containing notice to landlord to cease retaliatory threats to evict or retaliatory eviction 497310261 form

- Letter from landlord to tenant returning security deposit less deductions maryland form

- Letter from tenant to landlord containing notice of failure to return security deposit and demand for return maryland form

- Letter from tenant to landlord containing notice of wrongful deductions from security deposit and demand for return maryland form

Find out other M1pr Form

- Electronic signature Delaware High Tech Quitclaim Deed Online

- Electronic signature Maine Insurance Quitclaim Deed Later

- Electronic signature Louisiana Insurance LLC Operating Agreement Easy

- Electronic signature West Virginia Education Contract Safe

- Help Me With Electronic signature West Virginia Education Business Letter Template

- Electronic signature West Virginia Education Cease And Desist Letter Easy

- Electronic signature Missouri Insurance Stock Certificate Free

- Electronic signature Idaho High Tech Profit And Loss Statement Computer

- How Do I Electronic signature Nevada Insurance Executive Summary Template

- Electronic signature Wisconsin Education POA Free

- Electronic signature Wyoming Education Moving Checklist Secure

- Electronic signature North Carolina Insurance Profit And Loss Statement Secure

- Help Me With Electronic signature Oklahoma Insurance Contract

- Electronic signature Pennsylvania Insurance Letter Of Intent Later

- Electronic signature Pennsylvania Insurance Quitclaim Deed Now

- Electronic signature Maine High Tech Living Will Later

- Electronic signature Maine High Tech Quitclaim Deed Online

- Can I Electronic signature Maryland High Tech RFP

- Electronic signature Vermont Insurance Arbitration Agreement Safe

- Electronic signature Massachusetts High Tech Quitclaim Deed Fast