F 45016 Wisconsin Form

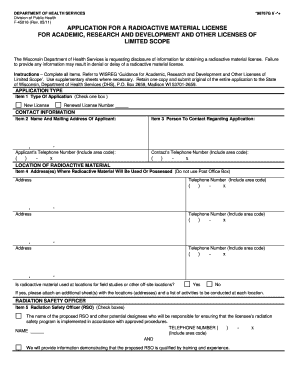

What is the F 45016 Wisconsin Form

The F 45016 Wisconsin Form is a specific document used for reporting certain tax-related information within the state of Wisconsin. This form is typically utilized by individuals and businesses to report income, deductions, and other financial data relevant to state tax obligations. Understanding the purpose and requirements of this form is essential for compliance with Wisconsin tax laws.

How to use the F 45016 Wisconsin Form

Using the F 45016 Wisconsin Form involves several steps to ensure accurate completion. First, gather all necessary financial documents, including income statements and deduction records. Next, carefully fill out the form, providing all required information as specified in the instructions. After completing the form, review it for accuracy before submission to avoid potential penalties or delays in processing.

Steps to complete the F 45016 Wisconsin Form

Completing the F 45016 Wisconsin Form requires attention to detail. Follow these steps:

- Gather all relevant financial documents, such as W-2s, 1099s, and receipts for deductions.

- Fill out the personal information section, including your name, address, and Social Security number.

- Report your income accurately in the designated sections.

- List any deductions or credits you are eligible for, ensuring you have supporting documentation.

- Double-check all entries for accuracy and completeness.

- Sign and date the form before submission.

Legal use of the F 45016 Wisconsin Form

The F 45016 Wisconsin Form must be used in accordance with state tax laws. It is legally binding, meaning that the information provided must be accurate and truthful. Misrepresentation or failure to file this form can lead to legal consequences, including fines or other penalties. It is important to understand the legal implications of submitting this form to ensure compliance with Wisconsin tax regulations.

Filing Deadlines / Important Dates

Filing deadlines for the F 45016 Wisconsin Form vary depending on the tax year and the type of filer. Generally, individual taxpayers must submit their forms by April 15 of the following year. Businesses may have different deadlines based on their fiscal year. It is crucial to stay informed about these dates to avoid late fees and ensure timely processing of your tax return.

Form Submission Methods

The F 45016 Wisconsin Form can be submitted through several methods. Taxpayers have the option to file online using state-approved e-filing systems, which provide a convenient and efficient way to submit forms. Alternatively, the form can be mailed to the appropriate state tax office. In-person submissions may also be possible at designated tax offices. Each method has its own processing times and requirements, so choose the one that best fits your needs.

Quick guide on how to complete f 45016 wisconsin form

Complete F 45016 Wisconsin Form seamlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an excellent eco-friendly alternative to traditional printed and signed paperwork, allowing you to find the right form and securely save it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents quickly and efficiently. Manage F 45016 Wisconsin Form on any device using the airSlate SignNow Android or iOS applications and simplify your document-related tasks today.

The simplest way to edit and eSign F 45016 Wisconsin Form effortlessly

- Find F 45016 Wisconsin Form and click Get Form to begin.

- Make use of the tools we offer to complete your form.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Generate your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to save your updates.

- Choose how you wish to share your form, whether by email, text message (SMS), invitation link, or by downloading it to your PC.

Say goodbye to lost or misplaced documents, tedious form hunting, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs with just a few clicks from any device of your choice. Edit and eSign F 45016 Wisconsin Form to ensure outstanding communication throughout your form preparation process using airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the f 45016 wisconsin form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the F 45016 Wisconsin Form?

The F 45016 Wisconsin Form is a specific document required for certain tax-related purposes in Wisconsin. It is essential for individuals and businesses to understand its requirements to ensure compliance with state regulations. Using airSlate SignNow can simplify the process of completing and eSigning this form.

-

How can airSlate SignNow help with the F 45016 Wisconsin Form?

airSlate SignNow provides an intuitive platform for filling out and eSigning the F 45016 Wisconsin Form. With its user-friendly interface, you can easily upload, edit, and send the form for signatures, streamlining your workflow. This ensures that you can complete your documentation quickly and efficiently.

-

What are the pricing options for using airSlate SignNow for the F 45016 Wisconsin Form?

airSlate SignNow offers various pricing plans to accommodate different business needs, including options for individuals and teams. Each plan provides access to features that can assist with the F 45016 Wisconsin Form, ensuring you get the best value for your investment. You can choose a plan that fits your budget and requirements.

-

Are there any features specifically designed for the F 45016 Wisconsin Form?

Yes, airSlate SignNow includes features that enhance the experience of working with the F 45016 Wisconsin Form. These features include customizable templates, automated workflows, and secure eSigning capabilities. This ensures that your documents are handled efficiently and securely.

-

Can I integrate airSlate SignNow with other applications for the F 45016 Wisconsin Form?

Absolutely! airSlate SignNow offers integrations with various applications, allowing you to streamline your processes when working with the F 45016 Wisconsin Form. Whether you use CRM systems, cloud storage, or other productivity tools, you can easily connect them to enhance your workflow.

-

What are the benefits of using airSlate SignNow for the F 45016 Wisconsin Form?

Using airSlate SignNow for the F 45016 Wisconsin Form provides numerous benefits, including time savings, improved accuracy, and enhanced security. The platform allows for quick eSigning and document management, reducing the risk of errors. Additionally, your documents are stored securely, ensuring compliance with regulations.

-

Is airSlate SignNow compliant with Wisconsin regulations for the F 45016 Wisconsin Form?

Yes, airSlate SignNow is designed to comply with Wisconsin regulations regarding the F 45016 Wisconsin Form. The platform adheres to industry standards for electronic signatures and document management, ensuring that your submissions meet legal requirements. This gives you peace of mind when handling sensitive documents.

Get more for F 45016 Wisconsin Form

- Towing reimbursement fax documents form

- Hrsdc ppu 116 forms download

- Yogli mogli job application form

- Birth certificate form 536243774

- Personal registration form michael page

- Erd 4971 request to withdraw complaint this form is used to withdraw a civil rights complaint

- Studentfamily residence questionnaire education for homeless homeless dpi wi form

- Kansas city mo rabies vaccination and license certificate form

Find out other F 45016 Wisconsin Form

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors