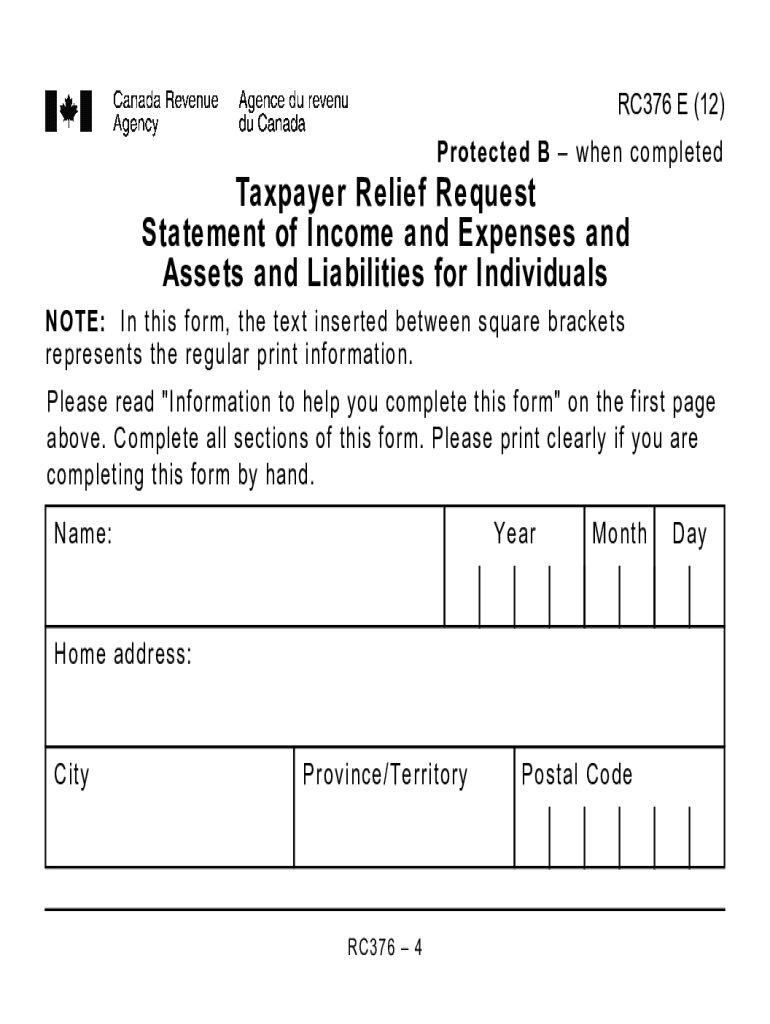

Rc376 Form 2012

What is the Rc376 Form

The Rc376 form is a specific document used primarily for tax purposes in the United States. It is designed to assist individuals and businesses in reporting certain financial information to the relevant tax authorities. This form may be required for various situations, including income reporting, deductions, or credits applicable to the taxpayer's circumstances. Understanding the purpose of the Rc376 form is essential for compliance with tax regulations and to ensure accurate reporting of financial data.

How to use the Rc376 Form

Using the Rc376 form involves several key steps to ensure proper completion and submission. First, gather all necessary financial information, including income statements and any relevant documentation that supports the claims made on the form. Next, fill out the form accurately, ensuring that all fields are completed as required. It is crucial to double-check entries for accuracy to avoid any potential issues with tax authorities. After completing the form, submit it according to the guidelines provided, which may include online submission or mailing it to the appropriate office.

Steps to complete the Rc376 Form

Completing the Rc376 form requires careful attention to detail. Follow these steps for successful completion:

- Step 1: Gather all necessary documents, including income records and any deductions you plan to claim.

- Step 2: Download or obtain a copy of the Rc376 form from the appropriate source.

- Step 3: Fill out the form, ensuring that all required fields are completed accurately.

- Step 4: Review the completed form for any errors or omissions.

- Step 5: Submit the form according to the specified submission guidelines.

Legal use of the Rc376 Form

The Rc376 form must be used in accordance with U.S. tax laws and regulations. This means that the information provided on the form should be truthful and accurate, reflecting the taxpayer's actual financial situation. Misuse or fraudulent reporting on the Rc376 form can lead to penalties, including fines or other legal repercussions. It is essential to understand the legal implications of the form and to ensure compliance with all relevant laws when submitting it.

Who Issues the Form

The Rc376 form is typically issued by the Internal Revenue Service (IRS) or the relevant state tax authority. These agencies provide guidelines and instructions for completing the form, ensuring that taxpayers have the necessary resources to comply with reporting requirements. It is important to obtain the form directly from these official sources to ensure that you are using the most current version and following the correct procedures.

Filing Deadlines / Important Dates

Filing deadlines for the Rc376 form can vary depending on the specific circumstances of the taxpayer. Generally, forms must be submitted by the annual tax filing deadline, which is typically April 15 for individual taxpayers. However, certain situations may allow for extensions or different deadlines. It is crucial to stay informed about these dates to avoid late submissions, which can result in penalties or interest on unpaid taxes.

Quick guide on how to complete rc376 form

Effortlessly Handle Rc376 Form on Any Device

Digital document management has gained traction among companies and individuals alike. It offers a perfect environmentally friendly alternative to traditional printed and signed documents, as you can obtain the correct form and securely store it online. airSlate SignNow provides all the tools you need to create, edit, and eSign your documents swiftly without any hold-ups. Manage Rc376 Form on any device using airSlate SignNow apps for Android or iOS and simplify any document-centric process today.

How to Edit and eSign Rc376 Form with Ease

- Obtain Rc376 Form and click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes just moments and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow addresses all your document management needs in a few clicks from any device you prefer. Edit and eSign Rc376 Form and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct rc376 form

Create this form in 5 minutes!

How to create an eSignature for the rc376 form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is rc376 and how does it relate to airSlate SignNow?

The rc376 is a unique identifier for a specific feature set within airSlate SignNow. It represents our commitment to providing businesses with an efficient eSigning solution. By utilizing rc376, users can streamline their document workflows and enhance productivity.

-

How much does airSlate SignNow cost with the rc376 feature?

Pricing for airSlate SignNow with the rc376 feature varies based on the plan you choose. We offer flexible pricing options to accommodate businesses of all sizes. For detailed pricing information, please visit our pricing page or contact our sales team.

-

What are the key features of airSlate SignNow associated with rc376?

The rc376 feature includes advanced eSigning capabilities, document templates, and real-time tracking. These features are designed to simplify the signing process and improve document management. With rc376, users can also integrate with various applications for enhanced functionality.

-

What benefits does rc376 offer to businesses using airSlate SignNow?

By leveraging the rc376 feature, businesses can signNowly reduce the time spent on document signing. This leads to faster turnaround times and improved customer satisfaction. Additionally, rc376 enhances security and compliance, ensuring that your documents are handled safely.

-

Can I integrate airSlate SignNow with other tools using rc376?

Yes, airSlate SignNow supports integrations with various tools and platforms through the rc376 feature. This allows users to connect their existing workflows seamlessly. Popular integrations include CRM systems, cloud storage services, and project management tools.

-

Is there a free trial available for airSlate SignNow with rc376?

Yes, we offer a free trial of airSlate SignNow that includes access to the rc376 feature. This allows potential customers to explore the platform and its capabilities without any commitment. Sign up today to experience the benefits of rc376 firsthand.

-

How does rc376 improve document security in airSlate SignNow?

The rc376 feature enhances document security by implementing advanced encryption and authentication measures. This ensures that your sensitive information remains protected throughout the signing process. With rc376, you can trust that your documents are secure and compliant with industry standards.

Get more for Rc376 Form

- Piecework contract form

- Vehicle rendition confidential 5629577 form

- Travelers waiver of probate and agreement of indemnity form

- Jnv medical fitness certificate form

- Sibley medical records form

- Dr roland sing urologist reviews ampamp ratings form

- Hvcors login form

- Cshc application form fill online printable fillable blank

Find out other Rc376 Form

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple

- eSignature Virginia Healthcare / Medical Living Will Computer

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online

- eSignature Alabama Insurance Forbearance Agreement Safe

- How Can I eSignature Arkansas Insurance LLC Operating Agreement

- Help Me With eSignature Michigan High Tech Emergency Contact Form

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now

- How Do I eSignature Mississippi Insurance Separation Agreement

- Help Me With eSignature Missouri Insurance Profit And Loss Statement

- eSignature New Hampshire High Tech Lease Agreement Template Mobile

- eSignature Montana Insurance Lease Agreement Template Online

- eSignature New Hampshire High Tech Lease Agreement Template Free