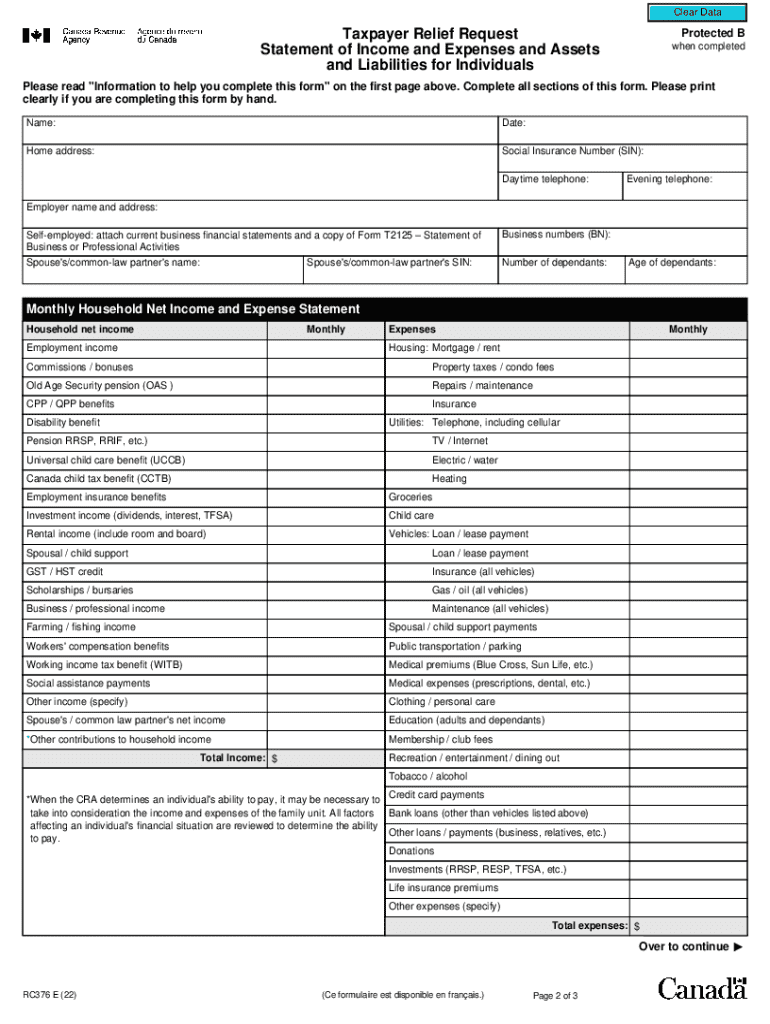

Taxpayer Relief RequestStatement of Income and Expenses and Assetsand Liabilities for Individuals 2022-2026

Understanding the Taxpayer Relief Request

The rc376 form, known as the Taxpayer Relief Request, is a document used by individuals to request relief from penalties or interest on unpaid taxes. This form is particularly relevant for taxpayers facing financial hardships or unexpected circumstances that hinder their ability to meet tax obligations. It provides a structured way to present your case to the IRS, detailing your situation and the reasons for your request.

Steps to Complete the Taxpayer Relief Request

Completing the rc376 form involves several key steps:

- Gather necessary documentation, including financial statements and proof of hardship.

- Fill out the form accurately, ensuring all required fields are completed.

- Clearly explain your circumstances in the designated section, providing as much detail as possible.

- Review the form for accuracy before submission, checking for any errors or omissions.

- Submit the form to the appropriate IRS office as specified in the instructions.

Eligibility Criteria for the Taxpayer Relief Request

To qualify for relief using the rc376 form, taxpayers must meet certain eligibility criteria. This typically includes demonstrating a valid reason for the inability to pay taxes on time, such as:

- Severe financial hardship due to job loss or medical expenses.

- Natural disasters that have impacted income or property.

- Other extenuating circumstances that justify the request for relief.

It is essential to provide supporting documentation that substantiates your claims.

Required Documents for Submission

When submitting the rc376 form, taxpayers should include several key documents to support their request. These may include:

- Proof of income, such as recent pay stubs or tax returns.

- Documentation of expenses, including bills and statements.

- Any relevant correspondence with the IRS regarding your tax situation.

Having these documents ready can help streamline the review process and strengthen your case.

Form Submission Methods

The rc376 form can be submitted to the IRS through various methods. Taxpayers can choose to:

- File the form online, if applicable, through the IRS website.

- Mail a hard copy of the form to the designated IRS address.

- In some cases, deliver the form in person at a local IRS office.

Choosing the right submission method can impact the processing time of your request.

IRS Guidelines for the Taxpayer Relief Request

The IRS provides specific guidelines for completing and submitting the rc376 form. It is important to follow these instructions carefully to avoid delays. Key guidelines include:

- Ensure that all sections of the form are completed fully and accurately.

- Submit the form within the timeframe specified by the IRS for penalty relief requests.

- Keep copies of all submitted documents for your records.

Adhering to these guidelines can increase the likelihood of a favorable outcome.

Quick guide on how to complete taxpayer relief requeststatement of income and expenses and assetsand liabilities for individuals

Complete Taxpayer Relief RequestStatement Of Income And Expenses And Assetsand Liabilities For Individuals effortlessly on any gadget

Digital document management has become increasingly favored by businesses and individuals alike. It serves as an excellent eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the correct form and securely keep it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents promptly without any delays. Handle Taxpayer Relief RequestStatement Of Income And Expenses And Assetsand Liabilities For Individuals on any gadget with airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The easiest method to alter and electronically sign Taxpayer Relief RequestStatement Of Income And Expenses And Assetsand Liabilities For Individuals without hassle

- Obtain Taxpayer Relief RequestStatement Of Income And Expenses And Assetsand Liabilities For Individuals and then click Get Form to commence.

- Utilize the tools at your disposal to finish your document.

- Emphasize signNow sections of the documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your electronic signature with the Sign feature, which takes seconds and holds the same legal validity as a traditional ink signature.

- Verify all the details and then click on the Done button to save your edits.

- Choose your preferred method for delivering your form, whether by email, SMS, invitation link, or downloading it to your computer.

Put aside concerns about lost or mislaid files, tedious form hunts, or mistakes that require new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Taxpayer Relief RequestStatement Of Income And Expenses And Assetsand Liabilities For Individuals and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct taxpayer relief requeststatement of income and expenses and assetsand liabilities for individuals

Create this form in 5 minutes!

How to create an eSignature for the taxpayer relief requeststatement of income and expenses and assetsand liabilities for individuals

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the rc376 form and how is it used?

The rc376 form is a document used for specific regulatory purposes, often related to compliance and reporting. Businesses utilize this form to ensure they meet necessary legal requirements. airSlate SignNow simplifies the process of filling out and eSigning the rc376 form, making it efficient and straightforward.

-

How can airSlate SignNow help with the rc376 form?

airSlate SignNow provides an easy-to-use platform for creating, sending, and eSigning the rc376 form. With its intuitive interface, users can quickly fill out the form and obtain signatures from multiple parties. This streamlines the process and reduces the time spent on paperwork.

-

Is there a cost associated with using airSlate SignNow for the rc376 form?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. Each plan provides access to features that facilitate the eSigning and management of documents like the rc376 form. You can choose a plan that fits your budget and requirements.

-

What features does airSlate SignNow offer for the rc376 form?

airSlate SignNow includes features such as customizable templates, secure eSigning, and document tracking specifically for forms like the rc376 form. These features enhance the user experience and ensure that all necessary steps are completed efficiently. Additionally, users can collaborate in real-time, making it easier to finalize documents.

-

Can I integrate airSlate SignNow with other applications for the rc376 form?

Absolutely! airSlate SignNow offers integrations with various applications, allowing you to streamline your workflow when handling the rc376 form. Whether you use CRM systems or cloud storage solutions, these integrations help you manage documents more effectively.

-

What are the benefits of using airSlate SignNow for the rc376 form?

Using airSlate SignNow for the rc376 form provides numerous benefits, including increased efficiency, reduced errors, and enhanced security. The platform ensures that your documents are signed and stored securely, while also allowing for easy access and management. This ultimately saves time and resources for your business.

-

Is airSlate SignNow compliant with regulations for the rc376 form?

Yes, airSlate SignNow is designed to comply with various regulations, ensuring that your use of the rc376 form meets legal standards. The platform adheres to industry best practices for security and compliance, giving you peace of mind when handling sensitive documents.

Get more for Taxpayer Relief RequestStatement Of Income And Expenses And Assetsand Liabilities For Individuals

- Weekly sleep log 101554012 form

- Metrobank remittance form

- Mayo portland adaptability inventory 4 pdf form

- Statement of exemption to immunization law commonwealth of form

- Colorado general durable power of attorney for property and finances or financial effective immediately form

- Ambetter peach state reviews form

- Ochsner power of attorney for health care decisions ochsner form

- Body art apprentice checklist form

Find out other Taxpayer Relief RequestStatement Of Income And Expenses And Assetsand Liabilities For Individuals

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors