1038 Form 2018-2026

What is the 1038 Form

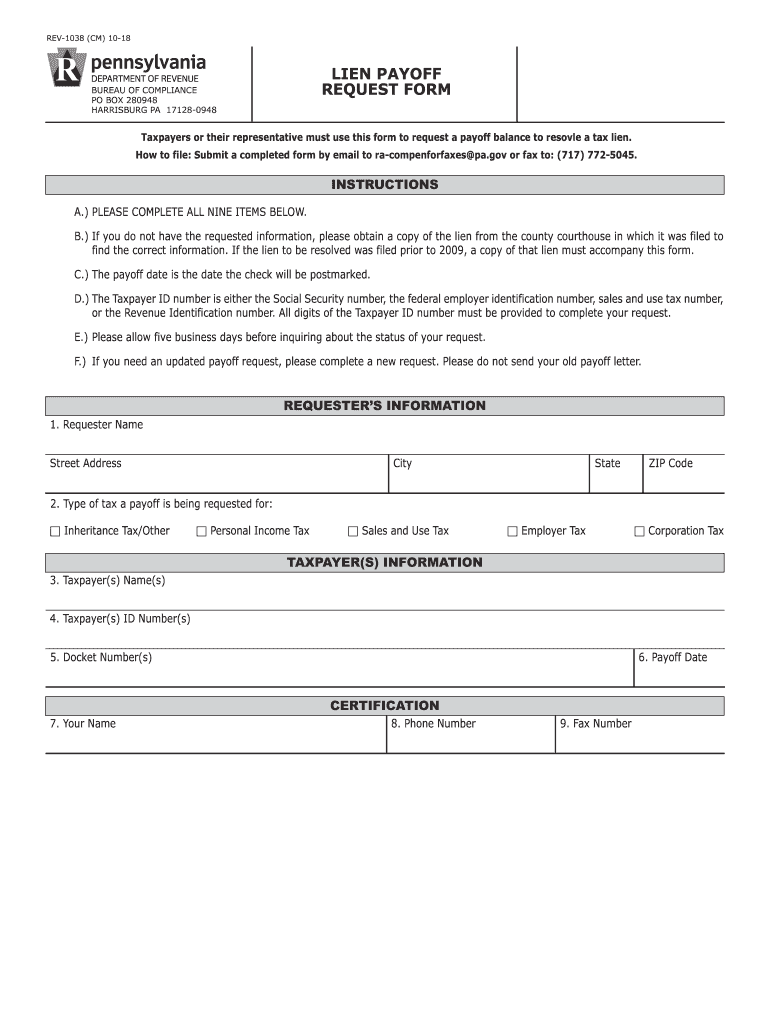

The 1038 form, also known as the IRS lien payoff request form, is a crucial document used by taxpayers to request the release of a federal tax lien. This form is specifically designed to facilitate the process of clearing a lien that may have been placed on a taxpayer's property due to unpaid taxes. Understanding the purpose of the 1038 form is essential for individuals looking to regain their financial standing and remove any barriers to property transactions.

How to use the 1038 Form

Using the 1038 form involves several steps to ensure that the request is processed smoothly. First, gather all necessary information, including your personal details and the specifics of the lien. Next, accurately fill out the form, ensuring that all required fields are completed. After filling out the form, review it for any errors or omissions before submitting it. Once the form is complete, you can submit it electronically or via mail, depending on your preference and the guidelines provided by the IRS.

Steps to complete the 1038 Form

Completing the 1038 form requires careful attention to detail. Follow these steps:

- Obtain the latest version of the 1038 form from the IRS website or a trusted source.

- Fill in your personal information, including your name, address, and Social Security number.

- Provide details regarding the lien, including the date it was filed and the amount owed.

- Sign and date the form to validate your request.

- Submit the form according to the instructions provided, either online or by mail.

Legal use of the 1038 Form

The 1038 form serves a legal purpose in the context of tax law. It is recognized by the IRS as an official request for the release of a lien, which means that it must be completed accurately and submitted in accordance with federal regulations. Failure to comply with the legal requirements associated with this form can result in delays or denials of your request, making it essential to understand the legal implications of using the 1038 form.

Filing Deadlines / Important Dates

Timely submission of the 1038 form is critical. While there may not be a specific deadline for submitting the form, it is advisable to file it as soon as you are eligible to ensure that your request is processed promptly. Additionally, keep in mind any deadlines related to tax payments or other financial obligations that may be impacted by the lien.

Required Documents

When submitting the 1038 form, certain documents may be required to support your request. These may include:

- Proof of payment for any outstanding taxes.

- Documentation showing the lien details, such as the lien notice.

- Any correspondence with the IRS related to the lien.

Having these documents ready can help streamline the process and ensure that your request is not delayed.

Quick guide on how to complete rev 1038 pa department of revenue pagov

Your assistance manual on how to prepare your 1038 Form

If you’re interested in learning how to create and dispatch your 1038 Form, here are some straightforward guidelines to simplify tax processing.

To start, you just need to set up your airSlate SignNow account to revolutionize how you manage documents online. airSlate SignNow is an incredibly user-friendly and powerful document solution that enables you to modify, generate, and finalize your tax forms effortlessly. Utilizing its editor, you can toggle between text, check boxes, and eSignatures, and revert to alter information as necessary. Enhance your tax management with sophisticated PDF editing, eSigning, and easy sharing.

Follow the instructions below to complete your 1038 Form in no time:

- Create your account and begin working on PDFs in moments.

- Use our library to locate any IRS tax form; explore different versions and schedules.

- Click Obtain form to access your 1038 Form in our editor.

- Complete the necessary fillable fields with your information (text, numbers, check marks).

- Utilize the Signature Tool to add your legally-binding eSignature (if required).

- Examine your document and correct any mistakes.

- Save modifications, print your copy, send it to your recipient, and download it to your device.

Make use of this manual to file your taxes electronically with airSlate SignNow. Please remember that submitting in paper form can lead to return errors and postponed refunds. Certainly, before e-filing your taxes, verify the IRS website for submission guidelines in your state.

Create this form in 5 minutes or less

Find and fill out the correct rev 1038 pa department of revenue pagov

Create this form in 5 minutes!

How to create an eSignature for the rev 1038 pa department of revenue pagov

How to create an eSignature for your Rev 1038 Pa Department Of Revenue Pagov in the online mode

How to generate an eSignature for the Rev 1038 Pa Department Of Revenue Pagov in Chrome

How to make an electronic signature for signing the Rev 1038 Pa Department Of Revenue Pagov in Gmail

How to generate an eSignature for the Rev 1038 Pa Department Of Revenue Pagov from your smart phone

How to create an electronic signature for the Rev 1038 Pa Department Of Revenue Pagov on iOS

How to generate an electronic signature for the Rev 1038 Pa Department Of Revenue Pagov on Android OS

People also ask

-

What is a PA lien form and why is it important?

A PA lien form is a legal document used to claim a right or interest in an asset until a debt owed by the asset's owner is paid. This form is crucial for securing payments in real estate transactions and ensures that creditors can protect their financial interests.

-

How can I create a PA lien form using airSlate SignNow?

Creating a PA lien form with airSlate SignNow is simple and user-friendly. You can choose from various templates, fill in the necessary details, and electronically sign it, ensuring a swift and secure process for your documentation needs.

-

Is airSlate SignNow suitable for multiple users to manage PA lien forms?

Yes, airSlate SignNow is designed to accommodate multiple users, allowing teams to collaborate effectively on PA lien forms. The platform provides unique permissions and roles to ensure that each team member can contribute securely.

-

What pricing plans does airSlate SignNow offer for managing PA lien forms?

airSlate SignNow offers various pricing plans tailored to different business needs, starting from affordable options for small businesses to comprehensive enterprise solutions. Each plan includes features that allow you to create and manage PA lien forms efficiently.

-

Does airSlate SignNow integrate with other applications for PA lien form management?

Absolutely! airSlate SignNow integrates seamlessly with popular applications like Google Drive, Salesforce, and Dropbox. This integration helps streamline your workflow when managing PA lien forms across different platforms.

-

What security measures does airSlate SignNow have for PA lien forms?

airSlate SignNow prioritizes security with advanced features such as end-to-end encryption and secure cloud storage. These measures ensure your PA lien forms and sensitive data are protected from unauthorized access.

-

Can I customize my PA lien form within airSlate SignNow?

Yes, airSlate SignNow allows you to customize your PA lien form according to your specific requirements. You can add fields, branding, and personalized messages to make the form more relevant to your business needs.

Get more for 1038 Form

- Justgivemethedamnmanual form

- Identifying sounds of poetry 1 answer key form

- Chapter arrangement of electrons in atoms form

- Cessna 206h model pod installation document aerocet form

- Dws ira form

- Medical conditions form

- Certificate of occupancy phoenix 204816951 form

- City of coppell building inspections form

Find out other 1038 Form

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word

- Can I eSignature Tennessee Police Form

- How Can I eSignature Vermont Police Presentation

- How Do I eSignature Pennsylvania Real Estate Document

- How Do I eSignature Texas Real Estate Document

- How Can I eSignature Colorado Courts PDF

- Can I eSignature Louisiana Courts Document

- How To Electronic signature Arkansas Banking Document

- How Do I Electronic signature California Banking Form

- How Do I eSignature Michigan Courts Document

- Can I eSignature Missouri Courts Document

- How Can I Electronic signature Delaware Banking PDF

- Can I Electronic signature Hawaii Banking Document

- Can I eSignature North Carolina Courts Presentation

- Can I eSignature Oklahoma Courts Word

- How To Electronic signature Alabama Business Operations Form

- Help Me With Electronic signature Alabama Car Dealer Presentation