Pa Estate Information Sheet Rev 946 2015

What is the Pa Estate Information Sheet Rev 946

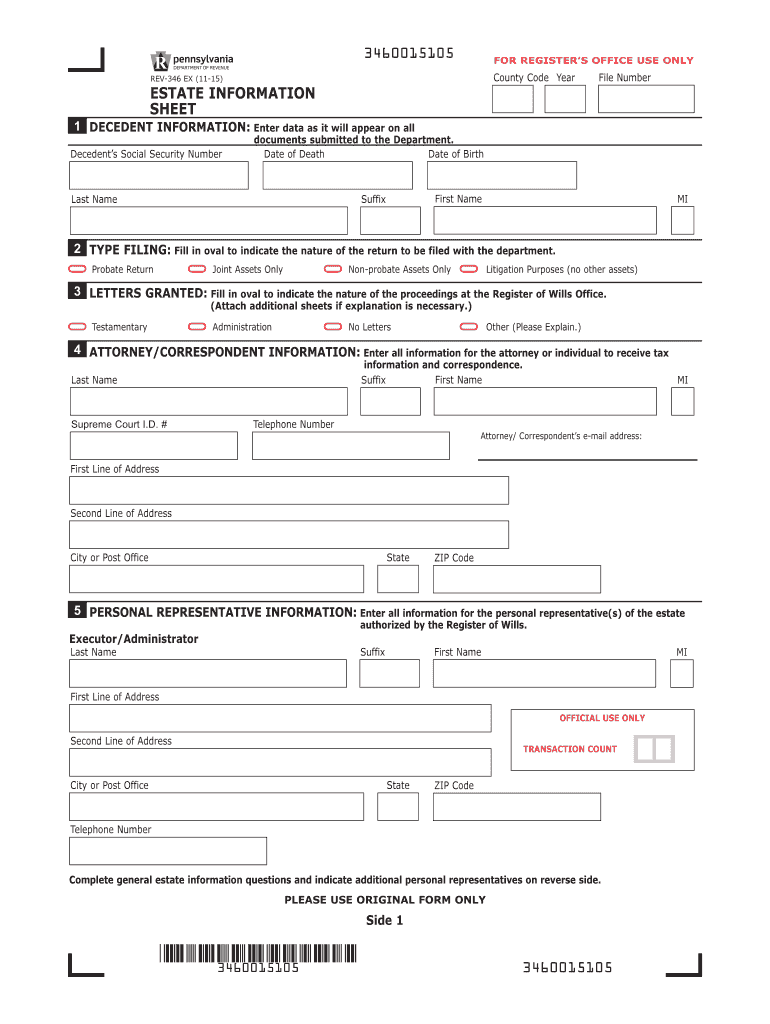

The Pa Estate Information Sheet Rev 946 is a crucial document used in Pennsylvania for reporting estate-related information. This form is designed to collect essential details about the estate of a deceased individual, including the assets, liabilities, and beneficiaries. It is a necessary component in the estate settlement process and ensures compliance with state regulations. Understanding this form is vital for executors and administrators managing an estate, as it aids in the proper distribution of assets and fulfillment of tax obligations.

Key elements of the Pa Estate Information Sheet Rev 946

The Pa Estate Information Sheet Rev 946 includes several key elements that must be accurately completed. These elements typically consist of:

- Decedent Information: Name, date of death, and social security number.

- Executor Details: Name and contact information of the executor or administrator.

- Asset Overview: A comprehensive list of the estate's assets, including real estate, bank accounts, and personal property.

- Liabilities: Any outstanding debts or obligations that the estate must settle.

- Beneficiary Information: Names and details of individuals or entities entitled to inherit from the estate.

Completing these sections accurately is essential for the smooth processing of the estate and compliance with Pennsylvania law.

Steps to complete the Pa Estate Information Sheet Rev 946

Completing the Pa Estate Information Sheet Rev 946 involves several important steps:

- Gather Information: Collect all necessary documents related to the decedent’s estate, including financial statements, property deeds, and beneficiary details.

- Fill Out the Form: Accurately enter the required information in each section of the form. Ensure that all data is current and correct.

- Review for Accuracy: Double-check all entries for accuracy and completeness to avoid delays in processing.

- Sign the Document: The executor or administrator must sign the form, affirming that the information provided is true to the best of their knowledge.

- Submit the Form: File the completed form with the appropriate Pennsylvania estate office, either online or by mail.

Following these steps carefully can help ensure that the estate is managed efficiently and in accordance with legal requirements.

Legal use of the Pa Estate Information Sheet Rev 946

The Pa Estate Information Sheet Rev 946 serves a legal purpose in the estate administration process. It is used to formally report the estate's financial status to the Pennsylvania Department of Revenue. This form must be filed to comply with state laws governing estate taxes and inheritance. Failure to submit this form can result in penalties and delays in the distribution of the estate's assets. Understanding its legal implications is essential for executors to fulfill their duties responsibly.

Form Submission Methods

The Pa Estate Information Sheet Rev 946 can be submitted through various methods, providing flexibility for executors. These methods include:

- Online Submission: Executors can complete and submit the form electronically through the Pennsylvania Department of Revenue's online portal.

- Mail Submission: The completed form can be printed and mailed to the appropriate estate office.

- In-Person Submission: Executors may also choose to submit the form in person at designated state offices.

Choosing the right submission method can streamline the process and ensure timely compliance with state requirements.

Examples of using the Pa Estate Information Sheet Rev 946

Using the Pa Estate Information Sheet Rev 946 can vary based on different scenarios. For instance:

- A family member acting as the executor of an estate must complete the form to report assets and liabilities before distributing inheritance.

- A trust administrator may use the form to provide details about a decedent's estate when settling a trust that includes estate assets.

- In cases where multiple beneficiaries are involved, the form helps clarify each party's entitlement and ensures all legal requirements are met.

These examples illustrate the versatility and importance of the Pa Estate Information Sheet Rev 946 in various estate management situations.

Quick guide on how to complete estate information sheet rev 346

Your assistance manual on how to set up your Pa Estate Information Sheet Rev 946

If you’re interested in understanding how to finalize and submit your Pa Estate Information Sheet Rev 946, here are a few concise instructions on how to simplify tax reporting.

First, you simply need to create your airSlate SignNow account to transform how you manage documents online. airSlate SignNow is an extremely user-friendly and powerful document tool that allows you to modify, generate, and complete your income tax documents effortlessly. With its editor, you can toggle between text, checkboxes, and eSignatures and return to modify details as necessary. Optimize your tax administration with enhanced PDF editing, eSigning, and straightforward sharing features.

Follow the instructions below to complete your Pa Estate Information Sheet Rev 946 in just a few minutes:

- Establish your account and begin editing PDFs within moments.

- Utilize our directory to access any IRS tax form; browse through variations and schedules.

- Select Get form to open your Pa Estate Information Sheet Rev 946 in our editor.

- Fill in the essential fillable areas with your details (text, numbers, checkmarks).

- Utilize the Sign Tool to add your legally-valid eSignature (if necessary).

- Examine your document and correct any mistakes.

- Save modifications, print your copy, send it to your intended recipient, and download it to your device.

Leverage this manual to electronically file your taxes with airSlate SignNow. Please be aware that submitting in print can lead to return mistakes and delay refunds. It goes without saying, before e-filing your taxes, check the IRS website for reporting regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct estate information sheet rev 346

FAQs

-

How can I get information I copy and paste onto a sheet, to fill into the correct columns I want?

Use the tools on the Data…Get and Transform to import the data from its source onto the proper columns in Excel. This feature (formerly called PowerQuery is a native part of Excel 2016, and is available as an add-in for Excel 2010 & 2013.What can you do with Get and Transform? You can split or combine columns, remove unneeded columns or rows, add calculated columns, retrieve matching values from lookup tables, change text strings to upper or lower case, unpivot summarized data, and transpose data. Behind the scenes, Excel is making a little script that can be used to automate these operations in the future. So if this is a repetitive task (something you do every week or need to do on a bunch of files), it is well worth your while to build and debug the script.Sample problem performed using Get and TransformVideo clip showing Get and Transform in action

-

When Cognizant drops an email to you containing a candidate information sheet and asks you to fill out details and respond back, what does it mean?

A2AAre you an experienced person looking for a Job change? If yes, then the company HR might require your details for initial screening to schedule an interview.Myself being a developer here, I have given you a info as per my knowledge. If you need more information regarding this you can contact HR who has sent you the email.

-

What is the procedure for filling out the candidate information sheet of Cognizant online?

S Kiran's answer to What should every engineering student know before joining TCS, CTS, Wipro, Infosys, Accenture, HCL, or IBM?

-

How can I add my business location on instagram"s suggested locations?

Making a custom location on Instagram is actually quite easy and gives you an advantage to other businesses because it allows you to drive traffic via location.First off, Facebook owns Instagram; therefore, any location listed on Facebook also appears on Instagram. So you are going to need to create a business location on Facebook.So let’s dive into how to create a business location on Instagram.Make sure that you have enabled location services through the Facebook App or in your phone settings. If you are using an iPhone, select “Settings” → “Account Settings” → “Location” → “While Using The App”You need to create a Facebook check-in status. You do this by making a status and type the name of what you want your location to be called. For example “Growth Hustlers HQ”. Scroll to the bottom of the options and select “Add Custom Location” then tap on it!Now that you’ve created a custom location you need to describe it. It will ask you to choose which category describes your location, which you will answer “Business”.After choosing a category Facebook will ask you to choose a location. You can either choose “I’m currently here” or you can search for a location that you want to create for your business.Finally, publish your status. Congratulations! You have just created a custom location to be used on Facebook and Instagram.Now you are able to tag your business or a custom location on Instagram.If you have any questions about Social Media Marketing for businesses feel free to check out GrowthHustlers.com where you can find tons of resources about growing your Instagram following.

Create this form in 5 minutes!

How to create an eSignature for the estate information sheet rev 346

How to make an electronic signature for the Estate Information Sheet Rev 346 in the online mode

How to generate an electronic signature for your Estate Information Sheet Rev 346 in Chrome

How to make an electronic signature for signing the Estate Information Sheet Rev 346 in Gmail

How to make an eSignature for the Estate Information Sheet Rev 346 straight from your smartphone

How to create an electronic signature for the Estate Information Sheet Rev 346 on iOS

How to make an eSignature for the Estate Information Sheet Rev 346 on Android OS

People also ask

-

What is a PA estate information sheet?

A PA estate information sheet is a document used in Pennsylvania for estate planning and probate processes. It outlines essential details about the decedent's assets, debts, and beneficiaries. This form is crucial for ensuring accurate estate administration in compliance with state laws.

-

How can airSlate SignNow help with PA estate information sheets?

airSlate SignNow provides an efficient platform for creating, signing, and managing PA estate information sheets electronically. With our easy-to-use interface, users can quickly input necessary information and have documents signed securely, streamlining the estate planning process. This reduces paperwork and saves time for legal professionals and families alike.

-

What are the pricing options for using airSlate SignNow?

airSlate SignNow offers competitive pricing plans tailored to meet the needs of individuals and businesses, including options for those specifically handling PA estate information sheets. Our plans are designed to be cost-effective, providing access to essential features like document templates and secure eSigning. You can choose from monthly or annual subscriptions based on your usage.

-

Is airSlate SignNow secure for handling sensitive estate documents?

Yes, airSlate SignNow prioritizes security, utilizing advanced encryption protocols to protect sensitive documents, including PA estate information sheets. Our platform complies with industry standards to ensure confidentiality and integrity. You can confidently manage and sign your estate documents, knowing they are secure.

-

Can I integrate airSlate SignNow with other tools for estate management?

Absolutely! airSlate SignNow seamlessly integrates with various popular tools and applications used in estate management. This includes CRM systems, cloud storage, and accounting software, allowing you to synchronize your workflow for processing PA estate information sheets and other documents efficiently.

-

What benefits does airSlate SignNow offer for estate planning?

Using airSlate SignNow for estate planning provides numerous benefits, including improved efficiency, enhanced security, and reduced paperwork. The platform allows for real-time collaboration among stakeholders, making it easy to manage PA estate information sheets and other vital documents. Additionally, eSigning accelerates the execution of necessary agreements.

-

How easy is it to create a PA estate information sheet with airSlate SignNow?

Creating a PA estate information sheet with airSlate SignNow is quick and straightforward. Our user-friendly template ensures you can fill in necessary details in minutes without any additional complicated steps. With drag-and-drop features, customizing your document is made simple, making it perfect for professionals and laypersons alike.

Get more for Pa Estate Information Sheet Rev 946

- Application for surrender of policy idbi federal form

- Novo trct comments on change in ownership statement and preliminary change of ownership report revisions form

- Punctuation period question mark exclamation mark the end of form

- Visa application to poland form

- Arizona department of economic security sign insign out record 1 2 form

- Safety service departmentlorain oh form

- Building permit application cincinnati form

- Cmr242 llc filing sheet 533a pdf toll 877 767 3453central form

Find out other Pa Estate Information Sheet Rev 946

- Help Me With eSign Hawaii Acknowledgement Letter

- eSign Rhode Island Deed of Indemnity Template Secure

- eSign Illinois Car Lease Agreement Template Fast

- eSign Delaware Retainer Agreement Template Later

- eSign Arkansas Attorney Approval Simple

- eSign Maine Car Lease Agreement Template Later

- eSign Oregon Limited Power of Attorney Secure

- How Can I eSign Arizona Assignment of Shares

- How To eSign Hawaii Unlimited Power of Attorney

- How To eSign Louisiana Unlimited Power of Attorney

- eSign Oklahoma Unlimited Power of Attorney Now

- How To eSign Oregon Unlimited Power of Attorney

- eSign Hawaii Retainer for Attorney Easy

- How To eSign Texas Retainer for Attorney

- eSign Hawaii Standstill Agreement Computer

- How Can I eSign Texas Standstill Agreement

- How To eSign Hawaii Lease Renewal

- How Can I eSign Florida Lease Amendment

- eSign Georgia Lease Amendment Free

- eSign Arizona Notice of Intent to Vacate Easy