Missing Receipt Form

Understanding the Missing Receipt Form

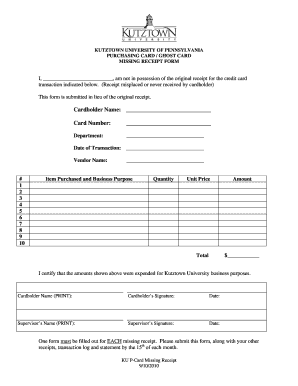

The Missing Receipt Form is a crucial document used primarily for reporting expenses when original receipts are not available. This form is often utilized by employees, freelancers, and business owners to ensure that they can still claim deductions or reimbursements without the physical proof of purchase. It serves as a formal declaration of the expenses incurred and provides a structured way to document these transactions for accounting and tax purposes.

Steps to Complete the Missing Receipt Form

Completing the Missing Receipt Form involves several key steps to ensure accuracy and compliance. First, gather all relevant information regarding the expense, including the date, amount, and purpose. Next, fill out the form by providing detailed descriptions of each expense. It is important to include any additional information that may support your claim, such as the nature of the expense and the reason for the missing receipt. Finally, review the completed form for any errors before submission.

How to Obtain the Missing Receipt Form

The Missing Receipt Form can typically be obtained through your employer’s finance or accounting department, or it may be available on the company’s intranet. For freelancers or self-employed individuals, the form can often be downloaded from various financial websites or created using templates available online. Ensure that you are using the most current version of the form to avoid any compliance issues.

Legal Use of the Missing Receipt Form

Using the Missing Receipt Form legally is essential to maintain compliance with IRS regulations. The form acts as a substitute for a missing receipt, but it must be filled out truthfully and accurately. Misrepresentation of expenses can lead to penalties or audits. Always ensure that the information provided aligns with IRS guidelines to avoid any legal complications.

Key Elements of the Missing Receipt Form

Several key elements must be included in the Missing Receipt Form to ensure it is valid. These include:

- Date of the expense: When the expense occurred.

- Amount: The total cost of the expense.

- Purpose: A brief description of why the expense was incurred.

- Signature: Your signature to affirm the accuracy of the information provided.

Examples of Using the Missing Receipt Form

There are various scenarios where the Missing Receipt Form is applicable. For instance, an employee might use it when attending a business conference and loses a receipt for a meal. Similarly, a freelancer may need to submit this form for travel expenses incurred while meeting with a client. In both cases, the form allows individuals to document and claim expenses despite the absence of original receipts.

Quick guide on how to complete missing receipt form 40470615

Prepare Missing Receipt Form effortlessly on any device

Digital document management has become widely embraced by businesses and individuals alike. It offers an ideal eco-friendly alternative to conventional printed and signed paperwork, as you can easily access the necessary form and securely keep it online. airSlate SignNow equips you with all the resources needed to create, modify, and eSign your documents swiftly without any delays. Handle Missing Receipt Form on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to edit and eSign Missing Receipt Form with ease

- Locate Missing Receipt Form and click Get Form to begin.

- Utilize the tools available to fill out your form.

- Mark essential sections of the documents or conceal sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the details and then click on the Done button to save your modifications.

- Select how you want to share your form, either by email, SMS, or using an invitation link, or download it to your computer.

Eliminate the stress of lost or misplaced documents, cumbersome form searches, or errors requiring new copies. airSlate SignNow caters to all your document management needs in just a few clicks from any device you choose. Edit and eSign Missing Receipt Form and ensure outstanding communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the missing receipt form 40470615

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a ghost credit card?

A ghost credit card is a virtual payment method that allows businesses to make online purchases without using a physical card. This type of card is often used for secure transactions and helps in managing expenses effectively. With airSlate SignNow, you can streamline your document signing process while utilizing ghost credit cards for secure payments.

-

How does airSlate SignNow integrate with ghost credit cards?

airSlate SignNow allows seamless integration with ghost credit cards, enabling businesses to manage their transactions securely. By using ghost credit cards, you can ensure that your payment information remains confidential while signing documents electronically. This integration enhances your overall workflow and security.

-

What are the benefits of using a ghost credit card with airSlate SignNow?

Using a ghost credit card with airSlate SignNow provides enhanced security and control over your transactions. It minimizes the risk of fraud and unauthorized charges, making it a safe option for online payments. Additionally, it simplifies expense tracking and management for businesses.

-

Is there a cost associated with using ghost credit cards in airSlate SignNow?

While airSlate SignNow itself offers a cost-effective solution for document signing, the fees associated with ghost credit cards may vary depending on your financial institution. It's important to check with your bank or card provider for any potential charges. Overall, using ghost credit cards can help you save on transaction costs.

-

Can I use ghost credit cards for recurring payments in airSlate SignNow?

Yes, you can use ghost credit cards for recurring payments when utilizing airSlate SignNow. This feature allows businesses to automate their payment processes while ensuring that sensitive information remains protected. By leveraging ghost credit cards, you can maintain a smooth and secure transaction flow.

-

Are ghost credit cards safe to use with airSlate SignNow?

Absolutely, ghost credit cards are designed to enhance security during online transactions. When used with airSlate SignNow, they provide an additional layer of protection for your payment information. This makes them a reliable option for businesses looking to safeguard their financial data.

-

What features does airSlate SignNow offer for managing ghost credit card transactions?

airSlate SignNow offers various features to help manage ghost credit card transactions, including tracking and reporting tools. These features allow businesses to monitor their spending and ensure compliance with financial policies. By integrating ghost credit cards, you can streamline your financial management processes.

Get more for Missing Receipt Form

Find out other Missing Receipt Form

- eSign Hawaii Business Credit Application Mobile

- Help Me With eSign California Credit Memo

- eSign Hawaii Credit Memo Online

- Help Me With eSign Hawaii Credit Memo

- How Can I eSign Hawaii Credit Memo

- eSign Utah Outsourcing Services Contract Computer

- How Do I eSign Maryland Interview Non-Disclosure (NDA)

- Help Me With eSign North Dakota Leave of Absence Agreement

- How To eSign Hawaii Acknowledgement of Resignation

- How Can I eSign New Jersey Resignation Letter

- How Do I eSign Ohio Resignation Letter

- eSign Arkansas Military Leave Policy Myself

- How To eSign Hawaii Time Off Policy

- How Do I eSign Hawaii Time Off Policy

- Help Me With eSign Hawaii Time Off Policy

- How To eSign Hawaii Addressing Harassement

- How To eSign Arkansas Company Bonus Letter

- eSign Hawaii Promotion Announcement Secure

- eSign Alaska Worksheet Strengths and Weaknesses Myself

- How To eSign Rhode Island Overtime Authorization Form