14 317 Form

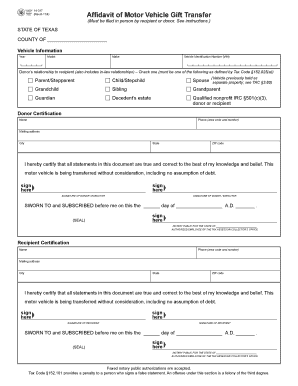

What is the 14 317 Form

The 14 317 form is a specific document used within the United States for various administrative purposes. It is essential for individuals and businesses to understand its function and relevance. This form may be required for compliance with certain regulations or as part of a formal application process. Knowing the purpose of the 14 317 form helps ensure that users can complete it accurately and submit it on time.

How to use the 14 317 Form

Using the 14 317 form involves several steps to ensure that all necessary information is accurately provided. First, gather all required information and documentation that pertains to the form. Next, carefully fill out each section, ensuring clarity and correctness. If the form requires signatures, consider using a digital signature solution to streamline the process. Once completed, review the form for any errors before submission.

Steps to complete the 14 317 Form

Completing the 14 317 form involves a systematic approach:

- Read the instructions carefully to understand the requirements.

- Gather all necessary documents and information needed to fill out the form.

- Fill out the form in clear, legible writing or use an electronic format.

- Review the completed form for accuracy and completeness.

- Sign and date the form if required.

- Submit the form according to the specified submission methods.

Legal use of the 14 317 Form

The legal use of the 14 317 form is crucial for ensuring compliance with applicable regulations. When filled out correctly, it can serve as a binding document in various legal contexts. It is important to adhere to the guidelines set forth by relevant authorities to avoid potential legal issues. Using a reputable electronic signature solution can enhance the form's legal validity by providing secure and compliant signatures.

Filing Deadlines / Important Dates

Filing deadlines for the 14 317 form can vary based on the specific requirements associated with its use. It is essential to be aware of these deadlines to ensure timely submission. Missing a deadline may result in penalties or complications in processing. Users should keep track of any important dates related to the form to avoid unnecessary delays.

Form Submission Methods

The 14 317 form can typically be submitted through various methods, including online, by mail, or in person. Each submission method may have its own set of guidelines and requirements. Users should choose the method that best suits their needs while ensuring compliance with any specific instructions provided with the form. Digital submission methods can offer convenience and speed, while traditional mail may be necessary in some cases.

Quick guide on how to complete 14 317 form

Complete 14 317 Form effortlessly on any gadget

Digital document management has become increasingly popular among businesses and individuals. It offers a perfect eco-friendly substitute for conventional printed and signed papers, as you can easily locate the appropriate form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents quickly without delays. Manage 14 317 Form on any gadget using the airSlate SignNow Android or iOS applications and enhance any document-focused operation today.

How to modify and eSign 14 317 Form with ease

- Locate 14 317 Form and then click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details and then click on the Done button to save your changes.

- Choose your preferred method to share your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Modify and eSign 14 317 Form and ensure excellent communication at any phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 14 317 form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 14 317 form and why is it important?

The 14 317 form is a crucial document used for specific legal or administrative purposes. It helps streamline processes by providing standardized information, making it essential for businesses to manage their paperwork effectively. Understanding how to utilize the 14 317 form efficiently can save time and reduce errors in documentation.

-

How can airSlate SignNow assist with the 14 317 form?

airSlate SignNow simplifies the process of sending and signing the 14 317 form digitally. Our platform enables users to fill out, sign, and share the form quickly, ensuring compliance with legal requirements. With airSlate SignNow, you can manage the 14 317 form with ease, reducing the need for physical paperwork.

-

Is there a cost associated with using airSlate SignNow for the 14 317 form?

Yes, airSlate SignNow offers various pricing plans tailored to different business needs, including features for managing the 14 317 form. Our plans are designed to be cost-effective, providing excellent value for the capabilities needed to streamline document handling. Visit our pricing page for more details on the plans suitable for your requirements.

-

Can I integrate airSlate SignNow with other software when processing the 14 317 form?

Absolutely! airSlate SignNow offers seamless integrations with many popular software applications, making it easy to enhance your workflow when handling the 14 317 form. Whether you use CRM systems, cloud storage services, or productivity tools, our platform can connect and streamline the entire process.

-

What features does airSlate SignNow offer for managing the 14 317 form?

airSlate SignNow includes features such as customizable templates, eSignature options, and document tracking specifically for the 14 317 form. These tools help ensure that your forms are accurately completed and legally binding. Our user-friendly interface also allows for easy collaboration among team members.

-

How secure is the transmission of the 14 317 form using airSlate SignNow?

Security is a top priority at airSlate SignNow, especially when transmitting the 14 317 form. Our platform employs advanced encryption protocols to protect your data during the signing and transmission process. You can trust that your sensitive information is handled securely and in compliance with applicable regulations.

-

What are the benefits of using airSlate SignNow for the 14 317 form over traditional methods?

Using airSlate SignNow for the 14 317 form offers numerous benefits compared to traditional methods, including time savings and reduced costs. Digital signing eliminates the need for printing, scanning, and postage, allowing for quicker processing. Additionally, our platform ensures that all forms are securely stored and easily accessible.

Get more for 14 317 Form

Find out other 14 317 Form

- Sign Connecticut Quitclaim Deed Free

- Help Me With Sign Delaware Quitclaim Deed

- How To Sign Arkansas Warranty Deed

- How Can I Sign Delaware Warranty Deed

- Sign California Supply Agreement Checklist Online

- How Can I Sign Georgia Warranty Deed

- Sign Maine Supply Agreement Checklist Computer

- Sign North Dakota Quitclaim Deed Free

- Sign Oregon Quitclaim Deed Simple

- Sign West Virginia Quitclaim Deed Free

- How Can I Sign North Dakota Warranty Deed

- How Do I Sign Oklahoma Warranty Deed

- Sign Florida Postnuptial Agreement Template Online

- Sign Colorado Prenuptial Agreement Template Online

- Help Me With Sign Colorado Prenuptial Agreement Template

- Sign Missouri Prenuptial Agreement Template Easy

- Sign New Jersey Postnuptial Agreement Template Online

- Sign North Dakota Postnuptial Agreement Template Simple

- Sign Texas Prenuptial Agreement Template Online

- Sign Utah Prenuptial Agreement Template Mobile