13 PARENT TAX FILING INFORMATION FORM You Reported on Your 13 FAFSA that Your Parents Are Not Going to File a Tax Return for

Understanding the 13 Parent Tax Filing Information Form

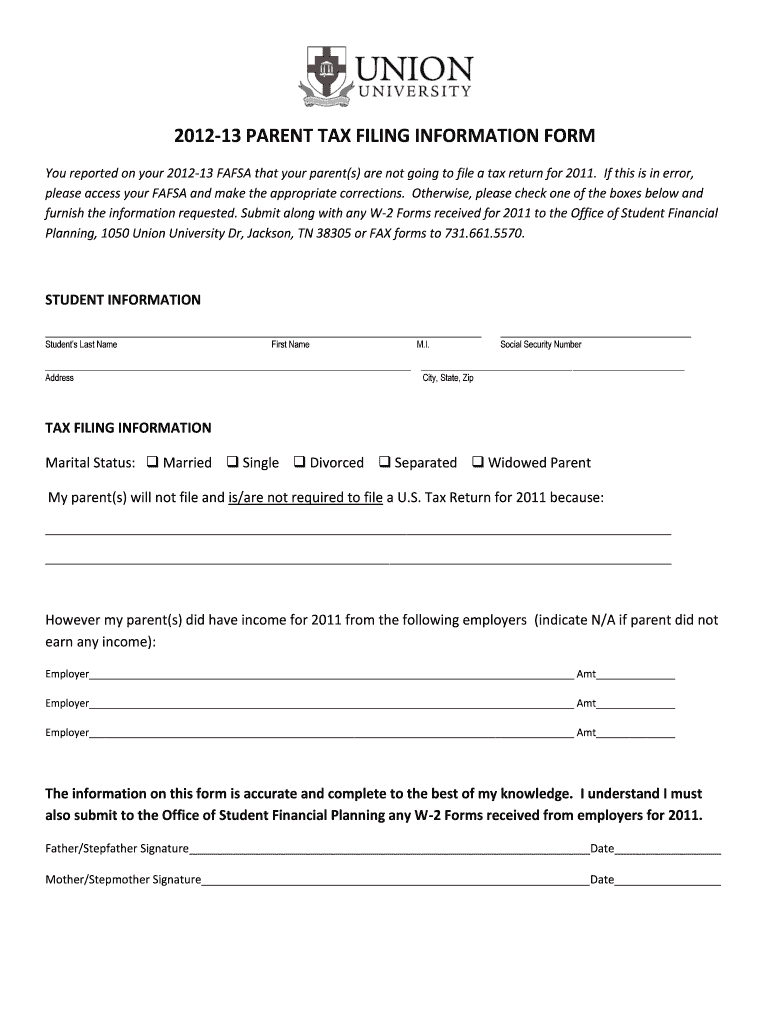

The 13 Parent Tax Filing Information Form is a crucial document for students completing the Free Application for Federal Student Aid (FAFSA). This form is specifically designed for situations where a student’s parents indicate they will not file a tax return. Understanding this form helps ensure that students provide accurate financial information, which is essential for determining their eligibility for federal financial aid.

How to Use the 13 Parent Tax Filing Information Form

To effectively use the 13 Parent Tax Filing Information Form, students should first gather all necessary information about their parents' financial situation. This includes details about income, assets, and any other relevant financial data. The form must be completed accurately to reflect that the parents will not file a tax return. Once filled out, this information should be included in the FAFSA submission to provide a clear picture of the household's financial status.

Steps to Complete the 13 Parent Tax Filing Information Form

Completing the 13 Parent Tax Filing Information Form involves several key steps:

- Gather financial documents that reflect your parents' income and assets.

- Indicate on the form that your parents will not file a tax return.

- Provide any additional income information as required.

- Review the completed form for accuracy before submission.

Following these steps ensures that the FAFSA application reflects the true financial situation of the household.

Key Elements of the 13 Parent Tax Filing Information Form

The 13 Parent Tax Filing Information Form includes several key elements that must be addressed:

- Identification of the student and parents.

- Confirmation of the decision not to file a tax return.

- Details about any income earned by the parents.

- Information on assets that may affect financial aid eligibility.

Each of these elements plays a vital role in the financial aid assessment process.

Required Documents for the 13 Parent Tax Filing Information Form

When completing the 13 Parent Tax Filing Information Form, certain documents are necessary to ensure accuracy:

- Proof of income, such as pay stubs or bank statements.

- Documentation of any benefits received, like unemployment or social security.

- Records of assets, including savings accounts and investments.

Having these documents on hand will facilitate the completion of the form and enhance the accuracy of the FAFSA submission.

IRS Guidelines Related to the 13 Parent Tax Filing Information Form

The IRS provides specific guidelines regarding tax filing and exemptions that are relevant when using the 13 Parent Tax Filing Information Form. Parents who earn below a certain income threshold may not be required to file a tax return. Understanding these guidelines helps clarify the financial situation reported on the FAFSA and ensures compliance with federal regulations regarding financial aid eligibility.

Quick guide on how to complete 13 parent tax filing information form you reported on your 13 fafsa that your parents are not going to file a tax return for

Complete [SKS] effortlessly on any device

Managing documents online has gained popularity among businesses and individuals. It serves as an ideal environmentally-friendly alternative to traditional printed and signed papers, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents quickly and efficiently. Handle [SKS] on any platform with airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to edit and electronically sign [SKS] with ease

- Locate [SKS] and click on Get Form to commence.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of your documents or obscure sensitive information using tools specifically provided by airSlate SignNow for that purpose.

- Create your electronic signature using the Sign feature, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and then click the Done button to save your changes.

- Choose your preferred method to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, and mistakes requiring new document printouts. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choice. Edit and electronically sign [SKS] and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to 13 PARENT TAX FILING INFORMATION FORM You Reported On Your 13 FAFSA That Your Parents Are Not Going To File A Tax Return For

Create this form in 5 minutes!

How to create an eSignature for the 13 parent tax filing information form you reported on your 13 fafsa that your parents are not going to file a tax return for

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 13 PARENT TAX FILING INFORMATION FORM You Reported On Your 13 FAFSA That Your Parents Are Not Going To File A Tax Return For?

The 13 PARENT TAX FILING INFORMATION FORM You Reported On Your 13 FAFSA That Your Parents Are Not Going To File A Tax Return For is a document that helps clarify your family's financial situation when applying for federal student aid. It is essential for ensuring that your FAFSA accurately reflects your eligibility for financial assistance.

-

How can airSlate SignNow assist with the 13 PARENT TAX FILING INFORMATION FORM You Reported On Your 13 FAFSA?

airSlate SignNow provides a seamless platform for electronically signing and sending the 13 PARENT TAX FILING INFORMATION FORM You Reported On Your 13 FAFSA. This ensures that you can complete your documentation quickly and securely, making the financial aid process more efficient.

-

Is there a cost associated with using airSlate SignNow for the 13 PARENT TAX FILING INFORMATION FORM?

Yes, airSlate SignNow offers various pricing plans that cater to different needs, including options for individuals and businesses. The cost is competitive and provides great value for the features offered, including the ability to manage the 13 PARENT TAX FILING INFORMATION FORM You Reported On Your 13 FAFSA.

-

What features does airSlate SignNow offer for managing the 13 PARENT TAX FILING INFORMATION FORM?

airSlate SignNow includes features such as document templates, real-time tracking, and secure cloud storage, all of which enhance the management of the 13 PARENT TAX FILING INFORMATION FORM You Reported On Your 13 FAFSA. These features streamline the process and ensure that your documents are always accessible.

-

Can I integrate airSlate SignNow with other applications for the 13 PARENT TAX FILING INFORMATION FORM?

Absolutely! airSlate SignNow offers integrations with various applications, allowing you to connect your workflow seamlessly. This means you can easily manage the 13 PARENT TAX FILING INFORMATION FORM You Reported On Your 13 FAFSA alongside other tools you already use.

-

What are the benefits of using airSlate SignNow for the 13 PARENT TAX FILING INFORMATION FORM?

Using airSlate SignNow for the 13 PARENT TAX FILING INFORMATION FORM You Reported On Your 13 FAFSA provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. This allows you to focus more on your education rather than administrative tasks.

-

How secure is airSlate SignNow when handling the 13 PARENT TAX FILING INFORMATION FORM?

airSlate SignNow prioritizes security and compliance, ensuring that your documents, including the 13 PARENT TAX FILING INFORMATION FORM You Reported On Your 13 FAFSA, are protected. The platform uses advanced encryption and security protocols to safeguard your sensitive information.

Get more for 13 PARENT TAX FILING INFORMATION FORM You Reported On Your 13 FAFSA That Your Parents Are Not Going To File A Tax Return For

- A national protocol for sexual abuse medical forensic form

- Uniform single party or multiple party account form

- Uniform anatomical gift act donation generic poa 203

- Transfer under the alaska uniform custodial trust act

- Declaration of trust under the massachusetts uniform custodial trust act

- 642 903 form and effect of receipt and acceptance by

- A registered in the name of the transferor an adult other than the transferor or a trust company followed in substance b form

- Notice of lien for medial services by hospital form

Find out other 13 PARENT TAX FILING INFORMATION FORM You Reported On Your 13 FAFSA That Your Parents Are Not Going To File A Tax Return For

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors