Va St 12 2016-2026

What is the Va St 12?

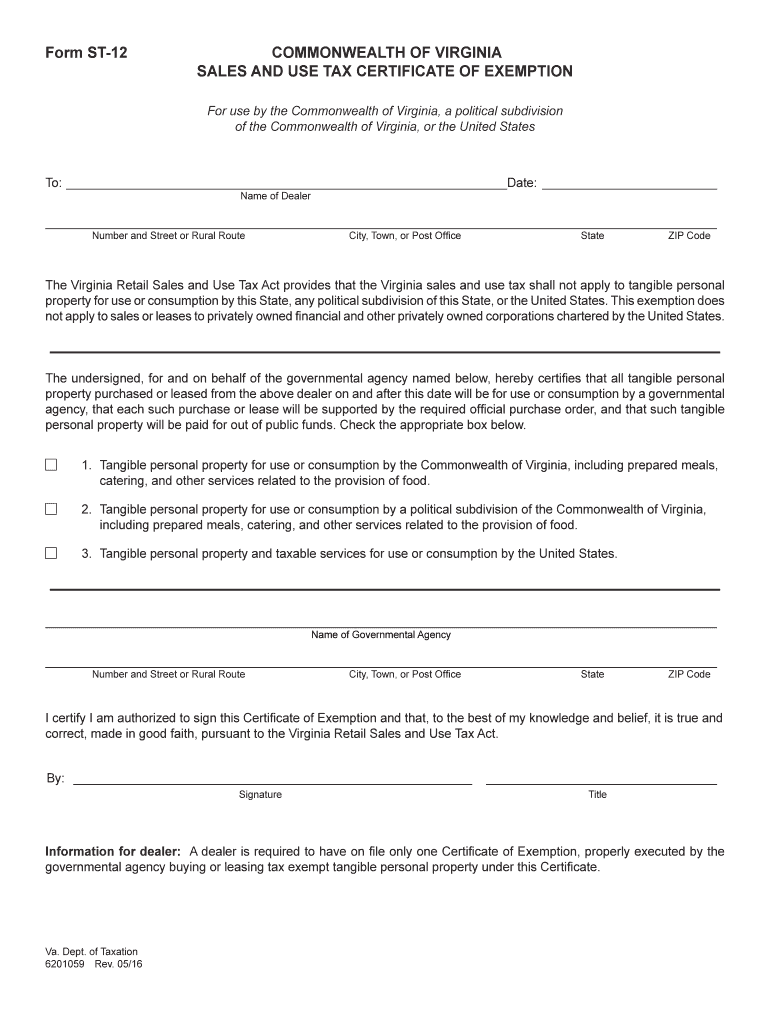

The Va St 12, also known as the Virginia Sales and Use Tax Certificate of Exemption, is a crucial document for businesses and organizations in Virginia that wish to claim exemption from sales tax on purchases. This form is primarily used by entities that qualify for tax-exempt status, such as non-profit organizations, government agencies, and certain educational institutions. By providing this certificate to vendors, these entities can avoid paying sales tax on qualifying purchases, thereby reducing their overall expenses.

How to Obtain the Va St 12

To obtain the Va St 12 form, interested parties can visit the Virginia Department of Taxation's official website. The form is typically available for download as a PDF, allowing users to print and fill it out. Additionally, businesses may need to provide documentation that proves their eligibility for tax exemption, such as proof of non-profit status or other relevant certifications. It is essential to ensure that all required information is accurately completed to avoid delays in processing.

Steps to Complete the Va St 12

Completing the Va St 12 involves several straightforward steps:

- Download the Va St 12 form from the Virginia Department of Taxation website.

- Fill in the required fields, including the name of the exempt organization, address, and type of exemption claimed.

- Provide the vendor's name and address where the certificate will be presented.

- Sign and date the form to certify that the information provided is accurate.

- Submit the completed form to the vendor to claim the exemption at the time of purchase.

Key Elements of the Va St 12

The Va St 12 includes several key elements that are necessary for it to be valid:

- Name and Address: The legal name and address of the exempt organization must be clearly stated.

- Type of Exemption: The specific reason for claiming exemption, such as non-profit status or government agency, should be indicated.

- Vendor Information: The name and address of the vendor to whom the certificate is presented must be included.

- Signature: The form must be signed by an authorized representative of the exempt organization.

Legal Use of the Va St 12

The legal use of the Va St 12 is governed by Virginia state tax laws. It is essential for users to understand that this certificate is only valid for purchases that qualify under the exemption criteria. Misuse of the certificate, such as using it for personal purchases or for items that do not qualify for exemption, may result in penalties, including fines or back taxes owed. Organizations should maintain accurate records of all transactions where the Va St 12 is used to ensure compliance with state regulations.

Eligibility Criteria

Eligibility for using the Va St 12 primarily includes non-profit organizations, government entities, and certain educational institutions. To qualify, organizations must provide proof of their tax-exempt status, such as a determination letter from the IRS or other relevant documentation. It is crucial for applicants to review the specific eligibility criteria outlined by the Virginia Department of Taxation to ensure compliance and avoid any issues when claiming sales tax exemption.

Quick guide on how to complete virginia sales tax exemption form st 12 2016 2019

Your assistance manual on how to prepare your Va St 12

If you desire to learn how to generate and submit your Va St 12, here are a few concise instructions on simplifying tax declaration.

To begin, you simply need to create your airSlate SignNow profile to transform your online document handling. airSlate SignNow is an extremely intuitive and powerful document management solution that enables you to modify, produce, and complete your income tax documents effortlessly. Utilizing its editor, you can toggle between text, checkboxes, and electronic signatures, and revert to amend details as necessary. Enhance your tax administration with advanced PDF editing, electronic signing, and easy sharing.

Adhere to the steps below to complete your Va St 12 in just a few minutes:

- Create your account and begin working on PDFs in no time.

- Utilize our directory to find any IRS tax form; browse through variations and schedules.

- Click Obtain form to access your Va St 12 in our editor.

- Populate the necessary fillable fields with your information (text, numbers, checkmarks).

- Employ the Signature Tool to add your legally-recognized electronic signature (if necessary).

- Examine your document and correct any errors.

- Save changes, print your copy, send it to your recipient, and download it to your device.

Utilize this manual to file your taxes digitally with airSlate SignNow. Please be aware that submitting in paper form can lead to increased return mistakes and delayed refunds. It is advisable to check the IRS website for filing regulations in your state before you e-file your taxes.

Create this form in 5 minutes or less

Find and fill out the correct virginia sales tax exemption form st 12 2016 2019

FAQs

-

Going out to lunch in Virginia, you pay a 12.5% sales tax. How is this justifiable? Why have the people not revolted? Am I the only one who is pissed off?

Because the elected legislators of the Commonwealth of Virginia have chosen to fund their government with sales taxes rather than income taxes, and the voters have not rejected them for doing so.

Create this form in 5 minutes!

How to create an eSignature for the virginia sales tax exemption form st 12 2016 2019

How to create an electronic signature for your Virginia Sales Tax Exemption Form St 12 2016 2019 online

How to generate an electronic signature for your Virginia Sales Tax Exemption Form St 12 2016 2019 in Chrome

How to create an eSignature for signing the Virginia Sales Tax Exemption Form St 12 2016 2019 in Gmail

How to make an electronic signature for the Virginia Sales Tax Exemption Form St 12 2016 2019 straight from your mobile device

How to create an eSignature for the Virginia Sales Tax Exemption Form St 12 2016 2019 on iOS devices

How to make an electronic signature for the Virginia Sales Tax Exemption Form St 12 2016 2019 on Android OS

People also ask

-

What is a VA sales use tax certificate exemption?

A VA sales use tax certificate exemption allows businesses to purchase goods or services without paying sales tax if those purchases are intended for specific uses. This exemption can signNowly reduce costs for companies that qualify. Understanding the requirements for applying this exemption is essential for compliance in Virginia.

-

How can airSlate SignNow help with VA sales use tax certificate exemption processes?

airSlate SignNow streamlines the process of managing VA sales use tax certificate exemptions by allowing businesses to easily create, send, and eSign relevant documents. This saves time and reduces the potential for errors in submission. Our solution ensures that organizations can handle compliance effortlessly.

-

What features does airSlate SignNow offer for managing tax exemption certificates?

airSlate SignNow includes features such as customizable templates, secure electronic signatures, and document tracking, specifically designed for managing VA sales use tax certificate exemptions. These features enhance efficiency and ensure that all necessary documentation is completed correctly. Additionally, our cloud-based platform allows for easy access and management from anywhere.

-

Is there a cost associated with using airSlate SignNow for VA sales use tax certificate exemptions?

Yes, airSlate SignNow operates on a subscription model, offering various pricing plans to fit different business needs. The cost is competitive and covers all necessary tools to manage VA sales use tax certificate exemptions efficiently. Businesses can choose a plan based on their specific document signing and management requirements.

-

What benefits do businesses gain by using airSlate SignNow for tax certificate management?

Utilizing airSlate SignNow for handling VA sales use tax certificate exemptions provides numerous benefits, including increased efficiency and improved compliance. The platform reduces the paperwork burden and ensures that all tax exemption documentation is handled accurately and securely. This allows businesses to focus on growth rather than administrative tasks.

-

Can airSlate SignNow integrate with other software for tax certificate management?

Absolutely! airSlate SignNow offers seamless integrations with various software systems, including accounting and enterprise resource planning tools. This enhances the management of VA sales use tax certificate exemptions by centralizing project databases and automating workflows. Such integrations help keep your financial records coherent and compliant.

-

What types of businesses can benefit from VA sales use tax certificate exemptions?

Both small and large businesses that frequently purchase goods or services for resale or production can benefit from VA sales use tax certificate exemptions. This allows them to reduce their overall expenditure on taxable purchases. By leveraging airSlate SignNow, these businesses can easily manage their exemption certificates and ensure compliance.

Get more for Va St 12

Find out other Va St 12

- eSignature Delaware Time Off Policy Online

- Help Me With Electronic signature Indiana Direct Deposit Enrollment Form

- Electronic signature Iowa Overtime Authorization Form Online

- Electronic signature Illinois Employee Appraisal Form Simple

- Electronic signature West Virginia Business Ethics and Conduct Disclosure Statement Free

- Electronic signature Alabama Disclosure Notice Simple

- Electronic signature Massachusetts Disclosure Notice Free

- Electronic signature Delaware Drug Testing Consent Agreement Easy

- Electronic signature North Dakota Disclosure Notice Simple

- Electronic signature California Car Lease Agreement Template Free

- How Can I Electronic signature Florida Car Lease Agreement Template

- Electronic signature Kentucky Car Lease Agreement Template Myself

- Electronic signature Texas Car Lease Agreement Template Easy

- Electronic signature New Mexico Articles of Incorporation Template Free

- Electronic signature New Mexico Articles of Incorporation Template Easy

- Electronic signature Oregon Articles of Incorporation Template Simple

- eSignature Montana Direct Deposit Enrollment Form Easy

- How To Electronic signature Nevada Acknowledgement Letter

- Electronic signature New Jersey Acknowledgement Letter Free

- Can I eSignature Oregon Direct Deposit Enrollment Form