Virginia Sales Tax Exemption Form St 12 2006

What is the Virginia Sales Tax Exemption Form St 12

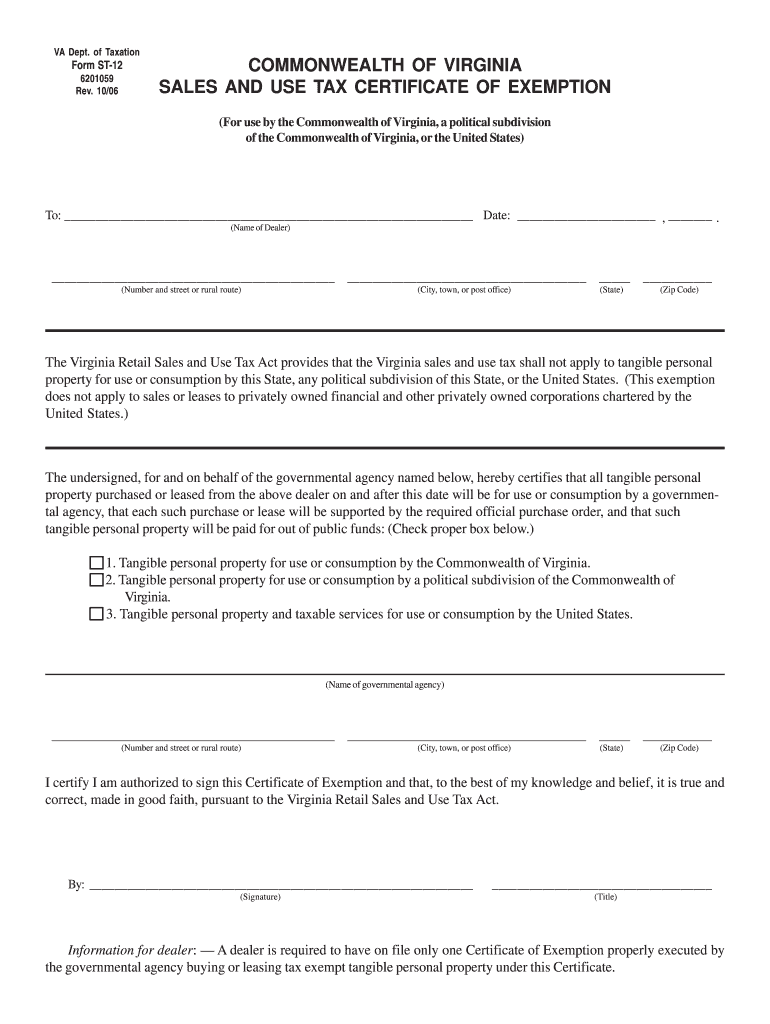

The Virginia Sales Tax Exemption Form St 12 is a crucial document that allows eligible businesses and organizations to claim exemption from sales tax on certain purchases. This form is primarily used by entities that qualify under specific categories, such as non-profit organizations, governmental bodies, and certain educational institutions. By completing this form, these entities can avoid paying sales tax on eligible items, which can lead to significant savings in operational costs.

How to use the Virginia Sales Tax Exemption Form St 12

To effectively use the Virginia Sales Tax Exemption Form St 12, individuals or organizations must first determine their eligibility for sales tax exemption. Once eligibility is confirmed, the form should be accurately filled out with the necessary details, including the name of the exempt organization, the type of exemption being claimed, and the specific items being purchased. After completing the form, it must be presented to the vendor at the time of purchase to ensure that sales tax is not charged.

Steps to complete the Virginia Sales Tax Exemption Form St 12

Completing the Virginia Sales Tax Exemption Form St 12 involves several key steps:

- Gather necessary documentation to prove eligibility, such as a letter of exemption or proof of non-profit status.

- Fill out the form with accurate information, including the organization’s name, address, and tax identification number.

- Specify the type of exemption being claimed and list the items for which the exemption applies.

- Review the completed form for accuracy and ensure all required fields are filled.

- Sign and date the form before presenting it to the vendor.

Key elements of the Virginia Sales Tax Exemption Form St 12

Several key elements must be included in the Virginia Sales Tax Exemption Form St 12 for it to be valid:

- Name of the exempt organization: Clearly state the legal name of the organization claiming the exemption.

- Tax identification number: Provide the organization’s tax ID number to verify its status.

- Type of exemption: Indicate the specific category under which the exemption is claimed, such as non-profit or governmental.

- Description of items: List the items being purchased that qualify for the sales tax exemption.

- Signature: The form must be signed by an authorized representative of the organization.

Eligibility Criteria

To qualify for the Virginia Sales Tax Exemption Form St 12, organizations must meet specific eligibility criteria. Generally, these include being a recognized non-profit organization, a governmental entity, or an educational institution. Additionally, the purchases must be for use in activities directly related to the organization’s exempt purposes. It is essential for applicants to review the criteria carefully to ensure compliance and avoid any potential issues during the exemption process.

Form Submission Methods

The Virginia Sales Tax Exemption Form St 12 can be submitted to vendors in various ways. Typically, the form is presented in person at the time of purchase. However, some vendors may accept the form via email or fax, depending on their policies. It is important for organizations to check with individual vendors regarding their preferred submission method to ensure that the exemption is honored.

Quick guide on how to complete virginia sales tax exemption form st 12 2006

Your assistance manual on how to prepare your Virginia Sales Tax Exemption Form St 12

If you’re uncertain about how to finalize and submit your Virginia Sales Tax Exemption Form St 12, here are a few straightforward guidelines to simplify the tax submission process.

To begin, you simply need to create your airSlate SignNow account to transform how you manage documents online. airSlate SignNow is an extremely user-friendly and powerful document solution that enables you to modify, generate, and complete your tax forms with ease. Utilizing its editor, you can alternate between text, checkboxes, and electronic signatures and return to amend responses where necessary. Enhance your tax administration with advanced PDF editing, eSigning, and user-friendly sharing.

Follow the steps outlined below to finalize your Virginia Sales Tax Exemption Form St 12 in just minutes:

- Create your account and start processing PDFs within minutes.

- Utilize our directory to find any IRS tax form; browse through different versions and schedules.

- Select Get form to open your Virginia Sales Tax Exemption Form St 12 in our editor.

- Complete the necessary fillable fields with your information (text, numbers, check marks).

- Employ the Sign Tool to add your legally-binding electronic signature (if required).

- Examine your document and rectify any mistakes.

- Save modifications, print your copy, send it to your recipient, and download it to your device.

Make the most of this guide to file your taxes electronically with airSlate SignNow. Keep in mind that submitting on paper can increase the likelihood of errors and delay refunds. As always, before e-filing your taxes, review the IRS website for filing regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct virginia sales tax exemption form st 12 2006

FAQs

-

Going out to lunch in Virginia, you pay a 12.5% sales tax. How is this justifiable? Why have the people not revolted? Am I the only one who is pissed off?

Because the elected legislators of the Commonwealth of Virginia have chosen to fund their government with sales taxes rather than income taxes, and the voters have not rejected them for doing so.

-

Why don't schools teach children about taxes and bills and things that they will definitely need to know as adults to get by in life?

Departments of education and school districts always have to make decisions about what to include in their curriculum. There are a lot of life skills that people need that aren't taught in school. The question is should those skills be taught in schools?I teach high school, so I'll talk about that. The typical high school curriculum is supposed to give students a broad-based education that prepares them to be citizens in a democracy and to be able to think critically. For a democracy to work, we need educated, discerning citizens with the ability to make good decisions based on evidence and objective thought. In theory, people who are well informed about history, culture, science, mathematics, etc., and are capable of critical, unbiased thinking, will have the tools to participate in a democracy and make good decisions for themselves and for society at large. In addition to that, they should be learning how to be learners, how to do effective, basic research, and collaborate with other people. If that happens, figuring out how to do procedural tasks in real life should not provide much of a challenge. We can't possibly teach every necessary life skill people need, but we can help students become better at knowing how to acquire the skills they need. Should we teach them how to change a tire when they can easily consult a book or search the internet to find step by step instructions for that? Should we teach them how to balance a check book or teach them how to think mathematically and make sense of problems so that the simple task of balancing a check book (which requires simple arithmetic and the ability to enter numbers and words in columns and rows in obvious ways) is easy for them to figure out. If we teach them to be good at critical thinking and have some problem solving skills they will be able to apply those overarching skills to all sorts of every day tasks that shouldn't be difficult for someone with decent cognitive ability to figure out. It's analogous to asking why a culinary school didn't teach its students the steps and ingredients to a specific recipe. The school taught them about more general food preparation and food science skills so that they can figure out how to make a lot of specific recipes without much trouble. They're also able to create their own recipes.So, do we want citizens with very specific skill sets that they need to get through day to day life or do we want citizens with critical thinking, problem solving, and other overarching cognitive skills that will allow them to easily acquire ANY simple, procedural skill they may come to need at any point in their lives?

-

How do we know the eligibility to fill out Form 12 BB?

Every year as a salaried employee many of you must have fill Form 12BB, but did you ever bothered to know its purpose. Don’t know ??It is indispensable for both, you and your employer. With the help of Form 12BB, you will be able to figure out how much income tax is to be deducted from your monthly pay. Further, with the help of Form 12BB, you will be in relief at the time of filing returns as at that time you will not have to pay anything due to correct TDS deduction.So, before filing such important form keep the below listed things in your mind so that you may live a tax hassle free life.For More Information:- 7 key points which must be known before filling Form 12BB

-

How do I fill taxes online?

you can file taxes online by using different online platforms. by using this online platform you can easily submit the income tax returns, optimize your taxes easily.Tachotax provides the most secure, easy and fast way of tax filing.

-

How do I fill out the income tax for online job payment? Are there any special forms to fill it?

I am answering to your question with the UNDERSTANDING that you are liableas per Income Tax Act 1961 of Republic of IndiaIf you have online source of Income as per agreement as an employer -employee, It will be treated SALARY income and you will file ITR 1 for FY 2017–18If you are rendering professional services outside India with an agreement as professional, in that case you need to prepare Financial Statements ie. Profit and loss Account and Balance sheet for FY 2017–18 , finalize your income and pay taxes accordingly, You will file ITR -3 for FY 2017–1831st Dec.2018 is last due date with minimum penalty, grab that opportunity and file income tax return as earliest

-

How does a Virginia LLC transfer a machine which is out of the normal line of business to another Virginia LLC without incurring sales tax?

Bill of Sale and record it appropriately on the Books.

-

I need to pay an $800 annual LLC tax for my LLC that formed a month ago, so I am looking to apply for an extension. It's a solely owned LLC, so I need to fill out a Form 7004. How do I fill this form out?

ExpressExtension is an IRS-authorized e-file provider for all types of business entities, including C-Corps (Form 1120), S-Corps (Form 1120S), Multi-Member LLC, Partnerships (Form 1065). Trusts, and Estates.File Tax Extension Form 7004 InstructionsStep 1- Begin by creating your free account with ExpressExtensionStep 2- Enter the basic business details including: Business name, EIN, Address, and Primary Contact.Step 3- Select the business entity type and choose the form you would like to file an extension for.Step 4- Select the tax year and select the option if your organization is a Holding CompanyStep 5- Enter and make a payment on the total estimated tax owed to the IRSStep 6- Carefully review your form for errorsStep 7- Pay and transmit your form to the IRSClick here to e-file before the deadline

Create this form in 5 minutes!

How to create an eSignature for the virginia sales tax exemption form st 12 2006

How to generate an electronic signature for the Virginia Sales Tax Exemption Form St 12 2006 in the online mode

How to create an electronic signature for the Virginia Sales Tax Exemption Form St 12 2006 in Google Chrome

How to create an electronic signature for signing the Virginia Sales Tax Exemption Form St 12 2006 in Gmail

How to generate an electronic signature for the Virginia Sales Tax Exemption Form St 12 2006 from your smartphone

How to create an electronic signature for the Virginia Sales Tax Exemption Form St 12 2006 on iOS

How to generate an eSignature for the Virginia Sales Tax Exemption Form St 12 2006 on Android

People also ask

-

What is the Virginia Sales Tax Exemption Form ST 12 used for?

The Virginia Sales Tax Exemption Form ST 12 is used by businesses and organizations to claim an exemption from sales tax on qualified purchases. By completing this form, you can ensure your purchases related to tax-exempt activities are not subject to Virginia sales tax, ultimately saving your business money.

-

How can I easily fill out the Virginia Sales Tax Exemption Form ST 12?

With airSlate SignNow, you can easily fill out the Virginia Sales Tax Exemption Form ST 12 online. Our user-friendly platform allows you to complete, sign, and share the form electronically, streamlining the process and ensuring that you don't miss any crucial information.

-

Is there a cost associated with using airSlate SignNow to complete the Virginia Sales Tax Exemption Form ST 12?

AirSlate SignNow offers cost-effective plans that cater to various business needs, including the completion of the Virginia Sales Tax Exemption Form ST 12. You can choose a plan that fits your budget while still accessing powerful features to help manage your documents efficiently.

-

Can I integrate airSlate SignNow with other software for managing the Virginia Sales Tax Exemption Form ST 12?

Yes, airSlate SignNow offers seamless integrations with various applications, allowing you to connect with your existing workflows. This makes it easier to manage the Virginia Sales Tax Exemption Form ST 12 alongside your other business processes.

-

What are the benefits of using airSlate SignNow for the Virginia Sales Tax Exemption Form ST 12?

Using airSlate SignNow for the Virginia Sales Tax Exemption Form ST 12 offers numerous benefits including time savings, enhanced security, and reduced paperwork. With electronic signatures and cloud storage, you can easily manage your exempt purchases while ensuring compliance with tax regulations.

-

Who can use the Virginia Sales Tax Exemption Form ST 12?

The Virginia Sales Tax Exemption Form ST 12 can be used by various entities, including nonprofits, exempt organizations, and certain governmental agencies. Understanding if your organization qualifies for exemption is crucial for utilizing this form effectively.

-

How do I submit the Virginia Sales Tax Exemption Form ST 12 once completed?

Once you have completed the Virginia Sales Tax Exemption Form ST 12 using airSlate SignNow, you can easily download or share the form as needed. Ensure that you submit it to the vendor or tax authority as per your requirements to take advantage of the exemption.

Get more for Virginia Sales Tax Exemption Form St 12

Find out other Virginia Sales Tax Exemption Form St 12

- eSignature Nebraska Finance & Tax Accounting Business Letter Template Online

- Help Me With eSignature Indiana Healthcare / Medical Notice To Quit

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple

- eSignature Virginia Healthcare / Medical Living Will Computer

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online

- eSignature Alabama Insurance Forbearance Agreement Safe

- How Can I eSignature Arkansas Insurance LLC Operating Agreement

- Help Me With eSignature Michigan High Tech Emergency Contact Form

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now