Virginia W9 2017

What is the Virginia W-9

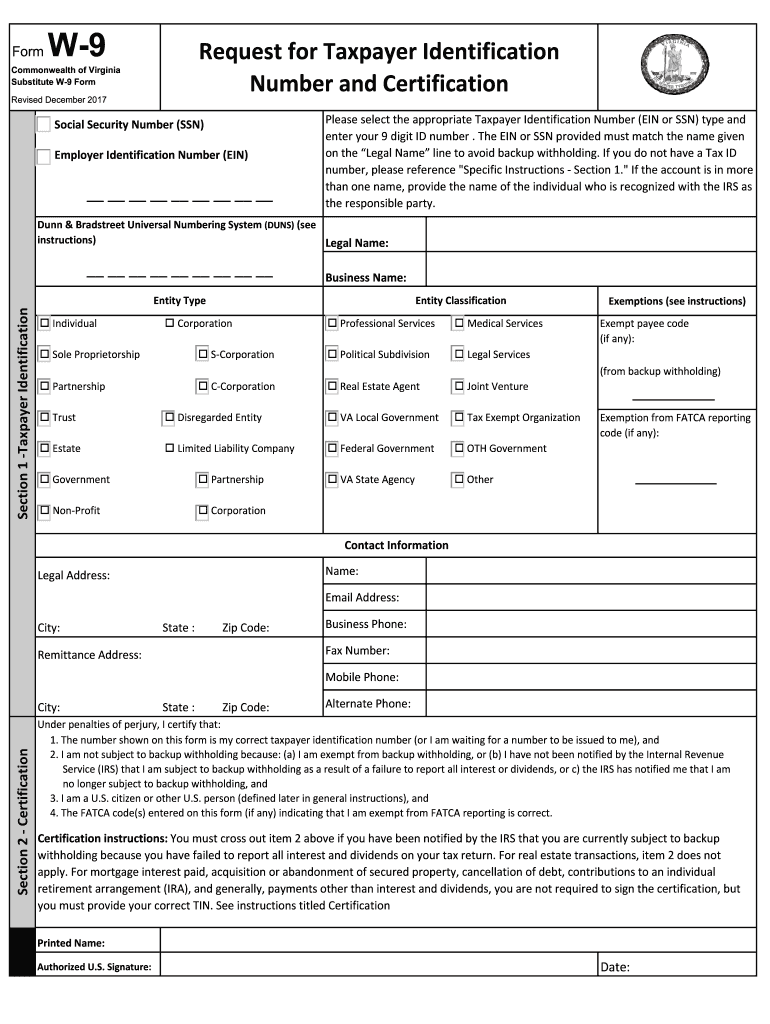

The Virginia W-9 form is a tax document used by individuals and businesses to provide their taxpayer identification information to other parties. This form is essential for reporting income and ensuring compliance with federal tax regulations. The information collected includes the name, address, and taxpayer identification number (TIN) of the individual or entity. The Virginia W-9 is particularly important for freelancers, contractors, and businesses that work with independent contractors within the state.

Steps to complete the Virginia W-9

Completing the Virginia W-9 form involves several straightforward steps:

- Download the form: Obtain the Virginia W-9 form from a reliable source or directly from the IRS website.

- Fill in your information: Enter your name, business name (if applicable), and address in the designated fields.

- Provide your TIN: Include your Social Security Number (SSN) or Employer Identification Number (EIN) as required.

- Sign and date: Ensure you sign the form to certify that the information provided is accurate and complete.

How to obtain the Virginia W-9

The Virginia W-9 form can be easily obtained online. You can visit the official IRS website or other reputable tax-related websites to download the latest version of the form. It is important to ensure that you are using the most current version to comply with any updates in tax regulations.

Legal use of the Virginia W-9

The Virginia W-9 form is legally binding once completed and signed. It serves as a declaration of your taxpayer identification information, which is used by the requester to report payments made to you to the IRS. Proper use of the form helps prevent issues with tax reporting and ensures compliance with federal tax laws.

Key elements of the Virginia W-9

Key elements of the Virginia W-9 include:

- Name: The legal name of the individual or business entity.

- Business name: If applicable, the name under which the business operates.

- Address: The complete mailing address where you receive correspondence.

- Taxpayer Identification Number: Your SSN or EIN, which is crucial for tax purposes.

- Signature: A signature certifying the accuracy of the information provided.

Filing Deadlines / Important Dates

When using the Virginia W-9, it is important to be aware of relevant deadlines. While the W-9 itself does not have a specific filing deadline, it is typically requested by businesses before issuing payments. Ensure that you provide the form promptly to avoid delays in payment processing or potential tax complications.

Quick guide on how to complete what is a w9 virginia 2017 2019 form

Your assistance manual on how to prepare your Virginia W9

If you’re interested in learning how to create and submit your Virginia W9, here are a few concise instructions on how to simplify tax filing.

To begin, you simply need to register your airSlate SignNow account to change how you manage documents online. airSlate SignNow is an exceptionally user-friendly and powerful document solution that allows you to edit, create, and complete your income tax documents with ease. Utilizing its editor, you can toggle between text, check boxes, and eSignatures and return to modify responses as necessary. Enhance your tax management with advanced PDF editing, eSigning, and seamless sharing.

Follow the steps below to complete your Virginia W9 in just a few minutes:

- Sign up for your account and start working on PDFs in no time.

- Use our directory to find any IRS tax form; browse through versions and schedules.

- Click Get form to access your Virginia W9 in our editor.

- Fill in the necessary fields with your information (text, numbers, check marks).

- Utilize the Sign Tool to add your legally-binding eSignature (if required).

- Review your document and fix any errors.

- Save your changes, print your copy, send it to your recipient, and download it to your device.

Make the most of this guide to file your taxes electronically with airSlate SignNow. Please remember that filing on paper can increase errors and delay reimbursements. Naturally, before e-filing your taxes, consult the IRS website for reporting regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct what is a w9 virginia 2017 2019 form

FAQs

-

Who do I send this W9 form to after I fill it out? Then what happens?

Send the W-9 to the business that asked you to complete it.Then the business will have your social security number or employer identification number so it can prepare a 1099 to report the income it gave you after year end.

-

How do I correctly fill out a W9 tax form as a single member LLC?

If your SMLLC is a sole proprietorship/disregarded entity, then you put your name in the name box and not the name of the LLC. You check the box for individual/sole proprietor not LLC.If the SMLLC is an S or C corp then check the box for LLC and write in the appropriate classification. In that case you would put the name of the LLC in the name box.

-

If someone receives a gratuity do they need to fill out a W9 tax form?

It depends on the amount of the gratuity and the context in which it is received.First a W9 form is used when a business pays for services to vendors that it reasonably expects the payments will total more than $600 during a calendar year. The W9 is required to give the business the necessary information needed to complete a Form 1099 to report payments for services provided during the year. Gratuities received for providing services to a business would certainly fall under the 1099 reporting requirements and therefore a W9 form would be appropriate.Some businesses have a policy of requiring a W9 from every service provider before any payment in any amount is made. Not particularly a legal requirement, but given the frequent difficulty of obtaining the information after payment has been made, not a necessarily unreasonable policy to have.That is when the gratuity is received in the context of providing a service to a business. Payments for personal services are not subject to 1099 reporting and a W9 should not be needed. Payment of gratuities in the context of what we typically think of in terms of gratuity such as a wait staff at a restaurant or stylist at a hair salon are generally personal in nature and the reporting falls on the service person’s employer and not the person paying the gratuity, so a W9 in that case would not be typical.So did you work a weekend event for a business convention and they want to give you a $500 tip for doing a great job, but require a W9, yea I would probably fill out the form. Do you wait tables at a restaurant and the guest wants to tip you $50 for his business luncheon, I would probably not be inclined to fill out the form.

-

Do W9 forms need to be filled out by hand? Can I fill it out in a text editor like Word instead?

No, W9 forms do not need to be filled out by hand. Assuming you have a PDF, there are many PDF editors which allow you to fill in the form on your personal computer and even insert a signature, if you have one.Mac’s Preview app does this on most PDFs. Word might actually do it as well, I simply don’t use Word. Google Docs has the functionality, as well.

-

What is the new procedure in filling out the AIIMS 2019 form? What is the last date to fill out its form?

AIIMS has introduced the PAAR facility (Prospective Applicant Advanced Registration) for filling up the application form. Through PAAR facility, the process application form is divided into two steps- basic registration and final registration.Basic Registration:On this part you have to fill up your basic details like Full name, parent’s name, date of birth, gender, category, state of domicile, ID proof/number and others. No paAIIMS Final RegistrationA Code will be issued to the candidates who complete the Basic Registration. You have to use the same code to login again and fill the form.At this stage, candidates are required to fill out the entire details of their personal, professional and academic background. Also, they have to submit the application fee as per their category.Here I have explained the two steps for AIIMS 2019 form.For more details visit aim4aiims’s website:About AIIMS Exam 2019

Create this form in 5 minutes!

How to create an eSignature for the what is a w9 virginia 2017 2019 form

How to generate an eSignature for your What Is A W9 Virginia 2017 2019 Form online

How to create an eSignature for your What Is A W9 Virginia 2017 2019 Form in Chrome

How to generate an eSignature for signing the What Is A W9 Virginia 2017 2019 Form in Gmail

How to make an eSignature for the What Is A W9 Virginia 2017 2019 Form straight from your mobile device

How to create an eSignature for the What Is A W9 Virginia 2017 2019 Form on iOS

How to make an eSignature for the What Is A W9 Virginia 2017 2019 Form on Android

People also ask

-

What is the Virginia Form W9 and how can airSlate SignNow help?

The Virginia Form W9 is a tax form used by businesses to request the taxpayer identification number of a payee. With airSlate SignNow, you can easily fill out, sign, and send the Virginia Form W9 electronically, streamlining your documentation process and ensuring compliance.

-

Is there a cost associated with using airSlate SignNow for the Virginia Form W9?

Yes, airSlate SignNow offers various pricing plans tailored to your business needs. You can choose a plan that provides the best value for electronically managing your Virginia Form W9 and other documents efficiently.

-

What features does airSlate SignNow provide for the Virginia Form W9?

airSlate SignNow includes features such as customizable templates, secure eSignature capabilities, and automated reminders which enhance the process of managing the Virginia Form W9. These features help save time and reduce the risk of errors.

-

How does airSlate SignNow ensure the security of the Virginia Form W9?

Security is a top priority for airSlate SignNow, and the platform employs advanced encryption technology to protect your Virginia Form W9 and other sensitive documents. Additionally, you can track activity and receive notifications for added peace of mind.

-

Can I integrate airSlate SignNow with other applications for the Virginia Form W9?

Yes, airSlate SignNow seamlessly integrates with numerous applications, allowing for easy management of the Virginia Form W9 alongside your other business processes. Integrations with tools like Google Drive and Dropbox enhance document accessibility and collaboration.

-

What benefits does airSlate SignNow offer for businesses using the Virginia Form W9?

Using airSlate SignNow for the Virginia Form W9 helps businesses save time, reduce paperwork, and ensure compliance. The intuitive interface also improves user experience, making it easier for both senders and recipients to handle documents.

-

How do I get started with airSlate SignNow for the Virginia Form W9?

Getting started with airSlate SignNow for the Virginia Form W9 is simple. Sign up for an account, choose a pricing plan, and start creating your W9 forms using our user-friendly platform.

Get more for Virginia W9

- Cd 401s corporation tax return dor web site dor state nc form

- Fitbit charge 3 manual form

- Cs 14b form

- Authorization form for alternate pick up day care

- Box 12157 austin texas 78711 512463 5101 800803 9202 fax 512463 1087 form

- Representative registration application texas workforce form

- Sample itemized receipt form vista ridge athletic booster club

- Pdf d5 middle school cheerleader candidate information form

Find out other Virginia W9

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors