W9Virginia PDF Form W 9 Request for Taxpayer Identification Number 2022-2026

What is the W-9 Form?

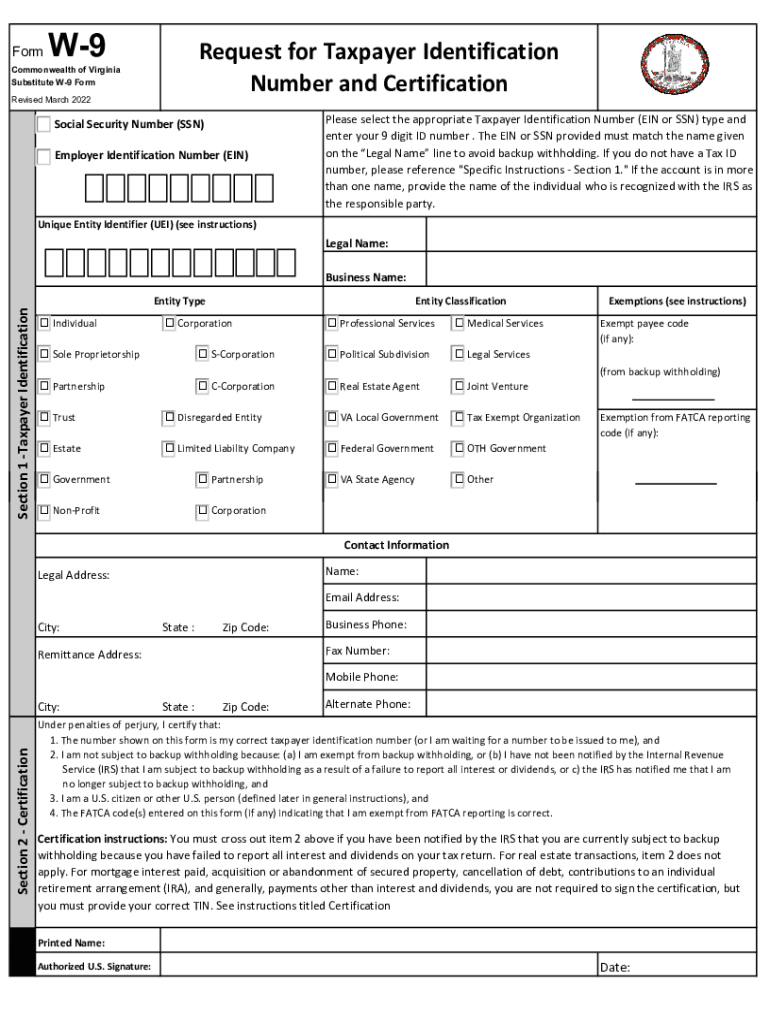

The W-9 form, officially known as the Request for Taxpayer Identification Number and Certification, is a crucial document used in the United States for tax purposes. It is primarily utilized by individuals or entities to provide their taxpayer identification number (TIN) to another party, typically a business or financial institution. This form is essential for reporting income paid to independent contractors, freelancers, and other non-employees, ensuring that the IRS receives accurate information about earnings. The W-9 form is not submitted to the IRS; instead, it is kept on file by the requester for record-keeping and reporting purposes.

Steps to Complete the W-9 Form

Completing the W-9 form is straightforward. Follow these steps to ensure accuracy:

- Provide your name: Enter your full name as it appears on your tax return.

- Business name (if applicable): If you operate under a different name, include it here.

- Check the appropriate box: Indicate whether you are an individual, corporation, partnership, or another entity type.

- Enter your TIN: This can be your Social Security Number (SSN) or Employer Identification Number (EIN).

- Certification: Sign and date the form to certify that the information provided is accurate.

Legal Use of the W-9 Form

The W-9 form is legally binding and serves as a certification of your TIN. It is important to ensure that the information provided is accurate and complete, as inaccuracies can lead to penalties from the IRS. When you submit a W-9 form, you are certifying that you are not subject to backup withholding and that the TIN you provided is correct. This form is vital for businesses to comply with IRS regulations when reporting payments made to contractors and other non-employees.

IRS Guidelines for the W-9 Form

The IRS provides specific guidelines regarding the use and completion of the W-9 form. It is essential to follow these guidelines to avoid potential issues with tax reporting. According to IRS regulations, the W-9 should be filled out accurately and submitted upon request. The IRS may require businesses to obtain a W-9 from any individual or entity they pay to ensure proper reporting of income. Failure to obtain a completed W-9 can result in penalties for the business.

Form Submission Methods

The W-9 form can be submitted in several ways, depending on the requester's preferences. Common submission methods include:

- Online: Many businesses prefer to receive W-9 forms electronically through secure document management systems.

- Mail: The completed form can be printed and mailed directly to the requester.

- In-Person: In some cases, individuals may submit the form in person, especially when establishing a business relationship.

Eligibility Criteria for the W-9 Form

Eligibility for completing a W-9 form generally includes anyone who is a U.S. citizen or resident alien, as well as certain entities such as corporations, partnerships, and LLCs. It is important to ensure that you meet the eligibility criteria before filling out the form. If you are a non-resident alien or foreign entity, you may need to use a different form, such as the W-8 series, to provide the necessary information for tax purposes.

Quick guide on how to complete w9virginiapdf form w 9 request for taxpayer identification number

Easily Prepare W9Virginia pdf Form W 9 Request For Taxpayer Identification Number on Any Device

Digital document management has become increasingly popular among businesses and individuals. It offers a perfect eco-friendly substitute to traditional printed and signed documents, as you can access the correct format and safely save it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly and without delays. Manage W9Virginia pdf Form W 9 Request For Taxpayer Identification Number on any platform using the airSlate SignNow Android or iOS applications and streamline any document-related task today.

How to Edit and eSign W9Virginia pdf Form W 9 Request For Taxpayer Identification Number Effortlessly

- Find W9Virginia pdf Form W 9 Request For Taxpayer Identification Number and click on Get Form to begin.

- Use the tools we provide to fill out your document.

- Highlight important sections of the documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign tool, which takes seconds and holds the same legal validity as a traditional ink signature.

- Review all the information and click on the Done button to save your changes.

- Select how you want to send your form, whether by email, SMS, or a shared link, or download it to your computer.

Say goodbye to lost or misplaced documents, cumbersome form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from your chosen device. Modify and eSign W9Virginia pdf Form W 9 Request For Taxpayer Identification Number and ensure excellent communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct w9virginiapdf form w 9 request for taxpayer identification number

Create this form in 5 minutes!

People also ask

-

What is the 2025 W9 form and why is it important?

The 2025 W9 form is an IRS document used by businesses to request taxpayer information from individuals and entities. It is crucial for reporting income paid to freelancers and contractors. Ensuring you correctly fill out and submit your 2025 W9 is essential for compliance with tax regulations.

-

How does airSlate SignNow facilitate the process of filling out the 2025 W9 form?

airSlate SignNow streamlines the completion of the 2025 W9 form by allowing users to easily fill it out electronically. The platform provides a user-friendly interface and templates that simplify the process, making it faster and more efficient. With airSlate SignNow, you can ensure your 2025 W9 form is accurate and ready to go.

-

Can I use airSlate SignNow to eSign the 2025 W9 securely?

Absolutely! airSlate SignNow offers secure electronic signatures that comply with legal standards. Once you have completed the 2025 W9 form, you can eSign it within the platform, ensuring your document is both secure and legally binding.

-

Is there a cost associated with using airSlate SignNow for the 2025 W9 form?

airSlate SignNow offers various pricing plans, catering to different business needs. The cost may vary based on the features you require, but overall, it provides a cost-effective solution for managing the 2025 W9 form and other documents. You can explore our pricing page for detailed options.

-

What features does airSlate SignNow include for managing the 2025 W9 form?

airSlate SignNow includes several features to manage the 2025 W9 form, such as templates, automated workflows, and cloud storage. You can easily share the form with clients, collect signatures, and track its status in real-time, making document management efficient and hassle-free.

-

Are there integrations available with airSlate SignNow for the 2025 W9 form?

Yes, airSlate SignNow integrates seamlessly with various applications and services, enhancing your workflow for the 2025 W9 form. You can sync with CRM software, accounting tools, and more to streamline document handling and ensure all your data is centralized.

-

How can using airSlate SignNow benefit my business when handling the 2025 W9 form?

Using airSlate SignNow to manage the 2025 W9 form saves time and reduces errors associated with manual processing. With its intuitive platform, secure eSigning, and automation features, you improve efficiency in your business operations while ensuring compliance with tax requirements.

Get more for W9Virginia pdf Form W 9 Request For Taxpayer Identification Number

- Ohio purchase form

- Satisfaction cancellation or release of mortgage package ohio form

- Premarital agreements package ohio form

- Painting contractor package ohio form

- Framing contractor package ohio form

- Foundation contractor package ohio form

- Plumbing contractor package ohio form

- Brick mason contractor package ohio form

Find out other W9Virginia pdf Form W 9 Request For Taxpayer Identification Number

- Sign Alaska Plumbing Moving Checklist Later

- Sign Arkansas Plumbing Business Plan Template Secure

- Sign Arizona Plumbing RFP Mobile

- Sign Arizona Plumbing Rental Application Secure

- Sign Colorado Plumbing Emergency Contact Form Now

- Sign Colorado Plumbing Emergency Contact Form Free

- How Can I Sign Connecticut Plumbing LLC Operating Agreement

- Sign Illinois Plumbing Business Plan Template Fast

- Sign Plumbing PPT Idaho Free

- How Do I Sign Wyoming Life Sciences Confidentiality Agreement

- Sign Iowa Plumbing Contract Safe

- Sign Iowa Plumbing Quitclaim Deed Computer

- Sign Maine Plumbing LLC Operating Agreement Secure

- How To Sign Maine Plumbing POA

- Sign Maryland Plumbing Letter Of Intent Myself

- Sign Hawaii Orthodontists Claim Free

- Sign Nevada Plumbing Job Offer Easy

- Sign Nevada Plumbing Job Offer Safe

- Sign New Jersey Plumbing Resignation Letter Online

- Sign New York Plumbing Cease And Desist Letter Free