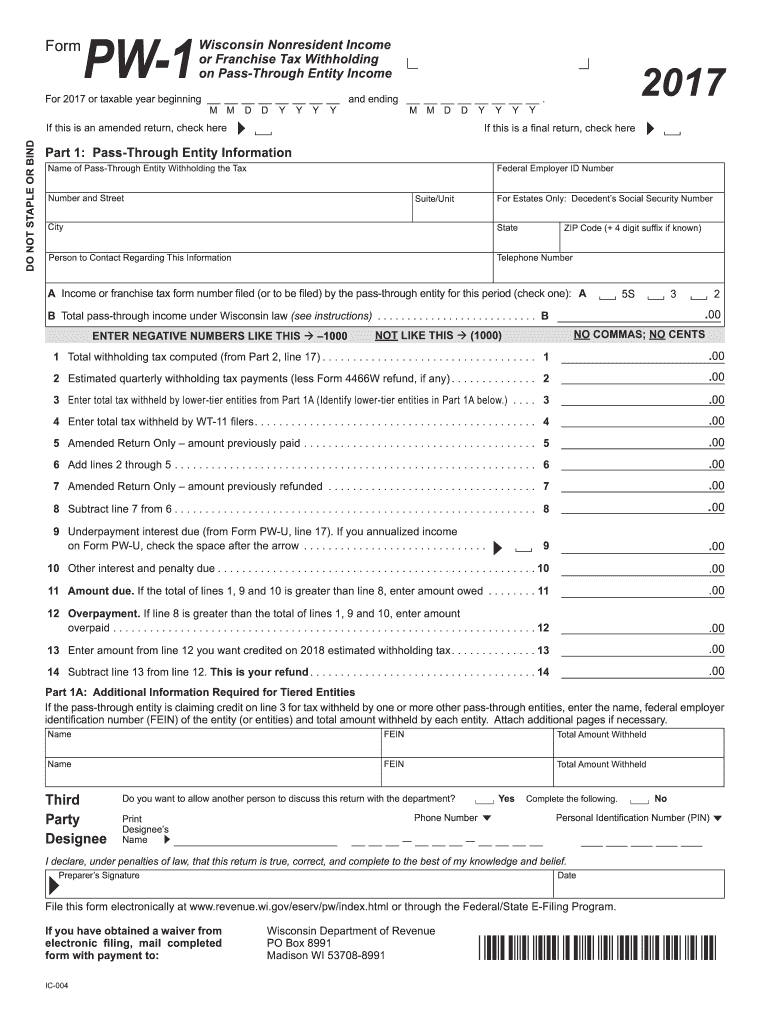

Pw 1 Form 2017

What is the Pw 1 Form

The Pw 1 Form is a specific document used primarily for tax-related purposes in the United States. This form is designed to collect essential information from individuals or businesses for accurate tax reporting. It serves as a means for taxpayers to report their income, deductions, and other relevant financial details to the Internal Revenue Service (IRS). Understanding the purpose and requirements of the Pw 1 Form is crucial for ensuring compliance with federal tax laws.

How to use the Pw 1 Form

Using the Pw 1 Form involves several steps to ensure that all required information is accurately reported. First, gather all necessary documentation, including income statements and deduction records. Next, fill out the form carefully, ensuring that each section is completed according to IRS guidelines. After completing the form, review it for accuracy before submitting it to the IRS. The form can be filed electronically or via traditional mail, depending on your preference and the specific requirements for your tax situation.

Steps to complete the Pw 1 Form

Completing the Pw 1 Form requires a systematic approach to ensure accuracy and compliance. Follow these steps:

- Collect all relevant financial documents, such as W-2s, 1099s, and receipts for deductions.

- Begin filling out the form, starting with your personal information, including name, address, and Social Security number.

- Report your income in the designated sections, ensuring you include all sources of income.

- List any deductions or credits you are eligible for, following the instructions provided on the form.

- Review your entries carefully to avoid errors that could lead to delays or penalties.

- Sign and date the form before submitting it to the IRS.

Legal use of the Pw 1 Form

The Pw 1 Form is legally recognized by the IRS as a valid method for reporting income and taxes owed. To ensure its legal validity, it is important to follow all instructions provided by the IRS and to submit the form by the designated deadlines. Additionally, using an eSignature solution, such as signNow, can enhance the security and legitimacy of your submission, as it complies with the ESIGN Act, making electronic signatures legally binding.

Filing Deadlines / Important Dates

Filing deadlines for the Pw 1 Form are crucial for avoiding penalties and ensuring compliance with tax regulations. Typically, individual taxpayers must submit their forms by April 15 of each year. However, if you are unable to meet this deadline, you may request an extension, which generally allows for an additional six months. It is important to note that while an extension gives you more time to file, it does not extend the deadline for any taxes owed.

Form Submission Methods (Online / Mail / In-Person)

The Pw 1 Form can be submitted through various methods, providing flexibility for taxpayers. The primary submission methods include:

- Online: Filing electronically through the IRS website or using approved e-filing software is the quickest method.

- Mail: You can print the completed form and mail it to the appropriate IRS address based on your location and filing status.

- In-Person: Some taxpayers may choose to file in person at designated IRS offices, although this option may require an appointment.

Quick guide on how to complete pw 1 2017 2019 form

Your assistance manual on how to prepare your Pw 1 Form

If you’re interested in learning how to generate and dispatch your Pw 1 Form, here are some brief instructions on how to simplify tax submission.

To begin, you just need to register your airSlate SignNow account to revolutionize how you manage documents online. airSlate SignNow is a highly user-friendly and powerful document solution that allows you to modify, draft, and finalize your tax documents with ease. With its editor, you can toggle between text, checkboxes, and eSignatures, and revisit to amend responses as necessary. Streamline your tax management with advanced PDF editing, eSigning, and seamless sharing.

Follow the instructions below to complete your Pw 1 Form in a matter of minutes:

- Create your account and begin working on PDFs within moments.

- Utilize our library to obtain any IRS tax form; explore different versions and schedules.

- Select Get form to open your Pw 1 Form in our editor.

- Complete the mandatory fillable fields with your information (text, numbers, check marks).

- Employ the Sign Tool to insert your legally-binding eSignature (if needed).

- Examine your document and rectify any discrepancies.

- Save modifications, print your copy, send it to your recipient, and download it to your device.

Utilize this manual to electronically file your taxes with airSlate SignNow. Please be aware that submitting in paper format may increase return errors and postpone refunds. Certainly, before e-filing your taxes, verify the IRS website for submission regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct pw 1 2017 2019 form

FAQs

-

How do I fill out the SSC CHSL 2017-18 form?

Its very easy task, you have to just put this link in your browser SSC, this page will appearOn this page click on Apply buttonthere a dialog box appears, in that dialog box click on CHSL a link will come “ Click here to apply” and you will signNow to registration page.I hope you all have understood the procedure. All the best for your exam

-

How do I fill out the CAT Application Form 2017?

CAT 2017 registration opened on August 9, 2017 will close on September 20 at 5PM. CAT online registration form and application form is a single document divided in 5 pages and is to be completed online. The 1st part of CAT online registration form requires your personal details. After completing your online registration, IIMs will send you CAT 2017 registration ID. With this unique ID, you will login to online registration form which will also contain application form and registration form.CAT Registration and application form will require you to fill up your academic details, uploading of photograph, signature and requires category certificates as per the IIMs prescribed format for CAT registration. CAT online application form 2017 consists of programme details on all the 20 IIMs. Candidates have to tick by clicking on the relevant programmes of the IIMs for which they wish to attend the personal Interview Process.

-

How do I fill out a CLAT 2019 application form?

Hi thereFirst of all, let me tell you some important points:CLAT 2019 has gone OFFLINE this yearBut the application forms for CLAT 2019 have to be filled ONLINEThe payment of the application fees also should be made onlineNow, kindly note the important dates:Note the details regarding the application fees:Here, if you want the Previous Year Question papers, Rs.500 would be added to the application fees.Apart from this, there would be bank transaction charges added to the application fees.The application fees is non-refundable.Note one important point here that before you fill the application form, check for your eligibility.To know the complete details of filling the application form along with other information like the eligibility - in terms of age, educational qualification, list of NLUs participating and the seats offered under each category, CLAT Reservation policies, CLAT exam pattern, marking scheme, syllabus, important documents required to be kept ready before filling the form, kindly go to the link below:How to fill CLAT 2019 Application form? Registration OPEN | All you need to knowTo know how to prepare for one of the very important section of CLAT exam, GK and Current Affairs, kindly go to the link below:How to prepare GK & Current Affairs for CLAT 2019To practice, daily MCQs on Current Affairs, kindly go to the link below:#CLAT2019 | #AILET2019 | #DULLB2019 | GK and Current Affairs Series: 5 in 10 Series: Day 12For any other queries, kindly write to us at mailateasyway@gmail.comThanks & Regards!

Create this form in 5 minutes!

How to create an eSignature for the pw 1 2017 2019 form

How to create an electronic signature for the Pw 1 2017 2019 Form online

How to make an electronic signature for your Pw 1 2017 2019 Form in Google Chrome

How to generate an electronic signature for putting it on the Pw 1 2017 2019 Form in Gmail

How to generate an electronic signature for the Pw 1 2017 2019 Form right from your smartphone

How to create an electronic signature for the Pw 1 2017 2019 Form on iOS

How to make an electronic signature for the Pw 1 2017 2019 Form on Android

People also ask

-

What is the Pw 1 Form and how can it help my business?

The Pw 1 Form is a document designed to facilitate easy electronic signing and management. By using airSlate SignNow, your business can streamline the signing process, reduce paper usage, and enhance workflow efficiency. This ensures your team can focus on what matters most, while the Pw 1 Form takes care of the documentation.

-

How much does it cost to use the Pw 1 Form with airSlate SignNow?

airSlate SignNow offers competitive pricing plans that include access to the Pw 1 Form. Depending on your business needs, you can choose from various subscription levels that allow for multiple users and additional features. The flexibility in pricing ensures there’s a plan that fits every budget.

-

What features are included with the Pw 1 Form?

When using the Pw 1 Form with airSlate SignNow, you'll gain access to features like document templates, real-time editing, and secure electronic signatures. Additionally, the platform allows for tracking document status and automated reminders, ensuring that your documents are signed promptly.

-

Can I integrate the Pw 1 Form with other applications?

Yes, airSlate SignNow supports integrations with a variety of applications, making it easy to incorporate the Pw 1 Form into your existing workflows. Whether you need to connect with CRM systems, project management tools, or cloud storage services, our platform works seamlessly with many popular software.

-

Is the Pw 1 Form legally binding?

Absolutely! The Pw 1 Form, when signed via airSlate SignNow, is legally binding and compliant with e-signature laws, including the ESIGN Act and UETA. This means that you can confidently use our platform for important agreements while maintaining legal integrity.

-

How can the Pw 1 Form improve my team's efficiency?

Using the Pw 1 Form can signNowly enhance your team's efficiency by reducing the time spent on paperwork and eliminating manual errors. airSlate SignNow automates the document flow and ensures that signatures are collected quickly, allowing your team to focus on core tasks without delay.

-

What benefits does airSlate SignNow offer beyond the Pw 1 Form?

Beyond the Pw 1 Form, airSlate SignNow offers a robust suite of tools for document management, including advanced analytics and workflow automation. This provides businesses with comprehensive solutions for not just signing, but also managing and optimizing document processes effectively.

Get more for Pw 1 Form

- New referral form format new doc

- Subway application for additional information fillable

- Cb13 bond form

- Credit rating form xls

- Turlock ca information about the city and its administration

- Mpusd interdistrict btransferb request form

- Thepressreleaseengine comshannan moon personidmoon shannanshannan moon is sheriff coroner public form

- Fillable form 22 15 1220 personal property fill io

Find out other Pw 1 Form

- eSign Minnesota Banking LLC Operating Agreement Online

- How Do I eSign Mississippi Banking Living Will

- eSign New Jersey Banking Claim Mobile

- eSign New York Banking Promissory Note Template Now

- eSign Ohio Banking LLC Operating Agreement Now

- Sign Maryland Courts Quitclaim Deed Free

- How To Sign Massachusetts Courts Quitclaim Deed

- Can I Sign Massachusetts Courts Quitclaim Deed

- eSign California Business Operations LLC Operating Agreement Myself

- Sign Courts Form Mississippi Secure

- eSign Alabama Car Dealer Executive Summary Template Fast

- eSign Arizona Car Dealer Bill Of Lading Now

- How Can I eSign Alabama Car Dealer Executive Summary Template

- eSign California Car Dealer LLC Operating Agreement Online

- eSign California Car Dealer Lease Agreement Template Fast

- eSign Arkansas Car Dealer Agreement Online

- Sign Montana Courts Contract Safe

- eSign Colorado Car Dealer Affidavit Of Heirship Simple

- eSign Car Dealer Form Georgia Simple

- eSign Florida Car Dealer Profit And Loss Statement Myself