a 772 2018-2026

What is the A-772?

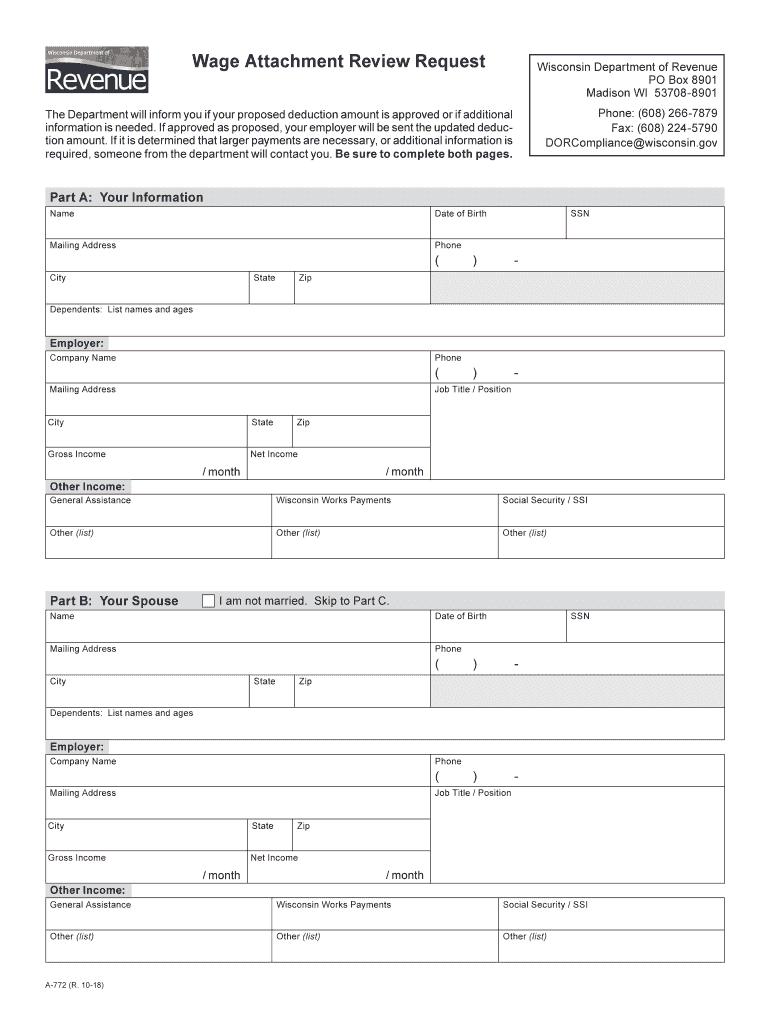

The A-772 form, also known as the Wisconsin A-772, is a tax document used in the state of Wisconsin. This form is primarily utilized for reporting wage information to the Wisconsin Department of Revenue. It allows employers to report wages paid to employees and any associated tax withholdings. Understanding the A-772 is essential for both employers and employees to ensure accurate tax reporting and compliance with state regulations.

How to use the A-772

Using the A-772 form involves several key steps. First, employers must gather all necessary wage information for their employees, including total wages, withholdings, and any deductions. Once the information is compiled, it can be entered into the appropriate fields on the form. After completing the form, employers should review it for accuracy before submitting it to the Wisconsin Department of Revenue. This ensures that all reported information is correct and helps avoid potential penalties.

Steps to complete the A-772

Completing the A-772 form requires careful attention to detail. Follow these steps:

- Gather employee wage data, including gross wages and withholdings.

- Access the A-772 form, either through a printable version or an online platform.

- Fill in the required fields with accurate information.

- Review the completed form for any errors or omissions.

- Submit the form electronically or via mail to the Wisconsin Department of Revenue.

Legal use of the A-772

The A-772 form must be used in accordance with Wisconsin state tax laws. It is legally binding and serves as an official record of wage reporting. Employers are required to submit this form to ensure compliance with state tax regulations. Failure to use the A-772 correctly can result in penalties or fines, making it crucial for employers to understand their obligations.

Filing Deadlines / Important Dates

Timely filing of the A-772 form is essential for compliance. The Wisconsin Department of Revenue typically sets specific deadlines for submission, which may vary based on the tax year. Employers should be aware of these deadlines to avoid late fees or penalties. It is advisable to check the Wisconsin Department of Revenue's official resources for the most current filing dates.

Who Issues the Form

The A-772 form is issued by the Wisconsin Department of Revenue. This state agency is responsible for overseeing tax collection and ensuring compliance with state tax laws. Employers must submit the completed form to this department, which processes the wage information and maintains records for tax purposes.

Quick guide on how to complete wisconsin dept of revenue wage assignment reduction request 2018 2019 form

Your assistance manual on how to prepare your A 772

If you’re wondering how to generate and submit your A 772, here are some straightforward guidelines on how to simplify tax filing.

To begin, you simply need to set up your airSlate SignNow profile to change the way you manage paperwork online. airSlate SignNow is a highly user-friendly and powerful document solution that enables you to modify, draft, and finalize your income tax documents effortlessly. Utilizing its editor, you can toggle between text, checkboxes, and eSignatures and return to alter information as needed. Streamline your tax management with advanced PDF editing, eSigning, and user-friendly sharing.

Adhere to the following steps to complete your A 772 in just a few minutes:

- Establish your account and start working on PDFs in no time.

- Utilize our directory to find any IRS tax form; explore different versions and schedules.

- Click Obtain form to open your A 772 in our editor.

- Complete the necessary fillable fields with your information (text, numbers, check marks).

- Employ the Sign Tool to add your legally-binding eSignature (if required).

- Examine your document and rectify any mistakes.

- Preserve alterations, print your version, send it to your recipient, and download it to your device.

Refer to this manual to file your taxes electronically with airSlate SignNow. Be aware that submitting on paper may lead to increased errors and delayed refunds. It is imperative to check the IRS website for submitting regulations in your state before e-filing your taxes.

Create this form in 5 minutes or less

Find and fill out the correct wisconsin dept of revenue wage assignment reduction request 2018 2019 form

Create this form in 5 minutes!

How to create an eSignature for the wisconsin dept of revenue wage assignment reduction request 2018 2019 form

How to create an electronic signature for your Wisconsin Dept Of Revenue Wage Assignment Reduction Request 2018 2019 Form in the online mode

How to generate an eSignature for your Wisconsin Dept Of Revenue Wage Assignment Reduction Request 2018 2019 Form in Google Chrome

How to make an electronic signature for signing the Wisconsin Dept Of Revenue Wage Assignment Reduction Request 2018 2019 Form in Gmail

How to create an eSignature for the Wisconsin Dept Of Revenue Wage Assignment Reduction Request 2018 2019 Form from your mobile device

How to create an electronic signature for the Wisconsin Dept Of Revenue Wage Assignment Reduction Request 2018 2019 Form on iOS

How to generate an eSignature for the Wisconsin Dept Of Revenue Wage Assignment Reduction Request 2018 2019 Form on Android OS

People also ask

-

What is the a772 form and how can airSlate SignNow help with it?

The a772 form is a document that requires electronic signatures for fast processing. With airSlate SignNow, you can easily send, receive, and eSign the a772 form, ensuring a quick and efficient workflow. Our platform simplifies the entire signing process, making it easy for all parties involved.

-

Is there a cost associated with using airSlate SignNow for the a772 form?

Yes, airSlate SignNow offers several pricing plans tailored to different business needs, and these include functionalities for managing the a772 form. You can choose a plan that best fits your budget while still enjoying the benefits of streamlining your document signing processes.

-

What features does airSlate SignNow offer for handling the a772 form?

airSlate SignNow provides a variety of features specifically designed for handling the a772 form, including templates, bulk sending, and tracking. You can automate reminders and notifications to ensure timely completion, making it a comprehensive solution for managing your documents.

-

Can I integrate airSlate SignNow with other applications for the a772 form?

Absolutely! airSlate SignNow offers seamless integrations with various applications, enabling you to enhance the management of the a772 form. This feature allows you to connect with CRMs, cloud storage, and other tools to streamline your workflow even further.

-

What are the benefits of using airSlate SignNow for the a772 form?

Using airSlate SignNow for the a772 form provides numerous benefits, including a user-friendly interface, enhanced security, and compliance with eSignature laws. This not only facilitates a smoother workflow but also assures all parties that their documents are handled securely.

-

Is it easy to get started with the a772 form on airSlate SignNow?

Yes, getting started with the a772 form on airSlate SignNow is quick and user-friendly. Simply sign up for an account, upload your document, and begin sending it for signatures. Our intuitive interface ensures that even those who are not tech-savvy can use the platform effortlessly.

-

What kind of support does airSlate SignNow offer for the a772 form?

airSlate SignNow provides comprehensive support for all users dealing with the a772 form. You can access detailed guides, FAQs, and live chat assistance to help you navigate any challenges you may encounter while using our platform.

Get more for A 772

- It 540 online form

- Dd form 792

- Digestive system reading comprehension pdf form

- Davy crockett by deborah lynn form

- State education department transportation unit form ce

- Ab 540 and ab california nonresident tuition exemption form

- City of sacramento animal care services 2127 front street cityofsacramento form

- Cslb ca form

Find out other A 772

- Help Me With eSign Idaho Plumbing Profit And Loss Statement

- eSign Illinois Plumbing Letter Of Intent Now

- eSign Massachusetts Orthodontists Last Will And Testament Now

- eSign Illinois Plumbing Permission Slip Free

- eSign Kansas Plumbing LLC Operating Agreement Secure

- eSign Kentucky Plumbing Quitclaim Deed Free

- eSign Legal Word West Virginia Online

- Can I eSign Wisconsin Legal Warranty Deed

- eSign New Hampshire Orthodontists Medical History Online

- eSign Massachusetts Plumbing Job Offer Mobile

- How To eSign Pennsylvania Orthodontists Letter Of Intent

- eSign Rhode Island Orthodontists Last Will And Testament Secure

- eSign Nevada Plumbing Business Letter Template Later

- eSign Nevada Plumbing Lease Agreement Form Myself

- eSign Plumbing PPT New Jersey Later

- eSign New York Plumbing Rental Lease Agreement Simple

- eSign North Dakota Plumbing Emergency Contact Form Mobile

- How To eSign North Dakota Plumbing Emergency Contact Form

- eSign Utah Orthodontists Credit Memo Easy

- How To eSign Oklahoma Plumbing Business Plan Template