Wisconsin Dept of Revenue Wage Assignment Reduction Request Form 2017

What is the Wisconsin Dept Of Revenue Wage Assignment Reduction Request Form

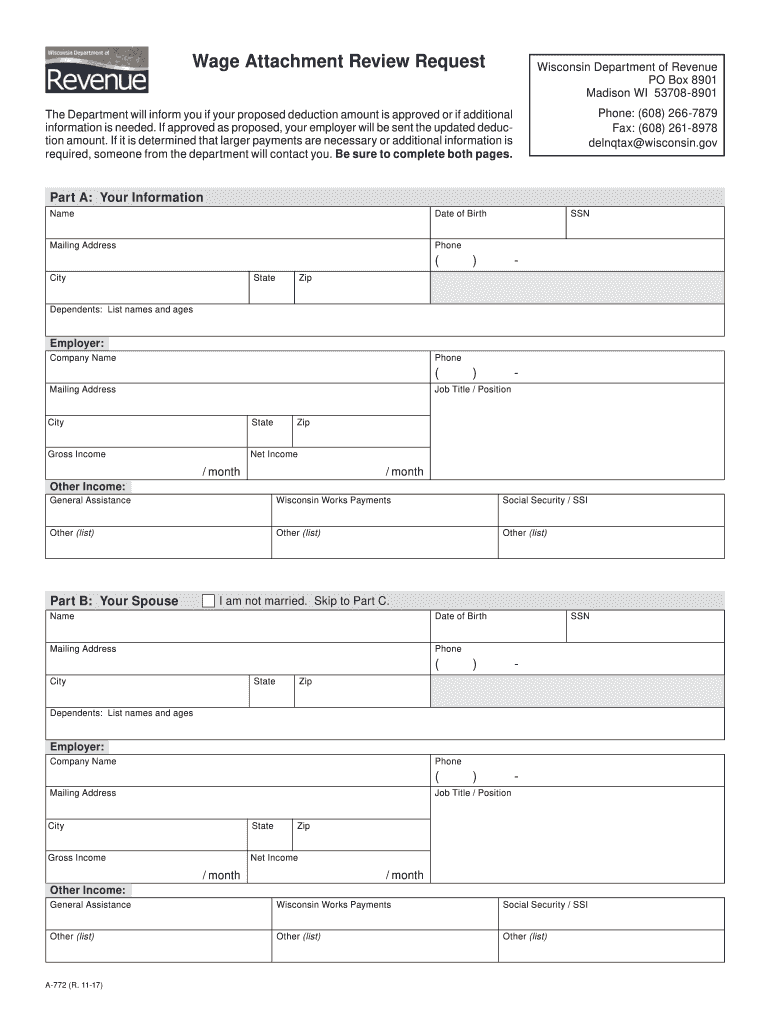

The Wisconsin Dept Of Revenue Wage Assignment Reduction Request Form is a specific document designed for individuals seeking to reduce the amount of their wages that are assigned for tax purposes. This form allows taxpayers to formally request a reassessment of their wage assignment, which may be necessary due to changes in financial circumstances or other qualifying reasons. Understanding the purpose and requirements of this form is crucial for ensuring compliance with state tax regulations.

How to use the Wisconsin Dept Of Revenue Wage Assignment Reduction Request Form

Using the Wisconsin Dept Of Revenue Wage Assignment Reduction Request Form involves several straightforward steps. First, gather all necessary financial documentation that supports your request for a reduction. This may include pay stubs, tax returns, or any relevant financial statements. Next, fill out the form accurately, ensuring that all required fields are completed. After completing the form, review it for any errors before submission. Finally, submit the form according to the guidelines provided, either electronically or via mail, depending on your preference.

Steps to complete the Wisconsin Dept Of Revenue Wage Assignment Reduction Request Form

Completing the Wisconsin Dept Of Revenue Wage Assignment Reduction Request Form requires careful attention to detail. Follow these steps:

- Obtain the form from the Wisconsin Department of Revenue website or other authorized sources.

- Fill in your personal information, including your name, address, and Social Security number.

- Provide details regarding your current wage assignment, including the amount and the reason for your request.

- Attach any supporting documentation that validates your request, such as income statements or financial hardship evidence.

- Review the form for accuracy and completeness before signing it.

- Submit the completed form as instructed, ensuring you keep a copy for your records.

Key elements of the Wisconsin Dept Of Revenue Wage Assignment Reduction Request Form

The Wisconsin Dept Of Revenue Wage Assignment Reduction Request Form includes several key elements that are essential for its validity. These elements typically consist of:

- Taxpayer identification information, including name and Social Security number.

- Details of the current wage assignment, including the amount being withheld.

- Reason for the reduction request, which must be clearly articulated.

- Signature of the taxpayer, affirming the accuracy of the information provided.

- Any necessary attachments that support the request.

Eligibility Criteria

To successfully submit the Wisconsin Dept Of Revenue Wage Assignment Reduction Request Form, applicants must meet specific eligibility criteria. Generally, these criteria include:

- Being a resident of Wisconsin or having income sourced from Wisconsin.

- Experiencing a change in financial circumstances that justifies a reduction in wage assignment.

- Providing adequate documentation to support the request for a reduction.

Form Submission Methods

The Wisconsin Dept Of Revenue Wage Assignment Reduction Request Form can be submitted through various methods, ensuring convenience for taxpayers. Options typically include:

- Online submission through the Wisconsin Department of Revenue's official website.

- Mailing the completed form to the appropriate address as indicated on the form.

- In-person submission at designated state offices, if applicable.

Quick guide on how to complete wisconsin dept of revenue wage assignment reduction request 2017 form

Your assistance manual on how to prepare your Wisconsin Dept Of Revenue Wage Assignment Reduction Request Form

If you’re interested in understanding how to finalize and submit your Wisconsin Dept Of Revenue Wage Assignment Reduction Request Form, below are several brief guidelines on how to make tax filing simpler.

To begin, you just need to create your airSlate SignNow account to modify your approach to managing documents online. airSlate SignNow is an extremely user-friendly and powerful document solution that enables you to edit, draft, and complete your income tax forms with ease. Utilizing its editor, you can alternate between text, checkboxes, and eSignatures, and return to modify details as necessary. Optimize your tax management with advanced PDF editing, eSigning, and straightforward sharing.

Follow the steps outlined below to finalize your Wisconsin Dept Of Revenue Wage Assignment Reduction Request Form in just a few minutes:

- Create your account and start working on PDFs in a matter of moments.

- Browse our catalog to locate any IRS tax form; explore different versions and schedules.

- Click Get form to open your Wisconsin Dept Of Revenue Wage Assignment Reduction Request Form in our editor.

- Complete the necessary fillable fields with your details (text, numbers, check marks).

- Utilize the Sign Tool to add your legally-binding eSignature (if needed).

- Review your document and correct any errors.

- Save your changes, print your copy, send it to your recipient, and download it to your device.

Refer to this manual to file your taxes electronically with airSlate SignNow. Please be aware that filing on paper can lead to increased return errors and delays in reimbursements. Before e-filing your taxes, check the IRS website for submission guidelines specific to your state.

Create this form in 5 minutes or less

Find and fill out the correct wisconsin dept of revenue wage assignment reduction request 2017 form

Create this form in 5 minutes!

How to create an eSignature for the wisconsin dept of revenue wage assignment reduction request 2017 form

How to make an electronic signature for your Wisconsin Dept Of Revenue Wage Assignment Reduction Request 2017 Form in the online mode

How to generate an electronic signature for the Wisconsin Dept Of Revenue Wage Assignment Reduction Request 2017 Form in Google Chrome

How to make an eSignature for signing the Wisconsin Dept Of Revenue Wage Assignment Reduction Request 2017 Form in Gmail

How to generate an electronic signature for the Wisconsin Dept Of Revenue Wage Assignment Reduction Request 2017 Form right from your mobile device

How to make an electronic signature for the Wisconsin Dept Of Revenue Wage Assignment Reduction Request 2017 Form on iOS devices

How to create an electronic signature for the Wisconsin Dept Of Revenue Wage Assignment Reduction Request 2017 Form on Android OS

People also ask

-

What is the Wisconsin Dept Of Revenue Wage Assignment Reduction Request Form?

The Wisconsin Dept Of Revenue Wage Assignment Reduction Request Form is an official document used to request a reduction in your wage assignment obligations. This form is essential for individuals facing financial hardship and seeking to manage their debts effectively. airSlate SignNow simplifies this process by allowing you to fill out, eSign, and submit the form digitally.

-

How can airSlate SignNow help me with the Wisconsin Dept Of Revenue Wage Assignment Reduction Request Form?

airSlate SignNow provides a user-friendly platform to complete and eSign the Wisconsin Dept Of Revenue Wage Assignment Reduction Request Form. With our solution, you can easily access the form, fill it out, and submit it without the hassle of printing or scanning. This streamlines the process and ensures your request is submitted promptly.

-

Is there a cost associated with using airSlate SignNow for the Wisconsin Dept Of Revenue Wage Assignment Reduction Request Form?

Yes, while airSlate SignNow offers a variety of pricing plans, you can start with a free trial to evaluate the features. Our cost-effective solutions provide excellent value, especially for those needing to manage forms like the Wisconsin Dept Of Revenue Wage Assignment Reduction Request Form frequently. Check our website for detailed pricing options.

-

Does airSlate SignNow offer any integrations for submitting the Wisconsin Dept Of Revenue Wage Assignment Reduction Request Form?

Absolutely! airSlate SignNow integrates with a variety of applications, allowing you to streamline your workflow and easily manage documents like the Wisconsin Dept Of Revenue Wage Assignment Reduction Request Form. You can connect with tools such as Google Drive, Dropbox, and more to enhance your document management experience.

-

What are the benefits of using airSlate SignNow for the Wisconsin Dept Of Revenue Wage Assignment Reduction Request Form?

Using airSlate SignNow to manage the Wisconsin Dept Of Revenue Wage Assignment Reduction Request Form offers several benefits, including speed, efficiency, and convenience. You can complete and submit your form from anywhere at any time, which helps you save time and reduce stress. Moreover, our platform ensures security and compliance throughout the process.

-

Can I access the Wisconsin Dept Of Revenue Wage Assignment Reduction Request Form on any device?

Yes, airSlate SignNow is compatible with multiple devices, including desktops, tablets, and smartphones. This ensures that you can work on your Wisconsin Dept Of Revenue Wage Assignment Reduction Request Form anytime and anywhere, making it extremely convenient to manage your documentation needs.

-

What if I encounter issues while filling out the Wisconsin Dept Of Revenue Wage Assignment Reduction Request Form on airSlate SignNow?

If you experience any issues while completing the Wisconsin Dept Of Revenue Wage Assignment Reduction Request Form, airSlate SignNow offers robust customer support. Our support team is available to assist you with any questions or concerns, ensuring you can navigate the platform smoothly and submit your form without complications.

Get more for Wisconsin Dept Of Revenue Wage Assignment Reduction Request Form

Find out other Wisconsin Dept Of Revenue Wage Assignment Reduction Request Form

- eSign Hawaii Application for University Free

- eSign Hawaii Application for University Secure

- eSign Hawaii Medical Power of Attorney Template Free

- eSign Washington Nanny Contract Template Free

- eSignature Ohio Guaranty Agreement Myself

- eSignature California Bank Loan Proposal Template Now

- Can I eSign Indiana Medical History

- eSign Idaho Emergency Contract Form Myself

- eSign Hawaii General Patient Information Fast

- Help Me With eSign Rhode Island Accident Medical Claim Form

- eSignature Colorado Demand for Payment Letter Mobile

- eSignature Colorado Demand for Payment Letter Secure

- eSign Delaware Shareholder Agreement Template Now

- eSign Wyoming Shareholder Agreement Template Safe

- eSign Kentucky Strategic Alliance Agreement Secure

- Can I eSign Alaska Equipment Rental Agreement Template

- eSign Michigan Equipment Rental Agreement Template Later

- Help Me With eSignature Washington IOU

- eSign Indiana Home Improvement Contract Myself

- eSign North Dakota Architectural Proposal Template Online