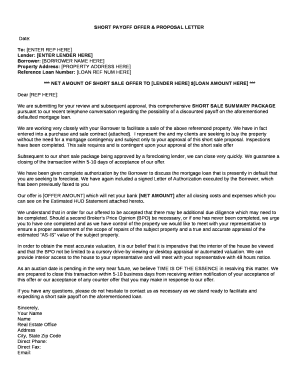

Short Payoff Letter Form

What is the Short Payoff Letter

A short payoff letter is a document that outlines the remaining balance on a loan, typically used in situations where a borrower is looking to settle their debt for less than the full amount owed. This letter is crucial for both lenders and borrowers, as it provides a clear understanding of the financial obligations and the potential for a negotiated settlement. It serves as a formal request to the lender for a payoff amount that is less than the outstanding balance, often due to financial hardship or other circumstances that prevent the borrower from continuing payments.

How to Use the Short Payoff Letter

To effectively use a short payoff letter, a borrower should first gather all relevant loan information, including the account number and outstanding balance. The letter should clearly state the request for a short payoff, including the proposed amount the borrower is willing to pay. It is important to include a brief explanation of the borrower's financial situation, demonstrating the need for a reduced payoff. Once completed, the letter should be sent to the lender, either via mail or electronically, depending on the lender's preferences.

Key Elements of the Short Payoff Letter

A well-crafted short payoff letter should include several key elements to ensure clarity and effectiveness:

- Borrower Information: Full name, address, and contact details.

- Lender Information: Name of the lender, loan account number, and contact information.

- Request Statement: A clear request for a short payoff, specifying the amount the borrower is able to pay.

- Financial Explanation: A brief overview of the borrower's financial situation, explaining the need for a reduced payoff.

- Signature: The borrower's signature to validate the request.

Steps to Complete the Short Payoff Letter

Completing a short payoff letter involves several straightforward steps:

- Gather all necessary loan documentation, including account details and payment history.

- Draft the letter, ensuring all key elements are included.

- Review the letter for accuracy and completeness.

- Send the letter to the lender, using the preferred method of communication.

- Keep a copy of the letter for personal records.

How to Obtain the Short Payoff Letter

Borrowers can typically obtain a short payoff letter by contacting their lender directly. Many lenders have specific procedures for requesting this type of letter, which may include filling out a form or providing certain documentation. It is advisable to reach out to customer service or the loan servicing department to understand the exact steps required. Some lenders may also provide a template or guidelines to assist in the process.

Legal Use of the Short Payoff Letter

The short payoff letter is legally recognized as a formal request for a reduction in the total amount owed on a loan. It is important for borrowers to understand that submitting this letter does not guarantee acceptance by the lender. The lender has the discretion to approve or deny the request based on their policies and the borrower's financial situation. Borrowers should ensure that their request is reasonable and backed by supporting documentation to enhance the likelihood of approval.

Quick guide on how to complete short payoff letter

Prepare Short Payoff Letter seamlessly on any device

Digital document management has gained signNow traction among businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the right form and securely store it online. airSlate SignNow provides all the necessary tools to create, modify, and electronically sign your documents quickly and without complications. Manage Short Payoff Letter on any platform with the airSlate SignNow apps for Android or iOS and streamline any document-related process today.

The easiest way to modify and electronically sign Short Payoff Letter effortlessly

- Find Short Payoff Letter and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Create your signature using the Sign feature, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Decide how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors requiring new document prints. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Short Payoff Letter and ensure outstanding communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the short payoff letter

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a short payoff letter?

A short payoff letter is a document that outlines the remaining balance on a loan or mortgage, providing a clear amount needed to pay off the debt. This letter is essential for borrowers looking to settle their accounts quickly and efficiently. With airSlate SignNow, you can easily create and send a short payoff letter to streamline the payoff process.

-

How can airSlate SignNow help me create a short payoff letter?

airSlate SignNow offers a user-friendly platform that allows you to generate a short payoff letter quickly. You can customize the letter with your specific details and send it directly to your lender for eSignature. This simplifies the process and ensures that your payoff request is handled promptly.

-

Is there a cost associated with using airSlate SignNow for a short payoff letter?

Yes, airSlate SignNow provides various pricing plans that cater to different business needs. The cost-effective solution allows you to create and manage documents, including short payoff letters, without breaking the bank. You can choose a plan that fits your budget and usage requirements.

-

What features does airSlate SignNow offer for managing short payoff letters?

airSlate SignNow includes features such as document templates, eSignature capabilities, and secure cloud storage. These tools make it easy to manage your short payoff letters and other important documents. Additionally, you can track the status of your letters and receive notifications when they are signed.

-

Can I integrate airSlate SignNow with other applications for my short payoff letters?

Absolutely! airSlate SignNow offers integrations with various applications, including CRM systems and cloud storage services. This allows you to streamline your workflow and manage your short payoff letters alongside other business processes seamlessly.

-

What are the benefits of using airSlate SignNow for short payoff letters?

Using airSlate SignNow for your short payoff letters provides numerous benefits, including increased efficiency, reduced paperwork, and faster turnaround times. The platform's eSignature feature ensures that your letters are signed quickly, helping you close transactions without delays. Additionally, the secure storage keeps your documents safe and accessible.

-

How secure is airSlate SignNow when handling short payoff letters?

airSlate SignNow prioritizes security, employing advanced encryption and compliance measures to protect your documents, including short payoff letters. Your data is stored securely in the cloud, ensuring that only authorized users have access. This commitment to security gives you peace of mind when managing sensitive financial documents.

Get more for Short Payoff Letter

- Oceaninvoice form

- Party booking form

- Diff git a core assets vendor zxcvbn zxcvbn async js b core assets vendor zxcvbn zxcvbn async js new file mode 100644 index form

- Srl inspection form

- Allied mathematics volume 1 pdf download form

- Isee blasters handbook pdf form

- Fmla broward county schools form

- Ncvec quick form 605 application

Find out other Short Payoff Letter

- How Can I eSignature Georgia Courts Quitclaim Deed

- Help Me With eSignature Florida Courts Affidavit Of Heirship

- Electronic signature Alabama Banking RFP Online

- eSignature Iowa Courts Quitclaim Deed Now

- eSignature Kentucky Courts Moving Checklist Online

- eSignature Louisiana Courts Cease And Desist Letter Online

- How Can I Electronic signature Arkansas Banking Lease Termination Letter

- eSignature Maryland Courts Rental Application Now

- eSignature Michigan Courts Affidavit Of Heirship Simple

- eSignature Courts Word Mississippi Later

- eSignature Tennessee Sports Last Will And Testament Mobile

- How Can I eSignature Nevada Courts Medical History

- eSignature Nebraska Courts Lease Agreement Online

- eSignature Nebraska Courts LLC Operating Agreement Easy

- Can I eSignature New Mexico Courts Business Letter Template

- eSignature New Mexico Courts Lease Agreement Template Mobile

- eSignature Courts Word Oregon Secure

- Electronic signature Indiana Banking Contract Safe

- Electronic signature Banking Document Iowa Online

- Can I eSignature West Virginia Sports Warranty Deed