Waller County, Texas Assessor's Office 2023-2026

What is the Waller County, Texas Assessor's Office

The Waller County Assessor's Office is responsible for managing property assessments and maintaining accurate property records within the county. This office plays a crucial role in determining property values for taxation purposes, ensuring that property taxes are fairly assessed based on the current market conditions. The Assessor's Office also oversees the homestead exemption application process, which can provide significant tax relief for eligible homeowners.

Eligibility Criteria for Texas Homestead Exemption

To qualify for the Texas homestead exemption, homeowners must meet specific criteria. The property must be the owner's primary residence, and the owner must occupy the home on January first of the tax year. Additionally, the homeowner should not claim a homestead exemption on any other property. Certain exemptions, such as those for disabled individuals or seniors, may have additional requirements that need to be met.

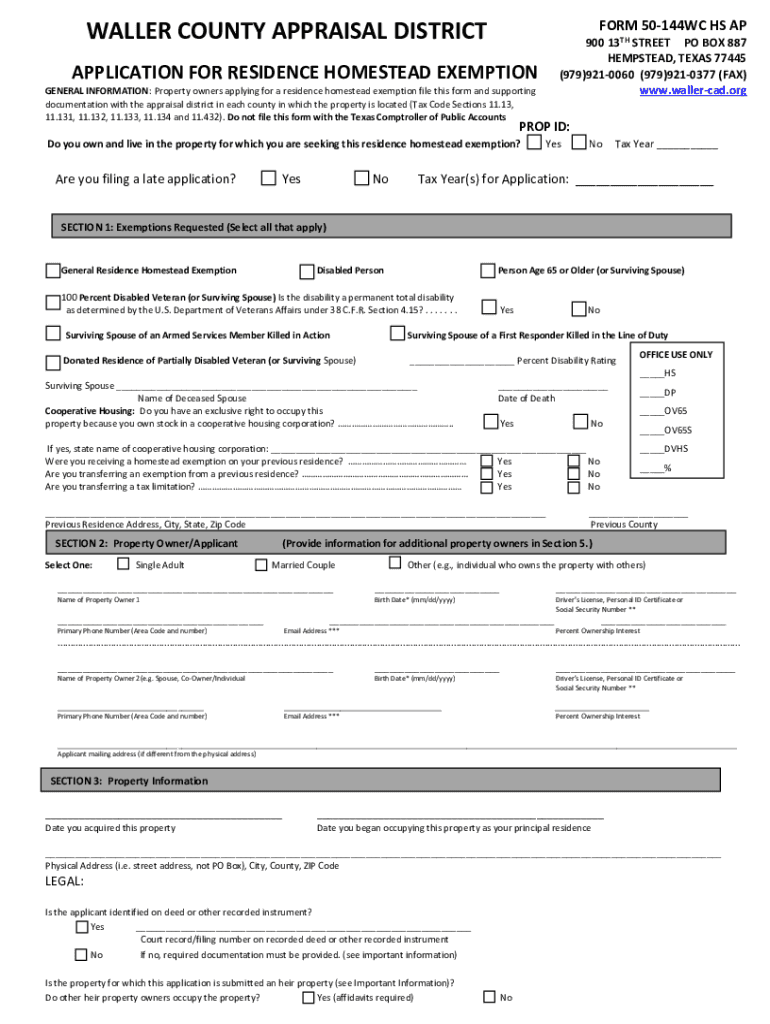

Required Documents for the Homestead Exemption Application

When applying for the Texas homestead exemption, homeowners need to submit several key documents. These typically include:

- A completed homestead exemption application form.

- Proof of identity, such as a driver's license or state ID.

- Evidence of ownership, like a deed or property tax statement.

- Any additional documentation required for specific exemptions, such as disability verification for disabled applicants.

Steps to Complete the Homestead Exemption Application

Completing the Texas homestead exemption application involves several straightforward steps:

- Obtain the homestead exemption application form from the Waller County Assessor's Office or their official website.

- Fill out the application form accurately, ensuring all required information is provided.

- Gather the necessary documents to support your application.

- Submit the completed application and supporting documents to the Assessor's Office by the designated deadline.

Form Submission Methods for Homestead Exemption

Homeowners in Waller County can submit their homestead exemption applications through various methods. These include:

- Online submission via the Waller County Assessor's Office website.

- Mailing the completed application to the Assessor's Office.

- In-person submission at the Assessor's Office during business hours.

Filing Deadlines for Homestead Exemption Applications

It is essential for homeowners to be aware of the filing deadlines for the Texas homestead exemption. Typically, applications must be submitted by April 30 of the tax year for which the exemption is being requested. However, specific deadlines may vary, so it is advisable to check with the Waller County Assessor's Office for the most current information.

Quick guide on how to complete waller county texas assessors office

Finalize Waller County, Texas Assessor's Office seamlessly on any gadget

Digital document management has become popular among businesses and individuals alike. It serves as an excellent environmentally friendly alternative to traditional printed and signed documents, allowing you to access the necessary forms and securely store them online. airSlate SignNow provides all the tools you need to create, modify, and eSign your paperwork quickly and without hassles. Manage Waller County, Texas Assessor's Office on any device using the airSlate SignNow Android or iOS applications and simplify any document-related task today.

How to modify and eSign Waller County, Texas Assessor's Office effortlessly

- Obtain Waller County, Texas Assessor's Office and click on Get Form to initiate.

- Utilize the tools we provide to finalize your document.

- Emphasize important sections of your documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your eSignature using the Sign feature, which takes moments and holds the same legal validity as a conventional ink signature.

- Review the details and click on the Done button to secure your modifications.

- Choose how you want to send your form, via email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs with just a few clicks from any device you prefer. Modify and eSign Waller County, Texas Assessor's Office and ensure excellent communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct waller county texas assessors office

Create this form in 5 minutes!

How to create an eSignature for the waller county texas assessors office

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Texas homestead exemption county?

The Texas homestead exemption county refers to the property tax exemption available to homeowners in Texas, which reduces the taxable value of their primary residence. This exemption can signNowly lower property taxes, making homeownership more affordable. Understanding the specifics of your county's exemption can help you maximize your savings.

-

How do I apply for the Texas homestead exemption county?

To apply for the Texas homestead exemption county, you need to complete an application form provided by your local appraisal district. This form typically requires proof of residency and ownership of the property. It's important to submit your application before the deadline to ensure you receive the exemption for the current tax year.

-

What are the benefits of the Texas homestead exemption county?

The benefits of the Texas homestead exemption county include reduced property taxes, which can lead to signNow savings for homeowners. Additionally, this exemption can provide protection against creditors, ensuring that your home remains secure in times of financial difficulty. Overall, it enhances the affordability of homeownership in Texas.

-

Are there any costs associated with the Texas homestead exemption county?

There are no direct costs associated with applying for the Texas homestead exemption county, as the application process is typically free. However, homeowners should be aware of any potential fees related to property assessments or other local regulations. It's advisable to check with your county's appraisal district for specific details.

-

Can I receive the Texas homestead exemption county if I own multiple properties?

No, the Texas homestead exemption county is only applicable to your primary residence. If you own multiple properties, you can only claim the exemption on the one you occupy as your main home. This rule is designed to ensure that the benefits of the exemption are directed towards homeowners who reside in their properties.

-

How does the Texas homestead exemption county affect my property taxes?

The Texas homestead exemption county reduces the assessed value of your home, which in turn lowers your property tax bill. For example, if your home is valued at $200,000 and you qualify for a $25,000 exemption, you will only be taxed on $175,000. This can lead to substantial savings over time.

-

What documents do I need for the Texas homestead exemption county application?

When applying for the Texas homestead exemption county, you typically need to provide proof of identity, such as a driver's license, and documentation that verifies your ownership and residency. This may include a utility bill or mortgage statement. It's essential to check with your local appraisal district for any specific requirements.

Get more for Waller County, Texas Assessor's Office

Find out other Waller County, Texas Assessor's Office

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word

- Can I eSignature Tennessee Police Form

- How Can I eSignature Vermont Police Presentation

- How Do I eSignature Pennsylvania Real Estate Document

- How Do I eSignature Texas Real Estate Document

- How Can I eSignature Colorado Courts PDF

- Can I eSignature Louisiana Courts Document

- How To Electronic signature Arkansas Banking Document

- How Do I Electronic signature California Banking Form

- How Do I eSignature Michigan Courts Document

- Can I eSignature Missouri Courts Document

- How Can I Electronic signature Delaware Banking PDF

- Can I Electronic signature Hawaii Banking Document

- Can I eSignature North Carolina Courts Presentation

- Can I eSignature Oklahoma Courts Word

- How To Electronic signature Alabama Business Operations Form