Federal Regulations Require the Office of Student Financial Aid to Use Financial Information from the FAFSA When

Understanding the Federal Regulations for Student Financial Aid

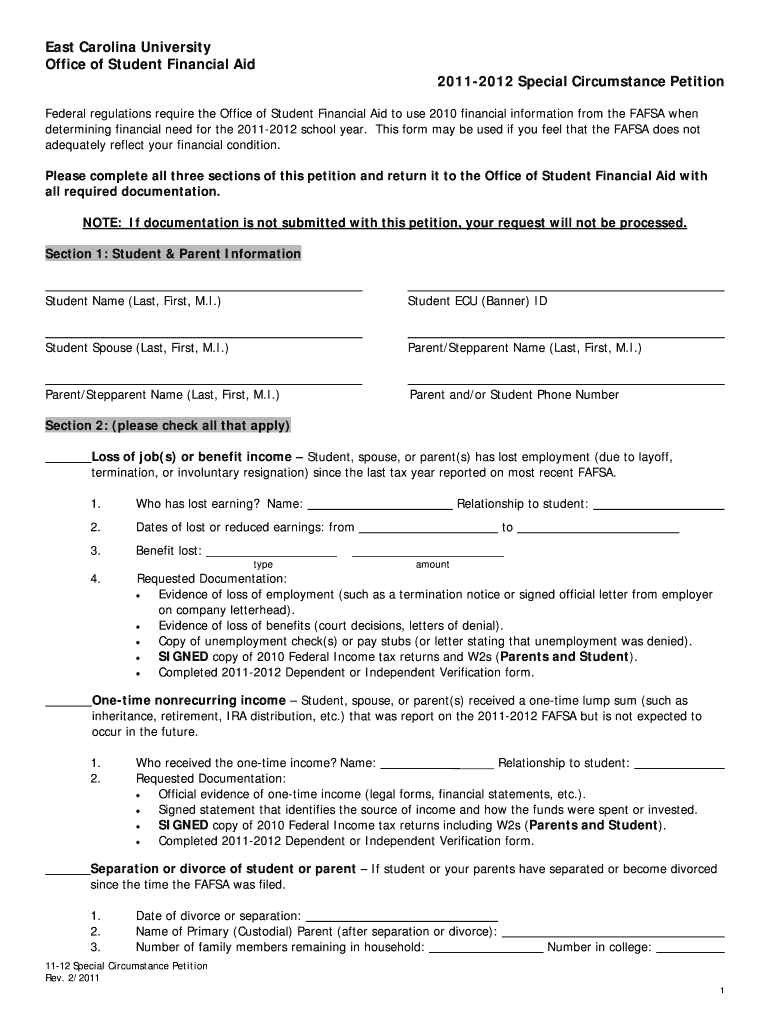

The Federal Regulations require the Office of Student Financial Aid to utilize financial information from the Free Application for Federal Student Aid (FAFSA) when determining a student's eligibility for federal financial aid. This regulation ensures that the financial aid process is standardized, allowing for fair assessment based on the financial circumstances of students and their families. The information collected through the FAFSA helps institutions allocate funds appropriately and ensures that aid is provided to those who need it most.

Steps to Complete the FAFSA

Completing the FAFSA involves several key steps that must be followed to ensure accurate processing of financial information. First, students should gather necessary documents, including tax returns, W-2 forms, and bank statements. Next, they can create an FSA ID, which serves as a unique identifier for accessing the FAFSA online. After logging in, students will fill out the application, providing detailed financial information and demographic data. Finally, it's essential to review the application for accuracy before submitting it electronically.

Required Documents for FAFSA Submission

To successfully complete the FAFSA, specific documents are necessary. These include:

- Tax returns from the previous year for both the student and parent(s)

- W-2 forms and other income statements

- Bank statements and investment records

- Social Security numbers for the student and parent(s)

- Records of untaxed income, if applicable

Having these documents ready will streamline the application process and help ensure that all required information is accurately reported.

Eligibility Criteria for Federal Financial Aid

Eligibility for federal financial aid is determined based on several factors outlined in the FAFSA. Students must be U.S. citizens or eligible non-citizens, possess a valid Social Security number, and be enrolled or accepted for enrollment in an eligible degree or certificate program. Additionally, students must demonstrate financial need, which is calculated using the information provided in the FAFSA. Maintaining satisfactory academic progress is also a requirement for continued eligibility.

Legal Use of FAFSA Financial Information

The financial information provided in the FAFSA is used legally by the Office of Student Financial Aid to assess a student's financial need and determine eligibility for various forms of aid, including grants, loans, and work-study programs. This information is protected under federal privacy laws, ensuring that it is only used for the intended purpose of evaluating financial aid eligibility. Institutions are required to maintain confidentiality and secure handling of this sensitive information.

Examples of FAFSA Application Scenarios

Different scenarios may affect how students complete the FAFSA. For instance, dependent students must include their parents' financial information, while independent students report only their own. Additionally, students who have unique circumstances, such as being a veteran or having a non-traditional family structure, may need to provide additional documentation or explanations. Understanding these scenarios can help students navigate the FAFSA process more effectively.

Quick guide on how to complete federal regulations require the office of student financial aid to use financial information from the fafsa when

Effortlessly Prepare [SKS] on Any Device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, allowing you to easily find the necessary form and securely store it online. airSlate SignNow provides all the resources you need to create, modify, and electronically sign your documents promptly without complications. Manage [SKS] on any device with airSlate SignNow Android or iOS applications and enhance any document-related workflow today.

How to Modify and Electronically Sign [SKS] with Ease

- Locate [SKS] and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of your documents or redact sensitive information using the tools that airSlate SignNow specifically provides for that purpose.

- Create your signature with the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and press the Done button to finalize your modifications.

- Choose your preferred method for sending your form, whether via email, text message (SMS), an invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device of your preference. Modify and electronically sign [SKS] to ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Federal Regulations Require The Office Of Student Financial Aid To Use Financial Information From The FAFSA When

Create this form in 5 minutes!

How to create an eSignature for the federal regulations require the office of student financial aid to use financial information from the fafsa when

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the key features of airSlate SignNow related to FAFSA?

airSlate SignNow offers features that streamline the document signing process, ensuring compliance with federal regulations. Federal Regulations Require The Office Of Student Financial Aid To Use Financial Information From The FAFSA When processing applications, and our platform helps facilitate this by providing secure and efficient eSignature solutions.

-

How does airSlate SignNow ensure compliance with federal regulations?

Our platform is designed with compliance in mind, adhering to the standards set forth by federal regulations. Federal Regulations Require The Office Of Student Financial Aid To Use Financial Information From The FAFSA When evaluating student aid, and we ensure that all documents are securely signed and stored to meet these requirements.

-

What is the pricing structure for airSlate SignNow?

airSlate SignNow offers flexible pricing plans to accommodate different needs, making it a cost-effective solution for businesses. Understanding that Federal Regulations Require The Office Of Student Financial Aid To Use Financial Information From The FAFSA When managing financial aid, our pricing is designed to provide value while ensuring compliance.

-

Can airSlate SignNow integrate with other financial aid software?

Yes, airSlate SignNow seamlessly integrates with various financial aid software systems. This is crucial because Federal Regulations Require The Office Of Student Financial Aid To Use Financial Information From The FAFSA When processing applications, and our integrations help streamline this process.

-

What benefits does airSlate SignNow provide for financial aid offices?

airSlate SignNow enhances efficiency and accuracy for financial aid offices by simplifying the document signing process. Since Federal Regulations Require The Office Of Student Financial Aid To Use Financial Information From The FAFSA When determining eligibility, our solution helps ensure that all necessary documents are processed quickly and securely.

-

Is airSlate SignNow user-friendly for new users?

Absolutely! airSlate SignNow is designed to be intuitive and user-friendly, making it easy for new users to navigate. This is particularly important as Federal Regulations Require The Office Of Student Financial Aid To Use Financial Information From The FAFSA When handling sensitive information, and our platform ensures a smooth experience.

-

How does airSlate SignNow enhance document security?

Document security is a top priority for airSlate SignNow. Given that Federal Regulations Require The Office Of Student Financial Aid To Use Financial Information From The FAFSA When processing sensitive financial data, our platform employs advanced encryption and security measures to protect all documents.

Get more for Federal Regulations Require The Office Of Student Financial Aid To Use Financial Information From The FAFSA When

- Three individuals to husband and wife as joint form

- Used car lemon law fact sheetnew york state attorney form

- New york state case registry filing formus legal forms

- Joint tenants with the right of form

- Control number ny sdeed 8 6 form

- Joint ownership of real property peoples law library form

- Ocfs form 3937 fill online printable fillable blankpdffiller

- Drl 111 111 a 112 115 form 1 c scpa17251

Find out other Federal Regulations Require The Office Of Student Financial Aid To Use Financial Information From The FAFSA When

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors