the TAXABLE WAGE BASE for EACH EMPLOYEE is $ 39,800 Labor Alaska 2017-2026

Understanding the Alaska TQ01C Form

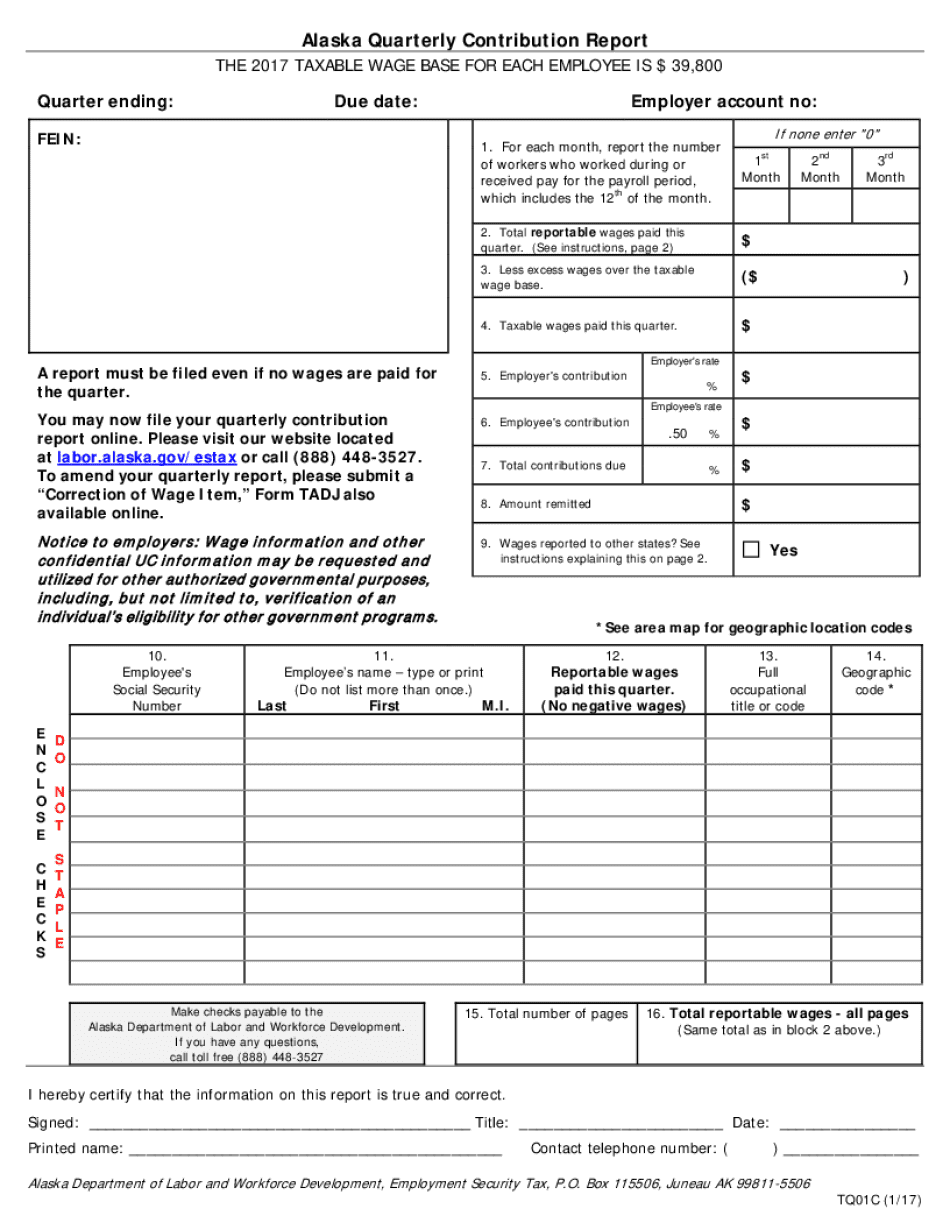

The Alaska TQ01C form, also known as the Alaska Quarterly Contribution Report, is essential for employers in Alaska to report wages paid and contributions owed to the state. This form is used to calculate the taxable wage base for each employee, which is currently set at $39,800. Accurate completion of the TQ01C ensures compliance with state labor laws and helps maintain the integrity of the unemployment insurance system.

Steps to Complete the Alaska TQ01C Form

Completing the Alaska TQ01C form involves several key steps:

- Gather all relevant payroll records for the quarter, including wages and hours worked for each employee.

- Calculate the total wages paid to each employee, ensuring that amounts do not exceed the taxable wage base of $39,800.

- Fill out the form by entering the total wages and contributions for each employee, along with any additional required information.

- Review the completed form for accuracy before submission to avoid penalties.

Filing Deadlines for the Alaska TQ01C Form

Employers must submit the Alaska TQ01C form quarterly. The deadlines for submission are as follows:

- For the first quarter (January to March), the deadline is April 30.

- For the second quarter (April to June), the deadline is July 31.

- For the third quarter (July to September), the deadline is October 31.

- For the fourth quarter (October to December), the deadline is January 31 of the following year.

Form Submission Methods for the Alaska TQ01C

Employers have several options for submitting the Alaska TQ01C form:

- Online submission through the Alaska Department of Labor and Workforce Development website.

- Mailing a paper copy of the form to the appropriate state office.

- In-person submission at designated state offices, if preferred.

Penalties for Non-Compliance with the Alaska TQ01C Form

Failure to file the Alaska TQ01C form on time or inaccuracies in reporting can result in penalties. These may include:

- Fines for late submissions, which can accumulate over time.

- Potential audits by the state to ensure compliance with labor laws.

- Increased scrutiny on future filings, leading to additional administrative burdens.

Key Elements of the Alaska TQ01C Form

When completing the Alaska TQ01C form, it is vital to include key elements such as:

- Employer identification information, including the business name and address.

- Employee details, including names, social security numbers, and total wages paid.

- Accurate calculations of contributions owed to the state based on reported wages.

Eligibility Criteria for Filing the Alaska TQ01C Form

All employers in Alaska who pay wages to employees are required to file the Alaska TQ01C form. This includes:

- Businesses of all sizes, from sole proprietorships to large corporations.

- Employers who have employees working in Alaska, regardless of where the business is based.

Quick guide on how to complete the taxable wage base for each employee is 39800 labor alaska

Prepare THE TAXABLE WAGE BASE FOR EACH EMPLOYEE IS $ 39,800 Labor Alaska effortlessly on any device

Web-based document management has gained signNow traction among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to locate the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly and without any delays. Manage THE TAXABLE WAGE BASE FOR EACH EMPLOYEE IS $ 39,800 Labor Alaska on any device using airSlate SignNow's Android or iOS applications and streamline your document-related processes today.

The effortless method to modify and eSign THE TAXABLE WAGE BASE FOR EACH EMPLOYEE IS $ 39,800 Labor Alaska

- Obtain THE TAXABLE WAGE BASE FOR EACH EMPLOYEE IS $ 39,800 Labor Alaska and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize relevant sections of the documents or obscure sensitive information with the tools that airSlate SignNow specifically provides for that purpose.

- Create your electronic signature using the Sign tool, which takes just seconds and holds the same legal validity as a traditional hand-signed signature.

- Review all details and click the Done button to save your modifications.

- Choose your preferred method of submitting your form, whether by email, text message (SMS), invitation link, or by downloading it to your computer.

Leave behind the worries of lost or misplaced documents, frustrating form searches, or errors that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Alter and eSign THE TAXABLE WAGE BASE FOR EACH EMPLOYEE IS $ 39,800 Labor Alaska and ensure seamless communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct the taxable wage base for each employee is 39800 labor alaska

Create this form in 5 minutes!

How to create an eSignature for the the taxable wage base for each employee is 39800 labor alaska

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the alaska tq01c form?

The alaska tq01c form is a specific document used for various administrative purposes in Alaska. It is essential for businesses and individuals to understand its requirements and how to complete it accurately. Utilizing airSlate SignNow can streamline the process of filling out and eSigning the alaska tq01c form.

-

How can airSlate SignNow help with the alaska tq01c form?

airSlate SignNow provides an intuitive platform for creating, sending, and eSigning the alaska tq01c form. With its user-friendly interface, you can easily manage your documents and ensure compliance with state regulations. This makes it an ideal solution for anyone needing to handle the alaska tq01c form efficiently.

-

Is there a cost associated with using airSlate SignNow for the alaska tq01c form?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. The cost is competitive and provides excellent value for the features offered, including the ability to manage the alaska tq01c form seamlessly. You can choose a plan that best fits your requirements and budget.

-

What features does airSlate SignNow offer for the alaska tq01c form?

airSlate SignNow includes features such as customizable templates, secure eSigning, and document tracking specifically for the alaska tq01c form. These features enhance the efficiency of document management and ensure that all parties can sign and access the form easily. This makes it a powerful tool for businesses in Alaska.

-

Can I integrate airSlate SignNow with other applications for the alaska tq01c form?

Absolutely! airSlate SignNow offers integrations with various applications, allowing you to streamline your workflow when dealing with the alaska tq01c form. Whether you use CRM systems or cloud storage solutions, you can easily connect them to enhance your document management process.

-

What are the benefits of using airSlate SignNow for the alaska tq01c form?

Using airSlate SignNow for the alaska tq01c form provides numerous benefits, including time savings, improved accuracy, and enhanced security. The platform ensures that your documents are handled efficiently and securely, reducing the risk of errors. This is particularly beneficial for businesses that frequently deal with the alaska tq01c form.

-

Is airSlate SignNow user-friendly for completing the alaska tq01c form?

Yes, airSlate SignNow is designed to be user-friendly, making it easy for anyone to complete the alaska tq01c form. The intuitive interface guides users through the process, ensuring that even those with minimal technical skills can navigate it effectively. This accessibility is a key advantage for businesses and individuals alike.

Get more for THE TAXABLE WAGE BASE FOR EACH EMPLOYEE IS $ 39,800 Labor Alaska

Find out other THE TAXABLE WAGE BASE FOR EACH EMPLOYEE IS $ 39,800 Labor Alaska

- Sign Utah Mutual non-disclosure agreement Free

- Sign Michigan Non disclosure agreement sample Later

- Sign Michigan Non-disclosure agreement PDF Safe

- Can I Sign Ohio Non-disclosure agreement PDF

- Help Me With Sign Oklahoma Non-disclosure agreement PDF

- How Do I Sign Oregon Non-disclosure agreement PDF

- Sign Oregon Non disclosure agreement sample Mobile

- How Do I Sign Montana Rental agreement contract

- Sign Alaska Rental lease agreement Mobile

- Sign Connecticut Rental lease agreement Easy

- Sign Hawaii Rental lease agreement Mobile

- Sign Hawaii Rental lease agreement Simple

- Sign Kansas Rental lease agreement Later

- How Can I Sign California Rental house lease agreement

- How To Sign Nebraska Rental house lease agreement

- How To Sign North Dakota Rental house lease agreement

- Sign Vermont Rental house lease agreement Now

- How Can I Sign Colorado Rental lease agreement forms

- Can I Sign Connecticut Rental lease agreement forms

- Sign Florida Rental lease agreement template Free