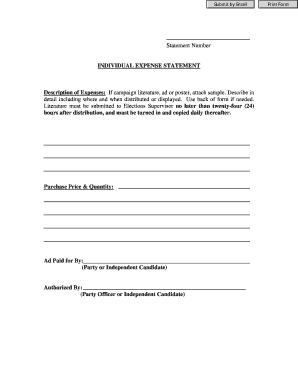

Statement Number INDIVIDUAL EXPENSE STATEMENT Form

What is the Statement Number INDIVIDUAL EXPENSE STATEMENT

The Statement Number INDIVIDUAL EXPENSE STATEMENT is a crucial document used to report various types of expenses incurred by individuals, particularly in the context of tax reporting and financial accountability. This statement helps individuals organize and present their expenses in a structured manner, ensuring compliance with federal and state regulations. It typically includes detailed information about the nature of the expenses, the amounts, and the dates they were incurred, making it easier for both the individual and tax authorities to track financial activities.

How to use the Statement Number INDIVIDUAL EXPENSE STATEMENT

Using the Statement Number INDIVIDUAL EXPENSE STATEMENT involves several steps to ensure accurate reporting. First, gather all relevant receipts and documentation that support the expenses being claimed. Next, fill out the statement by categorizing each expense according to its type, such as travel, meals, or supplies. Be sure to include the corresponding amounts and dates for each entry. Once completed, this statement can be submitted with your tax return or kept for personal records, depending on your specific needs and requirements.

Steps to complete the Statement Number INDIVIDUAL EXPENSE STATEMENT

Completing the Statement Number INDIVIDUAL EXPENSE STATEMENT requires careful attention to detail. Follow these steps:

- Collect all receipts and documentation related to your expenses.

- Organize expenses into categories such as travel, meals, or office supplies.

- Record each expense, including the date, amount, and purpose.

- Review the completed statement for accuracy and completeness.

- Store the statement securely or submit it as required for tax purposes.

Key elements of the Statement Number INDIVIDUAL EXPENSE STATEMENT

The key elements of the Statement Number INDIVIDUAL EXPENSE STATEMENT include:

- Date: The date when each expense was incurred.

- Amount: The total cost associated with each expense.

- Category: The classification of the expense, such as travel or meals.

- Description: A brief explanation of the purpose of the expense.

- Supporting Documentation: Receipts or invoices that validate the reported expenses.

IRS Guidelines

The IRS provides specific guidelines regarding the use of the Statement Number INDIVIDUAL EXPENSE STATEMENT. It is essential to ensure that all reported expenses are ordinary and necessary for the business or personal activities being claimed. The IRS may require supporting documentation for certain types of expenses, and individuals should maintain accurate records to substantiate their claims. Familiarizing yourself with these guidelines can help prevent issues during tax filing and audits.

Filing Deadlines / Important Dates

Filing deadlines for the Statement Number INDIVIDUAL EXPENSE STATEMENT typically align with the annual tax filing deadline, which is usually April fifteenth for most individuals. It is important to keep track of any changes in deadlines, especially for extensions or specific situations that may apply to your circumstances. Marking these dates on your calendar can help ensure timely submission and compliance with tax regulations.

Quick guide on how to complete statement number individual expense statement

Complete [SKS] effortlessly on any gadget

Web-based document management has gained traction among businesses and individuals alike. It serves as an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the correct form and securely save it online. airSlate SignNow equips you with all the necessary tools to create, adjust, and electronically sign your documents swiftly without delays. Handle [SKS] on any device with airSlate SignNow's Android or iOS applications and enhance any document-related task today.

The easiest way to alter and electronically sign [SKS] with ease

- Locate [SKS] and then click Get Form to initiate.

- Utilize the tools we provide to fill out your document.

- Emphasize important sections of the documents or conceal sensitive information with tools that airSlate SignNow specially offers for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and then click on the Done button to save your modifications.

- Choose how you wish to deliver your form, by email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form hunting, or errors that require reprinting new copies. airSlate SignNow covers all your document management needs in just a few clicks from any device you prefer. Adjust and electronically sign [SKS] and ensure optimal communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Statement Number INDIVIDUAL EXPENSE STATEMENT

Create this form in 5 minutes!

How to create an eSignature for the statement number individual expense statement

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Statement Number INDIVIDUAL EXPENSE STATEMENT?

A Statement Number INDIVIDUAL EXPENSE STATEMENT is a document that outlines individual expenses incurred by an employee or contractor. It provides a clear breakdown of costs for reimbursement or accounting purposes. Using airSlate SignNow, you can easily create and manage these statements digitally.

-

How does airSlate SignNow help with managing Statement Number INDIVIDUAL EXPENSE STATEMENTS?

airSlate SignNow streamlines the process of creating and signing Statement Number INDIVIDUAL EXPENSE STATEMENTS. Our platform allows users to fill out expense details, add signatures, and send documents for approval all in one place. This efficiency reduces paperwork and speeds up reimbursement processes.

-

What are the pricing options for using airSlate SignNow for Statement Number INDIVIDUAL EXPENSE STATEMENTS?

airSlate SignNow offers flexible pricing plans that cater to different business needs. Whether you are a small business or a large enterprise, you can find a plan that fits your budget while providing the necessary features for managing Statement Number INDIVIDUAL EXPENSE STATEMENTS. Visit our pricing page for detailed information.

-

Can I integrate airSlate SignNow with other software for managing Statement Number INDIVIDUAL EXPENSE STATEMENTS?

Yes, airSlate SignNow integrates seamlessly with various software applications, enhancing your workflow for Statement Number INDIVIDUAL EXPENSE STATEMENTS. You can connect with tools like accounting software, CRM systems, and more to ensure all your expense management processes are synchronized and efficient.

-

What features does airSlate SignNow offer for creating Statement Number INDIVIDUAL EXPENSE STATEMENTS?

airSlate SignNow provides a range of features for creating Statement Number INDIVIDUAL EXPENSE STATEMENTS, including customizable templates, electronic signatures, and document tracking. These features ensure that your expense statements are professional, secure, and easily accessible for all parties involved.

-

How secure is the information in my Statement Number INDIVIDUAL EXPENSE STATEMENTS when using airSlate SignNow?

Security is a top priority at airSlate SignNow. We use advanced encryption and secure cloud storage to protect your Statement Number INDIVIDUAL EXPENSE STATEMENTS and sensitive information. You can trust that your data is safe and compliant with industry standards.

-

What are the benefits of using airSlate SignNow for Statement Number INDIVIDUAL EXPENSE STATEMENTS?

Using airSlate SignNow for Statement Number INDIVIDUAL EXPENSE STATEMENTS offers numerous benefits, including increased efficiency, reduced paperwork, and faster approval times. Our user-friendly interface makes it easy for employees to submit their expenses, while managers can quickly review and approve them.

Get more for Statement Number INDIVIDUAL EXPENSE STATEMENT

- The top 25 online bachelors in health care administration form

- Weekly planner template edit fill sign onlinehandypdf form

- Group benefits ampampamp hr archives page 2 of 3 deland form

- Debitshipping authorization form

- What is compressed workweek hr definitions ampamp examples form

- Depreciation schedule template for straight line and form

- Employee conflict of interest policy template form

- Letter of transmittal form smartdraw

Find out other Statement Number INDIVIDUAL EXPENSE STATEMENT

- How Do I Sign Kentucky Sports Presentation

- Can I Sign North Carolina Orthodontists Presentation

- How Do I Sign Rhode Island Real Estate Form

- Can I Sign Vermont Real Estate Document

- How To Sign Wyoming Orthodontists Document

- Help Me With Sign Alabama Courts Form

- Help Me With Sign Virginia Police PPT

- How To Sign Colorado Courts Document

- Can I eSign Alabama Banking PPT

- How Can I eSign California Banking PDF

- How To eSign Hawaii Banking PDF

- How Can I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- Help Me With eSign Hawaii Banking Document

- How To eSign Hawaii Banking Document

- Can I eSign Hawaii Banking Presentation

- Can I Sign Iowa Courts Form

- Help Me With eSign Montana Banking Form

- Can I Sign Kentucky Courts Document