Depreciation Schedule Template for Straight Line and Form

What is the depreciation schedule template?

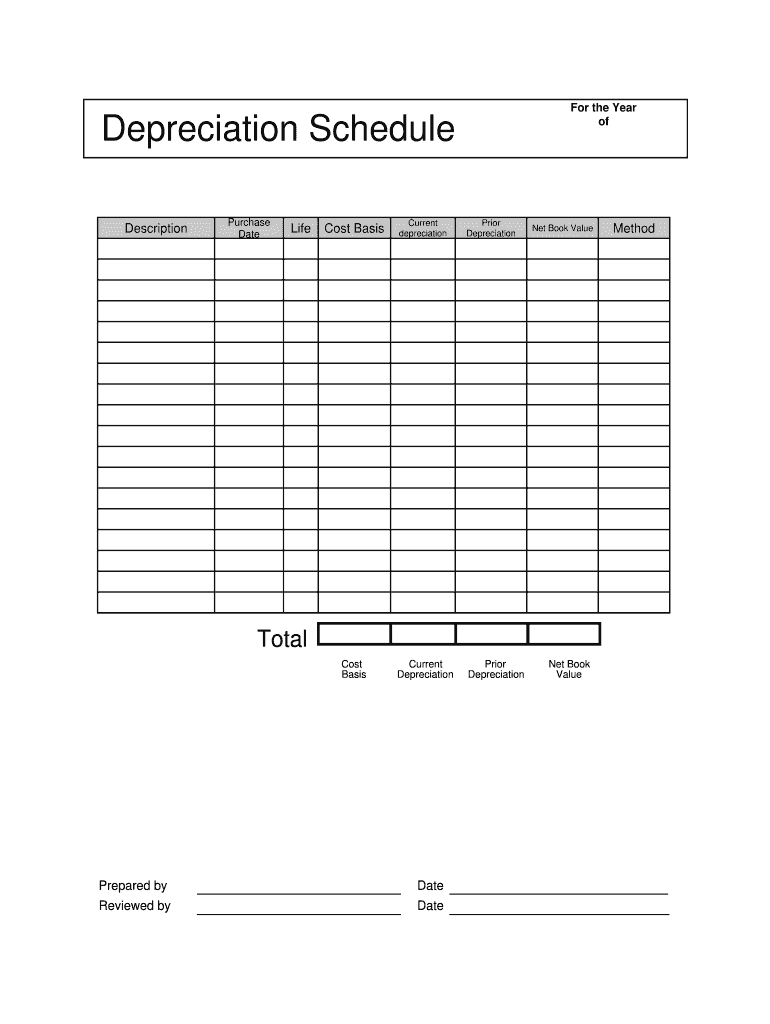

The depreciation schedule template is a structured tool used to calculate and track the depreciation of fixed assets over time. This template typically outlines the asset's purchase price, useful life, and the method of depreciation applied, such as the straight-line method. By using a depreciation schedule, businesses can effectively manage their assets and ensure accurate financial reporting. It is essential for tax purposes and helps in understanding the asset's value over its lifespan.

How to use the depreciation schedule template

To use the depreciation schedule template effectively, start by gathering all relevant information about the asset. This includes the purchase price, expected useful life, and the chosen method of depreciation. Input this data into the template, which will automatically calculate the annual depreciation expense. Regularly update the schedule to reflect any changes, such as asset disposals or revaluations, ensuring that your financial records remain accurate and up to date.

Key elements of the depreciation schedule template

A comprehensive depreciation schedule template includes several key elements:

- Asset Description: A brief description of the asset being depreciated.

- Purchase Price: The initial cost of the asset.

- Useful Life: The estimated duration the asset will be used.

- Depreciation Method: The method used for calculating depreciation, such as straight-line or declining balance.

- Annual Depreciation Expense: The calculated amount that will be deducted from the asset's value each year.

- Accumulated Depreciation: The total depreciation deducted from the asset's value over time.

Steps to complete the depreciation schedule template

Completing the depreciation schedule template involves several straightforward steps:

- Gather necessary information about the asset, including purchase price and useful life.

- Select the appropriate depreciation method based on your accounting practices.

- Input the asset details into the template, ensuring accuracy in all fields.

- Calculate the annual depreciation expense using the formula relevant to your chosen method.

- Regularly update the schedule to reflect any changes in asset status or financial reporting requirements.

Legal use of the depreciation schedule template

Using a depreciation schedule template is legally valid as long as it complies with applicable accounting standards and tax regulations. In the United States, businesses must follow the guidelines set forth by the Internal Revenue Service (IRS) regarding asset depreciation. Properly maintained depreciation schedules can serve as crucial documentation during audits and ensure compliance with federal and state tax laws.

IRS guidelines

The IRS provides specific guidelines on how to depreciate assets, which businesses must follow to ensure compliance. These guidelines include the acceptable methods of depreciation, the useful life of different asset classes, and the requirements for documenting depreciation expenses. Familiarizing yourself with these guidelines can help prevent issues during tax filing and audits, ensuring that your depreciation schedule template aligns with legal standards.

Quick guide on how to complete depreciation schedule template for straight line and

Complete Depreciation Schedule Template For Straight Line And easily on any gadget

Digital document management has become increasingly popular among businesses and individuals. It offers a fantastic eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the right form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents quickly without any delays. Manage Depreciation Schedule Template For Straight Line And on any gadget using the airSlate SignNow Android or iOS applications and simplify any document-related task today.

The easiest way to modify and electronically sign Depreciation Schedule Template For Straight Line And seamlessly

- Obtain Depreciation Schedule Template For Straight Line And and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight important sections of the documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your eSignature with the Sign feature, which takes mere seconds and holds the same legal validity as a conventional handwritten signature.

- Review the details and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Depreciation Schedule Template For Straight Line And and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a depreciation schedule template?

A depreciation schedule template is a structured document that outlines the depreciation of an asset over its useful life. It helps businesses track the reduction in value of their assets for accounting and tax purposes. With airSlate SignNow, you can easily create and eSign your depreciation schedule template to ensure accuracy and compliance.

-

How can airSlate SignNow help with my depreciation schedule template?

airSlate SignNow offers a user-friendly platform to create, customize, and eSign your depreciation schedule template. Our solution simplifies document management and ensures that your schedules are securely stored and easily accessible. This can signNowly enhance your workflow and save time in the long run.

-

Are there any costs associated with using the depreciation schedule template?

There are various pricing plans for airSlate SignNow, allowing you to choose one that fits your budget and needs. Each plan includes access to essential features for creating and managing your depreciation schedule template. We recommend checking our pricing page for detailed information and selecting the plan that best suits your requirements.

-

What features are included in the airSlate SignNow depreciation schedule template?

The airSlate SignNow depreciation schedule template includes customizable fields, electronic signatures, and automated workflows to streamline the process. You can also integrate with existing accounting software for easier financial tracking. These features help you maintain organization and accuracy in your depreciation tracking.

-

Is the depreciation schedule template compliant with accounting standards?

Yes, the depreciation schedule template created with airSlate SignNow is designed to comply with standard accounting practices. Our templates are updated regularly to reflect current regulations, ensuring your documentation is accurate and reliable. This helps to maintain transparency and credibility in your financial reporting.

-

Can I integrate the depreciation schedule template with other software?

Absolutely! airSlate SignNow allows you to integrate your depreciation schedule template with various accounting and ERP software. This feature helps streamline your financial processes, ensuring that your asset management data flows seamlessly across platforms without manual input.

-

What industries can benefit from using a depreciation schedule template?

Several industries, including manufacturing, real estate, and technology, can benefit from using a depreciation schedule template. It helps businesses of all sizes manage their assets effectively and comply with financial regulations. With airSlate SignNow, these industries can enhance their documentation processes within their specific workflows.

Get more for Depreciation Schedule Template For Straight Line And

- Geneva city tax form

- Lake county ohio homestead application form

- It nrc form

- How to claim louisiana state tax refund is spouse owes child support form

- Louisiana solar tax credit form

- Louisiana commercial farmer form

- Tax forms rhode island division of taxation rigov

- State of the world cities 2009 harmonious cities by issuu form

Find out other Depreciation Schedule Template For Straight Line And

- How To eSign Hawaii Government Word

- Can I eSign Hawaii Government Word

- How To eSign Hawaii Government Document

- How To eSign Hawaii Government Document

- How Can I eSign Hawaii Government Document

- Can I eSign Hawaii Government Document

- How Can I eSign Hawaii Government Document

- How To eSign Hawaii Government Document

- How To eSign Hawaii Government Form

- How Can I eSign Hawaii Government Form

- Help Me With eSign Hawaii Healthcare / Medical PDF

- How To eSign Arizona High Tech Document

- How Can I eSign Illinois Healthcare / Medical Presentation

- Can I eSign Hawaii High Tech Document

- How Can I eSign Hawaii High Tech Document

- How Do I eSign Hawaii High Tech Document

- Can I eSign Hawaii High Tech Word

- How Can I eSign Hawaii High Tech Form

- How Do I eSign New Mexico Healthcare / Medical Word

- How To eSign Washington High Tech Presentation