Natwest Sending Money to Usa 2018-2026

What is the Natwest Sending Money To USA

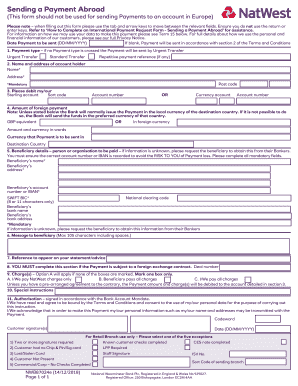

The Natwest Sending Money To USA service allows individuals and businesses to transfer funds from the UK to recipients in the United States. This service is particularly useful for expatriates, businesses with international clients, or anyone needing to send money abroad. The process typically involves completing a Natwest payment form, which captures essential details such as the recipient's bank account information, the amount to be sent, and the purpose of the payment. Understanding the specifics of this service can help ensure that transactions are completed efficiently and securely.

How to use the Natwest Sending Money To USA

To use the Natwest Sending Money To USA service, follow these steps:

- Log into your Natwest online banking account or visit a local branch.

- Locate the international payments section and select the option to send money to the USA.

- Fill out the Natwest payment form with the required details, including the recipient's name, address, and bank account information.

- Specify the amount you wish to send and choose the currency.

- Review the transaction details and confirm the payment.

It is important to double-check all information to avoid delays or issues with the transfer.

Steps to complete the Natwest Sending Money To USA

Completing the Natwest Sending Money To USA process involves several key steps:

- Gather necessary information about the recipient, including their bank details.

- Access your Natwest account through online banking or visit a branch.

- Navigate to the international payments section and select the option for sending money abroad.

- Complete the Natwest payment form, ensuring all fields are filled accurately.

- Submit the form and keep a record of the transaction reference for future reference.

Following these steps can help ensure a smooth transaction experience.

Legal use of the Natwest Sending Money To USA

Using the Natwest Sending Money To USA service is legal as long as the transaction complies with both UK and US regulations. It is essential to ensure that the funds are not being sent for illegal purposes, such as money laundering or fraud. Additionally, users should be aware of any reporting requirements that may apply, particularly for larger sums of money. Familiarizing oneself with these legal obligations can help prevent potential issues during the transfer process.

Key elements of the Natwest Sending Money To USA

When using the Natwest Sending Money To USA service, several key elements must be considered:

- Recipient Information: Accurate details about the recipient's bank account are crucial.

- Transfer Fees: Be aware of any fees associated with the transaction, as these can vary based on the amount and method of transfer.

- Exchange Rates: Understand the current exchange rates, as they can affect the total amount received by the recipient.

- Processing Times: Different payment methods may have varying processing times, so plan accordingly.

Being informed about these elements can enhance the efficiency of the transaction.

Required Documents

To successfully complete the Natwest Sending Money To USA process, certain documents may be required:

- A valid form of identification, such as a passport or driver's license.

- Proof of address, which may include a utility bill or bank statement.

- Details of the recipient's bank account, including the account number and routing number.

Having these documents ready can streamline the process and reduce delays.

Quick guide on how to complete sending a payment abroad natwest

A concise manual on how to assemble your Natwest Sending Money To Usa

Finding the appropriate template can prove to be a struggle when you need to submit official overseas paperwork. Even when you possess the necessary form, it might be challenging to promptly prepare it in accordance with all the stipulations if you're using hard copies instead of managing everything digitally. airSlate SignNow is the online eSignature platform that aids you in overcoming such obstacles. It enables you to select your Natwest Sending Money To Usa and swiftly fill it out and sign it on the spot without needing to reprint documents each time you make an error.

Here are the steps you must follow to prepare your Natwest Sending Money To Usa with airSlate SignNow:

- Click the Get Form button to instantly add your document to our editor.

- Begin with the first empty field, enter your information, and continue with the Next function.

- Complete the empty sections using the Cross and Check tools from the toolbar above.

- Select the Highlight or Line options to emphasize the most important details.

- Click on Image to upload one if your Natwest Sending Money To Usa requires it.

- Utilize the right-side panel to add extra fields for you or others to fill out if needed.

- Review your responses and confirm the template by clicking Date, Initials, and Sign.

- Draw, type, upload your eSignature, or capture it using a camera or QR code.

- Conclude editing by clicking the Done button and choosing your file-sharing preferences.

After your Natwest Sending Money To Usa is ready, you can distribute it however you wish - send it to your recipients via email, SMS, fax, or even print it directly from the editor. You can also securely keep all your completed documents in your account, organized in folders based on your preferences. Don’t squander time on manual document completion; give airSlate SignNow a try!

Create this form in 5 minutes or less

Find and fill out the correct sending a payment abroad natwest

FAQs

-

How do I fill customs cn 22 form for sending sample abroad?

CUSTOMS DECLARATION May be opened Officially CN 22 INDIA POST Important See the instructions on the back Gift Commercial Sample Documents Other Tick one or more boxes Quantity and detailed description Of contents (1) Weight (in Kg) Value (3) For commercial items only If known, HS tariff number (4) and country of origin of goods (5) Total weight (in kg) (6) Total value (7) I, the undersigned whose name and address are given on the item, signNow that the particulars given in this Declaration are correct and that this item does not contain any dangerous article or articles prohibited by legislation or by postal or customs regulations. Date and sender’s signature (8) For all articles value less than Rs.23000/ Instructions To accelerate customs clearance, fill in this form in English, French or in a language accepted by the destination country. If the value of the contents is over 300 SDR, you must use a CN 23 form. You must give the sender’s full name and address on the front of the item. (1) Give a detailed description, quantity and unit of measurement for each article eg 2 men’s cotton shirts, especially for articles subject to quarantine (plant, animal, food products etc) (2), (3), (6) and (7), give the weight and value of each article and the total weight and value of the item. Indicate the currency used eg. CHF for Swiss francs. (4) and (5) The HS tariff number (6 digit) must be based on the Harmonized Commodity Description and Coding System developed by the World Customs Organisation. Country of origin means the country where the goods originated eg were produced, manufactured or assembled. It is recommended you supply this information and attach an invoice to the outside as this will assist Customs in processing the items. (8) Your signature and the date confirm your liability for the item 300 SDR = Rs.23000 – Value of SDR may change. Please confirm before filling the form

-

How do I fill taxes online?

you can file taxes online by using different online platforms. by using this online platform you can easily submit the income tax returns, optimize your taxes easily.Tachotax provides the most secure, easy and fast way of tax filing.

-

How do I fill out the income tax for online job payment? Are there any special forms to fill it?

I am answering to your question with the UNDERSTANDING that you are liableas per Income Tax Act 1961 of Republic of IndiaIf you have online source of Income as per agreement as an employer -employee, It will be treated SALARY income and you will file ITR 1 for FY 2017–18If you are rendering professional services outside India with an agreement as professional, in that case you need to prepare Financial Statements ie. Profit and loss Account and Balance sheet for FY 2017–18 , finalize your income and pay taxes accordingly, You will file ITR -3 for FY 2017–1831st Dec.2018 is last due date with minimum penalty, grab that opportunity and file income tax return as earliest

-

How do I fill out a FAFSA form if I'm a US citizen living abroad?

How do I fill out a FAFSA form if I'm a US citizen living abroad?U.S. citizens are eligible for U.S. federal student aid regardless of where they live and regardless of whether their parents are U.S. citizens or not.If you file a U.S. federal income tax return, use that to complete the FAFSA. Otherwise, substitute the foreign income tax return, which is considered by the FAFSA to be the equivalent of IRS Form 1040. All financial figures should be converted into U.S. dollars using the exchange rate in effect on the date the FAFSA was filed or the most recent exchange rate prior to that date. Use the exchange rates that can be found on the Federal Reserve web site, Foreign Exchange Rates - H.10.If your parents are not U.S. citizens or permanent residents, use 000–00–0000 instead of a Social Security Number for them. They will need to print a signature page, sign and mail it.As a U.S. Citizen, you should have a Social Security Number. If your parents never filed SSA Form SS-5 to get you a Social Security Number, you will need to do so now. You will need to provide documents to prove age, identity and U.S. citizenship. Obtaining these documents, such as a birth certificate, can take time, so get started as soon as possible. You may need to schedule a meeting at the local U.S. embassy or consulate.Since you are a U.S. Citizen, you should be able to obtain a FSA ID to sign the FAFSA electronically. The main challenge will involve getting the forms to accept a foreign address. Otherwise, you will need to print, sign and mail the signature page.If you live in Mexico, Canada, a U.S. territory or a military installation, select the corresponding entry from the State menu. Otherwise, select “Foreign Country” and list your city and country in the field for City and enter 00000 in the Zip Code field.

-

How can I fill out my PF form when I am currently working abroad?

Try to withdraw onlineMore info comment or check contacts info

-

I'm a US citizen living abroad. What tax form should I fill out?

Get your answer from here on Quora knowing that at least two are already well off the mark and one is completely wrong to the point you can wave goodbye to your entire net worth in penalties and probably more.The only place to get good advice related to your own personal situation is from highly qualified specialist accountants and possibly a lawyer, because much comes down to interpretation of the law which leads to your first discovery when it comes to the outrageous demands of the USA on those who do not live there, enormous CPA costs before a single penny in illegitimate taxation is demanded by the USA.And the further you get from the US, as in building a local financial, family and business life, the deeper in your life the IRS get and the more punitive the US reporting, tax and penalty regime becomes.This for example are the reporting requirements of one US couple in Australia.“4.37 hours for Form 8938,• 57.2 hours for Form 720,• 54.20 hours for Form 3520,• 61.22 Hours for Form 3520-A.• 50 hours estimate for Form 5471For a total of 226.99 hours (according to the IRS’s own time estimates) not including time to file the FBAR.The penalties for innocent misfiling or non filings for the above foreign reporting forms for the couple are up to $50,000, per year. It is likely that the foreign income exclusion and foreign tax credit will negate any actual tax due to the IRS. So each year, there is a lurking $50,000 penalty for getting something technically wrong on a form, yet there would be no additional tax due to the US treasury. “Land of the free?http://republicansoverseas.com/w...Home | Purple Expat

-

Applying for PayPal adaptive payments, how to fill in the form?

Adaptive Accounts: is an API that allows you to provision creation of PayPal accounts through your application. You could collect all the user's profile information, call Adaptive Accounts API to create a PayPal account, and redirect the user to PayPal for them to setup their password and security information. Usually this API is highly vetted since you'll be collecting user's pii information. So unless you really need it don't select. 3rd Party Permissions - Request users grant you permission to make API calls on their behalf.: 3rd party permissions are when you need to do something on behalf of some one else. Collecting payments doesn't need 3rd party permissions since the end user explicitly approves the pre-approval in your case. But if you have a use case for your app to be able to issue refunds on behalf of your sellers, them yes you would need to use the permissions service to obtain approval from your sellers to issue refunds from their accounts.Testing Information: Basically the application review team wants to make sure they can verify the money flow. So if you can provide any information on how they can act both as a seller and also as a buyer that would help. It doesn't need to be in live - sandbox env should be more than enough. I've helped several go through this process - it's actually not that bad. But it could get frustrating when there is lack of complete information. So the more information you provide - presentations, mocks, flows, testing env/app, etc.. the better it would help the app review team understand what you're trying to use payments for. Money Aggregation and laundering are the biggest concerns they watch out for - so the more transparent your money trail is the better and quicker the process would be. Good luck!

Create this form in 5 minutes!

How to create an eSignature for the sending a payment abroad natwest

How to generate an electronic signature for the Sending A Payment Abroad Natwest online

How to generate an electronic signature for your Sending A Payment Abroad Natwest in Google Chrome

How to generate an eSignature for putting it on the Sending A Payment Abroad Natwest in Gmail

How to generate an eSignature for the Sending A Payment Abroad Natwest straight from your smartphone

How to generate an electronic signature for the Sending A Payment Abroad Natwest on iOS devices

How to generate an electronic signature for the Sending A Payment Abroad Natwest on Android

People also ask

-

What is the natwest chaps form?

The natwest chaps form is a document used for executing CHAPS payments through NatWest Bank. It is essential for initiating same-day bank transfers for large sums of money. Using airSlate SignNow, you can easily send and eSign the natwest chaps form to ensure secure and swift transactions.

-

How do I fill out the natwest chaps form using airSlate SignNow?

Filling out the natwest chaps form with airSlate SignNow is straightforward. Simply upload the form, complete the required fields, and then send it for signature. Our intuitive interface simplifies the process, ensuring you can manage your payments efficiently.

-

Is there a fee associated with using the natwest chaps form?

While the natwest chaps form itself may not incur fees, using airSlate SignNow provides a cost-effective solution for document management. We offer various pricing plans to fit your business needs, ensuring you can use the natwest chaps form affordably.

-

What are the benefits of using airSlate SignNow for the natwest chaps form?

Using airSlate SignNow for the natwest chaps form offers numerous benefits, including enhanced security and swift processing. You can track the status of the document and receive notifications once it's signed. This ensures timely and accurate transactions for your business.

-

Can I integrate airSlate SignNow with banking software for the natwest chaps form?

Yes, airSlate SignNow can be integrated with various banking software, making it easier to manage the natwest chaps form seamlessly. This integration allows you to automate workflows, store documents securely, and enhance overall efficiency in your payment processes.

-

How long does it take to process the natwest chaps form through airSlate SignNow?

The processing time for the natwest chaps form depends on how quickly recipients eSign the document. However, airSlate SignNow ensures that you can send out the form swiftly and track its progress in real-time, minimizing delays in payment processing.

-

Is airSlate SignNow compliant with regulations for the natwest chaps form?

Absolutely! airSlate SignNow complies with all relevant regulations to ensure secure eSigning of the natwest chaps form. Our platform adheres to industry standards, providing you peace of mind that your transactions are safe and legally binding.

Get more for Natwest Sending Money To Usa

- Leader format sdhandi

- Physical medicine request form idaho state insurance fund idahosif

- Musical theatre audition evaluation form 12244259

- Absent parent questions and assignment of rights ap 1 mass gov mass form

- Landlord registration form click here city of camden ci camden nj

- Std form nysna pension plan and benefits fund rnbenefits

- Ten years of the kenya adolescent reproductive health project what has happened aphia ii or project in kenya report may form

- Additional contract template form

Find out other Natwest Sending Money To Usa

- Electronic signature Oregon Real Estate Quitclaim Deed Free

- Electronic signature Kansas Police Arbitration Agreement Now

- Electronic signature Hawaii Sports LLC Operating Agreement Free

- Electronic signature Pennsylvania Real Estate Quitclaim Deed Fast

- Electronic signature Michigan Police Business Associate Agreement Simple

- Electronic signature Mississippi Police Living Will Safe

- Can I Electronic signature South Carolina Real Estate Work Order

- How To Electronic signature Indiana Sports RFP

- How Can I Electronic signature Indiana Sports RFP

- Electronic signature South Dakota Real Estate Quitclaim Deed Now

- Electronic signature South Dakota Real Estate Quitclaim Deed Safe

- Electronic signature Indiana Sports Forbearance Agreement Myself

- Help Me With Electronic signature Nevada Police Living Will

- Electronic signature Real Estate Document Utah Safe

- Electronic signature Oregon Police Living Will Now

- Electronic signature Pennsylvania Police Executive Summary Template Free

- Electronic signature Pennsylvania Police Forbearance Agreement Fast

- How Do I Electronic signature Pennsylvania Police Forbearance Agreement

- How Can I Electronic signature Pennsylvania Police Forbearance Agreement

- Electronic signature Washington Real Estate Purchase Order Template Mobile