ROTH Salary Reduction Agreement Fordham Form

What is the ROTH Salary Reduction Agreement Fordham

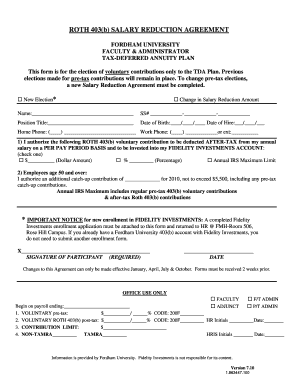

The ROTH Salary Reduction Agreement Fordham is a formal document that allows employees to designate a portion of their salary to be contributed to a ROTH retirement account. This agreement is crucial for employees who wish to take advantage of tax-free growth on their retirement savings. By entering into this agreement, employees can reduce their taxable income while saving for retirement, as contributions are made with after-tax dollars. This form is essential for those affiliated with Fordham University and ensures compliance with IRS regulations regarding retirement plans.

How to obtain the ROTH Salary Reduction Agreement Fordham

To obtain the ROTH Salary Reduction Agreement Fordham, employees should contact the Human Resources department at Fordham University. The department can provide the necessary forms and guidance on completing the agreement. Additionally, employees may find the form available on the university's internal website or employee portal. It is important to ensure that the most current version of the form is used to comply with all relevant regulations.

Steps to complete the ROTH Salary Reduction Agreement Fordham

Completing the ROTH Salary Reduction Agreement Fordham involves several straightforward steps:

- Download or request the agreement form from the Human Resources department.

- Fill out personal information, including your name, employee ID, and contact details.

- Specify the amount or percentage of your salary you wish to contribute to the ROTH account.

- Review the terms and conditions outlined in the agreement.

- Sign and date the form to validate your request.

- Submit the completed form to the Human Resources department for processing.

Key elements of the ROTH Salary Reduction Agreement Fordham

The ROTH Salary Reduction Agreement Fordham includes several key elements that employees should understand:

- Employee Information: Personal details such as name, employee ID, and department.

- Contribution Amount: The specific amount or percentage of salary to be contributed.

- Effective Date: The date when the salary reduction will begin.

- Terms and Conditions: Information regarding the implications of the agreement, including tax considerations.

- Signature: The employee's signature is required to validate the agreement.

Legal use of the ROTH Salary Reduction Agreement Fordham

The ROTH Salary Reduction Agreement Fordham is legally binding once signed by the employee and submitted to the Human Resources department. It complies with IRS regulations governing retirement accounts, ensuring that contributions are made in accordance with federal tax laws. Employees should retain a copy of the signed agreement for their records, as it may be necessary for future tax filings or retirement planning.

IRS Guidelines

IRS guidelines regarding ROTH contributions stipulate annual limits on the amount that can be contributed to retirement accounts. Employees should be aware of these limits and ensure that their contributions do not exceed them. Additionally, the IRS provides specific rules about eligibility for ROTH accounts, including income limits that may affect an employee's ability to contribute. Staying informed about these guidelines is essential for effective retirement planning.

Quick guide on how to complete roth salary reduction agreement fordham

Effortlessly Prepare [SKS] on Any Device

Managing documents online has gained traction among both businesses and individuals. It offers an ideal environmentally friendly option to conventional printed and signed papers, as you can locate the right format and securely save it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents quickly without delays. Handle [SKS] on any platform with the airSlate SignNow apps for Android or iOS and enhance any document-driven process today.

How to Edit and eSign [SKS] with Ease

- Find [SKS] and click Get Form to begin.

- Take advantage of the tools we offer to fill out your document.

- Emphasize pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Verify the details and click on the Done button to save your modifications.

- Select the method you prefer for sending your form, whether by email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that necessitate reprinting new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Modify and eSign [SKS] and guarantee excellent communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the roth salary reduction agreement fordham

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a ROTH Salary Reduction Agreement Fordham?

A ROTH Salary Reduction Agreement Fordham is a financial arrangement that allows employees to allocate a portion of their salary to a ROTH IRA. This agreement enables tax-free growth and tax-free withdrawals in retirement, making it a beneficial option for long-term savings.

-

How does the ROTH Salary Reduction Agreement Fordham work?

The ROTH Salary Reduction Agreement Fordham works by allowing employees to designate a specific percentage or amount of their salary to be contributed to a ROTH IRA. This contribution is deducted from their paycheck before taxes, providing a straightforward way to save for retirement.

-

What are the benefits of using a ROTH Salary Reduction Agreement Fordham?

The benefits of a ROTH Salary Reduction Agreement Fordham include tax-free growth on investments and tax-free withdrawals during retirement. Additionally, it provides employees with a disciplined savings approach, helping them to build a secure financial future.

-

Are there any fees associated with the ROTH Salary Reduction Agreement Fordham?

Typically, there are no direct fees associated with setting up a ROTH Salary Reduction Agreement Fordham. However, it's essential to review any potential fees related to the ROTH IRA itself, such as investment management fees, which may vary by provider.

-

Can I change my contributions to the ROTH Salary Reduction Agreement Fordham?

Yes, employees can usually adjust their contributions to the ROTH Salary Reduction Agreement Fordham at any time, depending on their financial situation. It's advisable to consult with your HR department or financial advisor to understand the specific procedures for making changes.

-

How does airSlate SignNow facilitate the ROTH Salary Reduction Agreement Fordham?

airSlate SignNow streamlines the process of creating and managing a ROTH Salary Reduction Agreement Fordham by providing an easy-to-use platform for document signing and management. This ensures that all agreements are securely signed and stored, enhancing efficiency and compliance.

-

What integrations does airSlate SignNow offer for the ROTH Salary Reduction Agreement Fordham?

airSlate SignNow offers various integrations with popular HR and payroll systems, making it easier to implement the ROTH Salary Reduction Agreement Fordham. These integrations help automate the process, ensuring accurate payroll deductions and seamless management of employee contributions.

Get more for ROTH Salary Reduction Agreement Fordham

- Ssur americas inc standard terms ampampamp conditions of sale form

- Occupancy affidavit and financial status form

- Flood insurance hud exchange form

- The revised loan estimate changed circumstances and form

- Reservation of life estate form

- What is a property manager responsible for form

- How to research a company for a job interview form

- Table of contents rock island county forest preserve district form

Find out other ROTH Salary Reduction Agreement Fordham

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors