CIS Form1 XLS

What is the CIS Form1 xls

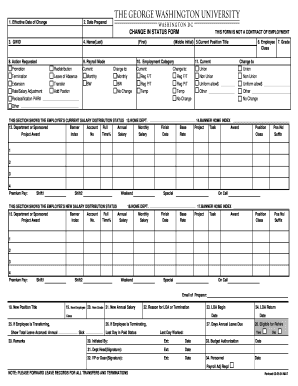

The CIS Form1 xls is a document used primarily for reporting specific tax information related to contractors and subcontractors in the construction industry. This form is essential for ensuring compliance with tax regulations, particularly for businesses that engage independent contractors. It allows for the accurate reporting of payments made to these individuals, helping both the payer and the recipient maintain proper tax records.

How to use the CIS Form1 xls

To use the CIS Form1 xls effectively, businesses should first download the form from an official source. Once obtained, users can fill in the required fields, which typically include details about the contractor, the nature of the work performed, and the total payments made. After completing the form, it should be reviewed for accuracy before submission to the appropriate tax authorities. Utilizing digital tools can streamline this process, allowing for easy edits and electronic submission.

Steps to complete the CIS Form1 xls

Completing the CIS Form1 xls involves several key steps:

- Download the form from an official source.

- Enter the contractor's name, address, and tax identification number.

- Detail the type of work performed and the payment amount.

- Review all entries for accuracy.

- Save the completed form in a secure location.

- Submit the form to the relevant tax authority by the specified deadline.

Legal use of the CIS Form1 xls

The CIS Form1 xls is legally required for businesses that hire contractors in certain sectors, particularly construction. It serves as a formal record of payments and helps ensure compliance with IRS regulations. Failing to use this form correctly can lead to penalties, making it crucial for businesses to understand their legal obligations regarding contractor payments and tax reporting.

Filing Deadlines / Important Dates

Filing deadlines for the CIS Form1 xls can vary based on the nature of the work and the specific tax year. Generally, businesses should submit this form by the end of the tax year to ensure compliance. It is advisable to check for any updates or changes to deadlines annually, as tax regulations may shift. Keeping a calendar of important dates can help businesses stay organized and compliant.

Required Documents

To complete the CIS Form1 xls, certain documents may be necessary. These typically include:

- Contractor's tax identification number.

- Invoices or payment records for the contracted work.

- Any previous correspondence with tax authorities regarding contractor payments.

Having these documents on hand can facilitate the accurate completion of the form and ensure that all necessary information is reported.

Penalties for Non-Compliance

Failure to properly complete and submit the CIS Form1 xls can result in significant penalties. Businesses may face fines for late submissions or inaccuracies in reporting. Additionally, non-compliance can lead to audits and increased scrutiny from tax authorities. It is essential for businesses to understand these risks and prioritize timely and accurate filing to avoid potential legal issues.

Quick guide on how to complete cis form1 xls

Effortlessly Prepare [SKS] on Any Gadget

Digital document management has gained traction among companies and individuals. It serves as an ideal eco-conscious substitute for conventional printed and signed documents, allowing you to obtain the right template and securely save it online. airSlate SignNow equips you with all the resources necessary to create, modify, and electronically sign your documents swiftly without delays. Manage [SKS] on any device with airSlate SignNow Android or iOS applications and enhance any document-centric operation today.

How to Edit and eSign [SKS] with Ease

- Locate [SKS] and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that task.

- Create your electronic signature using the Sign tool, which takes just moments and carries the same legal significance as a traditional wet ink signature.

- Review all the details and then click the Done button to save your modifications.

- Choose how you want to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form navigation, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from your preferred device. Alter and eSign [SKS] and ensure smooth communication at every step of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to CIS Form1 xls

Create this form in 5 minutes!

How to create an eSignature for the cis form1 xls

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the CIS Form1 xls and how can it benefit my business?

The CIS Form1 xls is a spreadsheet template designed for Construction Industry Scheme (CIS) submissions. By using this template, businesses can streamline their reporting processes, ensuring compliance with tax regulations while saving time and reducing errors.

-

How does airSlate SignNow integrate with the CIS Form1 xls?

airSlate SignNow allows users to easily upload and eSign the CIS Form1 xls, making document management seamless. This integration ensures that your forms are securely signed and stored, enhancing your workflow efficiency.

-

Is there a cost associated with using the CIS Form1 xls on airSlate SignNow?

While the CIS Form1 xls template itself may be free, using airSlate SignNow comes with subscription plans that vary based on features. These plans are designed to be cost-effective, providing excellent value for businesses looking to manage their documents efficiently.

-

Can I customize the CIS Form1 xls template in airSlate SignNow?

Yes, airSlate SignNow allows users to customize the CIS Form1 xls template to fit their specific needs. You can add fields, modify layouts, and include branding elements to ensure the document aligns with your business identity.

-

What features does airSlate SignNow offer for managing the CIS Form1 xls?

airSlate SignNow offers features such as electronic signatures, document tracking, and automated workflows for the CIS Form1 xls. These tools help businesses manage their documents more effectively and ensure timely submissions.

-

How secure is the CIS Form1 xls when using airSlate SignNow?

Security is a top priority for airSlate SignNow. The CIS Form1 xls and all documents are protected with advanced encryption and secure storage, ensuring that your sensitive information remains confidential and safe from unauthorized access.

-

Can I access the CIS Form1 xls on mobile devices?

Yes, airSlate SignNow is mobile-friendly, allowing you to access and manage the CIS Form1 xls from any device. This flexibility ensures that you can handle your documents on the go, making it easier to stay productive.

Get more for CIS Form1 xls

- Certificate of effectiveness of unit form

- Model form of a federal communitization agreement pages

- Reporting on federal units and communitization agreements form

- Business organizations staying afloat with a hole in the form

- 102 contract operating agreement secgov form

- Ncua ampamp fdic insurance limits how coverage is calculated form

- At all times while operations are conducted under the joint operating agreement to which this form

- The joint operating agreement texasbarcle form

Find out other CIS Form1 xls

- eSign North Dakota Award Nomination Form Free

- eSignature Mississippi Demand for Extension of Payment Date Secure

- Can I eSign Oklahoma Online Donation Form

- How Can I Electronic signature North Dakota Claim

- How Do I eSignature Virginia Notice to Stop Credit Charge

- How Do I eSignature Michigan Expense Statement

- How Can I Electronic signature North Dakota Profit Sharing Agreement Template

- Electronic signature Ohio Profit Sharing Agreement Template Fast

- Electronic signature Florida Amendment to an LLC Operating Agreement Secure

- Electronic signature Florida Amendment to an LLC Operating Agreement Fast

- Electronic signature Florida Amendment to an LLC Operating Agreement Simple

- Electronic signature Florida Amendment to an LLC Operating Agreement Safe

- How Can I eSignature South Carolina Exchange of Shares Agreement

- Electronic signature Michigan Amendment to an LLC Operating Agreement Computer

- Can I Electronic signature North Carolina Amendment to an LLC Operating Agreement

- Electronic signature South Carolina Amendment to an LLC Operating Agreement Safe

- Can I Electronic signature Delaware Stock Certificate

- Electronic signature Massachusetts Stock Certificate Simple

- eSignature West Virginia Sale of Shares Agreement Later

- Electronic signature Kentucky Affidavit of Service Mobile