FACULTYSTAFF SALARY REDUCTION AGREEMENT for 457b Form

What is the FACULTYSTAFF SALARY REDUCTION AGREEMENT FOR 457b

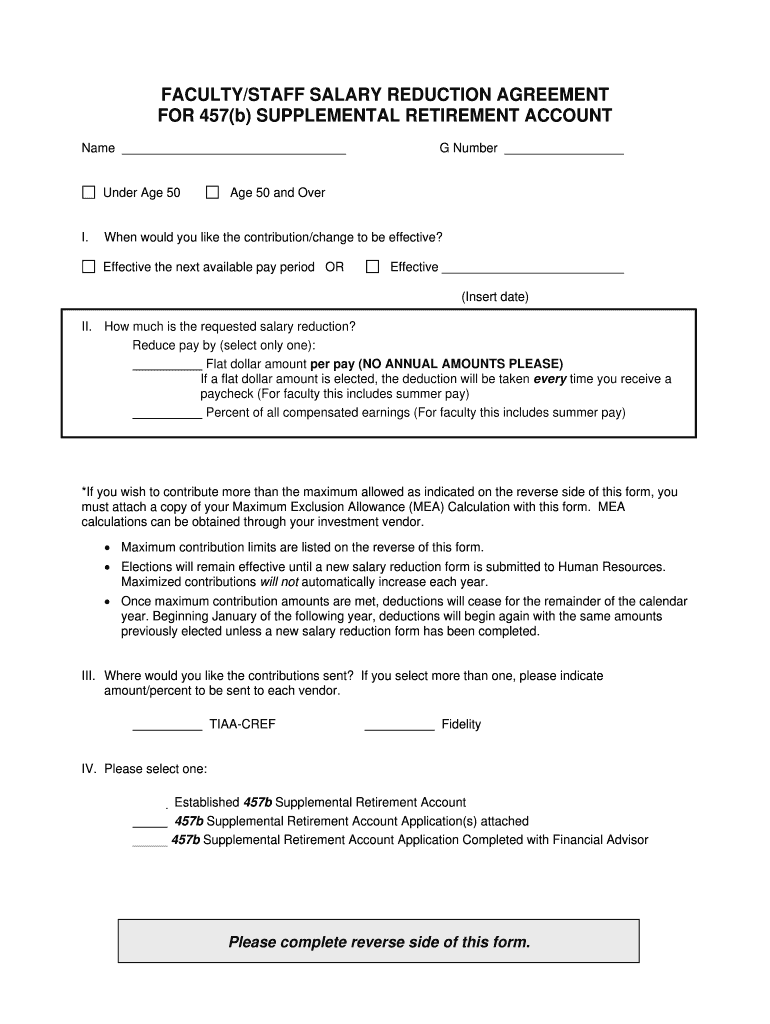

The FACULTYSTAFF SALARY REDUCTION AGREEMENT for 457b is a legal document that allows employees of educational institutions and certain non-profit organizations to defer a portion of their salary into a 457b retirement plan. This agreement is crucial for faculty and staff who wish to save for retirement while potentially reducing their taxable income. By participating in this program, employees can contribute pre-tax earnings, which can grow tax-deferred until withdrawal. This arrangement is particularly beneficial for those looking to enhance their retirement savings while managing their current tax liabilities.

How to use the FACULTYSTAFF SALARY REDUCTION AGREEMENT FOR 457b

Using the FACULTYSTAFF SALARY REDUCTION AGREEMENT involves several straightforward steps. First, employees need to obtain the agreement form from their institution's human resources department or designated benefits office. After receiving the form, employees should carefully review the terms and fill in the required information, including the amount they wish to defer from their salary. Once completed, the form must be submitted to the appropriate office for processing. It is important to keep a copy of the signed agreement for personal records, as it outlines the terms of the salary reduction and contributions to the 457b plan.

Steps to complete the FACULTYSTAFF SALARY REDUCTION AGREEMENT FOR 457b

Completing the FACULTYSTAFF SALARY REDUCTION AGREEMENT involves a series of steps that ensure accuracy and compliance. The following steps can guide you through the process:

- Obtain the salary reduction agreement form from your employer.

- Read the instructions carefully to understand the terms and conditions.

- Fill in your personal information, including your name, employee ID, and the amount you wish to defer.

- Sign and date the form to confirm your agreement.

- Submit the completed form to your human resources department or benefits administrator.

- Retain a copy of the signed agreement for your records.

Key elements of the FACULTYSTAFF SALARY REDUCTION AGREEMENT FOR 457b

The key elements of the FACULTYSTAFF SALARY REDUCTION AGREEMENT include the employee's personal information, the specified amount to be deducted from their salary, and the effective date of the salary reduction. Additionally, the agreement should outline the terms regarding the contributions to the 457b plan, including any limits set by the IRS. Understanding these elements is essential for ensuring that the agreement meets both personal retirement goals and compliance with federal regulations.

Eligibility Criteria

Eligibility for participating in the FACULTYSTAFF SALARY REDUCTION AGREEMENT for 457b typically includes being an employee of a qualified educational institution or a non-profit organization. Employees must also meet any specific criteria set by their employer, such as employment status (full-time or part-time) or length of service. It is advisable for employees to check with their human resources department to confirm their eligibility and understand any additional requirements that may apply.

IRS Guidelines

The Internal Revenue Service (IRS) provides specific guidelines regarding 457b plans, including contribution limits and tax implications. For the current tax year, the maximum contribution limit for a 457b plan is subject to annual adjustments by the IRS. Employees should stay informed about these limits and any catch-up provisions that may apply, especially for those nearing retirement age. Adhering to IRS guidelines ensures compliance and maximizes the benefits of the salary reduction agreement.

Quick guide on how to complete facultystaff salary reduction agreement for 457b

Prepare [SKS] effortlessly on any device

Online document management has gained popularity among businesses and individuals. It offers an excellent eco-friendly substitute for conventional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow provides you with all the necessary tools to create, modify, and eSign your documents swiftly and seamlessly. Manage [SKS] on any platform with airSlate SignNow Android or iOS applications and enhance any document-centric process today.

The easiest way to alter and eSign [SKS] without hassle

- Locate [SKS] and click on Get Form to initiate.

- Utilize the tools we provide to fill out your form.

- Emphasize pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Create your eSignature using the Sign feature, which takes just seconds and carries the same legal validity as a traditional ink signature.

- Review all the details and select the Done button to save your changes.

- Choose your preferred method to share your form, via email, SMS, or invitation link, or download it to your computer.

No more worrying about lost or misplaced documents, tedious form searching, or errors requiring new printouts. airSlate SignNow manages all your document administration needs with just a few clicks from a device of your choice. Edit and eSign [SKS] and ensure exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to FACULTYSTAFF SALARY REDUCTION AGREEMENT FOR 457b

Create this form in 5 minutes!

How to create an eSignature for the facultystaff salary reduction agreement for 457b

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a FACULTYSTAFF SALARY REDUCTION AGREEMENT FOR 457b?

A FACULTYSTAFF SALARY REDUCTION AGREEMENT FOR 457b is a legal document that allows employees to defer a portion of their salary into a 457b retirement plan. This agreement helps employees save for retirement while potentially reducing their taxable income. Understanding this agreement is crucial for faculty and staff looking to maximize their retirement savings.

-

How can airSlate SignNow help with FACULTYSTAFF SALARY REDUCTION AGREEMENT FOR 457b?

airSlate SignNow simplifies the process of creating and signing a FACULTYSTAFF SALARY REDUCTION AGREEMENT FOR 457b. Our platform allows users to easily draft, send, and eSign these agreements securely and efficiently. This streamlines the administrative process, making it easier for both employees and employers.

-

What are the benefits of using airSlate SignNow for FACULTYSTAFF SALARY REDUCTION AGREEMENT FOR 457b?

Using airSlate SignNow for your FACULTYSTAFF SALARY REDUCTION AGREEMENT FOR 457b offers numerous benefits, including enhanced security, ease of use, and cost-effectiveness. Our platform ensures that all documents are securely stored and easily accessible. Additionally, the user-friendly interface allows for quick and efficient document management.

-

Is there a cost associated with using airSlate SignNow for FACULTYSTAFF SALARY REDUCTION AGREEMENT FOR 457b?

Yes, there is a cost associated with using airSlate SignNow, but it is designed to be cost-effective for businesses. Our pricing plans are flexible and cater to different organizational needs, ensuring that you can manage your FACULTYSTAFF SALARY REDUCTION AGREEMENT FOR 457b without breaking the bank. We also offer a free trial to help you evaluate our services.

-

Can I integrate airSlate SignNow with other software for FACULTYSTAFF SALARY REDUCTION AGREEMENT FOR 457b?

Absolutely! airSlate SignNow offers seamless integrations with various software applications, making it easy to manage your FACULTYSTAFF SALARY REDUCTION AGREEMENT FOR 457b alongside your existing tools. This integration capability enhances workflow efficiency and ensures that all your documents are synchronized across platforms.

-

How secure is airSlate SignNow for handling FACULTYSTAFF SALARY REDUCTION AGREEMENT FOR 457b?

Security is a top priority at airSlate SignNow. We utilize advanced encryption and security protocols to protect your FACULTYSTAFF SALARY REDUCTION AGREEMENT FOR 457b and other sensitive documents. Our platform complies with industry standards to ensure that your data remains safe and confidential.

-

What features does airSlate SignNow offer for FACULTYSTAFF SALARY REDUCTION AGREEMENT FOR 457b?

airSlate SignNow provides a variety of features tailored for managing FACULTYSTAFF SALARY REDUCTION AGREEMENT FOR 457b, including customizable templates, eSignature capabilities, and automated workflows. These features help streamline the document signing process and enhance overall efficiency. Additionally, users can track document status in real-time.

Get more for FACULTYSTAFF SALARY REDUCTION AGREEMENT FOR 457b

- Use this form only for cases about changing a parentingcustody order when it is not an emergency and you have

- Use this form only for cases about changing a parentingcustody order

- X clerk do not file in a public access file form

- Free washington child custody form pdf form download

- Response to an objectionquot keyword found websites listing form

- Motion for temporary order preventing form

- Motion for temporary order allowing move form

- Temporary order about moving with form

Find out other FACULTYSTAFF SALARY REDUCTION AGREEMENT FOR 457b

- How Do I Sign Oregon Financial Affidavit

- Sign Maine Revocation of Power of Attorney Online

- Sign Louisiana Mechanic's Lien Online

- How To Sign New Mexico Revocation of Power of Attorney

- How Can I Sign Ohio Revocation of Power of Attorney

- Sign Michigan Mechanic's Lien Easy

- How To Sign Texas Revocation of Power of Attorney

- Sign Virginia Revocation of Power of Attorney Easy

- Can I Sign North Carolina Mechanic's Lien

- Sign Maine Payment Guaranty Myself

- Help Me With Sign Oklahoma Mechanic's Lien

- Sign Oregon Mechanic's Lien Simple

- How To Sign Utah Mechanic's Lien

- How To Sign Washington Mechanic's Lien

- Help Me With Sign Washington Mechanic's Lien

- Sign Arizona Notice of Rescission Safe

- Sign Hawaii Notice of Rescission Later

- Sign Missouri Demand Note Online

- How To Sign New York Notice to Stop Credit Charge

- How Do I Sign North Dakota Notice to Stop Credit Charge