Nasi Malpractice Insurance 2018

Understanding Nasi Malpractice Insurance

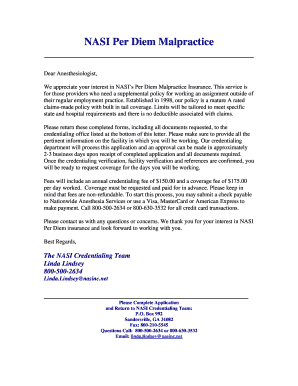

Nasi malpractice insurance is a specialized form of insurance designed to protect healthcare professionals against claims of negligence or malpractice. This type of insurance is crucial for those in the medical field, as it provides financial coverage for legal fees, settlements, and judgments that may arise from lawsuits. The insurance is tailored to meet the unique needs of various healthcare providers, including doctors, nurses, and therapists, ensuring they have the necessary support in case of a claim.

How to Obtain Nasi Malpractice Insurance

Obtaining nasi malpractice insurance involves several key steps. First, healthcare professionals should assess their specific needs based on their practice type and risk exposure. Next, they can research different insurance providers that offer malpractice coverage. It is essential to compare policies, premiums, and coverage limits to find the best fit. Once a suitable provider is selected, applicants typically need to fill out an application form, providing details about their practice and any previous claims. After the application is submitted, the insurer will review the information and provide a quote.

Key Elements of Nasi Malpractice Insurance

Several key elements define nasi malpractice insurance. These include:

- Coverage Limits: This refers to the maximum amount the insurer will pay for a claim. It is crucial to choose limits that adequately reflect potential risks.

- Policy Exclusions: Understanding what is not covered by the policy is essential. Common exclusions may include intentional misconduct or certain types of procedures.

- Claims-Made vs. Occurrence Policies: Claims-made policies provide coverage only if the policy is active when the claim is made, while occurrence policies cover incidents that occur during the policy period, regardless of when the claim is filed.

Legal Use of Nasi Malpractice Insurance

Nasi malpractice insurance is legally recognized and often required for healthcare professionals in many states. It serves as a safeguard against the financial repercussions of malpractice claims. In the event of a claim, the insurance company typically provides legal representation and covers defense costs, ensuring that healthcare providers can focus on their practice without the burden of legal issues. It is important for professionals to stay informed about their state’s regulations regarding malpractice insurance to ensure compliance.

State-Specific Rules for Nasi Malpractice Insurance

Each state in the U.S. has its own regulations regarding malpractice insurance, which can affect coverage requirements and liability limits. Some states may mandate specific coverage amounts or have unique provisions for certain types of healthcare providers. It is essential for professionals to familiarize themselves with their state’s laws to ensure they meet all legal requirements. Additionally, some states may offer resources or guidance for obtaining the necessary insurance.

Steps to Complete the Nasi Malpractice Insurance Application

Completing the application for nasi malpractice insurance involves several important steps:

- Gather Required Information: Collect necessary documents, including professional credentials, practice details, and any prior claims history.

- Fill Out the Application: Provide accurate and complete information on the application form to avoid delays.

- Review and Submit: Carefully review the application for any errors before submitting it to the insurance provider.

- Follow Up: After submission, follow up with the insurer to check the status of the application and address any additional questions they may have.

Quick guide on how to complete nasi malpractice insurance

Easily Prepare Nasi Malpractice Insurance on Any Device

Online document management has gained traction among companies and individuals. It offers an excellent eco-friendly substitute for conventional printed and signed documents, allowing you to obtain the necessary form and securely keep it online. airSlate SignNow equips you with all the resources you need to create, modify, and electronically sign your documents swiftly and without complications. Manage Nasi Malpractice Insurance on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The Easiest Way to Modify and Electronically Sign Nasi Malpractice Insurance

- Find Nasi Malpractice Insurance and click Get Form to begin.

- Make use of the tools provided to complete your document.

- Select important sections of your documents or obscure sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Generate your eSignature using the Sign feature, which takes seconds and carries the same legal validity as a traditional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Decide how you want to share your form, via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that require reprinting new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Nasi Malpractice Insurance and ensure exceptional communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct nasi malpractice insurance

Create this form in 5 minutes!

How to create an eSignature for the nasi malpractice insurance

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is NASI malpractice insurance?

NASI malpractice insurance is a specialized insurance designed to protect professionals from claims of negligence or inadequate performance in their services. It is essential for those in fields such as healthcare, law, and consulting, ensuring that they are financially safeguarded against potential lawsuits.

-

How much does NASI malpractice insurance cost?

The cost of NASI malpractice insurance can vary based on factors such as your profession, coverage limits, and claims history. Typically, premiums can range from a few hundred to several thousand dollars annually, making it crucial to compare quotes to find the best option for your needs.

-

What are the key features of NASI malpractice insurance?

Key features of NASI malpractice insurance include coverage for legal defense costs, settlements, and judgments related to malpractice claims. Additionally, many policies offer risk management resources and support to help professionals minimize their exposure to potential claims.

-

What are the benefits of having NASI malpractice insurance?

Having NASI malpractice insurance provides peace of mind, knowing that you are protected against unexpected legal claims. It also enhances your professional credibility, as clients often prefer working with insured professionals, which can lead to increased business opportunities.

-

Can NASI malpractice insurance be customized?

Yes, NASI malpractice insurance can often be customized to fit the specific needs of your profession and practice. You can choose coverage limits, additional endorsements, and specific exclusions to ensure that your policy aligns with your unique risk profile.

-

How do I file a claim with NASI malpractice insurance?

To file a claim with NASI malpractice insurance, you typically need to notify your insurance provider as soon as you become aware of a potential claim. This process usually involves submitting a claim form along with any relevant documentation to support your case.

-

Does NASI malpractice insurance cover cyber liability?

Many NASI malpractice insurance policies do not automatically include cyber liability coverage, which protects against data bsignNowes and cyberattacks. However, you can often add this coverage as an endorsement to your policy, ensuring comprehensive protection for your practice.

Get more for Nasi Malpractice Insurance

- How to get medical documents from hamad medical corporation form

- Aims test form

- Ds 16973952 form

- Mydermspecialists 460114785 form

- E awas online form 349573922

- Cmp 1190 form 399778746

- Transit visa australia form

- Www coveredca comnewsroomnews releasescovered california creates limited special enrollment period form

Find out other Nasi Malpractice Insurance

- Sign Non-Profit Document New Mexico Mobile

- Sign Alaska Orthodontists Business Plan Template Free

- Sign North Carolina Life Sciences Purchase Order Template Computer

- Sign Ohio Non-Profit LLC Operating Agreement Secure

- Can I Sign Ohio Non-Profit LLC Operating Agreement

- Sign South Dakota Non-Profit Business Plan Template Myself

- Sign Rhode Island Non-Profit Residential Lease Agreement Computer

- Sign South Carolina Non-Profit Promissory Note Template Mobile

- Sign South Carolina Non-Profit Lease Agreement Template Online

- Sign Oregon Life Sciences LLC Operating Agreement Online

- Sign Texas Non-Profit LLC Operating Agreement Online

- Can I Sign Colorado Orthodontists Month To Month Lease

- How Do I Sign Utah Non-Profit Warranty Deed

- Help Me With Sign Colorado Orthodontists Purchase Order Template

- Sign Virginia Non-Profit Living Will Fast

- How To Sign Virginia Non-Profit Lease Agreement Template

- How To Sign Wyoming Non-Profit Business Plan Template

- How To Sign Wyoming Non-Profit Credit Memo

- Sign Wisconsin Non-Profit Rental Lease Agreement Simple

- Sign Wisconsin Non-Profit Lease Agreement Template Safe