FL 195 Income Withholding for Support 2024-2026

What is the FL 195 Income Withholding For Support

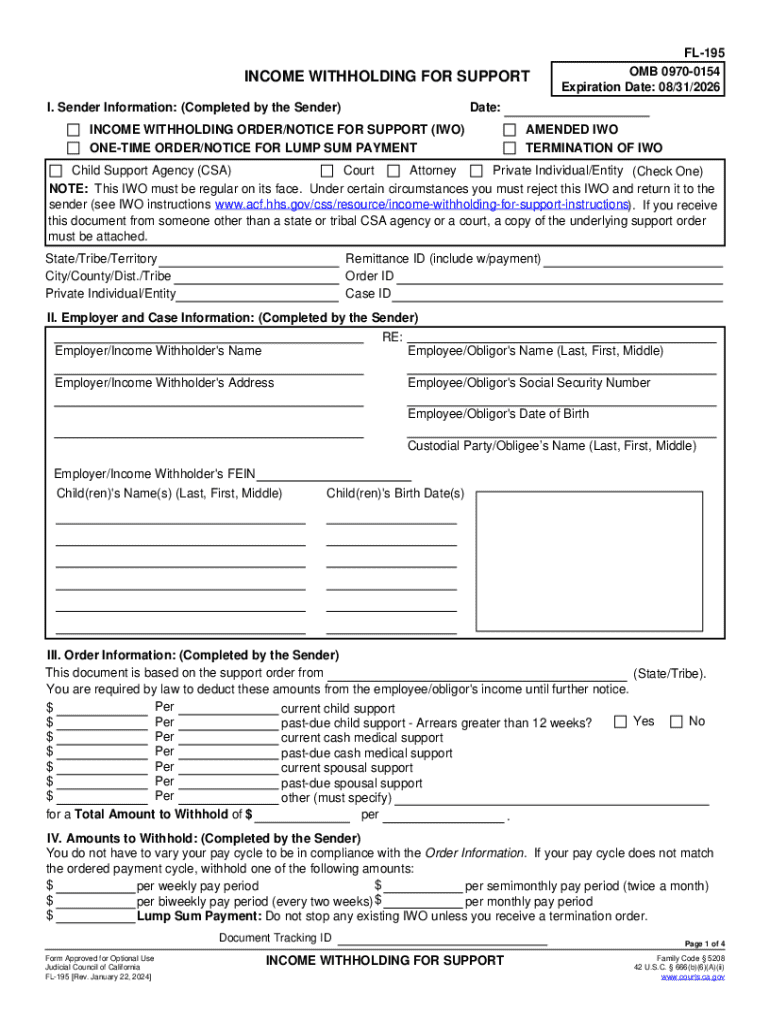

The FL 195 Income Withholding for Support is a legal document used primarily in California to facilitate the collection of child support and spousal support payments directly from an employee's wages. This form is essential for ensuring that support payments are made consistently and on time, helping to provide financial stability for children and dependents. The FL 195 serves as a directive to employers, instructing them to withhold a specified amount from an employee's paycheck and remit it to the appropriate child support agency.

How to use the FL 195 Income Withholding For Support

To effectively use the FL 195 Income Withholding for Support, the form must first be completed accurately. This involves filling in the necessary details, such as the names of the parties involved, the amount to be withheld, and the relevant case numbers. Once completed, the form should be submitted to the employer of the individual from whom support is being collected. Employers are legally obligated to comply with the withholding order and must ensure that the specified amounts are deducted from the employee's wages and sent to the designated agency.

Steps to complete the FL 195 Income Withholding For Support

Completing the FL 195 Income Withholding for Support involves several key steps:

- Obtain a copy of the FL 195 form from your local child support agency or the California Department of Child Support Services.

- Fill out the form with accurate information, including the names of the custodial and non-custodial parents, the child or children involved, and the amount to be withheld.

- Review the completed form for any errors or omissions to ensure compliance with legal requirements.

- Submit the form to the employer of the non-custodial parent, ensuring that they receive it in a timely manner.

- Keep a copy of the submitted form for your records.

Legal use of the FL 195 Income Withholding For Support

The FL 195 Income Withholding for Support is legally binding once issued by a court or child support agency. It is designed to ensure that support payments are made without delay and to protect the financial interests of the custodial parent and the child. Employers must adhere to the withholding order and are prohibited from retaliating against employees for complying with the order. Failure to comply with the FL 195 can result in legal penalties for the employer, including fines and other sanctions.

Key elements of the FL 195 Income Withholding For Support

Several key elements are essential for the proper functioning of the FL 195 Income Withholding for Support:

- Identification Information: The form requires the names, addresses, and Social Security numbers of both the custodial and non-custodial parents.

- Withholding Amount: The specific amount to be withheld from the non-custodial parent's wages must be clearly stated.

- Employer Information: Details about the employer, including their name and address, are necessary for proper processing.

- Case Information: The case number and any relevant court details must be included to ensure the correct allocation of funds.

Form Submission Methods (Online / Mail / In-Person)

The FL 195 Income Withholding for Support can be submitted through various methods. Typically, the form is delivered to the employer via mail or in person. Some jurisdictions may offer online submission options through their child support agency portals. It is important to verify the submission methods accepted by the employer to ensure timely processing. Employers should maintain a record of the submission date to track compliance with the withholding order.

Quick guide on how to complete fl 195 income withholding for support

Complete FL 195 Income Withholding For Support effortlessly on any device

Web-based document management has gained traction among organizations and individuals. It serves as an ideal environmentally friendly alternative to conventional printed and signed paperwork, as you can easily locate the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents swiftly without delays. Manage FL 195 Income Withholding For Support on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The most efficient way to alter and eSign FL 195 Income Withholding For Support seamlessly

- Obtain FL 195 Income Withholding For Support and click on Get Form to initiate.

- Use the tools we offer to fill out your document.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature with the Sign tool, which takes just seconds and carries the same legal significance as a traditional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you want to share your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow takes care of all your document management needs in just a few clicks from any preferred device. Modify and eSign FL 195 Income Withholding For Support and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct fl 195 income withholding for support

Create this form in 5 minutes!

How to create an eSignature for the fl 195 income withholding for support

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the dmv form195?

The dmv form195 is a specific document used for vehicle registration and title transfer in certain states. It is essential for ensuring that your vehicle is legally recognized and properly registered with the Department of Motor Vehicles. Using airSlate SignNow, you can easily fill out and eSign the dmv form195 online, streamlining the process.

-

How can airSlate SignNow help with the dmv form195?

airSlate SignNow provides a user-friendly platform to complete and eSign the dmv form195 efficiently. With our solution, you can fill out the form digitally, ensuring accuracy and saving time. Additionally, our platform allows for secure storage and easy sharing of your completed documents.

-

Is there a cost associated with using airSlate SignNow for the dmv form195?

Yes, airSlate SignNow offers various pricing plans to accommodate different needs, including options for individuals and businesses. The cost is competitive and provides access to a range of features that simplify the process of handling documents like the dmv form195. You can choose a plan that best fits your requirements.

-

What features does airSlate SignNow offer for the dmv form195?

airSlate SignNow includes features such as customizable templates, secure eSigning, and document tracking, all of which enhance the experience of managing the dmv form195. These features ensure that you can complete your paperwork efficiently and with confidence. Additionally, our platform is designed to be intuitive, making it easy for anyone to use.

-

Can I integrate airSlate SignNow with other applications for the dmv form195?

Absolutely! airSlate SignNow offers integrations with various applications, allowing you to streamline your workflow when handling the dmv form195. Whether you use CRM systems, cloud storage, or other business tools, our platform can connect seamlessly to enhance your document management process.

-

What are the benefits of using airSlate SignNow for the dmv form195?

Using airSlate SignNow for the dmv form195 provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform allows you to complete and eSign documents from anywhere, making it convenient for busy individuals and businesses. Additionally, the ability to track document status ensures you stay informed throughout the process.

-

Is airSlate SignNow secure for handling the dmv form195?

Yes, airSlate SignNow prioritizes security and compliance, ensuring that your dmv form195 and other documents are protected. We utilize advanced encryption and secure storage solutions to safeguard your information. You can trust that your sensitive data is handled with the utmost care and confidentiality.

Get more for FL 195 Income Withholding For Support

Find out other FL 195 Income Withholding For Support

- Help Me With eSignature Washington IOU

- eSign Indiana Home Improvement Contract Myself

- eSign North Dakota Architectural Proposal Template Online

- How To eSignature Alabama Mechanic's Lien

- Can I eSign Alabama Car Insurance Quotation Form

- eSign Florida Car Insurance Quotation Form Mobile

- eSign Louisiana Car Insurance Quotation Form Online

- Can I eSign Massachusetts Car Insurance Quotation Form

- eSign Michigan Car Insurance Quotation Form Online

- eSign Michigan Car Insurance Quotation Form Mobile

- eSignature Massachusetts Mechanic's Lien Online

- eSignature Massachusetts Mechanic's Lien Free

- eSign Ohio Car Insurance Quotation Form Mobile

- eSign North Dakota Car Insurance Quotation Form Online

- eSign Pennsylvania Car Insurance Quotation Form Mobile

- eSignature Nevada Mechanic's Lien Myself

- eSign California Life-Insurance Quote Form Online

- How To eSignature Ohio Mechanic's Lien

- eSign Florida Life-Insurance Quote Form Online

- eSign Louisiana Life-Insurance Quote Form Online