Nj Estate 2017-2026

What is the NJ Estate?

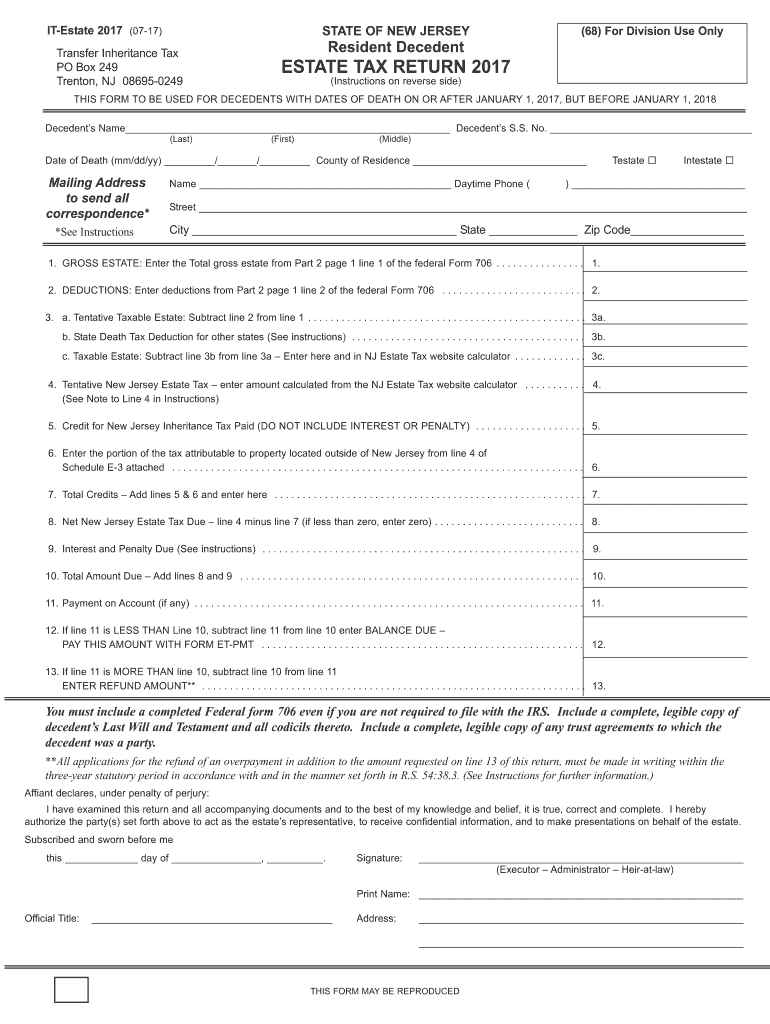

The NJ estate refers to the estate tax regulations and requirements specific to New Jersey. This tax applies to the transfer of assets from a deceased individual to their beneficiaries. The New Jersey estate tax is calculated based on the value of the estate at the time of death, and it is essential for executors and heirs to understand these rules to ensure compliance. The estate tax applies to estates exceeding a certain threshold, which can change based on state legislation.

Steps to Complete the NJ Estate

Completing the NJ estate tax return involves several key steps:

- Gather all necessary documentation, including the death certificate, asset valuations, and debts.

- Determine the total value of the estate, including real estate, bank accounts, and personal property.

- Complete the NJ estate tax return form accurately, ensuring all information is correct.

- Calculate the estate tax owed based on the current tax rates and exemptions.

- Submit the completed form and any required documentation to the New Jersey Division of Taxation.

Required Documents

When filing the NJ estate tax return, several documents are essential:

- Death certificate of the decedent.

- List of assets, including appraisals for real estate and personal property.

- Documentation of any debts owed by the estate.

- Previous tax returns, if applicable, to support deductions.

- Any relevant legal documents, such as wills or trusts.

Filing Deadlines / Important Dates

It is crucial to be aware of the filing deadlines associated with the NJ estate tax. Generally, the estate tax return must be filed within nine months of the decedent's date of death. Extensions may be available under certain circumstances, but it is important to file any requests for extensions before the original deadline. Failure to meet these deadlines can result in penalties and interest on any taxes owed.

Legal Use of the NJ Estate

The legal use of the NJ estate tax return is to report and settle the estate's financial obligations to the state. Executors or administrators of the estate are responsible for ensuring that the return is filed accurately and on time. This process not only fulfills legal obligations but also helps in the proper distribution of assets to beneficiaries. Understanding the legal framework surrounding the NJ estate is vital for compliance and to avoid potential legal issues.

IRS Guidelines

While the NJ estate tax is a state-level obligation, it is also essential to consider IRS guidelines when dealing with estate taxes. The IRS provides specific instructions on how to report estate taxes on federal returns, which may include Form 706 for federal estate tax returns. Executors should be aware of any federal implications and ensure that both state and federal requirements are met to avoid complications.

Quick guide on how to complete new jersey estate 2017 2019 form

Your assistance manual on how to prepare your Nj Estate

If you wish to learn how to create and dispatch your Nj Estate, here are some quick pointers on how to simplify tax processing.

First, you need to sign up for your airSlate SignNow account to revolutionize how you manage documents online. airSlate SignNow is an incredibly user-friendly and powerful document platform that allows you to edit, draft, and finalize your tax forms effortlessly. With its editor, you can navigate between text, check boxes, and eSignatures, and revisit to update information as necessary. Enhance your tax management with advanced PDF editing, eSigning, and intuitive sharing.

Follow the instructions below to complete your Nj Estate in a few minutes:

- Create your account and begin working on PDFs within moments.

- Browse our directory to find any IRS tax form; review variations and schedules.

- Click Get form to access your Nj Estate in our editor.

- Fill in the necessary fillable fields with your information (text, numbers, checkmarks).

- Utilize the Sign Tool to affix your legally-recognized eSignature (if required).

- Double-check your document and correct any errors.

- Save changes, print your copy, send it to your recipient, and download it to your device.

Utilize this manual to submit your taxes electronically with airSlate SignNow. Keep in mind that filing on paper can increase return errors and delay refunds. Naturally, prior to e-filing your taxes, verify the IRS website for submission guidelines in your state.

Create this form in 5 minutes or less

Find and fill out the correct new jersey estate 2017 2019 form

FAQs

-

What is the new procedure in filling out the AIIMS 2019 form? What is the last date to fill out its form?

AIIMS has introduced the PAAR facility (Prospective Applicant Advanced Registration) for filling up the application form. Through PAAR facility, the process application form is divided into two steps- basic registration and final registration.Basic Registration:On this part you have to fill up your basic details like Full name, parent’s name, date of birth, gender, category, state of domicile, ID proof/number and others. No paAIIMS Final RegistrationA Code will be issued to the candidates who complete the Basic Registration. You have to use the same code to login again and fill the form.At this stage, candidates are required to fill out the entire details of their personal, professional and academic background. Also, they have to submit the application fee as per their category.Here I have explained the two steps for AIIMS 2019 form.For more details visit aim4aiims’s website:About AIIMS Exam 2019

-

In the state of New Jersey, how long does it take to close out an estate?

I’ve spoken to a number of folks about this and three years seems to be relatively common to finish up the very last of the paper work. The amount of documentation the person left, the records, the size of the estate and family complications will make it longer or shorters depending, but 3 years seems to be not uncommon.

-

How do I fill out the CAT Application Form 2017?

CAT 2017 registration opened on August 9, 2017 will close on September 20 at 5PM. CAT online registration form and application form is a single document divided in 5 pages and is to be completed online. The 1st part of CAT online registration form requires your personal details. After completing your online registration, IIMs will send you CAT 2017 registration ID. With this unique ID, you will login to online registration form which will also contain application form and registration form.CAT Registration and application form will require you to fill up your academic details, uploading of photograph, signature and requires category certificates as per the IIMs prescribed format for CAT registration. CAT online application form 2017 consists of programme details on all the 20 IIMs. Candidates have to tick by clicking on the relevant programmes of the IIMs for which they wish to attend the personal Interview Process.

-

How do I fill out a CLAT 2019 application form?

Hi thereFirst of all, let me tell you some important points:CLAT 2019 has gone OFFLINE this yearBut the application forms for CLAT 2019 have to be filled ONLINEThe payment of the application fees also should be made onlineNow, kindly note the important dates:Note the details regarding the application fees:Here, if you want the Previous Year Question papers, Rs.500 would be added to the application fees.Apart from this, there would be bank transaction charges added to the application fees.The application fees is non-refundable.Note one important point here that before you fill the application form, check for your eligibility.To know the complete details of filling the application form along with other information like the eligibility - in terms of age, educational qualification, list of NLUs participating and the seats offered under each category, CLAT Reservation policies, CLAT exam pattern, marking scheme, syllabus, important documents required to be kept ready before filling the form, kindly go to the link below:How to fill CLAT 2019 Application form? Registration OPEN | All you need to knowTo know how to prepare for one of the very important section of CLAT exam, GK and Current Affairs, kindly go to the link below:How to prepare GK & Current Affairs for CLAT 2019To practice, daily MCQs on Current Affairs, kindly go to the link below:#CLAT2019 | #AILET2019 | #DULLB2019 | GK and Current Affairs Series: 5 in 10 Series: Day 12For any other queries, kindly write to us at mailateasyway@gmail.comThanks & Regards!

-

How do I fill out the NEET 2019 application form?

Expecting application form of NEET2019 will be same as that of NEET2018, follow the instructions-For Feb 2019 Exam:EventsDates (Announced)Release of application form-1st October 2018Application submission last date-31st October 2018Last date to pay the fee-Last week of October 2018Correction Window Open-1st week of November 2018Admit card available-1st week of January 2019Exam date-3rd February to 17th February 2019Answer key & OMR release-Within a week after examAnnouncement of result-1st week of March 2019Counselling begins-2nd week of June 2019For May 2019 Exam:EventsDates (Announced)Application form Release-2nd week of March 2019Application submission last date-2nd week of April 2019Last date to pay the fee-2nd week of April 2019Correction Window Open-3rd week of April 2019Admit card available-1st week of May 2019Exam date-12th May to 26th May 2019Answer key & OMR release-Within a week after examAnnouncement of result-1st week of June 2019Counselling begins-2nd week of June 2019NEET 2019 Application FormCandidates should fill the application form as per the instructions given in the information bulletin. Below we are providing NEET 2019 application form details:The application form will be issued through online mode only.No application will be entertained through offline mode.NEET UG registration 2019 will be commenced from the 1st October 2018 (Feb Exam) & second week of March 2018 (May Exam).Candidates should upload the scanned images of recent passport size photograph and signature.After filling the application form completely, a confirmation page will be generated. Download it.There will be no need to send the printed confirmation page to the board.Application Fee:General and OBC candidates will have to pay Rs. 1400/- as an application fee.The application fee for SC/ST and PH candidates will be Rs. 750/-.Fee payment can be done through credit/debit card, net banking, UPI and e-wallet.Service tax will also be applicable.CategoryApplication FeeGeneral/OBC-1400/-SC/ST/PH-750/-Step 1: Fill the Application FormGo the official portal of the conducting authority (Link will be given above).Click on “Apply Online” link.A candidate has to read all the instruction and then click on “Proceed to Apply Online NEET (UG) 2019”.Step 1.1: New RegistrationFill the registration form carefully.Candidates have to fill their name, Mother’s Name, Father’s Name, Category, Date of Birth, Gender, Nationality, State of Eligibility (for 15% All India Quota), Mobile Number, Email ID, Aadhaar card number, etc.After filling all the details, two links will be given “Preview &Next” and “Reset”.If candidate satisfied with the filled information, then they have to click on “Next”.After clicking on Next Button, the information submitted by the candidate will be displayed on the screen. If information correct, click on “Next” button, otherwise go for “Back” button.Candidates may note down the registration number for further procedure.Now choose the strong password and re enter the password.Choose security question and feed answer.Enter the OTP would be sent to your mobile number.Submit the button.Step 1.2: Login & Application Form FillingLogin with your Registration Number and password.Fill personal details.Enter place of birth.Choose the medium of question paper.Choose examination centres.Fill permanent address.Fill correspondence address.Fill Details (qualification, occupation, annual income) of parents and guardians.Choose the option for dress code.Enter security pin & click on save & draft.Now click on preview and submit.Now, review your entries.Then. click on Final Submit.Step 2: Upload Photo and SignatureStep 2 for images upload will be appeared on screen.Now, click on link for Upload photo & signature.Upload the scanned images.Candidate should have scanned images of his latest Photograph (size of 10 Kb to 100 Kb.Signature(size of 3 Kb to 20 Kb) in JPEG format only.Step 3: Fee PaymentAfter uploading the images, candidate will automatically go to the link for fee payment.A candidate has to follow the instruction & submit the application fee.Choose the Bank for making payment.Go for Payment.Candidate can pay the fee through Debit/Credit Card/Net Banking/e-wallet (CSC).Step 4: Take the Printout of Confirmation PageAfter the fee payment, a candidate may take the printout of the confirmation page.Candidates may keep at least three copies of the confirmation page.Note:Must retain copy of the system generated Self Declaration in respect of candidates from J&K who have opted for seats under 15% All India Quota.IF any queries, feel free to comment..best of luck

-

How do I fill out the Delhi Polytechnic 2017 form?

Delhi Polytechnic (CET DELHI) entrance examination form has been published. You can visit Welcome to CET Delhi and fill the online form. For more details you can call @ 7042426818

Create this form in 5 minutes!

How to create an eSignature for the new jersey estate 2017 2019 form

How to create an electronic signature for your New Jersey Estate 2017 2019 Form online

How to make an eSignature for the New Jersey Estate 2017 2019 Form in Chrome

How to generate an electronic signature for putting it on the New Jersey Estate 2017 2019 Form in Gmail

How to generate an electronic signature for the New Jersey Estate 2017 2019 Form from your smart phone

How to generate an eSignature for the New Jersey Estate 2017 2019 Form on iOS devices

How to generate an electronic signature for the New Jersey Estate 2017 2019 Form on Android devices

People also ask

-

What is airSlate SignNow and how does it relate to new jersey estate management?

airSlate SignNow is a digital solution that allows for seamless document management and eSigning. In the context of new jersey estate management, it streamlines the process of signing and sending crucial estate documents, making it easier for you to handle legal paperwork efficiently.

-

How does airSlate SignNow ensure the security of new jersey estate documents?

Security is a top priority for airSlate SignNow, especially for sensitive new jersey estate documents. The platform utilizes advanced encryption and compliance with legal standards to ensure that all your estate documents are securely signed and stored.

-

What are the pricing options for airSlate SignNow relevant to new jersey estate professionals?

airSlate SignNow offers flexible pricing plans designed to fit the needs of new jersey estate professionals. Whether you're an individual, a small firm, or a large organization, you can find a plan that provides cost-effective solutions tailored for managing estate documents.

-

Can airSlate SignNow integrate with other tools commonly used in new jersey estate handling?

Yes, airSlate SignNow integrates seamlessly with various tools used by new jersey estate professionals, such as CRM systems and cloud storage services. This integration allows for a more efficient workflow, enabling quick access to your estate documents and tracking their status.

-

What features does airSlate SignNow offer to simplify new jersey estate transactions?

airSlate SignNow provides features like customizable templates, in-person signing, and automated reminders, which simplify new jersey estate transactions. These tools help ensure that all parties involved are kept in the loop and that the signing process runs smoothly without delays.

-

Is airSlate SignNow user-friendly for individuals handling new jersey estate documents?

Absolutely! airSlate SignNow is designed to be user-friendly, making it accessible for individuals managing new jersey estate documents. Its intuitive interface enables users to easily send, sign, and track documents, regardless of their technical expertise.

-

What benefits does airSlate SignNow provide for new jersey estate planning?

Using airSlate SignNow for new jersey estate planning offers numerous benefits, including time savings and enhanced document organization. It allows estate planners to focus on their clients' needs while ensuring that the administrative processes are efficient and secure.

Get more for Nj Estate

- Prospective tenants are to complete this form

- Www granitestatefuture orgget involvedbloggranite state future obesity prevention in nh communities form

- Unisa music examinations form

- Tenancy application form newtown ljhooker com au

- Legatees and devisees estate with will ecourt form

- Number registration form for employer

- Pendaftaran fail cukai lembaga hasil dalam negeri form

- Payee information form

Find out other Nj Estate

- Help Me With Sign New Mexico Healthcare / Medical Medical History

- Can I Sign Ohio Healthcare / Medical Residential Lease Agreement

- How To Sign Oregon Healthcare / Medical Living Will

- How Can I Sign South Carolina Healthcare / Medical Profit And Loss Statement

- Sign Tennessee Healthcare / Medical Business Plan Template Free

- Help Me With Sign Tennessee Healthcare / Medical Living Will

- Sign Texas Healthcare / Medical Contract Mobile

- Sign Washington Healthcare / Medical LLC Operating Agreement Now

- Sign Wisconsin Healthcare / Medical Contract Safe

- Sign Alabama High Tech Last Will And Testament Online

- Sign Delaware High Tech Rental Lease Agreement Online

- Sign Connecticut High Tech Lease Template Easy

- How Can I Sign Louisiana High Tech LLC Operating Agreement

- Sign Louisiana High Tech Month To Month Lease Myself

- How To Sign Alaska Insurance Promissory Note Template

- Sign Arizona Insurance Moving Checklist Secure

- Sign New Mexico High Tech Limited Power Of Attorney Simple

- Sign Oregon High Tech POA Free

- Sign South Carolina High Tech Moving Checklist Now

- Sign South Carolina High Tech Limited Power Of Attorney Free