New Jersey Estate Form 2016

What is the New Jersey Estate Form

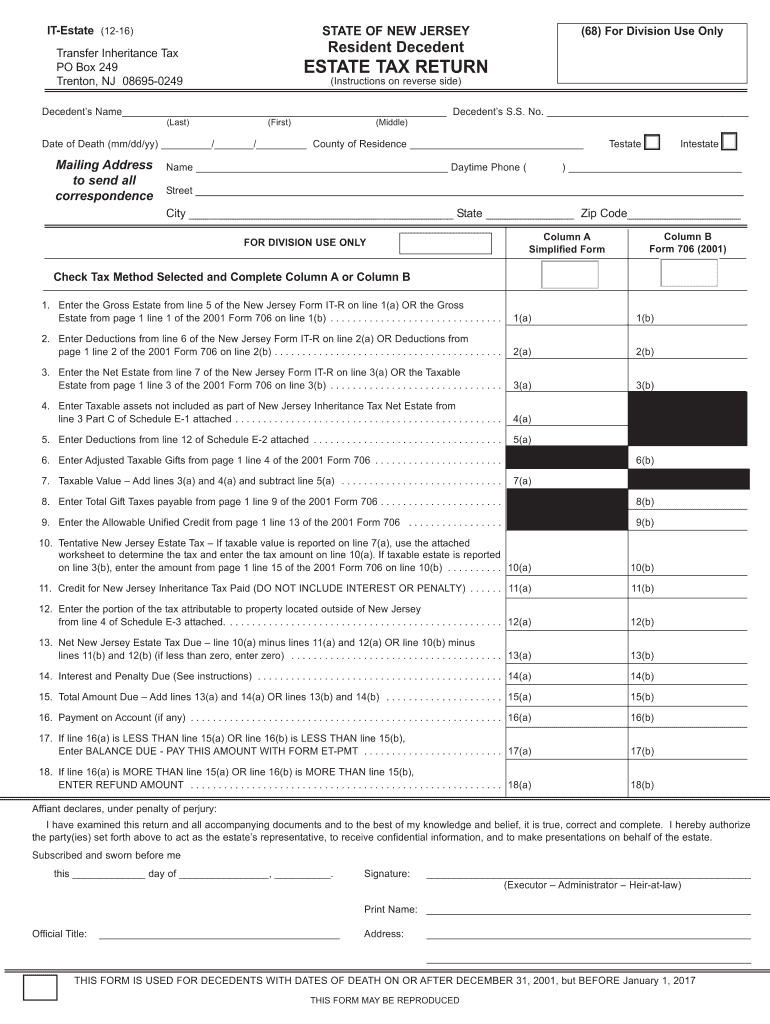

The New Jersey Estate Form is a legal document required for reporting the estate of a deceased individual in New Jersey. This form is essential for the proper assessment of estate taxes and ensures compliance with state laws. It provides a detailed account of the assets, liabilities, and the distribution of the estate to beneficiaries. Understanding this form is crucial for executors and administrators managing the estate, as it outlines the necessary information needed for tax calculations and legal obligations.

How to use the New Jersey Estate Form

Using the New Jersey Estate Form involves several steps to ensure accurate completion and submission. First, gather all relevant financial documents, including bank statements, property deeds, and any outstanding debts. Next, fill out the form with precise details about the deceased's assets and liabilities. Ensure that all information is correct and complete, as inaccuracies can lead to delays or penalties. After completing the form, it must be signed by the executor or administrator before submission to the appropriate state office.

Steps to complete the New Jersey Estate Form

Completing the New Jersey Estate Form requires careful attention to detail. Follow these steps:

- Gather all necessary documentation related to the deceased's estate.

- Fill in the personal information of the deceased, including name, date of birth, and date of death.

- List all assets, including real estate, bank accounts, and investments.

- Detail any liabilities, such as outstanding debts or mortgages.

- Provide information on beneficiaries and how the estate will be distributed.

- Review the form for accuracy and completeness.

- Sign the form and prepare it for submission.

Legal use of the New Jersey Estate Form

The New Jersey Estate Form serves a legal purpose in the administration of an estate. It is used to report the estate's value for tax purposes and to ensure compliance with state laws. Executors and administrators must use this form to provide a transparent account of the deceased's financial affairs. Filing this form correctly is crucial to avoid legal complications and ensure that the estate is settled according to the deceased's wishes and state regulations.

Filing Deadlines / Important Dates

Filing deadlines for the New Jersey Estate Form are critical to ensure compliance with state regulations. Generally, the form must be filed within nine months of the date of death. However, extensions may be available under certain circumstances. It is important to stay informed about any specific deadlines that may apply to your situation, as failing to file on time can result in penalties and interest on unpaid taxes.

Required Documents

When completing the New Jersey Estate Form, several documents are required to support the information provided. These may include:

- Death certificate of the deceased.

- Will or trust documents, if applicable.

- Financial statements, including bank and investment account statements.

- Property deeds and titles.

- Documentation of any outstanding debts or liabilities.

Form Submission Methods

The New Jersey Estate Form can be submitted through various methods. Executors and administrators have the option to file the form online, by mail, or in person at designated state offices. Each submission method has its own requirements and processing times, so it is advisable to choose the method that best suits your needs while ensuring compliance with state regulations.

Quick guide on how to complete new jersey estate 2016 form

Your assistance manual on how to prepare your New Jersey Estate Form

If you're interested in learning how to generate and submit your New Jersey Estate Form, here are some straightforward guidelines to make tax reporting simpler.

To begin, you simply need to set up your airSlate SignNow account to revolutionize how you handle documents online. airSlate SignNow is an extremely user-friendly and robust document solution that enables you to modify, produce, and finalize your income tax forms effortlessly. With its editor, you can toggle between text, checkboxes, and eSignatures and return to amend responses as necessary. Streamline your tax administration with advanced PDF editing, electronic signing, and user-friendly sharing.

Complete the steps below to finalize your New Jersey Estate Form in just a few minutes:

- Establish your account and begin working on PDFs in no time.

- Utilize our directory to access any IRS tax form; explore different versions and schedules.

- Click Obtain form to open your New Jersey Estate Form in our editor.

- Populate the mandatory fields with your information (text, numbers, checkmarks).

- Employ the Signature Tool to add your legally-recognized eSignature (if necessary).

- Examine your document and correct any mistakes.

- Save changes, print your version, send it to your recipient, and download it to your device.

Leverage this manual to file your taxes online using airSlate SignNow. Please remember that paper filing may lead to return discrepancies and delayed refunds. Naturally, before electronically filing your taxes, consult the IRS website for reporting regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct new jersey estate 2016 form

FAQs

-

How do I fill out 2016 ITR form?

First of all you must know about all of your sources of income. In Indian Income Tax Act there are multiple forms for different types of sources of Income. If you have only salary & other source of income you can fill ITR-1 by registering your PAN on e-Filing Home Page, Income Tax Department, Government of India after registration you have to login & select option fill ITR online in this case you have to select ITR-1 for salary, house property & other source income.if you have income from business & profession and not maintaining books & also not mandatory to prepare books & total turnover in business less than 1 Crores & want to show profit more than 8% & if you are a professional and not required to make books want to show profit more than 50% of receipts than you can use online quick e-filling form ITR-4S i.s. for presumptive business income.for other source of income there are several forms according to source of income download Excel utility or JAVA utility form e-Filing Home Page, Income Tax Department, Government of India fill & upload after login to your account.Prerequisite before E-filling.Last year return copy (if available)Bank Account number with IFSC Code.Form 16/16A (if Available)Saving Details / Deduction Slips LIC,PPF, etc.Interest Statement from Banks or OthersProfit & Loss Account, Balance Sheet, Tax Audit Report only if filling ITR-4, ITR-5, ITR-6, ITR-7.hope this will help you in case any query please let me know.

-

In the state of New Jersey, how long does it take to close out an estate?

I’ve spoken to a number of folks about this and three years seems to be relatively common to finish up the very last of the paper work. The amount of documentation the person left, the records, the size of the estate and family complications will make it longer or shorters depending, but 3 years seems to be not uncommon.

-

How do I fill out the New Zealand visa form?

Hi,Towards the front of your Immigration Form there is a check list. This check list explains the documents you will need to include with your form (i.e. passport documents, proof of funds, medical information etc). With any visa application it’s important to ensure that you attach all the required information or your application may be returned to you.The forms themselves will guide you through the process, but you must ensure you have the correct form for the visa you want to apply for. Given that some visa applications can carry hefty fees it may also be wise to check with an Immigration Adviser or Lawyer as to whether you qualify for that particular visa.The form itself will explain which parts you need to fill out and which parts you don’t. If you don’t understand the form you may wish to get a friend or a family member to explain it to you. There is a part at the back of the form for them to complete saying that they have assisted you in the completion of it.If all else fails you may need to seek advice from a Immigration Adviser or Lawyer. However, I always suggest calling around so you can ensure you get the best deal.

-

For the new 2016 W8-BEN-E form to be filled out by companies doing business as a seller on the Amazon USA website, do I fill out a U.S. TIN, a GIIN, or a foreign TIN?

You will need to obtain an EIN for the BC corporation; however, I would imagine a W8-BEN is not appropriate for you, if you are selling through Amazon FBA. The FBA program generally makes Amazon your agent in the US, which means any of your US source income, ie anything sold to a US customer is taxable in the US. W8-BEN is asserting that you either have no US sourced income or that income is exempt under the US/Canadian tax treaty. Based on the limited knowledge I have of your situation, but if you are selling through the FBA program, I would say you don’t qualify to file a W8-BEN, but rather should be completing a W8-ECI and your BC corporation should be filing an 1120F to report your US effectively connected income.

-

How do I fill out the SS-4 form for a new Delaware C-Corp to get an EIN?

You indicate this is a Delaware C Corp so check corporation and you will file Form 1120.Check that you are starting a new corporation.Date business started is the date you actually started the business. Typically you would look on the paperwork from Delaware and put the date of incorporation.December is the standard closing month for most corporations. Unless you have a signNow business reason to pick a different month use Dec.If you plan to pay yourself wages put one. If you don't know put zero.Unless you are fairly sure you will owe payroll taxes the first year check that you will not have payroll or check that your liability will be less than $1,000. Anything else and the IRS will expect you to file quarterly payroll tax returns.Indicate the type of SaaS services you will offer.

-

How should I fill this contract form "Signed this... day of..., 2016"?

I agree that you need to have the document translated to your native language or read to you by an interpreter.

Create this form in 5 minutes!

How to create an eSignature for the new jersey estate 2016 form

How to generate an eSignature for the New Jersey Estate 2016 Form in the online mode

How to make an eSignature for your New Jersey Estate 2016 Form in Google Chrome

How to create an electronic signature for signing the New Jersey Estate 2016 Form in Gmail

How to generate an electronic signature for the New Jersey Estate 2016 Form from your smart phone

How to make an eSignature for the New Jersey Estate 2016 Form on iOS devices

How to make an electronic signature for the New Jersey Estate 2016 Form on Android OS

People also ask

-

What is the New Jersey Estate Form and why do I need it?

The New Jersey Estate Form is a legal document required for managing the distribution of an estate in New Jersey. It helps to ensure that your assets are handled according to your wishes after your passing. Utilizing this form simplifies the probate process and can help prevent disputes among heirs.

-

How does airSlate SignNow simplify the New Jersey Estate Form process?

airSlate SignNow provides a user-friendly platform for creating, sending, and eSigning your New Jersey Estate Form. With its intuitive interface, you'll find it easy to fill out and manage documents securely. This streamlines the estate planning process, allowing you to focus on what matters most.

-

What features does airSlate SignNow offer for the New Jersey Estate Form?

With airSlate SignNow, you can benefit from features like customizable templates, real-time collaboration, and mobile accessibility for the New Jersey Estate Form. This means you can fill out and sign your forms from anywhere at any time, optimizing your workflow and ensuring quick document turnaround.

-

Is there a cost associated with using airSlate SignNow for the New Jersey Estate Form?

Yes, airSlate SignNow offers competitive pricing plans tailored to businesses and individuals needing the New Jersey Estate Form. There are various subscription options to choose from, ensuring that you find the right fit for your budget and needs while benefiting from our robust features.

-

Does airSlate SignNow integrate with other applications for managing the New Jersey Estate Form?

Absolutely! airSlate SignNow seamlessly integrates with various applications, including Google Drive, Salesforce, and Dropbox, making it easier to manage your New Jersey Estate Form across platforms. These integrations enhance productivity by centralizing your documents in one accessible location.

-

Can I track the progress of my New Jersey Estate Form with airSlate SignNow?

Yes, airSlate SignNow provides tracking capabilities for your New Jersey Estate Form. You'll receive notifications about each stage of the document, including when it is viewed and signed, ensuring you stay informed throughout the process and can manage your estate planning efficiently.

-

Is eSigning the New Jersey Estate Form legally binding?

Yes, eSigning the New Jersey Estate Form through airSlate SignNow is legally binding. Our platform complies with federal eSignature laws, ensuring that your online signatures are valid and enforceable in New Jersey, providing you peace of mind during the estate planning process.

Get more for New Jersey Estate Form

Find out other New Jersey Estate Form

- Can I Electronic signature Hawaii Real Estate PPT

- How Can I Electronic signature Illinois Real Estate Document

- How Do I Electronic signature Indiana Real Estate Presentation

- How Can I Electronic signature Ohio Plumbing PPT

- Can I Electronic signature Texas Plumbing Document

- How To Electronic signature Michigan Real Estate Form

- How To Electronic signature Arizona Police PDF

- Help Me With Electronic signature New Hampshire Real Estate PDF

- Can I Electronic signature New Hampshire Real Estate Form

- Can I Electronic signature New Mexico Real Estate Form

- How Can I Electronic signature Ohio Real Estate Document

- How To Electronic signature Hawaii Sports Presentation

- How To Electronic signature Massachusetts Police Form

- Can I Electronic signature South Carolina Real Estate Document

- Help Me With Electronic signature Montana Police Word

- How To Electronic signature Tennessee Real Estate Document

- How Do I Electronic signature Utah Real Estate Form

- How To Electronic signature Utah Real Estate PPT

- How Can I Electronic signature Virginia Real Estate PPT

- How Can I Electronic signature Massachusetts Sports Presentation