Nj Ifta Fuel Report Forms PDF 2018-2026

What is the nj ifta quarterly tax return?

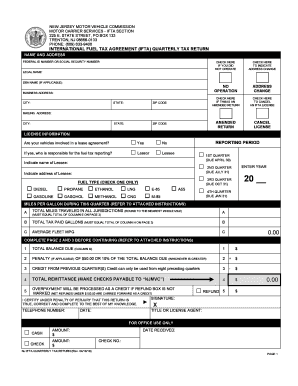

The nj ifta quarterly tax return is a tax form specifically designed for businesses operating in New Jersey that are registered under the International Fuel Tax Agreement (IFTA). This form allows carriers to report fuel use and calculate the tax owed to various jurisdictions based on their mileage and fuel consumption. The return consolidates information from all states and provinces where the carrier operates, making it easier to comply with tax obligations across multiple regions.

Steps to complete the nj ifta quarterly tax return

Completing the nj ifta quarterly tax return involves several key steps:

- Gather necessary documentation, including mileage logs and fuel purchase receipts.

- Calculate total miles driven and total fuel purchased in each jurisdiction.

- Determine tax rates for each jurisdiction based on the fuel type used.

- Fill out the nj ifta form accurately, ensuring all required fields are completed.

- Review the form for accuracy and completeness.

- Submit the form electronically or via mail by the specified deadline.

Filing deadlines for the nj ifta quarterly tax return

It is crucial to be aware of the filing deadlines for the nj ifta quarterly tax return. The returns are typically due on the last day of the month following the end of each quarter. This means:

- First quarter: Due April 30

- Second quarter: Due July 31

- Third quarter: Due October 31

- Fourth quarter: Due January 31 of the following year

Filing on time helps avoid penalties and ensures compliance with state regulations.

Required documents for the nj ifta quarterly tax return

To successfully complete the nj ifta quarterly tax return, certain documents are necessary:

- Mileage logs detailing miles driven in each jurisdiction.

- Fuel purchase receipts for all fuel bought during the reporting period.

- Previous IFTA returns for reference and accuracy.

- Any relevant correspondence with state tax authorities.

Having these documents organized will streamline the filing process and help ensure accuracy.

Form submission methods for the nj ifta quarterly tax return

The nj ifta quarterly tax return can be submitted through various methods:

- Online: Many businesses prefer to file electronically through authorized e-filing platforms, which can expedite processing.

- Mail: The completed form can be printed and sent via postal service to the appropriate tax authority.

- In-person: Some may choose to deliver their forms directly to local tax offices for immediate confirmation.

Each method has its advantages, and businesses should choose the one that best fits their needs.

Penalties for non-compliance with the nj ifta quarterly tax return

Failing to file the nj ifta quarterly tax return on time can lead to significant penalties. These may include:

- Late filing penalties, which can accumulate over time.

- Interest on unpaid taxes, increasing the total amount owed.

- Potential audits or increased scrutiny from tax authorities.

Understanding these penalties emphasizes the importance of timely and accurate filing to avoid unnecessary financial burdens.

Quick guide on how to complete nj ifta 2018 2019 form

Your assistance manual on how to prepare your Nj Ifta Fuel Report Forms Pdf

If you’re wondering how to complete and submit your Nj Ifta Fuel Report Forms Pdf, here are some brief instructions on how to simplify tax processing.

To begin, all you need to do is create your airSlate SignNow account to revolutionize how you manage documents online. airSlate SignNow is an exceptionally user-friendly and powerful document solution that allows you to edit, draft, and finalize your income tax documents with ease. With its editor, you can toggle between text, checkboxes, and eSignatures, and return to modify answers as necessary. Streamline your tax administration with advanced PDF editing, eSigning, and user-friendly sharing.

Follow the steps below to finalize your Nj Ifta Fuel Report Forms Pdf in just a few minutes:

- Create your account and begin working on PDFs within minutes.

- Utilize our catalogue to access any IRS tax form; browse through editions and schedules.

- Click Get form to load your Nj Ifta Fuel Report Forms Pdf in our editor.

- Fill in the necessary fillable fields with your details (text, numbers, checkmarks).

- Employ the Sign Tool to add your legally-binding eSignature (if needed).

- Review your document and correct any errors.

- Save changes, print your copy, send it to your recipient, and download it to your device.

Utilize this manual to file your taxes electronically with airSlate SignNow. Please remember that filing on paper can increase errors and delay refunds. Naturally, before e-filing your taxes, check the IRS website for submission regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct nj ifta 2018 2019 form

FAQs

-

How do I fill out the IT-2104 form if I live in NJ?

Do you work only in NY? Married? Kids? If your w-2 shows NY state withholding on your taxes, fill out a non-resident NY tax return which is fairly simple. If it doesn't, you don't fill out NY at all. If it shows out NYC withholding you enter that as well on the same forms.Then you would fill out your NJ returns as well with any withholding for NJ. Make sure to put any taxes paid to other states on your reciprocal states (nj paid, on NY return and vice versa)

-

Which ITR form should an NRI fill out for AY 2018–2019 to claim the TDS deducted by banks only?

ITR form required to be submitted depends upon nature of income. As a NRI shall generally have income from other sources like interest, rental income therefore s/he should file ITR 2.

-

Which ITR form should an NRI fill out for AY 2018–2019 for salary income?

File ITR 2 and for taking credit of foreign taxes fill form 67 before filling ITR.For specific clarifications / legal advice feel free to write to dsssvtax[at]gmail or call/WhatsApp: 9052535440.

-

Can I fill the form for the SSC CGL 2018 which will be held in June 2019 and when will the form for 2019 come out?

No, you can’t fill the form for SSC CGL 2018 as application process has been long over.SSC CGL 2019 : No concrete information at this time. Some update should come by August-September 2019.Like Exambay on facebook for all latest updates on SSC CGL 2018 , SSC CGL 2019 and other upcoming exams

-

How do I fill out the IIFT 2018 application form?

Hi!IIFT MBA (IB) Application Form 2018 – The last date to submit the Application Form of IIFT 2018 has been extended. As per the initial notice, the last date to submit the application form was September 08, 2017. However, now the candidates may submit it untill September 15, 2017. The exam date for IIFT 2018 has also been shifted to December 03, 2017. The candidates will only be issued the admit card, if they will submit IIFT application form and fee in the prescribed format. Before filling the IIFT application form, the candidates must check the eligibility criteria because ineligible candidates will not be granted admission. The application fee for candidates is Rs. 1550, however, the candidates belonging to SC/STPWD category only need to pay Rs. 775. Check procedure to submit IIFT Application Form 2018, fee details and more information from the article below.Latest – Last date to submit IIFT application form extended until September 15, 2017.IIFT 2018 Application FormThe application form of IIFT MBA 2018 has only be released online, on http://tedu.iift.ac.in. The candidates must submit it before the laps of the deadline, which can be checked from the table below.Application form released onJuly 25, 2017Last date to submit Application form(for national candidates)September 08, 2017 September 15, 2017Last date to submit the application form(by Foreign National and NRI)February 15, 2018IIFT MBA IB entrance exam will be held onNovember 26, 2017 December 03, 2017IIFT 2018 Application FeeThe candidates should take note of the application fee before submitting the application form. The fee amount is as given below and along with it, the medium to submit the fee are also mentioned.Fee amount for IIFT 2018 Application Form is as given below:General/OBC candidatesRs 1550SC/ST/PH candidatesRs 775Foreign National/NRI/Children of NRI candidatesUS$ 80 (INR Rs. 4500)The medium to submit the application fee of IIFT 2018 is as below:Credit CardsDebit Cards (VISA/Master)Demand Draft (DD)Candidates who will submit the application fee via Demand Draft will be required to submit a DD, in favour of Indian Institute of Foreign Trade, payable at New Delhi.Procedure to Submit IIFT MBA Application Form 2018Thank you & Have a nice day! :)

Create this form in 5 minutes!

How to create an eSignature for the nj ifta 2018 2019 form

How to create an eSignature for your Nj Ifta 2018 2019 Form online

How to generate an eSignature for the Nj Ifta 2018 2019 Form in Google Chrome

How to create an eSignature for signing the Nj Ifta 2018 2019 Form in Gmail

How to generate an eSignature for the Nj Ifta 2018 2019 Form right from your smart phone

How to make an electronic signature for the Nj Ifta 2018 2019 Form on iOS

How to generate an eSignature for the Nj Ifta 2018 2019 Form on Android OS

People also ask

-

What are NJ IFTA Fuel Report Forms PDF and why are they important?

NJ IFTA Fuel Report Forms PDF are essential documents used by businesses to report fuel use and taxes for vehicles traveling in and out of New Jersey. These forms help ensure compliance with state regulations and accurate tax reporting, making them crucial for fleet managers and transportation companies.

-

How can airSlate SignNow help me with NJ IFTA Fuel Report Forms PDF?

AirSlate SignNow simplifies the process of completing and signing NJ IFTA Fuel Report Forms PDF by providing a user-friendly platform for electronic signatures and document management. With our solution, you can easily fill out, eSign, and share these forms, ensuring timely submissions and compliance.

-

What pricing options are available for using airSlate SignNow for NJ IFTA Fuel Report Forms PDF?

AirSlate SignNow offers flexible pricing plans that cater to different business needs, allowing you to choose the best option for managing NJ IFTA Fuel Report Forms PDF. Our plans are designed to be cost-effective while providing comprehensive features for document management and eSigning.

-

Can I integrate airSlate SignNow with other software for NJ IFTA Fuel Report Forms PDF?

Yes, airSlate SignNow seamlessly integrates with various software applications, enabling you to manage NJ IFTA Fuel Report Forms PDF more efficiently. Whether you use accounting software or fleet management systems, our integrations enhance your workflow and streamline the document handling process.

-

What features does airSlate SignNow offer for NJ IFTA Fuel Report Forms PDF?

AirSlate SignNow includes a variety of features tailored for NJ IFTA Fuel Report Forms PDF, such as customizable templates, secure eSigning, and real-time tracking of document status. These features ensure that your forms are completed accurately and submitted on time.

-

Is airSlate SignNow secure for handling NJ IFTA Fuel Report Forms PDF?

Absolutely! AirSlate SignNow prioritizes security, implementing advanced encryption protocols to protect your NJ IFTA Fuel Report Forms PDF and sensitive information. Our platform is compliant with industry standards, ensuring your data remains safe and confidential.

-

How do I get started with airSlate SignNow for NJ IFTA Fuel Report Forms PDF?

Getting started with airSlate SignNow for NJ IFTA Fuel Report Forms PDF is easy. Simply sign up for an account, choose your pricing plan, and explore our intuitive interface to create, eSign, and manage your forms effectively.

Get more for Nj Ifta Fuel Report Forms Pdf

- Notice of change of directors bc form

- How much does cost seal court record rocky river form

- Employee enrollment form 16206598

- Family registration form first baptist church mansfield

- Supervisor hat writeup criminon western united states form

- Waste disposal certificate template 573266203 form

- Rhode island state income tax withholding form

- Film investor contract template form

Find out other Nj Ifta Fuel Report Forms Pdf

- eSignature Oklahoma Payroll Deduction Authorization Easy

- How To eSignature Texas Payroll Deduction Authorization

- Can I Electronic signature Connecticut Retainer for Attorney

- How Do I Electronic signature Idaho Assignment of License

- Electronic signature New Jersey Lease Renewal Free

- Electronic signature Texas Lease Renewal Fast

- How Can I Electronic signature Colorado Notice of Intent to Vacate

- eSignature Delaware Employee Compliance Survey Later

- eSignature Kansas Employee Compliance Survey Myself

- Can I Electronic signature Colorado Bill of Sale Immovable Property

- How Can I Electronic signature West Virginia Vacation Rental Short Term Lease Agreement

- How Do I Electronic signature New Hampshire Bill of Sale Immovable Property

- Electronic signature North Dakota Bill of Sale Immovable Property Myself

- Can I Electronic signature Oregon Bill of Sale Immovable Property

- How To Electronic signature West Virginia Bill of Sale Immovable Property

- Electronic signature Delaware Equipment Sales Agreement Fast

- Help Me With Electronic signature Louisiana Assignment of Mortgage

- Can I Electronic signature Minnesota Assignment of Mortgage

- Electronic signature West Virginia Sales Receipt Template Free

- Electronic signature Colorado Sales Invoice Template Computer