Rhode Island State Income Tax Withholding 2025-2026

Understanding Rhode Island State Income Tax Withholding

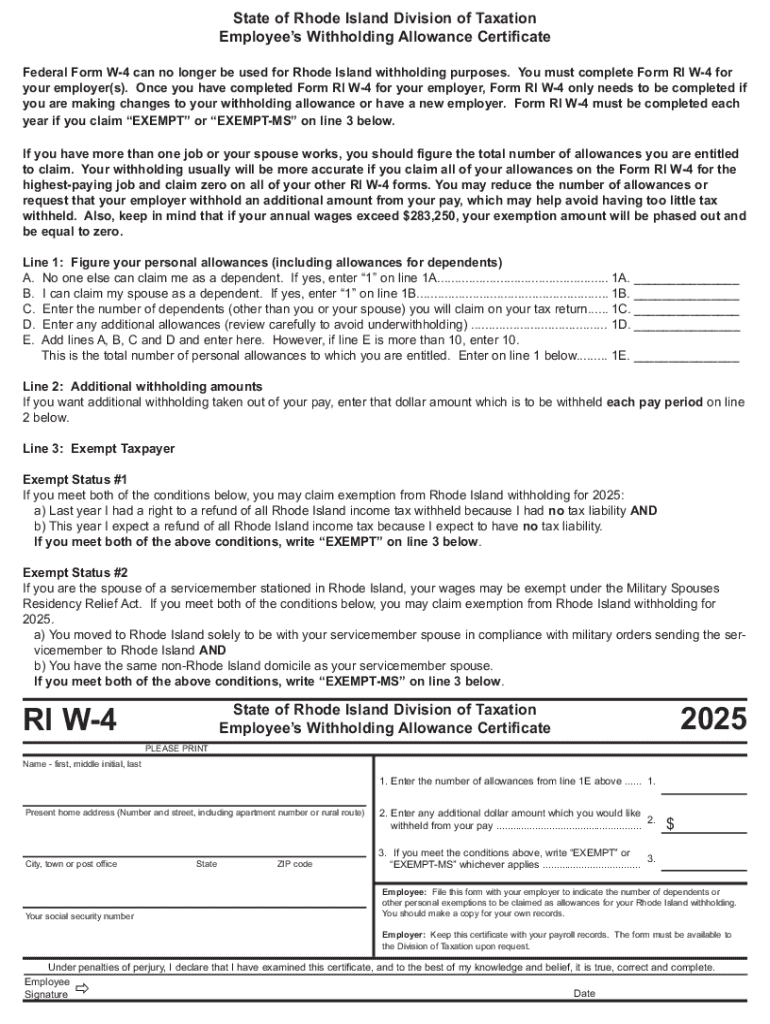

The Rhode Island State Income Tax Withholding is a system that requires employers to withhold a portion of employees' earnings to cover state income taxes. This withholding helps ensure that individuals meet their tax obligations throughout the year, rather than facing a large tax bill at the end of the tax season. The amount withheld is based on various factors, including the employee's income level, filing status, and the number of allowances claimed on the 2025 W-4 PDF.

Steps to Complete the Rhode Island State Income Tax Withholding

Completing the Rhode Island State Income Tax Withholding involves several key steps:

- Obtain the Form: Download the 2025 W-4 PDF from the official state website or request it from your employer.

- Fill Out Personal Information: Provide your name, address, and Social Security number accurately.

- Claim Allowances: Indicate the number of allowances you are claiming, which will affect the amount withheld.

- Sign and Date: Ensure you sign and date the form to validate it.

- Submit the Form: Return the completed form to your employer for processing.

Legal Use of the Rhode Island State Income Tax Withholding

The legal framework for the Rhode Island State Income Tax Withholding is established by state tax laws. Employers are required to comply with these laws to ensure proper withholding from employees' wages. Failure to withhold the correct amount can result in penalties for both the employer and the employee. It is essential for employers to stay updated on any changes to these laws to maintain compliance.

Key Elements of the Rhode Island State Income Tax Withholding

Several key elements define the Rhode Island State Income Tax Withholding process:

- Withholding Rates: The rates can vary based on income levels and filing status.

- Allowances: Employees can claim allowances to reduce their taxable income.

- Employer Responsibilities: Employers must accurately calculate and remit the withheld amounts to the state.

- Employee Rights: Employees have the right to review their withholding and make adjustments if necessary.

Filing Deadlines and Important Dates

Staying aware of filing deadlines is crucial for both employers and employees. The Rhode Island State Income Tax Withholding must be reported and remitted according to the state’s schedule. Typically, employers are required to submit withheld amounts on a monthly or quarterly basis, depending on the volume of withholding. Employees should also be mindful of the annual tax filing deadline, which usually falls on April fifteenth.

Form Submission Methods

Employers can submit the Rhode Island State Income Tax Withholding form through various methods:

- Online: Many employers choose to file electronically through the state’s tax portal.

- Mail: Completed forms can be mailed directly to the Rhode Island Division of Taxation.

- In-Person: Employers may also submit forms in person at designated tax offices.

Create this form in 5 minutes or less

Find and fill out the correct rhode island state income tax withholding

Create this form in 5 minutes!

How to create an eSignature for the rhode island state income tax withholding

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 2025 W 4 PDF and why is it important?

The 2025 W 4 PDF is the official form used by employees to indicate their tax withholding preferences to their employers. It is important because it helps ensure that the correct amount of federal income tax is withheld from your paycheck, which can affect your tax return and refund.

-

How can airSlate SignNow help with the 2025 W 4 PDF?

airSlate SignNow allows you to easily upload, fill out, and eSign the 2025 W 4 PDF. Our platform streamlines the process, making it simple to manage your tax documents securely and efficiently, ensuring compliance and accuracy.

-

Is there a cost associated with using airSlate SignNow for the 2025 W 4 PDF?

Yes, airSlate SignNow offers various pricing plans to suit different business needs. Our cost-effective solution provides access to features that simplify the management of documents like the 2025 W 4 PDF, ensuring you get great value for your investment.

-

What features does airSlate SignNow offer for managing the 2025 W 4 PDF?

airSlate SignNow offers features such as customizable templates, secure eSigning, and document tracking for the 2025 W 4 PDF. These tools enhance productivity and ensure that your documents are handled efficiently and securely.

-

Can I integrate airSlate SignNow with other software for the 2025 W 4 PDF?

Absolutely! airSlate SignNow integrates seamlessly with various software applications, allowing you to manage the 2025 W 4 PDF alongside your existing tools. This integration helps streamline your workflow and enhances overall efficiency.

-

How secure is my information when using the 2025 W 4 PDF with airSlate SignNow?

Security is a top priority at airSlate SignNow. When using the 2025 W 4 PDF, your information is protected with advanced encryption and secure storage, ensuring that your sensitive data remains confidential and safe from unauthorized access.

-

Can I access the 2025 W 4 PDF on mobile devices?

Yes, airSlate SignNow is fully optimized for mobile devices, allowing you to access and manage the 2025 W 4 PDF on the go. This flexibility ensures that you can complete your tax documents anytime, anywhere, without hassle.

Get more for Rhode Island State Income Tax Withholding

- Abc 208 b form

- Hbd 12 5427956 form

- Gep funding online application form

- Ab inbev vpo pillars form

- Purchaser declaration form

- Positive pregnancy test email form

- Affidavit for citation by posting form

- Aok plus erteilung sepa lastschriftmandat aok plus dokumente sicher und bequem direkt herunterladen haben sie fragen rufen sie form

Find out other Rhode Island State Income Tax Withholding

- eSignature North Carolina Non-Profit Credit Memo Secure

- eSignature North Dakota Non-Profit Quitclaim Deed Later

- eSignature Florida Orthodontists Business Plan Template Easy

- eSignature Georgia Orthodontists RFP Secure

- eSignature Ohio Non-Profit LLC Operating Agreement Later

- eSignature Ohio Non-Profit LLC Operating Agreement Easy

- How Can I eSignature Ohio Lawers Lease Termination Letter

- Can I eSignature Ohio Lawers Lease Termination Letter

- Can I eSignature Oregon Non-Profit Last Will And Testament

- Can I eSignature Oregon Orthodontists LLC Operating Agreement

- How To eSignature Rhode Island Orthodontists LLC Operating Agreement

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed

- eSignature California Plumbing Profit And Loss Statement Easy

- How To eSignature California Plumbing Business Letter Template

- eSignature Kansas Plumbing Lease Agreement Template Myself

- eSignature Louisiana Plumbing Rental Application Secure

- eSignature Maine Plumbing Business Plan Template Simple

- Can I eSignature Massachusetts Plumbing Business Plan Template