Untimely Deposit Form Niu

What is the Untimely Deposit Form Niu

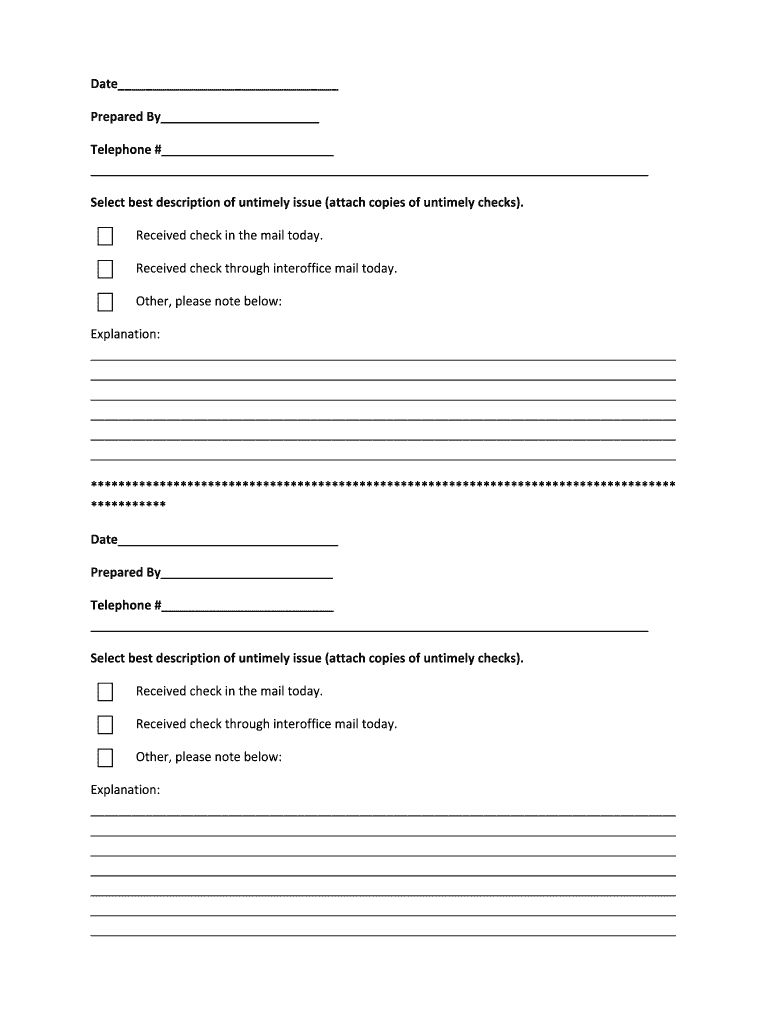

The Untimely Deposit Form Niu is a specific document used by businesses and individuals in the United States to report and rectify late deposits of certain taxes. This form is crucial for ensuring compliance with tax regulations and avoiding penalties associated with late payments. It serves as a formal request to the Internal Revenue Service (IRS) to acknowledge the late deposit and may provide a basis for penalty relief under certain circumstances.

How to use the Untimely Deposit Form Niu

Using the Untimely Deposit Form Niu involves several straightforward steps. First, gather all necessary information regarding the late deposit, including the amount, the tax period, and the reason for the delay. Next, accurately fill out the form, ensuring that all details are correct to avoid further complications. Once completed, submit the form to the IRS through the appropriate channels, which may include online submission, mailing, or in-person delivery, depending on the specific instructions provided by the IRS.

Steps to complete the Untimely Deposit Form Niu

Completing the Untimely Deposit Form Niu requires careful attention to detail. Follow these steps to ensure accuracy:

- Identify the specific tax type related to the untimely deposit.

- Gather supporting documentation that explains the circumstances of the late deposit.

- Fill out the form, providing all required information, including your business name, tax identification number, and details of the late deposit.

- Review the form for any errors or omissions before submission.

- Submit the form according to IRS guidelines, ensuring it is sent to the correct address or submitted online if applicable.

Legal use of the Untimely Deposit Form Niu

The legal use of the Untimely Deposit Form Niu is essential for compliance with federal tax laws. This form allows taxpayers to formally report late deposits and may serve as a basis for requesting abatement of penalties. It is important to understand that improper use of the form, such as submitting false information, can lead to severe penalties, including fines or legal action. Therefore, it is crucial to ensure that all information provided is accurate and truthful.

Filing Deadlines / Important Dates

Filing deadlines for the Untimely Deposit Form Niu are critical for compliance. Generally, the form should be submitted as soon as the taxpayer becomes aware of the late deposit. While there are no specific deadlines for filing the form itself, timely submission can influence the IRS's decision regarding penalty relief. It is advisable to consult IRS guidelines or a tax professional for specific dates related to your tax situation.

Penalties for Non-Compliance

Failing to submit the Untimely Deposit Form Niu or neglecting to make timely deposits can result in significant penalties. The IRS imposes penalties based on the amount of tax due and the length of time the payment is late. These penalties can accumulate quickly, making it essential for taxpayers to address any late deposits promptly. Understanding the potential financial implications of non-compliance can motivate timely action and adherence to tax obligations.

Quick guide on how to complete untimely deposit form niu

Complete [SKS] effortlessly on any gadget

Web-based document administration has become favored by both businesses and individuals. It offers a perfect environmentally friendly substitute for conventional printed and signed documents, as you can obtain the necessary form and securely keep it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents promptly without delays. Manage [SKS] on any device with airSlate SignNow Android or iOS applications and simplify any document-related task today.

How to modify and eSign [SKS] effortlessly

- Locate [SKS] and click Get Form to begin.

- Utilize the tools we offer to finish your form.

- Emphasize pertinent sections of the documents or obscure sensitive data with tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature using the Sign feature, which takes seconds and holds the same legal validity as a traditional wet ink signature.

- Verify all the details and click on the Done button to save your modifications.

- Select how you wish to send your form, by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or mislaid files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your requirements in document management within a few clicks from any device of your choice. Modify and eSign [SKS] and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Untimely Deposit Form Niu

Create this form in 5 minutes!

How to create an eSignature for the untimely deposit form niu

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Untimely Deposit Form Niu?

The Untimely Deposit Form Niu is a specialized document designed to streamline the process of reporting late deposits. This form ensures that all necessary information is captured accurately, making it easier for businesses to manage their financial obligations efficiently.

-

How can airSlate SignNow help with the Untimely Deposit Form Niu?

airSlate SignNow provides an intuitive platform for creating, sending, and eSigning the Untimely Deposit Form Niu. With its user-friendly interface, businesses can quickly fill out and submit the form, ensuring compliance and reducing the risk of errors.

-

Is there a cost associated with using the Untimely Deposit Form Niu on airSlate SignNow?

Yes, there is a pricing structure for using airSlate SignNow, which includes access to the Untimely Deposit Form Niu. The cost is competitive and offers various plans to suit different business needs, ensuring that you get the best value for your investment.

-

What features does airSlate SignNow offer for the Untimely Deposit Form Niu?

airSlate SignNow offers features such as customizable templates, secure eSigning, and real-time tracking for the Untimely Deposit Form Niu. These features enhance the efficiency of document management and ensure that all transactions are secure and compliant.

-

Can I integrate airSlate SignNow with other software for the Untimely Deposit Form Niu?

Absolutely! airSlate SignNow supports integrations with various software applications, allowing you to seamlessly manage the Untimely Deposit Form Niu alongside your existing tools. This integration capability enhances workflow efficiency and data accuracy.

-

What are the benefits of using the Untimely Deposit Form Niu with airSlate SignNow?

Using the Untimely Deposit Form Niu with airSlate SignNow offers numerous benefits, including faster processing times, reduced paperwork, and improved compliance. This solution empowers businesses to focus on their core operations while ensuring timely financial reporting.

-

How secure is the Untimely Deposit Form Niu when using airSlate SignNow?

Security is a top priority at airSlate SignNow. The Untimely Deposit Form Niu is protected with advanced encryption and secure access controls, ensuring that your sensitive information remains confidential and safe from unauthorized access.

Get more for Untimely Deposit Form Niu

Find out other Untimely Deposit Form Niu

- How Do I eSign New Mexico Healthcare / Medical Word

- How To eSign Washington High Tech Presentation

- Help Me With eSign Vermont Healthcare / Medical PPT

- How To eSign Arizona Lawers PDF

- How To eSign Utah Government Word

- How Can I eSign Connecticut Lawers Presentation

- Help Me With eSign Hawaii Lawers Word

- How Can I eSign Hawaii Lawers Document

- How To eSign Hawaii Lawers PPT

- Help Me With eSign Hawaii Insurance PPT

- Help Me With eSign Idaho Insurance Presentation

- Can I eSign Indiana Insurance Form

- How To eSign Maryland Insurance PPT

- Can I eSign Arkansas Life Sciences PDF

- How Can I eSign Arkansas Life Sciences PDF

- Can I eSign Connecticut Legal Form

- How Do I eSign Connecticut Legal Form

- How Do I eSign Hawaii Life Sciences Word

- Can I eSign Hawaii Life Sciences Word

- How Do I eSign Hawaii Life Sciences Document