Parent Spouse Non Filer Statement Pmc Form

What is the Parent Spouse Non Filer Statement Pmc

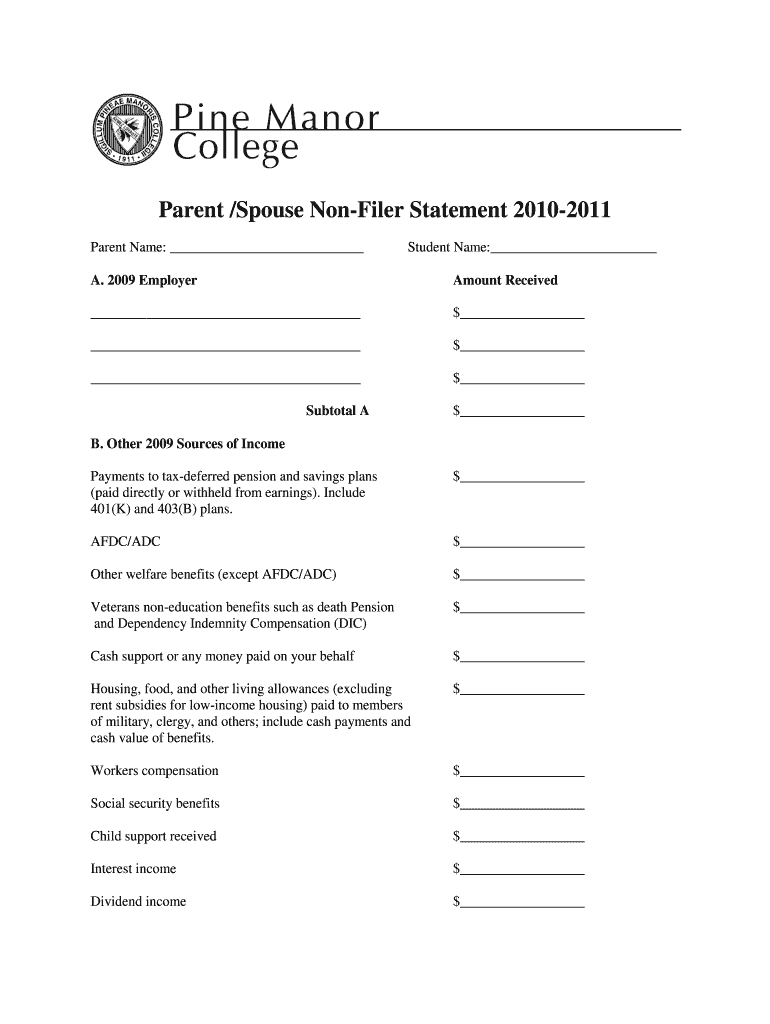

The Parent Spouse Non Filer Statement Pmc is a document used primarily in the context of financial aid applications. It is essential for students who are considered dependents but whose parents or spouses do not file a federal tax return. This statement provides necessary information regarding the income of the non-filing parent or spouse, allowing educational institutions to assess the financial situation accurately. By submitting this form, students can ensure that their financial aid applications reflect their true financial need, which can impact their eligibility for grants, loans, and other forms of assistance.

How to use the Parent Spouse Non Filer Statement Pmc

The Parent Spouse Non Filer Statement Pmc is used to report the income of a parent or spouse who has not filed a tax return. To utilize this statement effectively, students should first verify if their financial aid application requires it. If required, they can fill out the form with accurate income details, including wages, benefits, and any other sources of income. This information should be submitted alongside the financial aid application to ensure that the financial aid office has a complete picture of the household's financial status.

Steps to complete the Parent Spouse Non Filer Statement Pmc

Completing the Parent Spouse Non Filer Statement Pmc involves several straightforward steps:

- Gather necessary information about the non-filing parent or spouse, including income sources and amounts.

- Obtain the form from the relevant educational institution or financial aid office.

- Fill out the form accurately, ensuring all income details are correct and complete.

- Review the completed form for any errors or omissions.

- Submit the form along with the financial aid application by the specified deadline.

Key elements of the Parent Spouse Non Filer Statement Pmc

Several key elements are essential when completing the Parent Spouse Non Filer Statement Pmc:

- Identification Information: Include the student's name, identification number, and the relationship of the non-filer.

- Income Details: Provide a comprehensive overview of all income sources for the non-filer, including wages, benefits, and any other financial support.

- Certification: The non-filer must certify that the information provided is accurate and complete, often requiring a signature.

Legal use of the Parent Spouse Non Filer Statement Pmc

The Parent Spouse Non Filer Statement Pmc serves a legal purpose in the financial aid process. It is a formal declaration that provides educational institutions with the necessary information to assess a student's financial needs accurately. By using this statement, institutions can ensure compliance with federal regulations regarding financial aid eligibility. It is important for students to understand that providing false information on this form can lead to penalties, including the loss of financial aid.

Filing Deadlines / Important Dates

Filing deadlines for the Parent Spouse Non Filer Statement Pmc are typically aligned with the financial aid application deadlines set by educational institutions. Students should be aware of these dates to ensure timely submission. Missing a deadline can result in delays in financial aid processing or loss of eligibility. It is advisable to check with the specific institution for their deadlines and any additional requirements that may apply.

Quick guide on how to complete parent spouse non filer statement pmc

Complete [SKS] effortlessly on any device

Digital document administration has gained traction with businesses and individuals alike. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents, as you can easily locate the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, alter, and eSign your documents quickly and without delays. Manage [SKS] on any device using the airSlate SignNow applications for Android or iOS and streamline any document-based procedure today.

The simplest way to modify and eSign [SKS] with ease

- Find [SKS] and then click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Highlight important sections of the documents or censor sensitive information with tools specially provided by airSlate SignNow for this purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and then click the Done button to save your changes.

- Choose how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about missing or lost files, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you choose. Modify and eSign [SKS] and ensure effective communication throughout the form preparation process using airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Parent Spouse Non Filer Statement Pmc

Create this form in 5 minutes!

How to create an eSignature for the parent spouse non filer statement pmc

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Parent Spouse Non Filer Statement Pmc?

The Parent Spouse Non Filer Statement Pmc is a document used to verify that a parent or spouse did not file a tax return for a specific year. This statement is often required for financial aid applications and can help streamline the process of obtaining necessary funds for education.

-

How can airSlate SignNow help with the Parent Spouse Non Filer Statement Pmc?

airSlate SignNow provides an efficient platform to create, send, and eSign the Parent Spouse Non Filer Statement Pmc. With our user-friendly interface, you can easily manage your documents and ensure that all necessary signatures are collected promptly.

-

Is there a cost associated with using airSlate SignNow for the Parent Spouse Non Filer Statement Pmc?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. Our cost-effective solutions ensure that you can manage your Parent Spouse Non Filer Statement Pmc without breaking the bank, providing excellent value for your investment.

-

What features does airSlate SignNow offer for the Parent Spouse Non Filer Statement Pmc?

airSlate SignNow includes features such as customizable templates, secure eSigning, and document tracking for the Parent Spouse Non Filer Statement Pmc. These features enhance the efficiency of your document management process and ensure compliance with legal standards.

-

Can I integrate airSlate SignNow with other applications for the Parent Spouse Non Filer Statement Pmc?

Absolutely! airSlate SignNow offers seamless integrations with various applications, allowing you to streamline your workflow for the Parent Spouse Non Filer Statement Pmc. This means you can connect with tools you already use, enhancing productivity and collaboration.

-

What are the benefits of using airSlate SignNow for the Parent Spouse Non Filer Statement Pmc?

Using airSlate SignNow for the Parent Spouse Non Filer Statement Pmc provides numerous benefits, including faster processing times, reduced paperwork, and enhanced security. Our platform ensures that your documents are handled efficiently, allowing you to focus on what matters most.

-

Is airSlate SignNow secure for handling the Parent Spouse Non Filer Statement Pmc?

Yes, airSlate SignNow prioritizes security and compliance, ensuring that your Parent Spouse Non Filer Statement Pmc is protected. We utilize advanced encryption and secure storage solutions to safeguard your sensitive information throughout the signing process.

Get more for Parent Spouse Non Filer Statement Pmc

- Colorado limited liability company form

- Quitclaim deed from a trust to two individuals colorado form

- Quitclaim deed husband wife 497299804 form

- Time share 497299805 form

- Quitclaim deed from a limited liability company a individual colorado form

- Colorado limited company 497299807 form

- Colorado limited company 497299808 form

- Colorado renunciation and disclaimer of joint tenant or tenancy interest colorado form

Find out other Parent Spouse Non Filer Statement Pmc

- Electronic signature Pennsylvania Business Operations Promissory Note Template Later

- Help Me With Electronic signature North Dakota Charity Resignation Letter

- Electronic signature Indiana Construction Business Plan Template Simple

- Electronic signature Wisconsin Charity Lease Agreement Mobile

- Can I Electronic signature Wisconsin Charity Lease Agreement

- Electronic signature Utah Business Operations LLC Operating Agreement Later

- How To Electronic signature Michigan Construction Cease And Desist Letter

- Electronic signature Wisconsin Business Operations LLC Operating Agreement Myself

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template

- Electronic signature Doctors PDF Louisiana Now

- How To Electronic signature Massachusetts Doctors Quitclaim Deed

- Electronic signature Minnesota Doctors Last Will And Testament Later

- How To Electronic signature Michigan Doctors LLC Operating Agreement

- How Do I Electronic signature Oregon Construction Business Plan Template

- How Do I Electronic signature Oregon Construction Living Will

- How Can I Electronic signature Oregon Construction LLC Operating Agreement

- How To Electronic signature Oregon Construction Limited Power Of Attorney

- Electronic signature Montana Doctors Last Will And Testament Safe

- Electronic signature New York Doctors Permission Slip Free