Motor Vehicle Fuel Tax Claim for Refund by Federal Agency Motor Vehicle Fuel Tax Claim for Refund by Federal Agency Form

Understanding the Motor Vehicle Fuel Tax Claim for Refund

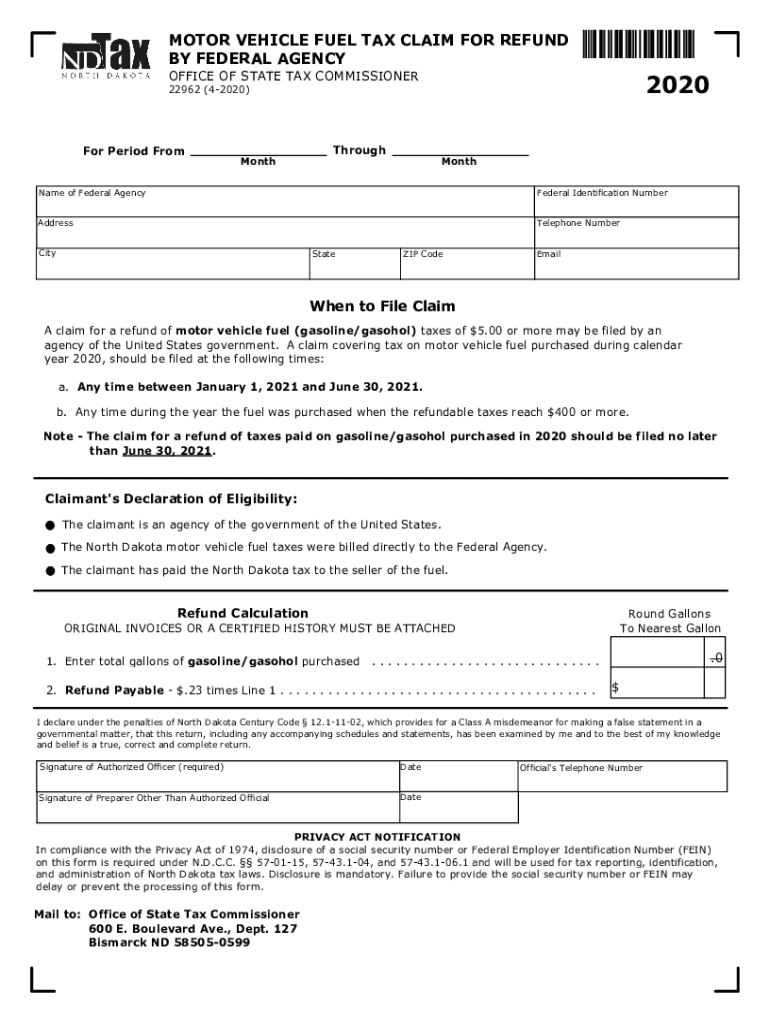

The Motor Vehicle Fuel Tax Claim for Refund is a process that allows taxpayers to recover fuel taxes paid on fuel used for certain exempt purposes. This claim is particularly relevant for individuals and businesses that use fuel for activities not subject to state fuel taxes, such as agricultural use or non-highway vehicles. Understanding the eligibility criteria and the specifics of the claim can help ensure that you receive the refunds you are entitled to.

Steps to Complete the Motor Vehicle Fuel Tax Claim for Refund

Completing the Motor Vehicle Fuel Tax Claim for Refund involves several key steps:

- Gather necessary documentation, including proof of fuel purchases and records of usage.

- Fill out the claim form accurately, ensuring all required fields are completed.

- Submit the form along with any supporting documents to the appropriate state agency.

- Keep copies of all submitted materials for your records.

Following these steps can streamline the process and increase the likelihood of a successful refund.

Eligibility Criteria for the Motor Vehicle Fuel Tax Claim for Refund

To qualify for a refund through the Motor Vehicle Fuel Tax Claim, you must meet specific eligibility criteria. Generally, eligible claimants include:

- Individuals or businesses using fuel for exempt purposes, such as farming or off-road use.

- Those who have paid fuel taxes on fuel that was not used for taxable activities.

- Taxpayers who maintain accurate records of fuel purchases and usage.

It is essential to review the specific requirements for your state, as these can vary.

Required Documents for Filing the Motor Vehicle Fuel Tax Claim for Refund

When filing the Motor Vehicle Fuel Tax Claim for Refund, certain documents are typically required to support your claim. These may include:

- Receipts or invoices for fuel purchases.

- Documentation of fuel usage, such as mileage logs or records of exempt activities.

- Completed claim forms, ensuring all information is accurate and up to date.

Having these documents ready will facilitate a smoother filing process.

Form Submission Methods for the Motor Vehicle Fuel Tax Claim for Refund

The Motor Vehicle Fuel Tax Claim for Refund can usually be submitted through various methods, including:

- Online submission through the state’s tax agency website.

- Mailing a hard copy of the completed form and supporting documents.

- In-person submission at designated state agency offices.

Choosing the appropriate submission method can depend on your preferences and the requirements of your state.

Common Scenarios for Filing the Motor Vehicle Fuel Tax Claim for Refund

Different taxpayer scenarios may influence how the Motor Vehicle Fuel Tax Claim for Refund is filed. Common situations include:

- Self-employed individuals using fuel for business purposes.

- Agricultural producers using fuel for farming activities.

- Businesses operating non-highway vehicles that require fuel.

Understanding these scenarios can help tailor your claim to fit your specific situation and maximize your chances of approval.

Quick guide on how to complete motor vehicle fuel tax claim for refund by federal agency motor vehicle fuel tax claim for refund by federal agency

Complete Motor Vehicle Fuel Tax Claim For Refund By Federal Agency Motor Vehicle Fuel Tax Claim For Refund By Federal Agency effortlessly on any gadget

Digital document management has become increasingly favored by businesses and individuals alike. It serves as an excellent environmentally-friendly alternative to traditional printed and signed paperwork, as you can easily locate the necessary form and securely store it online. airSlate SignNow provides all the tools you require to create, modify, and eSign your documents swiftly without delays. Handle Motor Vehicle Fuel Tax Claim For Refund By Federal Agency Motor Vehicle Fuel Tax Claim For Refund By Federal Agency on any gadget with airSlate SignNow apps for Android or iOS and enhance any document-related process today.

The simplest method to amend and eSign Motor Vehicle Fuel Tax Claim For Refund By Federal Agency Motor Vehicle Fuel Tax Claim For Refund By Federal Agency without hassle

- Locate Motor Vehicle Fuel Tax Claim For Refund By Federal Agency Motor Vehicle Fuel Tax Claim For Refund By Federal Agency and click Retrieve Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize relevant sections of the documents or redact sensitive data with tools provided by airSlate SignNow specifically for this task.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Finish button to save your edits.

- Select how you wish to send your form, via email, SMS, invitation link, or download it to your computer.

Forget about lost or misfiled documents, tedious form searching, or mistakes that require reprinting new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choosing. Amend and eSign Motor Vehicle Fuel Tax Claim For Refund By Federal Agency Motor Vehicle Fuel Tax Claim For Refund By Federal Agency and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the motor vehicle fuel tax claim for refund by federal agency motor vehicle fuel tax claim for refund by federal agency

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is gtrclaims sco ca gov and how does it relate to airSlate SignNow?

Gtrclaims sco ca gov is a platform that facilitates claims processing for various services. By integrating airSlate SignNow, users can easily eSign documents related to their claims, streamlining the process and ensuring compliance with state regulations.

-

How much does airSlate SignNow cost for users accessing gtrclaims sco ca gov?

AirSlate SignNow offers competitive pricing plans that cater to different business needs. Users accessing gtrclaims sco ca gov can choose from various subscription options, ensuring they find a cost-effective solution that fits their budget.

-

What features does airSlate SignNow provide for gtrclaims sco ca gov users?

AirSlate SignNow provides a range of features including document templates, real-time tracking, and secure eSigning. These features enhance the user experience for gtrclaims sco ca gov, making document management efficient and reliable.

-

How can airSlate SignNow benefit businesses using gtrclaims sco ca gov?

By using airSlate SignNow, businesses can signNowly reduce the time spent on paperwork associated with gtrclaims sco ca gov. The platform's automation capabilities allow for quicker processing and improved accuracy, ultimately enhancing productivity.

-

Is airSlate SignNow easy to integrate with gtrclaims sco ca gov?

Yes, airSlate SignNow is designed for seamless integration with various platforms, including gtrclaims sco ca gov. This ensures that users can easily incorporate eSigning into their existing workflows without any technical hurdles.

-

What security measures does airSlate SignNow implement for gtrclaims sco ca gov users?

AirSlate SignNow prioritizes security with features like encryption, secure cloud storage, and compliance with industry standards. Users of gtrclaims sco ca gov can trust that their sensitive documents are protected throughout the signing process.

-

Can I access airSlate SignNow on mobile devices for gtrclaims sco ca gov?

Absolutely! AirSlate SignNow is mobile-friendly, allowing users to access gtrclaims sco ca gov on their smartphones and tablets. This flexibility ensures that you can manage and eSign documents on the go, enhancing convenience.

Get more for Motor Vehicle Fuel Tax Claim For Refund By Federal Agency Motor Vehicle Fuel Tax Claim For Refund By Federal Agency

Find out other Motor Vehicle Fuel Tax Claim For Refund By Federal Agency Motor Vehicle Fuel Tax Claim For Refund By Federal Agency

- eSignature Kansas Legal Separation Agreement Online

- eSignature Georgia Lawers Cease And Desist Letter Now

- eSignature Maryland Legal Quitclaim Deed Free

- eSignature Maryland Legal Lease Agreement Template Simple

- eSignature North Carolina Legal Cease And Desist Letter Safe

- How Can I eSignature Ohio Legal Stock Certificate

- How To eSignature Pennsylvania Legal Cease And Desist Letter

- eSignature Oregon Legal Lease Agreement Template Later

- Can I eSignature Oregon Legal Limited Power Of Attorney

- eSignature South Dakota Legal Limited Power Of Attorney Now

- eSignature Texas Legal Affidavit Of Heirship Easy

- eSignature Utah Legal Promissory Note Template Free

- eSignature Louisiana Lawers Living Will Free

- eSignature Louisiana Lawers Last Will And Testament Now

- How To eSignature West Virginia Legal Quitclaim Deed

- eSignature West Virginia Legal Lease Agreement Template Online

- eSignature West Virginia Legal Medical History Online

- eSignature Maine Lawers Last Will And Testament Free

- eSignature Alabama Non-Profit Living Will Free

- eSignature Wyoming Legal Executive Summary Template Myself