Tax Credit Claimant Information 2023

Understanding Tax Credit Claimant Information

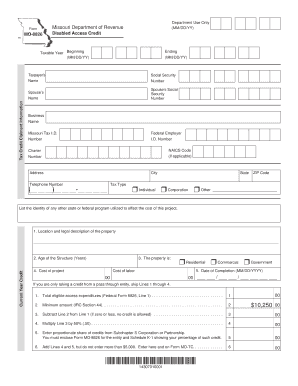

Tax Credit Claimant Information refers to the details required by the IRS to assess eligibility for various tax credits. This information typically includes personal identification details, income levels, and specific circumstances that may affect tax credit eligibility. Understanding this information is crucial for taxpayers to ensure they receive the appropriate credits and avoid potential issues with their tax filings.

Steps to Complete the Tax Credit Claimant Information

Completing the Tax Credit Claimant Information involves several key steps:

- Gather necessary personal documents, including Social Security numbers and income statements.

- Review the specific tax credits for which you may be eligible, such as the Earned Income Tax Credit or Child Tax Credit.

- Fill out the required forms accurately, ensuring all information is current and complete.

- Double-check your entries for any errors or omissions that could delay processing.

- Submit the completed form through the appropriate channels, whether online or via mail.

Required Documents for Tax Credit Claimant Information

To complete the Tax Credit Claimant Information accurately, you will need several documents:

- Social Security cards for all individuals listed on the form.

- Income documentation, such as W-2s or 1099s, to verify earnings.

- Proof of residency, which may include utility bills or lease agreements.

- Any relevant tax forms that pertain to the specific credits you are claiming.

Eligibility Criteria for Tax Credits

Eligibility for tax credits can vary based on several factors, including:

- Your filing status (single, married filing jointly, etc.).

- Your total income, which must fall within specific thresholds.

- The number of dependents you claim on your tax return.

- Specific circumstances, such as age or disability status, that may qualify you for additional credits.

IRS Guidelines for Tax Credit Claimant Information

The IRS provides comprehensive guidelines for completing the Tax Credit Claimant Information. These guidelines outline:

- How to determine eligibility for various tax credits.

- Instructions for filling out the forms accurately.

- Deadlines for submitting your claims to ensure timely processing.

- Resources available for assistance, including IRS publications and helplines.

Form Submission Methods

Tax Credit Claimant Information can be submitted through various methods:

- Online submission via the IRS e-file system, which is typically the fastest option.

- Mailing a paper form to the appropriate IRS address, which may take longer for processing.

- In-person submission at designated IRS offices, although this option may require an appointment.

Quick guide on how to complete tax credit claimant information

Complete Tax Credit Claimant Information effortlessly on any device

The management of documents online has become widely embraced by businesses and individuals alike. It offers an excellent eco-conscious substitute for traditional printed and signed documents, allowing you to locate the correct form and securely store it in the cloud. airSlate SignNow provides all the tools necessary to create, edit, and electronically sign your documents swiftly without any holdups. Manage Tax Credit Claimant Information on any device using the airSlate SignNow apps for Android or iOS and streamline any document-related procedure today.

The easiest way to modify and eSign Tax Credit Claimant Information with minimal effort

- Locate Tax Credit Claimant Information and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Mark important sections of the documents or conceal sensitive information using tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or mislaid files, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Edit and eSign Tax Credit Claimant Information to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct tax credit claimant information

Create this form in 5 minutes!

How to create an eSignature for the tax credit claimant information

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Tax Credit Claimant Information and why is it important?

Tax Credit Claimant Information refers to the details required to claim tax credits effectively. Understanding this information is crucial for businesses to maximize their tax benefits and ensure compliance with tax regulations. By utilizing airSlate SignNow, you can easily manage and eSign documents related to your tax credit claims.

-

How does airSlate SignNow help with Tax Credit Claimant Information?

airSlate SignNow streamlines the process of collecting and managing Tax Credit Claimant Information. Our platform allows you to send, receive, and eSign necessary documents securely and efficiently, ensuring that all information is accurate and readily accessible for tax filing purposes.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers flexible pricing plans to accommodate various business needs. Our plans are designed to provide cost-effective solutions for managing Tax Credit Claimant Information, with options for small businesses to larger enterprises. You can choose a plan that best fits your budget and requirements.

-

Can I integrate airSlate SignNow with other software for managing Tax Credit Claimant Information?

Yes, airSlate SignNow offers seamless integrations with various software applications. This allows you to enhance your workflow when managing Tax Credit Claimant Information, ensuring that all your documents and data are synchronized across platforms for better efficiency.

-

What features does airSlate SignNow offer for handling Tax Credit Claimant Information?

airSlate SignNow provides a range of features tailored for managing Tax Credit Claimant Information, including customizable templates, automated workflows, and secure eSigning capabilities. These features help simplify the documentation process, making it easier for businesses to handle their tax credit claims.

-

Is airSlate SignNow secure for handling sensitive Tax Credit Claimant Information?

Absolutely! airSlate SignNow prioritizes the security of your data, employing advanced encryption and compliance measures to protect sensitive Tax Credit Claimant Information. You can trust our platform to keep your documents safe while you manage your tax credit claims.

-

How can airSlate SignNow improve the efficiency of my tax credit claims process?

By using airSlate SignNow, you can signNowly enhance the efficiency of your tax credit claims process. Our platform automates document management and eSigning, reducing the time spent on paperwork and allowing you to focus on maximizing your tax benefits with accurate Tax Credit Claimant Information.

Get more for Tax Credit Claimant Information

- Alliant irb form

- School reference form

- Azmvd form

- State of connecticut wic programdepartment of public health certificationmedical referral form infants and children participant

- Vat515 form

- Scholastic record 452057276 form

- Stit kp gov pkcontactscience ampamp technology and information technology depratment

- Motor vehicle proposal form revised igi insurance

Find out other Tax Credit Claimant Information

- How To Sign Texas Doctors PDF

- Help Me With Sign Arizona Education PDF

- How To Sign Georgia Education Form

- How To Sign Iowa Education PDF

- Help Me With Sign Michigan Education Document

- How Can I Sign Michigan Education Document

- How Do I Sign South Carolina Education Form

- Can I Sign South Carolina Education Presentation

- How Do I Sign Texas Education Form

- How Do I Sign Utah Education Presentation

- How Can I Sign New York Finance & Tax Accounting Document

- How Can I Sign Ohio Finance & Tax Accounting Word

- Can I Sign Oklahoma Finance & Tax Accounting PPT

- How To Sign Ohio Government Form

- Help Me With Sign Washington Government Presentation

- How To Sign Maine Healthcare / Medical PPT

- How Do I Sign Nebraska Healthcare / Medical Word

- How Do I Sign Washington Healthcare / Medical Word

- How Can I Sign Indiana High Tech PDF

- How To Sign Oregon High Tech Document