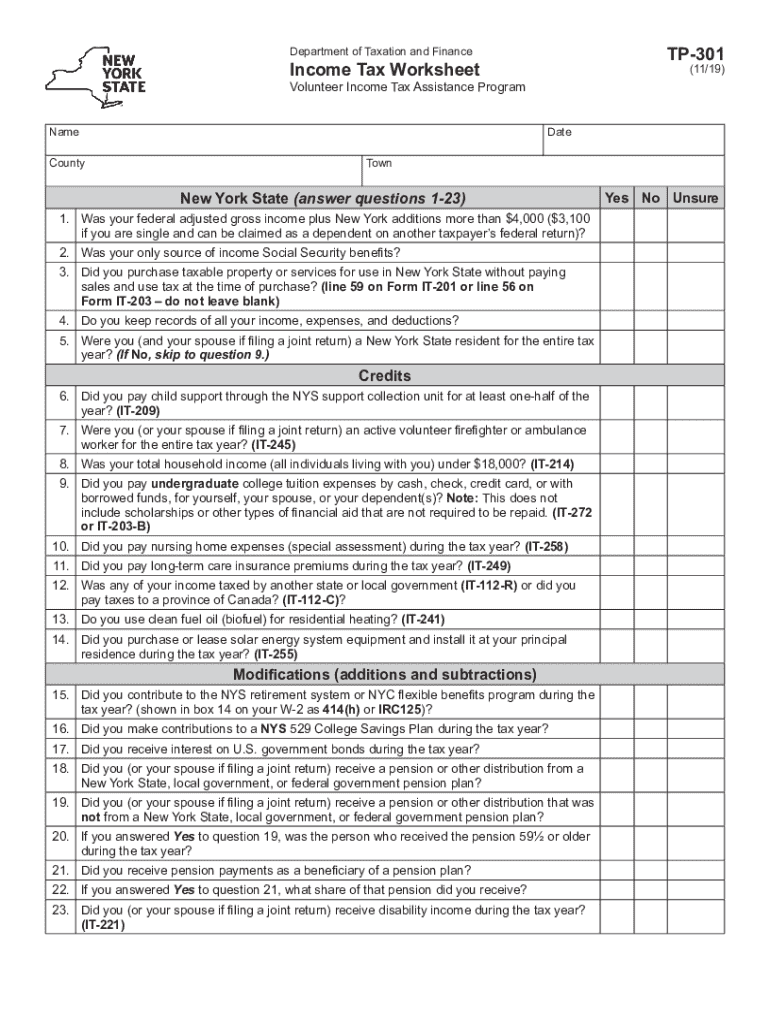

TP 301, Income Tax Worksheet 2019

What is the TP 301, Income Tax Worksheet

The TP 301, Income Tax Worksheet, is a crucial document used by taxpayers in the United States to calculate their income tax obligations. This worksheet helps individuals organize their financial information, ensuring they accurately report income, deductions, and credits. By providing a structured format, the TP 301 simplifies the tax preparation process, making it easier for taxpayers to understand their financial responsibilities.

How to use the TP 301, Income Tax Worksheet

Using the TP 301, Income Tax Worksheet involves several straightforward steps. First, gather all necessary financial documents, such as W-2 forms, 1099s, and receipts for deductible expenses. Next, fill out the worksheet by entering your income sources, applicable deductions, and credits. Be sure to follow the instructions carefully to ensure accuracy. Once completed, this worksheet can serve as a guide for filling out your tax return, helping you to minimize errors and maximize potential refunds.

Steps to complete the TP 301, Income Tax Worksheet

Completing the TP 301 requires a systematic approach to ensure all information is accurately reported. Follow these steps:

- Collect all relevant income documents, including forms from employers and any additional income sources.

- Identify eligible deductions and credits that apply to your financial situation.

- Begin filling out the worksheet by entering your total income at the designated section.

- Subtract any deductions to arrive at your taxable income.

- Calculate your tax liability using the appropriate tax rates.

- Review the worksheet for accuracy before using it to complete your tax return.

Key elements of the TP 301, Income Tax Worksheet

The TP 301 includes several key elements essential for accurate tax reporting. These elements typically consist of:

- Income Section: Where all sources of income are reported.

- Deductions: A section to list all eligible deductions that can reduce taxable income.

- Tax Credits: Information regarding any credits that may lower the overall tax liability.

- Final Calculations: A summary area for calculating total tax owed or refund expected.

IRS Guidelines

The Internal Revenue Service (IRS) provides specific guidelines for completing the TP 301, Income Tax Worksheet. These guidelines emphasize the importance of accuracy in reporting income and claiming deductions. Taxpayers should refer to the IRS instructions for the TP 301 to understand eligibility criteria for various deductions and credits, as well as any recent changes in tax laws that may affect their filings.

Filing Deadlines / Important Dates

It is essential to be aware of filing deadlines when using the TP 301, Income Tax Worksheet. Typically, individual tax returns are due on April fifteenth of each year. However, if this date falls on a weekend or holiday, the deadline may be extended. Taxpayers should also be mindful of any extensions they may file, which can provide additional time to complete their tax returns.

Form Submission Methods (Online / Mail / In-Person)

The TP 301 can be submitted through various methods, depending on the taxpayer's preference. Common submission methods include:

- Online Submission: Many taxpayers choose to file electronically using tax software, which often includes the TP 301.

- Mail: Taxpayers can print the completed worksheet and send it via postal mail to the appropriate IRS address.

- In-Person: Some individuals may prefer to file their taxes in person at local IRS offices or through certified tax preparers.

Quick guide on how to complete tp 301 income tax worksheet

Effortlessly prepare TP 301, Income Tax Worksheet on any device

Digital document management has gained traction among businesses and individuals. It serves as an ideal eco-conscious alternative to conventional printed and signed documents, as it allows you to obtain the necessary form and securely keep it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents promptly without interruptions. Manage TP 301, Income Tax Worksheet on any device using airSlate SignNow's Android or iOS applications and enhance any document-focused process today.

The simplest method to modify and electronically sign TP 301, Income Tax Worksheet with ease

- Locate TP 301, Income Tax Worksheet and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of your documents or redact sensitive information using tools specifically provided by airSlate SignNow for that purpose.

- Generate your signature with the Sign tool, which takes just seconds and holds the same legal validity as a conventional ink signature.

- Review all the details and click the Done button to save your changes.

- Choose your preferred method to send your form, whether via email, SMS, an invitation link, or download it to your computer.

Eliminate the worries of missing or lost documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow takes care of all your document management needs in just a few clicks from any device you prefer. Modify and electronically sign TP 301, Income Tax Worksheet to ensure excellent communication at every phase of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct tp 301 income tax worksheet

Create this form in 5 minutes!

How to create an eSignature for the tp 301 income tax worksheet

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the TP 301, Income Tax Worksheet?

The TP 301, Income Tax Worksheet is a crucial document used for calculating income tax obligations. It helps individuals and businesses accurately report their income and deductions, ensuring compliance with tax regulations. Utilizing the TP 301, Income Tax Worksheet can simplify the tax filing process and minimize errors.

-

How can airSlate SignNow assist with the TP 301, Income Tax Worksheet?

airSlate SignNow provides a seamless platform for electronically signing and sending the TP 301, Income Tax Worksheet. Our solution ensures that your documents are securely signed and stored, making it easy to manage your tax paperwork. With airSlate SignNow, you can streamline your tax preparation process.

-

What are the pricing options for using airSlate SignNow with the TP 301, Income Tax Worksheet?

airSlate SignNow offers flexible pricing plans that cater to various business needs, including those requiring the TP 301, Income Tax Worksheet. Our plans are designed to be cost-effective, ensuring you get the best value for your investment. You can choose from monthly or annual subscriptions based on your usage.

-

What features does airSlate SignNow offer for the TP 301, Income Tax Worksheet?

airSlate SignNow includes features such as customizable templates, secure eSigning, and document tracking specifically for the TP 301, Income Tax Worksheet. These features enhance efficiency and ensure that your tax documents are handled professionally. Additionally, our platform is user-friendly, making it accessible for everyone.

-

Can I integrate airSlate SignNow with other software for the TP 301, Income Tax Worksheet?

Yes, airSlate SignNow offers integrations with various software applications that can assist in managing the TP 301, Income Tax Worksheet. This allows you to connect your existing tools and streamline your workflow. Our integrations help you maintain a cohesive system for your tax documentation needs.

-

What are the benefits of using airSlate SignNow for the TP 301, Income Tax Worksheet?

Using airSlate SignNow for the TP 301, Income Tax Worksheet provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform allows for quick document turnaround, which is essential during tax season. Additionally, you can access your documents anytime, anywhere, ensuring convenience.

-

Is airSlate SignNow secure for handling the TP 301, Income Tax Worksheet?

Absolutely! airSlate SignNow prioritizes security, employing advanced encryption and compliance measures to protect your TP 301, Income Tax Worksheet. We ensure that your sensitive information remains confidential and secure throughout the signing process. Trust us to safeguard your important tax documents.

Get more for TP 301, Income Tax Worksheet

Find out other TP 301, Income Tax Worksheet

- eSignature Missouri Car Dealer Purchase Order Template Easy

- eSignature Indiana Charity Residential Lease Agreement Simple

- How Can I eSignature Maine Charity Quitclaim Deed

- How Do I eSignature Michigan Charity LLC Operating Agreement

- eSignature North Carolina Car Dealer NDA Now

- eSignature Missouri Charity Living Will Mobile

- eSignature New Jersey Business Operations Memorandum Of Understanding Computer

- eSignature North Dakota Car Dealer Lease Agreement Safe

- eSignature Oklahoma Car Dealer Warranty Deed Easy

- eSignature Oregon Car Dealer Rental Lease Agreement Safe

- eSignature South Carolina Charity Confidentiality Agreement Easy

- Can I eSignature Tennessee Car Dealer Limited Power Of Attorney

- eSignature Utah Car Dealer Cease And Desist Letter Secure

- eSignature Virginia Car Dealer Cease And Desist Letter Online

- eSignature Virginia Car Dealer Lease Termination Letter Easy

- eSignature Alabama Construction NDA Easy

- How To eSignature Wisconsin Car Dealer Quitclaim Deed

- eSignature California Construction Contract Secure

- eSignature Tennessee Business Operations Moving Checklist Easy

- eSignature Georgia Construction Residential Lease Agreement Easy