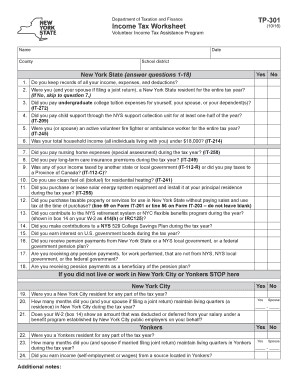

Form TP 301, Income Tax Worksheet 2016

What is the Form TP 301, Income Tax Worksheet

The Form TP 301, Income Tax Worksheet, is a crucial document used by taxpayers in the United States to calculate their income tax obligations. This form helps individuals and businesses assess their taxable income, deductions, and credits to determine the amount of tax owed or the potential refund. It is designed to streamline the tax preparation process, ensuring that all necessary calculations are clear and concise.

How to use the Form TP 301, Income Tax Worksheet

Using the Form TP 301 involves several straightforward steps. First, gather all relevant financial documents, including W-2s, 1099s, and any other income statements. Next, follow the instructions on the form to input your income details, deductions, and credits. It is essential to ensure accuracy in your entries to avoid errors that could lead to penalties. After completing the worksheet, review the calculations to confirm that they align with your financial records.

Steps to complete the Form TP 301, Income Tax Worksheet

Completing the Form TP 301 requires careful attention to detail. Begin by entering your personal information, such as your name and Social Security number. Then, list your total income from various sources, including wages and investment earnings. After that, calculate your allowable deductions, which may include student loan interest or mortgage interest. Finally, apply any tax credits you qualify for, and use the provided calculations to determine your total tax liability. Ensure that you double-check each section for accuracy before submission.

Filing Deadlines / Important Dates

Filing deadlines for the Form TP 301 are typically aligned with the annual tax filing schedule in the United States. Taxpayers are generally required to submit their completed forms by April 15 of each year. However, if this date falls on a weekend or holiday, the deadline may be extended to the next business day. It is crucial to stay informed about any changes in tax regulations that could affect these deadlines.

Required Documents

To accurately complete the Form TP 301, you will need several key documents. These include your W-2 forms from employers, 1099 forms for any freelance or contract work, records of any other income sources, and documentation for deductions, such as receipts for charitable contributions or medical expenses. Having these documents organized and readily available will facilitate a smoother completion process.

Penalties for Non-Compliance

Failing to comply with the requirements associated with the Form TP 301 can result in significant penalties. These may include fines for late filing, interest on unpaid taxes, and potential legal actions for fraudulent submissions. It is essential to ensure that the form is filled out accurately and submitted on time to avoid these consequences. Understanding your obligations can help you navigate the tax process more effectively.

Quick guide on how to complete form tp 301 income tax worksheet

Complete Form TP 301, Income Tax Worksheet effortlessly on any device

Digital document management has gained signNow traction among organizations and individuals. It serves as an ideal sustainable alternative to traditional printed and signed documents, allowing you to obtain the necessary form and securely archive it online. airSlate SignNow provides all the resources you require to create, modify, and electronically sign your documents promptly without any hold-ups. Manage Form TP 301, Income Tax Worksheet on any device with the airSlate SignNow Android or iOS applications and simplify any document-related task today.

The most efficient method to modify and electronically sign Form TP 301, Income Tax Worksheet effortlessly

- Locate Form TP 301, Income Tax Worksheet and click on Get Form to begin.

- Utilize the tools available to fill out your form.

- Emphasize important sections of the documents or conceal sensitive details using tools that airSlate SignNow specifically provides for that purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Verify the details and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Disregard concerns about lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your preference. Alter and electronically sign Form TP 301, Income Tax Worksheet while ensuring outstanding communication at any stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form tp 301 income tax worksheet

Create this form in 5 minutes!

How to create an eSignature for the form tp 301 income tax worksheet

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form TP 301, Income Tax Worksheet?

Form TP 301, Income Tax Worksheet, is a document used to calculate income tax obligations for individuals and businesses. It helps users organize their financial information and determine their tax liabilities accurately. Utilizing this form can streamline the tax filing process and ensure compliance with tax regulations.

-

How can airSlate SignNow help with Form TP 301, Income Tax Worksheet?

airSlate SignNow provides an efficient platform for electronically signing and sending Form TP 301, Income Tax Worksheet. With its user-friendly interface, you can easily manage your tax documents and ensure they are securely signed and stored. This simplifies the process of preparing and submitting your tax forms.

-

Is there a cost associated with using airSlate SignNow for Form TP 301, Income Tax Worksheet?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs. The cost depends on the features and number of users required. However, the investment in airSlate SignNow can save you time and reduce errors when handling Form TP 301, Income Tax Worksheet.

-

What features does airSlate SignNow offer for managing Form TP 301, Income Tax Worksheet?

airSlate SignNow includes features such as document templates, eSignature capabilities, and secure cloud storage. These tools make it easy to create, send, and manage Form TP 301, Income Tax Worksheet efficiently. Additionally, you can track the status of your documents in real-time.

-

Can I integrate airSlate SignNow with other software for Form TP 301, Income Tax Worksheet?

Yes, airSlate SignNow offers integrations with various software applications, enhancing your workflow for managing Form TP 301, Income Tax Worksheet. You can connect it with accounting software, CRM systems, and more to streamline your document management process. This ensures that all your tax-related documents are easily accessible.

-

What are the benefits of using airSlate SignNow for Form TP 301, Income Tax Worksheet?

Using airSlate SignNow for Form TP 301, Income Tax Worksheet provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. The platform allows for quick eSigning and document sharing, which can signNowly speed up the tax filing process. Additionally, it helps maintain compliance with legal standards.

-

Is airSlate SignNow secure for handling Form TP 301, Income Tax Worksheet?

Absolutely, airSlate SignNow prioritizes security and employs advanced encryption methods to protect your documents, including Form TP 301, Income Tax Worksheet. Your data is stored securely in the cloud, ensuring that only authorized users have access. This commitment to security helps safeguard sensitive tax information.

Get more for Form TP 301, Income Tax Worksheet

- College reading test form b answers 384002487

- Disney sports waiver and permission form robotevents com best eng auburn

- Gbi submission form

- Mcdonalds application paper form

- Taco bell letterhead form

- Dhs 3552 eng direct deposit for minnesota child care assistance form

- Printable iowa dov and groundwater form

- Form 199 exempt organization annual information return form 199 exempt organization annual information return

Find out other Form TP 301, Income Tax Worksheet

- eSign Legal Word West Virginia Online

- Can I eSign Wisconsin Legal Warranty Deed

- eSign New Hampshire Orthodontists Medical History Online

- eSign Massachusetts Plumbing Job Offer Mobile

- How To eSign Pennsylvania Orthodontists Letter Of Intent

- eSign Rhode Island Orthodontists Last Will And Testament Secure

- eSign Nevada Plumbing Business Letter Template Later

- eSign Nevada Plumbing Lease Agreement Form Myself

- eSign Plumbing PPT New Jersey Later

- eSign New York Plumbing Rental Lease Agreement Simple

- eSign North Dakota Plumbing Emergency Contact Form Mobile

- How To eSign North Dakota Plumbing Emergency Contact Form

- eSign Utah Orthodontists Credit Memo Easy

- How To eSign Oklahoma Plumbing Business Plan Template

- eSign Vermont Orthodontists Rental Application Now

- Help Me With eSign Oregon Plumbing Business Plan Template

- eSign Pennsylvania Plumbing RFP Easy

- Can I eSign Pennsylvania Plumbing RFP

- eSign Pennsylvania Plumbing Work Order Free

- Can I eSign Pennsylvania Plumbing Purchase Order Template