Income for STAR Purposes 2019-2026

Understanding Income For STAR Purposes

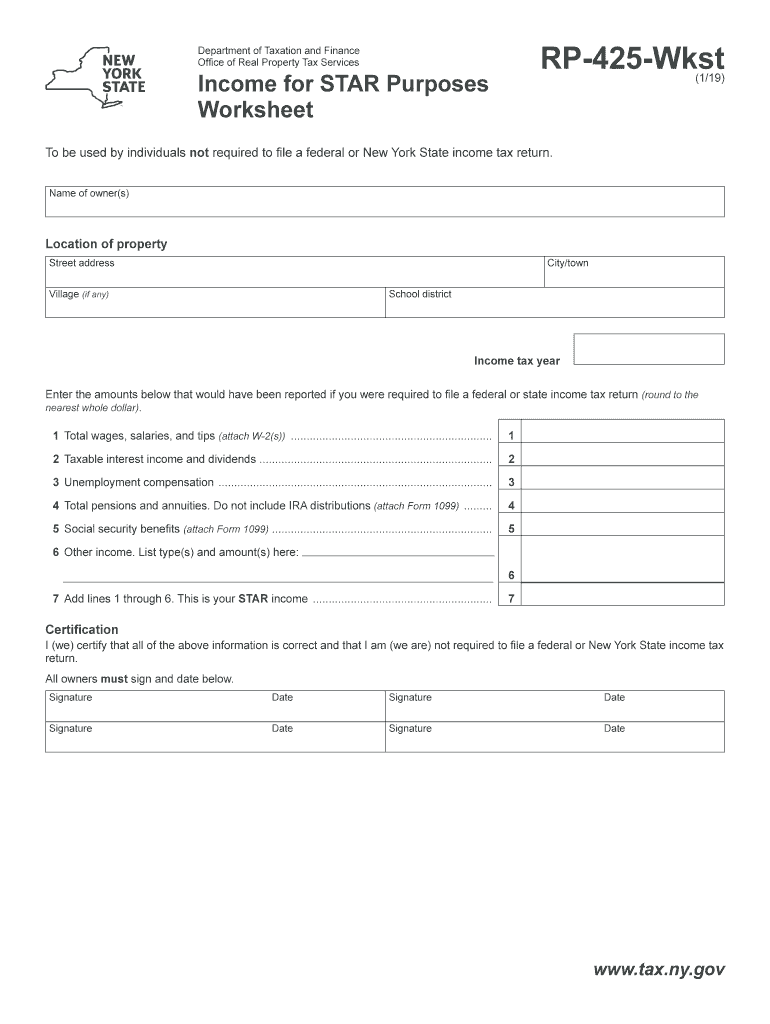

The Income For STAR Purposes is a critical component for determining eligibility for the School Tax Relief (STAR) program in the United States. This income calculation helps assess whether a homeowner qualifies for a reduction in school property taxes. It typically includes various sources of income, such as wages, pensions, and certain benefits, while excluding specific types of income like gifts or inheritances. Understanding what constitutes income for STAR purposes ensures that applicants can accurately evaluate their eligibility and benefits.

Steps to Complete the Income For STAR Purposes

Completing the Income For STAR Purposes involves several straightforward steps:

- Gather all necessary financial documents, including pay stubs, tax returns, and statements from social security or pension plans.

- Identify and list all sources of income, ensuring to include wages, interest, dividends, and any other taxable income.

- Exclude non-qualifying income such as gifts, inheritances, and certain government benefits.

- Calculate the total income by summing all qualifying sources and ensuring accuracy in reporting.

Legal Use of the Income For STAR Purposes

The legal framework surrounding the Income For STAR Purposes is designed to ensure that only eligible homeowners benefit from the STAR program. It is essential to provide accurate and truthful information when reporting income, as any discrepancies can lead to penalties or disqualification from the program. Homeowners must adhere to state regulations regarding income reporting to maintain compliance and avoid legal issues.

Required Documents for Income For STAR Purposes

To accurately report income for STAR purposes, homeowners must prepare several key documents:

- Recent pay stubs or wage statements to verify employment income.

- Federal and state tax returns, including all schedules, to provide a comprehensive view of income.

- Statements from pension plans or social security to document retirement income.

- Any additional documentation that supports claims of income or exclusions.

Eligibility Criteria for STAR Purposes

Eligibility for the STAR program is primarily based on income thresholds established by state law. Homeowners must meet specific criteria, including:

- Residency in the property for which the STAR benefit is claimed.

- Income must fall below the designated limit set by the state for the current tax year.

- Homeowners must be the primary occupants of the property and must not own other properties that could disqualify them.

Examples of Using the Income For STAR Purposes

Understanding how to apply the Income For STAR Purposes can be illustrated through various scenarios:

- A retired couple with a combined income from pensions and social security must report their total income while excluding any gifts received.

- A single homeowner working part-time must account for their wages and any interest earned from savings, ensuring to exclude non-taxable income.

- A family with multiple income sources, including wages and rental income, must accurately calculate their total income while adhering to the exclusions allowed under STAR guidelines.

Quick guide on how to complete income for star purposes

Effortlessly Prepare Income For STAR Purposes on Any Device

The management of online documents has become increasingly popular among businesses and individuals alike. It serves as an ideal environmentally-friendly alternative to traditional printed and signed paperwork, allowing you to locate the correct form and store it securely online. airSlate SignNow equips you with all the tools necessary to create, edit, and electronically sign your documents swiftly without delays. Manage Income For STAR Purposes on any device using the airSlate SignNow apps for Android or iOS and enhance any document-related process today.

The Easiest Way to Modify and Electronically Sign Income For STAR Purposes

- Locate Income For STAR Purposes and click Get Form to begin.

- Utilize the tools provided to fill out your form.

- Emphasize pertinent sections of the documents or obscure sensitive details with tools specifically designed for that purpose by airSlate SignNow.

- Generate your electronic signature with the Sign feature, which takes mere seconds and holds the same legal validity as a conventional handwritten signature.

- Review all the details and then click on the Done button to save your changes.

- Choose how you wish to send your form: via email, text message (SMS), an invite link, or download it to your computer.

Say goodbye to lost or misfiled documents, frustrating form searches, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your preference. Modify and electronically sign Income For STAR Purposes and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct income for star purposes

Create this form in 5 minutes!

How to create an eSignature for the income for star purposes

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the rp 425 wkst and how can it benefit my business?

The rp 425 wkst is a powerful tool designed to streamline document management and eSigning processes. By utilizing the rp 425 wkst, businesses can enhance efficiency, reduce turnaround times, and improve overall workflow. This solution is particularly beneficial for organizations looking to simplify their document handling.

-

How much does the rp 425 wkst cost?

Pricing for the rp 425 wkst varies based on the features and number of users required. airSlate SignNow offers flexible pricing plans to accommodate businesses of all sizes. You can choose a plan that best fits your budget and needs while enjoying the benefits of the rp 425 wkst.

-

What features are included with the rp 425 wkst?

The rp 425 wkst includes a variety of features such as customizable templates, secure eSigning, and real-time tracking of document status. Additionally, it offers integration capabilities with popular applications, making it a versatile choice for businesses. These features help ensure a seamless document workflow.

-

Can the rp 425 wkst integrate with other software?

Yes, the rp 425 wkst can easily integrate with various software applications, enhancing its functionality. This includes popular tools like CRM systems, cloud storage services, and productivity apps. Such integrations allow for a more cohesive workflow and improved productivity.

-

Is the rp 425 wkst user-friendly for non-technical users?

Absolutely! The rp 425 wkst is designed with user-friendliness in mind, making it accessible for non-technical users. Its intuitive interface allows anyone to navigate the platform easily, ensuring that all team members can utilize its features without extensive training.

-

What are the security measures in place for the rp 425 wkst?

The rp 425 wkst prioritizes security with advanced encryption and compliance with industry standards. This ensures that all documents are securely stored and transmitted, protecting sensitive information. Users can trust that their data is safe while using the rp 425 wkst.

-

How can the rp 425 wkst improve my document turnaround time?

By using the rp 425 wkst, businesses can signNowly reduce document turnaround times through automated workflows and instant eSigning capabilities. This means that documents can be sent, signed, and returned in a fraction of the time compared to traditional methods. Faster processing leads to improved efficiency and productivity.

Get more for Income For STAR Purposes

- Easement electric pole form

- Louisiana release form

- Louisiana estates form

- Louisiana unlawful form

- Louisiana tenant eviction law form

- Real estate home sales package with offer to purchase contract of sale disclosure statements and more for residential house 497309284 form

- Annual minutes louisiana louisiana form

- Notices resolutions simple stock ledger and certificate louisiana form

Find out other Income For STAR Purposes

- eSign California Finance & Tax Accounting IOU Free

- How To eSign North Dakota Education Rental Application

- How To eSign South Dakota Construction Promissory Note Template

- eSign Education Word Oregon Secure

- How Do I eSign Hawaii Finance & Tax Accounting NDA

- eSign Georgia Finance & Tax Accounting POA Fast

- eSign Georgia Finance & Tax Accounting POA Simple

- How To eSign Oregon Education LLC Operating Agreement

- eSign Illinois Finance & Tax Accounting Resignation Letter Now

- eSign Texas Construction POA Mobile

- eSign Kansas Finance & Tax Accounting Stock Certificate Now

- eSign Tennessee Education Warranty Deed Online

- eSign Tennessee Education Warranty Deed Now

- eSign Texas Education LLC Operating Agreement Fast

- eSign Utah Education Warranty Deed Online

- eSign Utah Education Warranty Deed Later

- eSign West Virginia Construction Lease Agreement Online

- How To eSign West Virginia Construction Job Offer

- eSign West Virginia Construction Letter Of Intent Online

- eSign West Virginia Construction Arbitration Agreement Myself