Form FT 10201118Exemption Certificate for Certain Taxes

What is the Form FT 10201118 Exemption Certificate For Certain Taxes

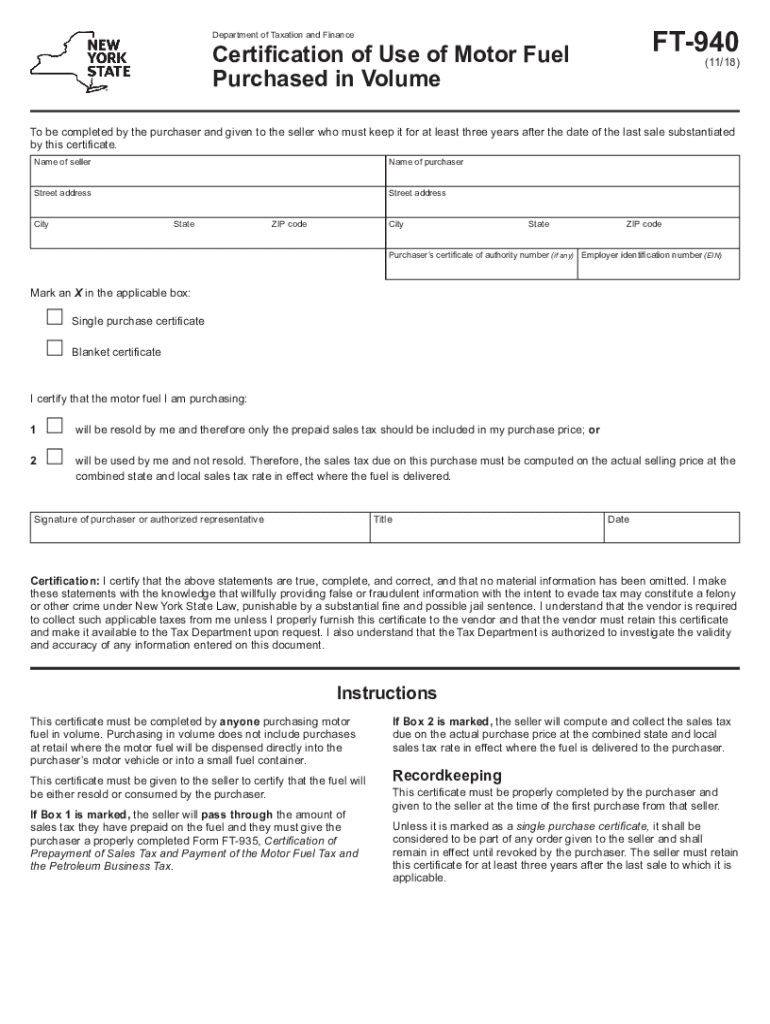

The Form FT 10201118 Exemption Certificate For Certain Taxes is a document used in the United States to claim exemption from certain taxes. This form is essential for individuals and businesses that qualify for tax exemptions under specific criteria set by state or federal tax authorities. By submitting this form, taxpayers can avoid unnecessary tax liabilities on purchases or transactions that are eligible for exemption.

How to use the Form FT 10201118 Exemption Certificate For Certain Taxes

To effectively use the Form FT 10201118, taxpayers must first determine their eligibility for the exemption. Once confirmed, the form should be filled out accurately, providing all required information. After completing the form, it can be presented to the seller or service provider to validate the exemption claim. It is crucial to retain a copy of the submitted form for personal records and future reference.

Steps to complete the Form FT 10201118 Exemption Certificate For Certain Taxes

Completing the Form FT 10201118 involves several key steps:

- Gather necessary information, including your name, address, and tax identification number.

- Identify the specific tax exemption you are claiming and ensure it aligns with the requirements.

- Fill out the form clearly and accurately, ensuring all sections are completed.

- Review the form for any errors or omissions before submission.

- Submit the completed form to the relevant party, such as a vendor or service provider.

Key elements of the Form FT 10201118 Exemption Certificate For Certain Taxes

The Form FT 10201118 includes several key elements that must be addressed:

- Taxpayer Information: This section requires the taxpayer's name, address, and identification number.

- Exemption Reason: Clearly state the reason for claiming the exemption, referencing applicable laws or regulations.

- Signature: The form must be signed by the taxpayer or an authorized representative to validate the claim.

- Date: Include the date of signing to establish the timeline of the exemption claim.

Eligibility Criteria

Eligibility for the Form FT 10201118 Exemption Certificate For Certain Taxes varies based on specific criteria established by tax authorities. Generally, individuals or businesses must demonstrate that their purchases or transactions fall under the categories eligible for exemption. Common criteria include the type of goods or services, the purpose of the purchase, and the status of the buyer (e.g., non-profit organizations, government entities).

Legal use of the Form FT 10201118 Exemption Certificate For Certain Taxes

The legal use of the Form FT 10201118 is governed by state and federal tax laws. Taxpayers must ensure they are compliant with all regulations when claiming an exemption. Misuse of the form, such as claiming exemptions without proper justification, can lead to penalties or legal repercussions. It is advisable to consult with a tax professional if there are any uncertainties regarding the legal implications of using this form.

Quick guide on how to complete form ft 10201118exemption certificate for certain taxes

Complete Form FT 10201118Exemption Certificate For Certain Taxes seamlessly on any device

Digital document management has gained traction among businesses and individuals. It serves as an excellent eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the necessary forms and securely store them online. airSlate SignNow equips you with all the resources you require to create, edit, and eSign your documents swiftly and without hassle. Manage Form FT 10201118Exemption Certificate For Certain Taxes on any platform using airSlate SignNow's Android or iOS applications and enhance any document-centric procedure today.

The simplest method to modify and eSign Form FT 10201118Exemption Certificate For Certain Taxes effortlessly

- Obtain Form FT 10201118Exemption Certificate For Certain Taxes and then click Get Form to begin.

- Use the tools we offer to complete your form.

- Emphasize important sections of the documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Verify the information and then click the Done button to save your modifications.

- Choose your preferred method to share your form, whether by email, text message (SMS), invite link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious document searches, or mistakes that require printing additional copies. airSlate SignNow meets your document management needs with just a few clicks from your chosen device. Edit and eSign Form FT 10201118Exemption Certificate For Certain Taxes while ensuring outstanding communication at any step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form ft 10201118exemption certificate for certain taxes

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form FT 10201118Exemption Certificate For Certain Taxes?

The Form FT 10201118Exemption Certificate For Certain Taxes is a document used to claim exemption from certain taxes. It is essential for businesses looking to reduce their tax liabilities legally. By utilizing this form, companies can ensure compliance while maximizing their financial efficiency.

-

How can airSlate SignNow help with the Form FT 10201118Exemption Certificate For Certain Taxes?

airSlate SignNow provides a streamlined platform for businesses to create, send, and eSign the Form FT 10201118Exemption Certificate For Certain Taxes. Our user-friendly interface simplifies the process, ensuring that your documents are completed accurately and efficiently. This helps you save time and reduce errors in your tax exemption claims.

-

Is there a cost associated with using airSlate SignNow for the Form FT 10201118Exemption Certificate For Certain Taxes?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs. Our plans are designed to be cost-effective, ensuring that you get the best value while managing documents like the Form FT 10201118Exemption Certificate For Certain Taxes. You can choose a plan that fits your budget and requirements.

-

What features does airSlate SignNow offer for managing the Form FT 10201118Exemption Certificate For Certain Taxes?

airSlate SignNow includes features such as customizable templates, secure eSigning, and real-time tracking for the Form FT 10201118Exemption Certificate For Certain Taxes. These features enhance the document management process, making it easier for businesses to handle their tax exemption paperwork efficiently. Additionally, our platform ensures that all documents are stored securely.

-

Can I integrate airSlate SignNow with other software for the Form FT 10201118Exemption Certificate For Certain Taxes?

Absolutely! airSlate SignNow offers integrations with various software applications, allowing you to streamline your workflow when handling the Form FT 10201118Exemption Certificate For Certain Taxes. This means you can connect with your existing tools, enhancing productivity and ensuring a seamless experience across platforms.

-

What are the benefits of using airSlate SignNow for the Form FT 10201118Exemption Certificate For Certain Taxes?

Using airSlate SignNow for the Form FT 10201118Exemption Certificate For Certain Taxes provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced compliance. Our platform simplifies the eSigning process, allowing you to focus on your core business activities while ensuring that your tax exemption claims are handled correctly.

-

How secure is airSlate SignNow when handling the Form FT 10201118Exemption Certificate For Certain Taxes?

Security is a top priority at airSlate SignNow. We implement advanced encryption and security protocols to protect your documents, including the Form FT 10201118Exemption Certificate For Certain Taxes. You can trust that your sensitive information is safe and secure while using our platform.

Get more for Form FT 10201118Exemption Certificate For Certain Taxes

- Warranty deed for parents to child with reservation of life estate montana form

- Warranty deed for separate or joint property to joint tenancy montana form

- Warranty deed to separate property of one spouse to both spouses as joint tenants montana form

- Fiduciary deed for use by executors trustees trustors administrators and other fiduciaries montana form

- Warranty deed from limited partnership or llc is the grantor or grantee montana form

- Exhibit sheet montana form

- Montana workers compensation form

- Notice supreme court form

Find out other Form FT 10201118Exemption Certificate For Certain Taxes

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word

- Can I eSignature Tennessee Police Form

- How Can I eSignature Vermont Police Presentation

- How Do I eSignature Pennsylvania Real Estate Document

- How Do I eSignature Texas Real Estate Document

- How Can I eSignature Colorado Courts PDF

- Can I eSignature Louisiana Courts Document

- How To Electronic signature Arkansas Banking Document

- How Do I Electronic signature California Banking Form

- How Do I eSignature Michigan Courts Document

- Can I eSignature Missouri Courts Document

- How Can I Electronic signature Delaware Banking PDF

- Can I Electronic signature Hawaii Banking Document

- Can I eSignature North Carolina Courts Presentation

- Can I eSignature Oklahoma Courts Word

- How To Electronic signature Alabama Business Operations Form

- Help Me With Electronic signature Alabama Car Dealer Presentation

- How Can I Electronic signature California Car Dealer PDF

- How Can I Electronic signature California Car Dealer Document