Form DTF 17 ATT Schedule of Business Locations for a Consolidated Filer Revised 124 2024-2026

Understanding the DTF 17 ATT Form

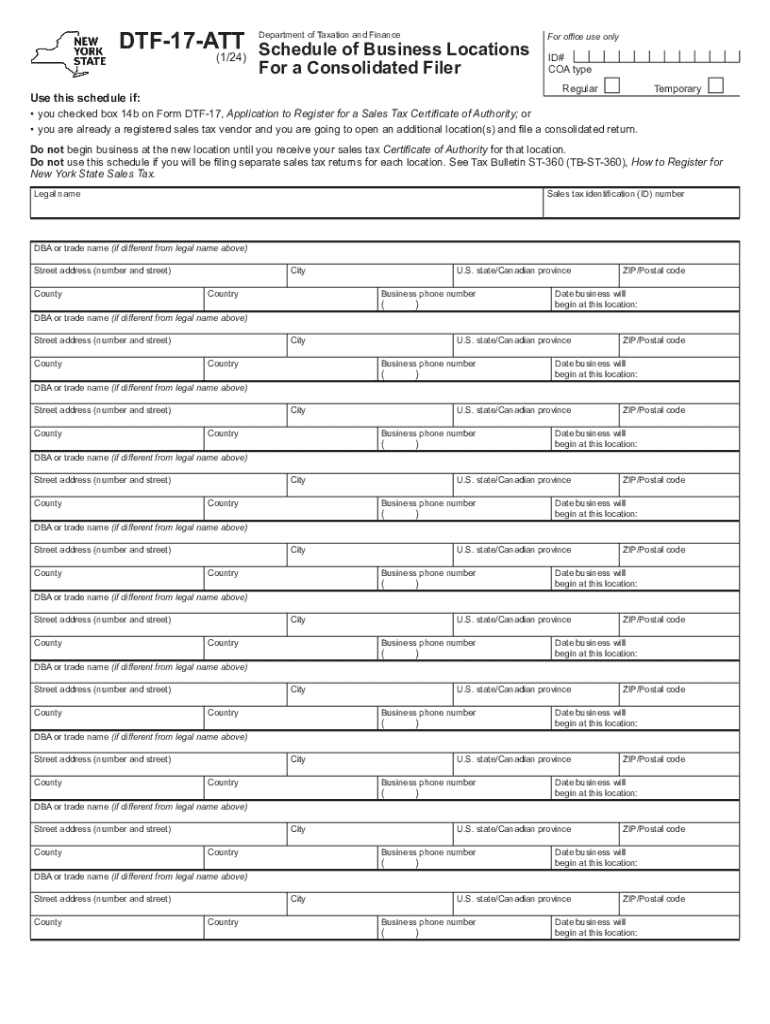

The DTF 17 ATT form, officially known as the Schedule of Business Locations for a Consolidated Filer, is a crucial document for businesses operating in New York. This form is specifically designed for consolidated filers, allowing them to report their business locations across the state. It ensures that all pertinent information regarding business operations is accurately captured for tax purposes. This form is essential for compliance with New York tax regulations, enabling the state to assess tax obligations based on the locations of the business activities.

Steps to Complete the DTF 17 ATT Form

Completing the DTF 17 ATT form involves several key steps to ensure accuracy and compliance. First, gather all necessary business information, including your business name, address, and tax identification number. Next, list all business locations in New York where operations are conducted. For each location, provide details such as the type of business activity and the duration of operations at that site. It is important to review the completed form for any errors before submission, as inaccuracies can lead to complications with tax reporting.

Legal Use of the DTF 17 ATT Form

The DTF 17 ATT form serves a legal purpose in New York's tax framework. It is used to report the locations of businesses that are part of a consolidated filing group. By accurately completing this form, businesses fulfill their legal obligations under New York tax laws. This compliance helps avoid potential penalties or audits from the tax authorities. Understanding the legal significance of the DTF 17 ATT form is essential for maintaining good standing with state tax regulations.

How to Obtain the DTF 17 ATT Form

The DTF 17 ATT form can be obtained through the New York State Department of Taxation and Finance website. It is typically available for download in PDF format, allowing businesses to print and complete the form manually. Additionally, businesses may contact the department directly for assistance or to request a physical copy of the form if needed. Ensuring you have the most current version of the form is important for compliance.

Key Elements of the DTF 17 ATT Form

Several key elements must be included when completing the DTF 17 ATT form. These include the business's name and address, the tax identification number, and a detailed list of all business locations. For each location, it is necessary to specify the type of business activity conducted and the operational timeline. Providing accurate information in these sections is vital for ensuring that the form meets state requirements and reflects the business's activities correctly.

Filing Deadlines for the DTF 17 ATT Form

Filing deadlines for the DTF 17 ATT form align with the overall tax filing deadlines set by the New York State Department of Taxation and Finance. It is important for businesses to be aware of these deadlines to avoid penalties for late submissions. Typically, the form must be filed along with the business's tax returns, so planning ahead and preparing the form in advance can help ensure timely compliance.

Quick guide on how to complete form dtf 17 att schedule of business locations for a consolidated filer revised 124

Prepare Form DTF 17 ATT Schedule Of Business Locations For A Consolidated Filer Revised 124 effortlessly on any device

Managing documents online has become increasingly popular among companies and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to find the correct form and securely save it online. airSlate SignNow equips you with all the tools you need to create, modify, and eSign your documents swiftly without delays. Handle Form DTF 17 ATT Schedule Of Business Locations For A Consolidated Filer Revised 124 on any platform with airSlate SignNow's Android or iOS applications and streamline any document-related task today.

How to modify and eSign Form DTF 17 ATT Schedule Of Business Locations For A Consolidated Filer Revised 124 effortlessly

- Find Form DTF 17 ATT Schedule Of Business Locations For A Consolidated Filer Revised 124 and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight important sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal authenticity as a traditional wet ink signature.

- Review all the information and then click on the Done button to save your changes.

- Choose how you want to send your form, via email, SMS, invitation link, or download it to your PC.

Eliminate concerns over lost or misplaced files, tedious document searches, or errors that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and eSign Form DTF 17 ATT Schedule Of Business Locations For A Consolidated Filer Revised 124 and maintain excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form dtf 17 att schedule of business locations for a consolidated filer revised 124

Create this form in 5 minutes!

How to create an eSignature for the form dtf 17 att schedule of business locations for a consolidated filer revised 124

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the dtf 17 att form?

The dtf 17 att form is a specific document used for tax purposes in New York State. It allows taxpayers to claim certain credits and deductions. Understanding how to properly fill out the dtf 17 att form can help ensure compliance and maximize your tax benefits.

-

How can airSlate SignNow help with the dtf 17 att form?

airSlate SignNow simplifies the process of completing and eSigning the dtf 17 att form. With our user-friendly interface, you can easily fill out the form, add your signature, and send it securely. This streamlines your tax filing process and saves you valuable time.

-

Is there a cost associated with using airSlate SignNow for the dtf 17 att form?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs. Our plans are designed to be cost-effective, ensuring that you can efficiently manage documents like the dtf 17 att form without breaking the bank. Check our website for detailed pricing information.

-

What features does airSlate SignNow offer for the dtf 17 att form?

airSlate SignNow provides features such as customizable templates, secure eSigning, and document tracking for the dtf 17 att form. These features enhance your document management experience, making it easier to handle tax forms and other important paperwork.

-

Can I integrate airSlate SignNow with other applications for the dtf 17 att form?

Absolutely! airSlate SignNow offers integrations with various applications, allowing you to streamline your workflow when handling the dtf 17 att form. Whether you use CRM systems or cloud storage solutions, our integrations help you manage documents more efficiently.

-

What are the benefits of using airSlate SignNow for the dtf 17 att form?

Using airSlate SignNow for the dtf 17 att form provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform ensures that your documents are handled securely while allowing for quick access and easy collaboration.

-

Is airSlate SignNow user-friendly for completing the dtf 17 att form?

Yes, airSlate SignNow is designed with user-friendliness in mind. Completing the dtf 17 att form is straightforward, even for those who may not be tech-savvy. Our intuitive interface guides you through the process, making it accessible for everyone.

Get more for Form DTF 17 ATT Schedule Of Business Locations For A Consolidated Filer Revised 124

- President of universal guardian acceptance form

- Agwm giving form

- Agreement to transfer liquor licences to new owner pssg gov bc form

- Bpss complaint form

- T 72 rhode island division of taxation tax state ri form

- Form d 7175 louisiana public service commission lpsc louisiana

- Vehicle sale with seller financ contract template form

- Vehicle sale contract template form

Find out other Form DTF 17 ATT Schedule Of Business Locations For A Consolidated Filer Revised 124

- Electronic signature Oklahoma Business Operations Stock Certificate Mobile

- Electronic signature Pennsylvania Business Operations Promissory Note Template Later

- Help Me With Electronic signature North Dakota Charity Resignation Letter

- Electronic signature Indiana Construction Business Plan Template Simple

- Electronic signature Wisconsin Charity Lease Agreement Mobile

- Can I Electronic signature Wisconsin Charity Lease Agreement

- Electronic signature Utah Business Operations LLC Operating Agreement Later

- How To Electronic signature Michigan Construction Cease And Desist Letter

- Electronic signature Wisconsin Business Operations LLC Operating Agreement Myself

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template

- Electronic signature Doctors PDF Louisiana Now

- How To Electronic signature Massachusetts Doctors Quitclaim Deed

- Electronic signature Minnesota Doctors Last Will And Testament Later

- How To Electronic signature Michigan Doctors LLC Operating Agreement

- How Do I Electronic signature Oregon Construction Business Plan Template

- How Do I Electronic signature Oregon Construction Living Will

- How Can I Electronic signature Oregon Construction LLC Operating Agreement

- How To Electronic signature Oregon Construction Limited Power Of Attorney

- Electronic signature Montana Doctors Last Will And Testament Safe