Florida Annual Resale Certificate for Sales T 2024

What is the Florida Annual Resale Certificate For Sales Tax

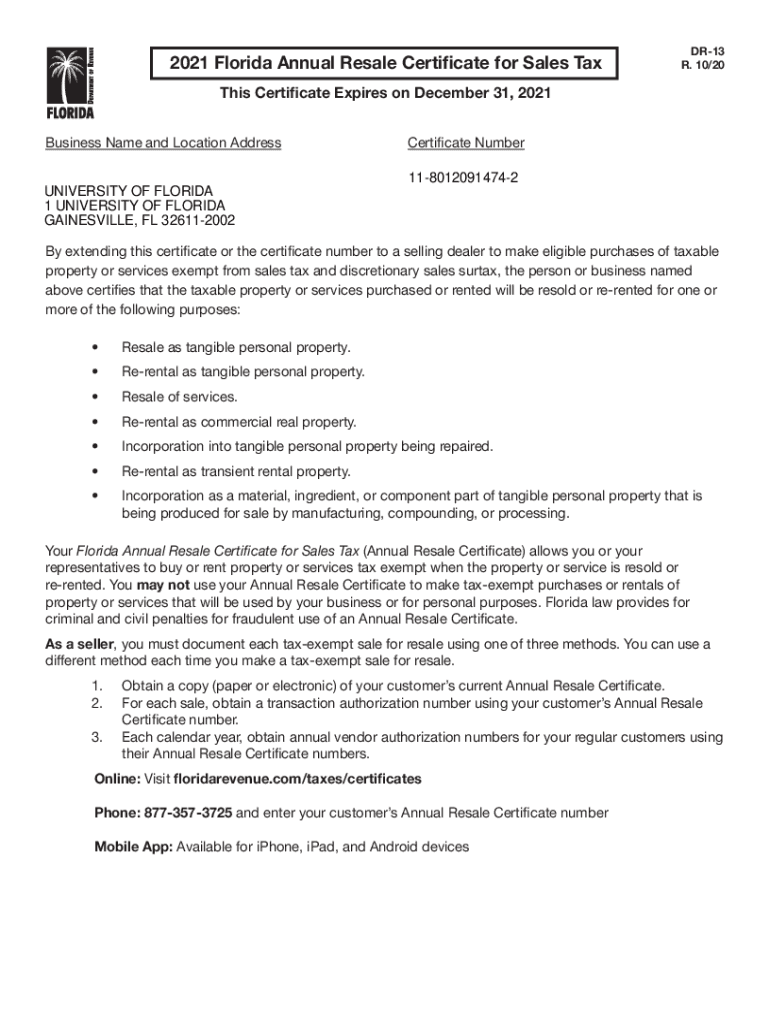

The Florida Annual Resale Certificate for Sales Tax is a document that allows businesses to purchase goods tax-free if they intend to resell those goods. This certificate is particularly beneficial for retailers and wholesalers who need to manage their tax liabilities efficiently. By presenting this certificate to suppliers, businesses can avoid paying sales tax on items that will be resold, thereby streamlining their purchasing process and improving cash flow.

How to use the Florida Annual Resale Certificate For Sales Tax

To utilize the Florida Annual Resale Certificate for Sales Tax, a business must present the certificate to vendors when making purchases of items intended for resale. The vendor will keep a copy of the certificate for their records. This process ensures that the vendor does not charge sales tax on the transaction. It is essential for businesses to ensure that the certificate is valid and up to date, as using an expired certificate may result in tax liabilities.

How to obtain the Florida Annual Resale Certificate For Sales Tax

Obtaining the Florida Annual Resale Certificate for Sales Tax is a straightforward process. Businesses must complete the application form available through the Florida Department of Revenue. This application requires basic information about the business, including the name, address, and type of business entity. Once submitted, the certificate is typically issued promptly, allowing businesses to begin making tax-exempt purchases immediately.

Steps to complete the Florida Annual Resale Certificate For Sales Tax

Completing the Florida Annual Resale Certificate for Sales Tax involves several key steps:

- Gather necessary business information, including the federal employer identification number (EIN).

- Access the Florida Department of Revenue website to download the application form.

- Fill out the form accurately, ensuring all required fields are completed.

- Submit the form through the designated method, either online or via mail.

- Receive the certificate and keep it on file for future transactions.

Legal use of the Florida Annual Resale Certificate For Sales Tax

The legal use of the Florida Annual Resale Certificate for Sales Tax is governed by state regulations. Businesses must ensure that they are using the certificate solely for purchases intended for resale. Misuse of the certificate, such as using it for personal purchases or items not meant for resale, can lead to penalties and tax liabilities. It is important for businesses to maintain accurate records of all transactions made using the certificate to comply with state laws.

Key elements of the Florida Annual Resale Certificate For Sales Tax

Several key elements are essential for the Florida Annual Resale Certificate for Sales Tax to be valid:

- The certificate must include the name and address of the purchaser.

- The certificate should state the nature of the business and the type of goods being purchased.

- It must contain the seller's name and address.

- The document should be signed by an authorized representative of the business.

- It should clearly indicate that the purchase is for resale purposes.

State-specific rules for the Florida Annual Resale Certificate For Sales Tax

Florida has specific rules regarding the use of the Annual Resale Certificate for Sales Tax. Businesses must renew their certificates annually to ensure compliance with state regulations. Additionally, Florida law mandates that sellers must keep a copy of the certificate on file for at least four years. This retention is crucial in case of audits or inquiries by the Florida Department of Revenue. Businesses should also be aware of any changes in state tax laws that may affect their eligibility or the use of the certificate.

Quick guide on how to complete florida annual resale certificate for sales t 533299391

Effortlessly Prepare Florida Annual Resale Certificate For Sales T on Any Device

Digital document management has become increasingly favored by both organizations and individuals. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents, as you can easily locate the necessary form and securely store it online. airSlate SignNow offers all the tools required to create, modify, and electronically sign your documents promptly and without delay. Manage Florida Annual Resale Certificate For Sales T across all platforms using airSlate SignNow's Android or iOS applications and streamline any document-related workflow today.

How to edit and electronically sign Florida Annual Resale Certificate For Sales T with ease

- Acquire Florida Annual Resale Certificate For Sales T and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize essential sections of your documents or obscure sensitive details with tools that airSlate SignNow offers specifically for that purpose.

- Generate your electronic signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Verify all information and click the Done button to save your modifications.

- Select your preferred method to share your form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, and mistakes that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Edit and electronically sign Florida Annual Resale Certificate For Sales T to ensure seamless communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct florida annual resale certificate for sales t 533299391

Create this form in 5 minutes!

How to create an eSignature for the florida annual resale certificate for sales t 533299391

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Florida Annual Resale Certificate For Sales T?

The Florida Annual Resale Certificate For Sales T is a document that allows businesses to purchase goods tax-free for resale. This certificate is essential for retailers and wholesalers in Florida to avoid paying sales tax on items they intend to sell. By utilizing this certificate, businesses can streamline their purchasing process and enhance their cash flow.

-

How can I obtain a Florida Annual Resale Certificate For Sales T?

To obtain a Florida Annual Resale Certificate For Sales T, you need to apply through the Florida Department of Revenue. The application process is straightforward and can often be completed online. Once approved, you will receive your certificate, which you can present to suppliers when making tax-exempt purchases.

-

What are the benefits of using the Florida Annual Resale Certificate For Sales T?

Using the Florida Annual Resale Certificate For Sales T allows businesses to save money by avoiding sales tax on purchases intended for resale. This not only improves profit margins but also simplifies accounting processes. Additionally, it helps businesses maintain compliance with state tax regulations.

-

Is there a cost associated with the Florida Annual Resale Certificate For Sales T?

There is no fee to apply for the Florida Annual Resale Certificate For Sales T. However, businesses must ensure they meet the eligibility requirements and maintain proper records to avoid any penalties. It's a cost-effective solution for businesses looking to optimize their purchasing strategy.

-

Can the Florida Annual Resale Certificate For Sales T be used for online purchases?

Yes, the Florida Annual Resale Certificate For Sales T can be used for online purchases from vendors who accept it. When making online transactions, you may need to provide a copy of the certificate to the seller. This allows you to buy goods without incurring sales tax, just as you would in a physical store.

-

How often do I need to renew my Florida Annual Resale Certificate For Sales T?

The Florida Annual Resale Certificate For Sales T is valid for one year and must be renewed annually. Businesses should keep track of their renewal dates to ensure they remain compliant and can continue to make tax-exempt purchases. Renewal is typically a simple process through the Florida Department of Revenue.

-

What types of businesses can benefit from the Florida Annual Resale Certificate For Sales T?

Retailers, wholesalers, and any business that sells goods in Florida can benefit from the Florida Annual Resale Certificate For Sales T. This certificate is particularly advantageous for businesses that frequently purchase inventory for resale. It helps them manage costs effectively and maintain compliance with tax laws.

Get more for Florida Annual Resale Certificate For Sales T

Find out other Florida Annual Resale Certificate For Sales T

- Electronic signature Virginia Residential lease form Free

- eSignature North Dakota Guarantee Agreement Easy

- Can I Electronic signature Indiana Simple confidentiality agreement

- Can I eSignature Iowa Standstill Agreement

- How To Electronic signature Tennessee Standard residential lease agreement

- How To Electronic signature Alabama Tenant lease agreement

- Electronic signature Maine Contract for work Secure

- Electronic signature Utah Contract Myself

- How Can I Electronic signature Texas Electronic Contract

- How Do I Electronic signature Michigan General contract template

- Electronic signature Maine Email Contracts Later

- Electronic signature New Mexico General contract template Free

- Can I Electronic signature Rhode Island Email Contracts

- How Do I Electronic signature California Personal loan contract template

- Electronic signature Hawaii Personal loan contract template Free

- How To Electronic signature Hawaii Personal loan contract template

- Electronic signature New Hampshire Managed services contract template Computer

- Electronic signature Alabama Real estate sales contract template Easy

- Electronic signature Georgia Real estate purchase contract template Secure

- Electronic signature South Carolina Real estate sales contract template Mobile