Sales Tax Exemption Forms by State

What is the Sales Tax Exemption Forms By State

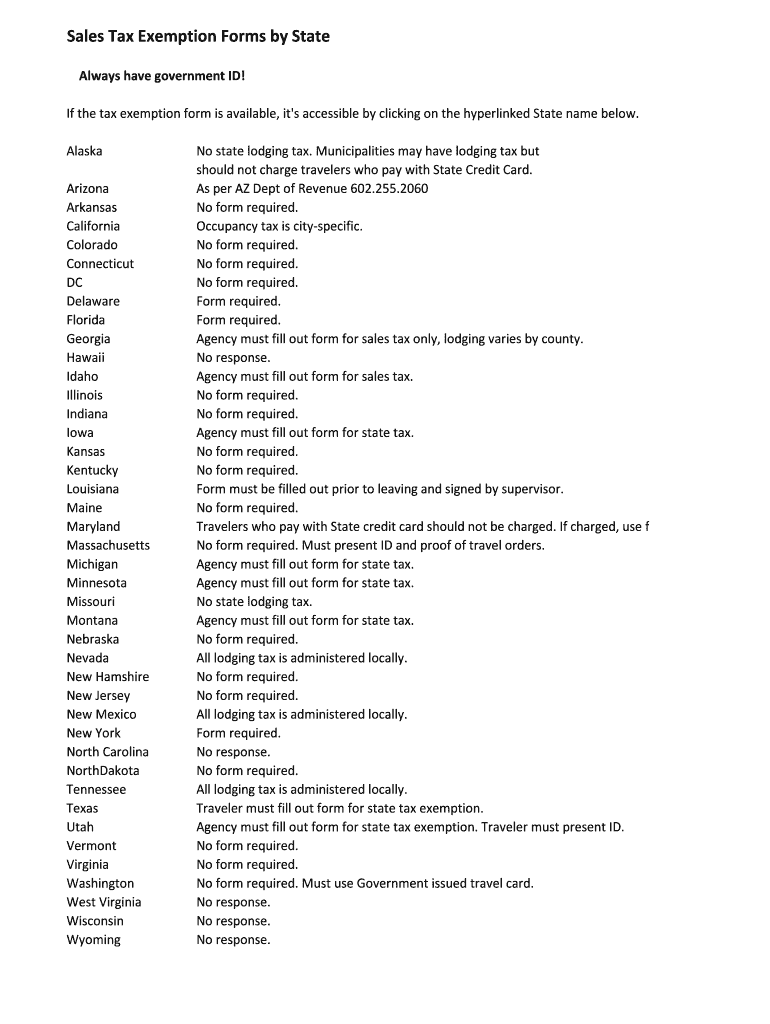

The Sales Tax Exemption Forms by state are official documents that allow eligible purchasers to buy goods and services without paying sales tax. These forms are essential for businesses and individuals who qualify for tax exemptions based on specific criteria, such as non-profit status, resale purposes, or certain governmental functions. Each state in the U.S. has its own version of the exemption form, which must be filled out accurately to ensure compliance with state tax laws.

How to use the Sales Tax Exemption Forms By State

Using the Sales Tax Exemption Forms involves several straightforward steps. First, identify the appropriate form for your state, as each state has unique requirements. Next, complete the form by providing necessary information, such as your name, address, and the reason for the exemption. After filling out the form, present it to the seller at the time of purchase. It is important to keep a copy of the completed form for your records, as it may be required for future reference or audits.

Steps to complete the Sales Tax Exemption Forms By State

Completing the Sales Tax Exemption Forms requires careful attention to detail. Follow these steps:

- Obtain the correct form from your state’s tax authority website or office.

- Fill in your personal or business information accurately, including your tax identification number if applicable.

- Clearly state the reason for the exemption, referencing the specific exemption category that applies to you.

- Review the form for any errors or omissions before submitting it.

- Sign and date the form, ensuring it is completed in accordance with your state’s requirements.

State-specific rules for the Sales Tax Exemption Forms By State

Each state has its own regulations governing the use of Sales Tax Exemption Forms. It is crucial to understand these state-specific rules, as they dictate who qualifies for exemptions and under what circumstances. Some states may require additional documentation to support your exemption claim, while others may have specific forms for different types of exemptions. Always check with your state’s tax authority for the most current and relevant information regarding sales tax exemptions.

Eligibility Criteria

Eligibility for using Sales Tax Exemption Forms varies by state but generally includes categories such as non-profit organizations, resellers, and government entities. To qualify, applicants often need to provide proof of their status, such as a tax-exempt certificate or documentation that supports their claim. Understanding the eligibility criteria for your state is essential to ensure that you meet the necessary requirements before submitting the form.

Form Submission Methods (Online / Mail / In-Person)

Sales Tax Exemption Forms can typically be submitted through various methods, depending on the state. Many states offer online submission options, allowing for quicker processing. Alternatively, forms can often be mailed to the appropriate tax authority or submitted in person at designated offices. It is important to follow your state’s specific guidelines for submission to avoid delays or issues with your exemption claim.

Quick guide on how to complete sales tax exemption forms by state

Complete Sales Tax Exemption Forms By State effortlessly on any device

Digital document management has gained traction among businesses and individuals. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents, enabling you to locate the appropriate form and securely store it online. airSlate SignNow provides you with all the resources you need to create, modify, and electronically sign your documents swiftly without delays. Manage Sales Tax Exemption Forms By State on any platform with airSlate SignNow Android or iOS applications and simplify any document-related task today.

How to alter and eSign Sales Tax Exemption Forms By State with ease

- Obtain Sales Tax Exemption Forms By State and then click Get Form to begin.

- Utilize the tools we provide to finalize your document.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Create your signature using the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your changes.

- Choose the method for sending your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Modify and eSign Sales Tax Exemption Forms By State to guarantee effective communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the sales tax exemption forms by state

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are Sales Tax Exemption Forms By State?

Sales Tax Exemption Forms By State are official documents that allow eligible businesses and individuals to purchase goods and services without paying sales tax. Each state has its own specific form and requirements, making it essential to understand the nuances of these forms to ensure compliance.

-

How can airSlate SignNow help with Sales Tax Exemption Forms By State?

airSlate SignNow provides a streamlined platform for businesses to create, send, and eSign Sales Tax Exemption Forms By State efficiently. Our user-friendly interface simplifies the process, ensuring that you can manage your exemption forms quickly and accurately.

-

Are there any costs associated with using airSlate SignNow for Sales Tax Exemption Forms By State?

Yes, airSlate SignNow offers various pricing plans tailored to meet the needs of different businesses. Our cost-effective solutions ensure that you can manage your Sales Tax Exemption Forms By State without breaking the bank, with options for both small and large enterprises.

-

What features does airSlate SignNow offer for managing Sales Tax Exemption Forms By State?

airSlate SignNow includes features such as customizable templates, automated workflows, and secure eSigning capabilities for Sales Tax Exemption Forms By State. These features enhance efficiency and ensure that your documents are processed quickly and securely.

-

Can I integrate airSlate SignNow with other software for Sales Tax Exemption Forms By State?

Absolutely! airSlate SignNow offers integrations with various software applications, allowing you to manage your Sales Tax Exemption Forms By State seamlessly alongside your existing tools. This flexibility helps streamline your workflow and improve productivity.

-

What are the benefits of using airSlate SignNow for Sales Tax Exemption Forms By State?

Using airSlate SignNow for Sales Tax Exemption Forms By State provides numerous benefits, including reduced processing time, enhanced accuracy, and improved compliance. Our platform ensures that your forms are completed correctly and submitted on time, minimizing the risk of errors.

-

Is airSlate SignNow secure for handling Sales Tax Exemption Forms By State?

Yes, airSlate SignNow prioritizes security and compliance, ensuring that your Sales Tax Exemption Forms By State are protected. We utilize advanced encryption and security protocols to safeguard your sensitive information throughout the signing process.

Get more for Sales Tax Exemption Forms By State

Find out other Sales Tax Exemption Forms By State

- How Can I Electronic signature New Jersey Insurance Document

- How To Electronic signature Indiana High Tech Document

- How Do I Electronic signature Indiana High Tech Document

- How Can I Electronic signature Ohio Insurance Document

- Can I Electronic signature South Dakota Insurance PPT

- How Can I Electronic signature Maine Lawers PPT

- How To Electronic signature Maine Lawers PPT

- Help Me With Electronic signature Minnesota Lawers PDF

- How To Electronic signature Ohio High Tech Presentation

- How Can I Electronic signature Alabama Legal PDF

- How To Electronic signature Alaska Legal Document

- Help Me With Electronic signature Arkansas Legal PDF

- How Can I Electronic signature Arkansas Legal Document

- How Can I Electronic signature California Legal PDF

- Can I Electronic signature Utah High Tech PDF

- How Do I Electronic signature Connecticut Legal Document

- How To Electronic signature Delaware Legal Document

- How Can I Electronic signature Georgia Legal Word

- How Do I Electronic signature Alaska Life Sciences Word

- How Can I Electronic signature Alabama Life Sciences Document