Form 1084

What is the Form 1084

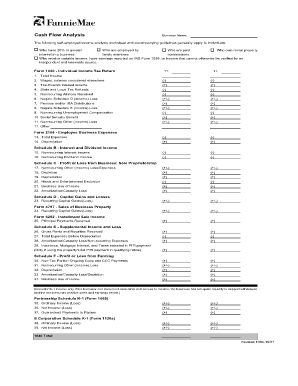

The Form 1084, also known as the FNMA Form 1084, is a document used primarily in the context of personal tax returns in the United States. This form is essential for individuals and businesses to report specific financial information to the Internal Revenue Service (IRS). It serves as a tool for taxpayers to provide detailed insights into their income, deductions, and credits, ensuring compliance with federal tax regulations.

Steps to Complete the Form 1084

Completing the Form 1084 involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary financial documents, such as income statements, receipts for deductions, and any relevant tax forms. Next, fill out the form with precise information regarding your income sources and applicable deductions. Be sure to review each section carefully, as inaccuracies can lead to delays or penalties. Finally, sign and date the form before submission.

Legal Use of the Form 1084

The legal use of the Form 1084 is crucial for ensuring that the information provided is valid and binding. When completed accurately, the form becomes a legal document that can be used in audits or disputes with the IRS. It is essential to adhere to all IRS guidelines and regulations when filling out the form to maintain its legal standing. Utilizing a reliable eSignature solution can enhance the legitimacy of the completed form.

How to Obtain the Form 1084

The Form 1084 can be obtained through several channels. Taxpayers can download the form directly from the IRS website or request a physical copy through the mail. Additionally, many tax preparation software programs include the Form 1084 as part of their offerings, allowing users to fill it out digitally. Ensure that you are using the most current version of the form to comply with any recent tax law changes.

Key Elements of the Form 1084

Key elements of the Form 1084 include sections for reporting income, deductions, and credits. Each section is designed to capture specific financial details, such as wages, interest income, and business expenses. Additionally, the form requires personal information, including the taxpayer's name, Social Security number, and filing status. Understanding these elements is vital for accurate completion and submission.

Form Submission Methods

There are various methods for submitting the Form 1084 to the IRS. Taxpayers can file the form electronically using approved e-filing software, which is often the fastest method. Alternatively, the form can be mailed to the appropriate IRS address, depending on the taxpayer's location and filing status. In some cases, in-person submission may be possible at designated IRS offices, although this is less common.

Quick guide on how to complete form 1084

Manage Form 1084 easily on any device

Digital document management has become prevalent among businesses and individuals. It offers an excellent environmentally friendly substitute for traditional printed and signed paperwork, allowing you to find the correct form and store it securely online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents quickly and efficiently. Manage Form 1084 on any device using airSlate SignNow's Android or iOS applications and improve your document-based procedures today.

The simplest way to modify and eSign Form 1084 with ease

- Obtain Form 1084 and click Get Form to begin.

- Use the tools we provide to fill out your document.

- Emphasize important sections of your documents or conceal sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Create your signature using the Sign feature, which takes moments and holds the same legal validity as a conventional ink signature.

- Review the details and click the Done button to save your changes.

- Choose how you’d like to share your form, via email, text (SMS), or a shared link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow manages all your document handling needs in just a few clicks from any device you prefer. Modify and eSign Form 1084 and ensure excellent communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 1084

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form 1084 for personal tax returns?

Form 1084 for personal tax returns is a tax document used by individuals to report their tax information to the IRS. It is essential for accurately filing your tax returns and can help ensure that you maximize your deductions and credits. airSlate SignNow can streamline the process of preparing and signing this document, making it easier to submit.

-

How can airSlate SignNow assist me with form 1084 personal tax returns?

airSlate SignNow simplifies the process of managing form 1084 personal tax returns by providing an intuitive platform for document preparation and electronic signatures. With our solution, users can securely send, sign, and store essential tax documents from anywhere, enhancing efficiency and convenience during tax season.

-

What are the pricing options for using airSlate SignNow for form 1084 personal tax returns?

airSlate SignNow offers competitive pricing plans designed to suit various needs for managing form 1084 personal tax returns. Our plans include flexible monthly and annual subscriptions, along with features that provide signNow ROI by reducing the time and effort involved in document handling.

-

Are there any integrations available for handling form 1084 personal tax returns?

Yes, airSlate SignNow integrates with various accounting and tax software to facilitate handling of form 1084 personal tax returns. This connectivity allows users to seamlessly import and export data, making it easier to manage their tax documents and ensuring accuracy and compliance in their filings.

-

What features does airSlate SignNow offer for form 1084 personal tax returns?

AirSlate SignNow offers a range of features specifically designed for managing form 1084 personal tax returns, including customizable templates, secure electronic signatures, and automated workflows. These features work in tandem to simplify the completion and submission process, ensuring that users can file their tax returns promptly and accurately.

-

Is it safe to use airSlate SignNow for form 1084 personal tax returns?

Absolutely! airSlate SignNow prioritizes user security, with robust encryption and compliance measures in place to protect sensitive information like form 1084 personal tax returns. Our platform adheres to strict security standards, ensuring that your data remains confidential and secure throughout the document lifecycle.

-

Can I track the status of my form 1084 personal tax returns with airSlate SignNow?

Yes, airSlate SignNow enables users to track the status of their form 1084 personal tax returns in real time. This feature allows you to see when documents are sent, viewed, and signed, providing peace of mind and transparency during the filing process.

Get more for Form 1084

- Financial support document form

- Sonic application form

- Auto insurance cancellation request form

- Bc form 5 cbl

- Multifamily servicer guide freddie 1144 form

- Student exploration heat transfer by conduction answer key pdf form

- University registration form 5454819

- Www irs govpubirs pdfnormas sobre la causa razonable y requisitos para los nombres form

Find out other Form 1084

- Sign Nevada Business Operations Emergency Contact Form Simple

- Sign New Hampshire Business Operations Month To Month Lease Later

- Can I Sign New York Business Operations Promissory Note Template

- Sign Oklahoma Business Operations Contract Safe

- Sign Oregon Business Operations LLC Operating Agreement Now

- Sign Utah Business Operations LLC Operating Agreement Computer

- Sign West Virginia Business Operations Rental Lease Agreement Now

- How To Sign Colorado Car Dealer Arbitration Agreement

- Sign Florida Car Dealer Resignation Letter Now

- Sign Georgia Car Dealer Cease And Desist Letter Fast

- Sign Georgia Car Dealer Purchase Order Template Mobile

- Sign Delaware Car Dealer Limited Power Of Attorney Fast

- How To Sign Georgia Car Dealer Lease Agreement Form

- How To Sign Iowa Car Dealer Resignation Letter

- Sign Iowa Car Dealer Contract Safe

- Sign Iowa Car Dealer Limited Power Of Attorney Computer

- Help Me With Sign Iowa Car Dealer Limited Power Of Attorney

- Sign Kansas Car Dealer Contract Fast

- Sign Kansas Car Dealer Agreement Secure

- Sign Louisiana Car Dealer Resignation Letter Mobile