Maine Income Tax Withholding Business Change Notification FORM 2022-2026

What is the Maine Income Tax Withholding Business Change Notification FORM

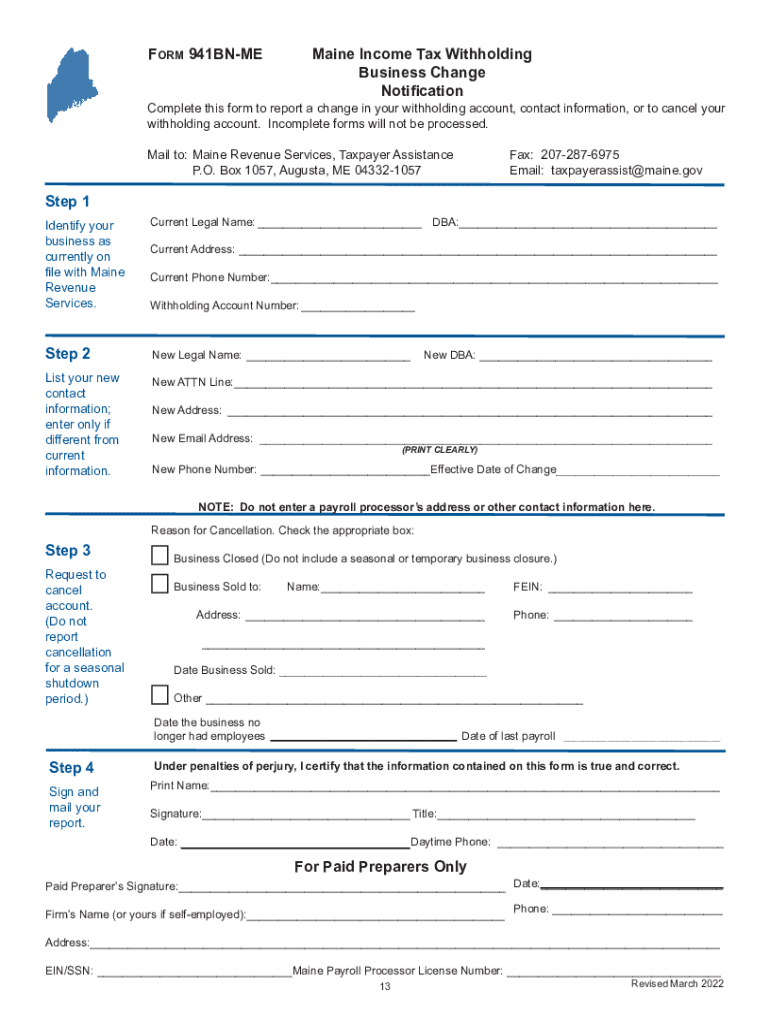

The Maine Income Tax Withholding Business Change Notification FORM is a crucial document that businesses in Maine must use to notify the state of any changes related to income tax withholding. This form is essential for ensuring compliance with state tax laws and helps maintain accurate records for both employers and employees. It is specifically designed for businesses that need to update their withholding information due to changes such as a change in business structure, ownership, or address.

How to use the Maine Income Tax Withholding Business Change Notification FORM

Using the Maine Income Tax Withholding Business Change Notification FORM involves several straightforward steps. First, businesses must download the form from the appropriate state tax authority website. After downloading, carefully fill out the required fields, ensuring that all information is accurate and up-to-date. Once completed, the form can be submitted via mail or electronically, depending on the preferred submission method. It is important to keep a copy of the submitted form for your records.

Steps to complete the Maine Income Tax Withholding Business Change Notification FORM

Completing the Maine Income Tax Withholding Business Change Notification FORM requires attention to detail. Here are the steps to follow:

- Download the form from the Maine Revenue Services website.

- Provide the business name, address, and federal employer identification number (EIN).

- Indicate the specific changes being made, such as changes in ownership or business structure.

- Review all entered information for accuracy.

- Sign and date the form to certify that the information is correct.

- Submit the form according to the specified submission methods.

Key elements of the Maine Income Tax Withholding Business Change Notification FORM

The Maine Income Tax Withholding Business Change Notification FORM contains several key elements that are essential for proper completion. These elements include:

- Business Identification: This includes the business name, address, and EIN.

- Type of Change: A section to specify the nature of the change, such as a change in ownership or business structure.

- Signature: A signature line for the authorized representative of the business, along with the date of submission.

Form Submission Methods

The Maine Income Tax Withholding Business Change Notification FORM can be submitted through various methods to accommodate different preferences. Businesses can choose to:

- Submit the form electronically via the Maine Revenue Services online platform.

- Mail the completed form to the designated address provided on the form.

- Deliver the form in person to a local Maine Revenue Services office.

Penalties for Non-Compliance

Failure to submit the Maine Income Tax Withholding Business Change Notification FORM can result in penalties for businesses. Non-compliance may lead to fines, interest on unpaid taxes, and potential audits. It is crucial for businesses to stay compliant with state regulations to avoid these consequences. Regularly updating withholding information helps ensure that businesses meet their tax obligations and maintain good standing with the state.

Quick guide on how to complete maine income tax withholding business change notification form

Effortlessly Prepare Maine Income Tax Withholding Business Change Notification FORM on Any Device

Managing documents online has gained signNow traction among both enterprises and individuals. It serves as an ideal environmentally friendly alternative to conventional printed and signed papers, as you can easily find the right template and securely store it online. airSlate SignNow provides all the necessary tools to create, modify, and electronically sign your documents swiftly without any hassles. Handle Maine Income Tax Withholding Business Change Notification FORM on any device using airSlate SignNow's Android or iOS applications and enhance any document-related workflow today.

The simplest way to edit and electronically sign Maine Income Tax Withholding Business Change Notification FORM with ease

- Find Maine Income Tax Withholding Business Change Notification FORM and click on Obtain Form to begin.

- Utilize the features we offer to fill out your document.

- Mark important parts of the documents or redact private information using tools that airSlate SignNow specifically provides for this purpose.

- Create your signature with the Sign feature, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Finish button to save your modifications.

- Select your preferred method for sending your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tiring form searches, or mistakes that require printing new versions. airSlate SignNow caters to your document management needs in just a few clicks from any device you choose. Edit and electronically sign Maine Income Tax Withholding Business Change Notification FORM to ensure excellent communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct maine income tax withholding business change notification form

Create this form in 5 minutes!

How to create an eSignature for the maine income tax withholding business change notification form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Maine Income Tax Withholding Business Change Notification FORM?

The Maine Income Tax Withholding Business Change Notification FORM is a document that businesses in Maine must submit to notify the state of any changes in their income tax withholding status. This form ensures that the Maine Revenue Services is updated with accurate information regarding your business's tax obligations.

-

How can airSlate SignNow help with the Maine Income Tax Withholding Business Change Notification FORM?

airSlate SignNow provides an easy-to-use platform for businesses to create, send, and eSign the Maine Income Tax Withholding Business Change Notification FORM. Our solution streamlines the process, making it efficient and secure, so you can focus on your business operations.

-

Is there a cost associated with using airSlate SignNow for the Maine Income Tax Withholding Business Change Notification FORM?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. Our cost-effective solutions ensure that you can manage your documents, including the Maine Income Tax Withholding Business Change Notification FORM, without breaking the bank.

-

What features does airSlate SignNow offer for managing the Maine Income Tax Withholding Business Change Notification FORM?

airSlate SignNow includes features such as customizable templates, secure eSigning, and document tracking. These tools make it easy to manage the Maine Income Tax Withholding Business Change Notification FORM and ensure compliance with state regulations.

-

Can I integrate airSlate SignNow with other software for the Maine Income Tax Withholding Business Change Notification FORM?

Absolutely! airSlate SignNow offers integrations with various software applications, allowing you to streamline your workflow when handling the Maine Income Tax Withholding Business Change Notification FORM. This ensures that your business processes remain efficient and interconnected.

-

What are the benefits of using airSlate SignNow for the Maine Income Tax Withholding Business Change Notification FORM?

Using airSlate SignNow for the Maine Income Tax Withholding Business Change Notification FORM provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform simplifies the eSigning process, allowing you to complete your tax notifications quickly and accurately.

-

How secure is airSlate SignNow when handling the Maine Income Tax Withholding Business Change Notification FORM?

Security is a top priority at airSlate SignNow. We utilize advanced encryption and security protocols to protect your documents, including the Maine Income Tax Withholding Business Change Notification FORM, ensuring that your sensitive information remains confidential and secure.

Get more for Maine Income Tax Withholding Business Change Notification FORM

Find out other Maine Income Tax Withholding Business Change Notification FORM

- Sign Rhode Island Tenant lease agreement Myself

- Sign Wyoming Tenant lease agreement Now

- Sign Florida Contract Safe

- Sign Nebraska Contract Safe

- How To Sign North Carolina Contract

- How Can I Sign Alabama Personal loan contract template

- Can I Sign Arizona Personal loan contract template

- How To Sign Arkansas Personal loan contract template

- Sign Colorado Personal loan contract template Mobile

- How Do I Sign Florida Personal loan contract template

- Sign Hawaii Personal loan contract template Safe

- Sign Montana Personal loan contract template Free

- Sign New Mexico Personal loan contract template Myself

- Sign Vermont Real estate contracts Safe

- Can I Sign West Virginia Personal loan contract template

- How Do I Sign Hawaii Real estate sales contract template

- Sign Kentucky New hire forms Myself

- Sign Alabama New hire packet Online

- How Can I Sign California Verification of employment form

- Sign Indiana Home rental application Online