Form 941bn Me 2008

What is the Form 941bn Me

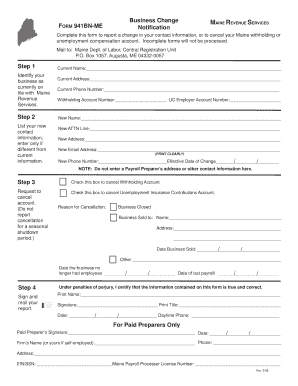

The Form 941bn Me is a specific tax form used in Maine for reporting employment taxes. This form is essential for employers who need to report wages, tips, and other compensation paid to employees, as well as the federal income tax withheld from those payments. It is a state-specific variant of the federal Form 941, tailored to meet Maine's tax requirements. Understanding the purpose and use of this form is crucial for compliance with state tax laws.

How to use the Form 941bn Me

Using the Form 941bn Me involves several key steps. First, gather all necessary information regarding employee wages and taxes withheld. This includes total wages paid, the number of employees, and any applicable deductions. Next, accurately fill out the form with this information. After completing the form, it must be submitted to the appropriate state tax authority. It is important to ensure that all entries are correct to avoid penalties and ensure compliance with Maine tax regulations.

Steps to complete the Form 941bn Me

Completing the Form 941bn Me requires careful attention to detail. Follow these steps for accurate completion:

- Gather necessary documentation, including payroll records and tax withholding information.

- Enter the total wages paid to employees during the reporting period.

- Calculate the total federal income tax withheld from employee wages.

- Provide information on any adjustments or credits applicable to your business.

- Review all entries for accuracy before submission.

Once completed, ensure the form is signed and dated before sending it to the state tax authority.

Filing Deadlines / Important Dates

It is crucial to be aware of the filing deadlines associated with the Form 941bn Me to avoid penalties. Typically, the form is due on a quarterly basis. The deadlines for submission are as follows:

- For the first quarter (January to March): April 30

- For the second quarter (April to June): July 31

- For the third quarter (July to September): October 31

- For the fourth quarter (October to December): January 31 of the following year

Adhering to these deadlines is essential for maintaining compliance with state tax laws.

Key elements of the Form 941bn Me

The Form 941bn Me contains several key elements that are vital for accurate reporting. These include:

- Employer identification information, including the name and address of the business.

- Total wages paid to employees during the reporting period.

- Federal income tax withheld from employee wages.

- Any adjustments for overpayments or underpayments from previous periods.

- Signature and date of the person completing the form.

Each of these elements must be completed accurately to ensure compliance and avoid potential issues with the state tax authority.

Legal use of the Form 941bn Me

The Form 941bn Me is legally required for employers in Maine to report employment taxes. Failing to file this form can result in penalties and interest on unpaid taxes. It is important for employers to understand their legal obligations regarding this form, including the requirement to report accurate information and meet filing deadlines. Proper use of the form helps ensure compliance with state tax laws and avoids potential legal issues.

Quick guide on how to complete form 941bn me

Complete Form 941bn Me effortlessly on any device

Digital document management has become increasingly popular with businesses and individuals. It offers an excellent eco-friendly substitute to conventional printed and signed documents, allowing you to find the necessary form and securely store it online. airSlate SignNow provides you with all the resources you need to create, modify, and eSign your documents swiftly without any delays. Manage Form 941bn Me on any platform using airSlate SignNow Android or iOS applications and simplify any document-related task today.

The easiest way to modify and eSign Form 941bn Me without stress

- Find Form 941bn Me and click Get Form to begin.

- Use the tools we provide to complete your document.

- Emphasize pertinent sections of the documents or black out sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select how you wish to share your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate the worry of lost or mislaid documents, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow meets your document management requirements in just a few clicks from a device of your choice. Modify and eSign Form 941bn Me and ensure exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 941bn me

Create this form in 5 minutes!

How to create an eSignature for the form 941bn me

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form 941bn me and how can it benefit my business?

Form 941bn me is a specific tax form used for reporting employment taxes. By utilizing airSlate SignNow, businesses can easily eSign and send this form, ensuring compliance and accuracy. This streamlined process saves time and reduces the risk of errors, making it an essential tool for any business managing payroll.

-

How much does it cost to use airSlate SignNow for form 941bn me?

airSlate SignNow offers competitive pricing plans that cater to various business needs. You can choose from monthly or annual subscriptions, which provide access to features that simplify the signing and sending of form 941bn me. Check our pricing page for detailed information on the plans available.

-

What features does airSlate SignNow offer for managing form 941bn me?

airSlate SignNow provides a range of features designed to enhance the management of form 941bn me. These include customizable templates, automated reminders, and secure cloud storage. With these tools, you can ensure that your documents are handled efficiently and securely.

-

Can I integrate airSlate SignNow with other software for form 941bn me?

Yes, airSlate SignNow offers seamless integrations with various software applications, making it easy to manage form 941bn me alongside your existing tools. Whether you use accounting software or CRM systems, our platform can connect with them to streamline your workflow.

-

Is airSlate SignNow secure for sending sensitive documents like form 941bn me?

Absolutely! airSlate SignNow prioritizes security and compliance, ensuring that your sensitive documents, including form 941bn me, are protected. We use advanced encryption and authentication measures to safeguard your data throughout the signing process.

-

How can airSlate SignNow improve the efficiency of submitting form 941bn me?

By using airSlate SignNow, you can signNowly improve the efficiency of submitting form 941bn me. The platform allows for quick eSigning, real-time tracking, and instant notifications, which means you can complete your submissions faster and with fewer hassles.

-

What support options are available for users of airSlate SignNow regarding form 941bn me?

airSlate SignNow offers comprehensive support options for users needing assistance with form 941bn me. You can access our help center, contact customer support via chat or email, and explore our extensive library of tutorials and guides to help you navigate the platform.

Get more for Form 941bn Me

Find out other Form 941bn Me

- How Can I eSign Colorado Plumbing PDF

- Can I eSign Hawaii Plumbing PDF

- How Do I eSign Hawaii Plumbing Form

- Can I eSign Hawaii Plumbing Form

- How To eSign Hawaii Plumbing Word

- Help Me With eSign Hawaii Plumbing Document

- How To eSign Hawaii Plumbing Presentation

- How To eSign Maryland Plumbing Document

- How Do I eSign Mississippi Plumbing Word

- Can I eSign New Jersey Plumbing Form

- How Can I eSign Wisconsin Plumbing PPT

- Can I eSign Colorado Real Estate Form

- How To eSign Florida Real Estate Form

- Can I eSign Hawaii Real Estate Word

- How Do I eSign Hawaii Real Estate Word

- How To eSign Hawaii Real Estate Document

- How Do I eSign Hawaii Real Estate Presentation

- How Can I eSign Idaho Real Estate Document

- How Do I eSign Hawaii Sports Document

- Can I eSign Hawaii Sports Presentation