In Kind Donation Form Uwosh

What is the In kind Donation Form Uwosh

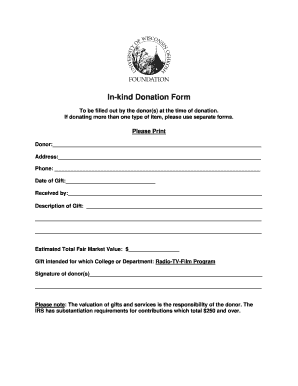

The In kind Donation Form Uwosh is a specific document used to record and acknowledge non-cash contributions made to organizations. This form is essential for tracking donations of goods or services, ensuring that both the donor and the recipient have a clear understanding of the value and purpose of the donation. It serves as a formal record that can be utilized for accounting and tax purposes, particularly for individuals and businesses looking to claim deductions for charitable contributions.

How to use the In kind Donation Form Uwosh

Using the In kind Donation Form Uwosh involves several straightforward steps. First, gather all necessary information about the donation, including a description of the items or services provided and their estimated value. Next, fill out the form accurately, ensuring that all fields are completed. Once the form is filled out, both the donor and the recipient should sign it to validate the transaction. Finally, keep a copy for your records, as it may be needed for tax filings or organizational audits.

Steps to complete the In kind Donation Form Uwosh

Completing the In kind Donation Form Uwosh requires careful attention to detail. Follow these steps:

- Start by entering the donor's information, including name and contact details.

- Provide the recipient's information, typically the organization receiving the donation.

- List the items or services being donated, including a detailed description.

- Estimate the fair market value of each item or service.

- Include the date of the donation.

- Both parties should sign and date the form to confirm the transaction.

Key elements of the In kind Donation Form Uwosh

Several key elements are crucial for the In kind Donation Form Uwosh to serve its purpose effectively. These include:

- Donor Information: Full name, address, and contact details of the donor.

- Recipient Information: Name and address of the organization receiving the donation.

- Description of Donation: Clear details about the items or services provided.

- Value Assessment: An accurate estimation of the fair market value of the donation.

- Date of Donation: The date when the donation takes place.

- Signatures: Signatures of both the donor and the recipient to validate the form.

Legal use of the In kind Donation Form Uwosh

The In kind Donation Form Uwosh is legally recognized as a valid document for reporting non-cash contributions. It helps ensure compliance with IRS regulations regarding charitable donations. By maintaining accurate records, both donors and recipients can protect themselves in case of audits or inquiries regarding the legitimacy of the donation. It is important to adhere to local and federal laws when completing and submitting this form.

Form Submission Methods

The In kind Donation Form Uwosh can be submitted through various methods, depending on the organization's requirements. Common submission methods include:

- Online Submission: Some organizations may allow digital submissions through their websites.

- Mail: The completed form can be mailed to the organization’s designated address.

- In-Person: Donors may also choose to deliver the form directly to the organization.

Quick guide on how to complete in kind donation form uwosh

Complete [SKS] effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed paperwork, allowing you to access the necessary form and securely save it online. airSlate SignNow provides all the tools you need to create, modify, and eSign your documents swiftly without delays. Manage [SKS] on any device with the airSlate SignNow apps available for Android or iOS and streamline any document-related task today.

How to modify and eSign [SKS] with ease

- Obtain [SKS] and click on Get Form to begin.

- Make use of the tools we offer to fill out your form.

- Highlight pertinent sections of your documents or redact sensitive information using tools specifically provided by airSlate SignNow for this purpose.

- Create your eSignature with the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Choose how you would like to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Edit and eSign [SKS] and ensure effective communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to In kind Donation Form Uwosh

Create this form in 5 minutes!

How to create an eSignature for the in kind donation form uwosh

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the In kind Donation Form Uwosh?

The In kind Donation Form Uwosh is a customizable document designed to facilitate the process of recording and acknowledging in-kind donations. It allows organizations to easily track and manage non-cash contributions, ensuring compliance and transparency. With airSlate SignNow, you can create and eSign this form effortlessly.

-

How can I create an In kind Donation Form Uwosh using airSlate SignNow?

Creating an In kind Donation Form Uwosh with airSlate SignNow is simple. You can start by selecting a template or building your form from scratch using our intuitive drag-and-drop editor. Once your form is ready, you can easily share it for eSignature, streamlining the donation process.

-

What are the benefits of using the In kind Donation Form Uwosh?

Using the In kind Donation Form Uwosh offers numerous benefits, including improved tracking of donations and enhanced record-keeping. It simplifies the acknowledgment process for donors, fostering better relationships. Additionally, it helps organizations maintain compliance with tax regulations regarding in-kind contributions.

-

Is there a cost associated with the In kind Donation Form Uwosh?

The In kind Donation Form Uwosh is part of the airSlate SignNow platform, which offers various pricing plans to suit different organizational needs. You can choose a plan that fits your budget, and there are often free trials available to test the features before committing. Overall, it provides a cost-effective solution for managing donations.

-

Can the In kind Donation Form Uwosh be integrated with other software?

Yes, the In kind Donation Form Uwosh can be seamlessly integrated with various software applications, enhancing its functionality. airSlate SignNow supports integrations with popular CRM systems, accounting software, and other tools to streamline your workflow. This ensures that your donation management process is efficient and cohesive.

-

How secure is the In kind Donation Form Uwosh?

The In kind Donation Form Uwosh is designed with security in mind. airSlate SignNow employs advanced encryption and security protocols to protect your data and ensure that all eSignatures are legally binding. You can trust that your sensitive information is safe while using our platform.

-

Can I customize the In kind Donation Form Uwosh to fit my organization's branding?

Absolutely! The In kind Donation Form Uwosh can be fully customized to reflect your organization's branding. You can modify colors, logos, and text to create a form that aligns with your brand identity. This personalization helps enhance your organization's professionalism and credibility.

Get more for In kind Donation Form Uwosh

- Letter from landlord to tenant as notice to remove wild animals in premises montana form

- Letter from landlord to tenant as notice to remove unauthorized pets from premises montana form

- Letter from tenant to landlord containing notice that premises in uninhabitable in violation of law and demand immediate repair 497316170 form

- Letter from tenant to landlord containing notice that premises leaks during rain and demand for repair montana form

- Letter from tenant to landlord containing notice that doors are broken and demand repair montana form

- Montana letter landlord form

- Letter from tenant to landlord with demand that landlord repair plumbing problem montana form

- Letter from tenant to landlord containing notice that heater is broken unsafe or inadequate and demand for immediate remedy 497316175 form

Find out other In kind Donation Form Uwosh

- Electronic signature North Dakota Healthcare / Medical Notice To Quit Secure

- Help Me With Electronic signature Ohio Healthcare / Medical Moving Checklist

- Electronic signature Education PPT Ohio Secure

- Electronic signature Tennessee Healthcare / Medical NDA Now

- Electronic signature Tennessee Healthcare / Medical Lease Termination Letter Online

- Electronic signature Oklahoma Education LLC Operating Agreement Fast

- How To Electronic signature Virginia Healthcare / Medical Contract

- How To Electronic signature Virginia Healthcare / Medical Operating Agreement

- Electronic signature Wisconsin Healthcare / Medical Business Letter Template Mobile

- Can I Electronic signature Wisconsin Healthcare / Medical Operating Agreement

- Electronic signature Alabama High Tech Stock Certificate Fast

- Electronic signature Insurance Document California Computer

- Electronic signature Texas Education Separation Agreement Fast

- Electronic signature Idaho Insurance Letter Of Intent Free

- How To Electronic signature Idaho Insurance POA

- Can I Electronic signature Illinois Insurance Last Will And Testament

- Electronic signature High Tech PPT Connecticut Computer

- Electronic signature Indiana Insurance LLC Operating Agreement Computer

- Electronic signature Iowa Insurance LLC Operating Agreement Secure

- Help Me With Electronic signature Kansas Insurance Living Will