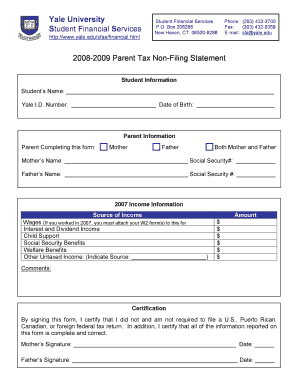

Parent Tax Non Filing Statement Form

What is the Parent Tax Non Filing Statement

The Parent Tax Non Filing Statement is a document used primarily by parents who do not file a federal income tax return. This statement serves as a formal declaration that the parent has not filed taxes for the relevant tax year. It is often required for various financial aid applications, including those for college, as it helps institutions assess a student’s financial need based on the parent's income status. Understanding this form is crucial for parents navigating financial aid processes.

How to use the Parent Tax Non Filing Statement

The Parent Tax Non Filing Statement is utilized in several contexts, particularly when applying for financial aid or scholarships. When completing financial aid forms, such as the FAFSA, parents may need to submit this statement to clarify their tax status. It is essential to ensure that the statement is accurately filled out and submitted along with any other required documentation to avoid delays in processing financial aid applications.

Steps to complete the Parent Tax Non Filing Statement

Completing the Parent Tax Non Filing Statement involves several key steps:

- Gather necessary personal information, including the parent's Social Security number and any relevant identification.

- Clearly indicate the tax year for which the statement is being submitted.

- Provide a brief explanation of why the parent did not file a tax return, if applicable.

- Sign and date the statement to certify its accuracy.

Once completed, the statement should be submitted according to the instructions provided by the institution or organization requesting it.

Legal use of the Parent Tax Non Filing Statement

The Parent Tax Non Filing Statement is legally recognized as a formal declaration regarding tax filing status. Institutions may require this statement to comply with federal regulations when assessing financial aid eligibility. It is important for parents to understand that providing false information on this statement can lead to legal repercussions, including penalties or loss of financial aid.

Required Documents

When preparing to submit the Parent Tax Non Filing Statement, parents may need to gather several supporting documents, including:

- Proof of income, such as pay stubs or W-2 forms, if applicable.

- Any other financial documents that demonstrate the family's financial situation.

- Identification documents, such as a driver's license or Social Security card.

Having these documents ready can streamline the process and ensure that the statement is accepted without issues.

IRS Guidelines

The Internal Revenue Service (IRS) provides specific guidelines regarding tax filing requirements and exemptions. Parents should refer to the IRS guidelines to determine if they qualify for non-filing status. This information can help in accurately completing the Parent Tax Non Filing Statement and ensuring compliance with federal tax laws.

Quick guide on how to complete parent tax non filing statement

Effortlessly Prepare [SKS] on Any Device

Digital document management has become increasingly favored by businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to locate the necessary form and securely store it online. airSlate SignNow offers all the tools you require to create, modify, and electronically sign your documents swiftly and without interruptions. Manage [SKS] on any device using airSlate SignNow's Android or iOS applications and enhance your document-based processes today.

The easiest way to modify and electronically sign [SKS] hassle-free

- Access [SKS] and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow specifically provides for this purpose.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose your preferred method for sending your form, whether by email, SMS, invitation link, or download it to your computer.

Forget about lost or mislaid documents, tedious searches for forms, or inaccuracies that necessitate reprinting new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and electronically sign [SKS] and ensure excellent communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Parent Tax Non Filing Statement

Create this form in 5 minutes!

How to create an eSignature for the parent tax non filing statement

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Parent Tax Non Filing Statement?

A Parent Tax Non Filing Statement is a document that certifies a parent or guardian's non-filing status for tax purposes. This statement is often required for financial aid applications or other official processes where proof of income is necessary. Using airSlate SignNow, you can easily create and eSign this document to meet your needs.

-

How can airSlate SignNow help with the Parent Tax Non Filing Statement?

airSlate SignNow provides a user-friendly platform to create, send, and eSign your Parent Tax Non Filing Statement quickly and efficiently. Our solution streamlines the document management process, ensuring that you can focus on what matters most. With our templates, you can customize your statement to fit your specific requirements.

-

Is there a cost associated with using airSlate SignNow for the Parent Tax Non Filing Statement?

Yes, airSlate SignNow offers various pricing plans to accommodate different needs, including options for individuals and businesses. Our plans are designed to be cost-effective, ensuring you get the best value for your document management needs, including the creation of a Parent Tax Non Filing Statement.

-

What features does airSlate SignNow offer for document signing?

airSlate SignNow includes features such as customizable templates, secure eSigning, and real-time tracking of document status. These features make it easy to manage your Parent Tax Non Filing Statement and other important documents. Additionally, our platform ensures compliance with legal standards for electronic signatures.

-

Can I integrate airSlate SignNow with other applications?

Yes, airSlate SignNow offers integrations with various applications, including CRM systems and cloud storage services. This allows you to streamline your workflow and manage your Parent Tax Non Filing Statement alongside other important documents. Our integrations enhance productivity and ensure seamless document handling.

-

What are the benefits of using airSlate SignNow for my Parent Tax Non Filing Statement?

Using airSlate SignNow for your Parent Tax Non Filing Statement provides numerous benefits, including time savings, enhanced security, and ease of use. Our platform simplifies the signing process, allowing you to complete your documents quickly and securely. This efficiency can be crucial when meeting deadlines for financial aid or other applications.

-

Is airSlate SignNow secure for handling sensitive documents?

Absolutely! airSlate SignNow employs advanced security measures, including encryption and secure data storage, to protect your sensitive documents like the Parent Tax Non Filing Statement. We prioritize your privacy and ensure that your information is safe throughout the signing process.

Get more for Parent Tax Non Filing Statement

- What does a michigan boat title look like 612309909 form

- Caledonia wi govpermits licensingpermits licensing ampamp miscellaneous formsvillage of caledonia

- Motion for continuance postponement form

- Circuit court for city or county civil domestic form

- 8505 program form

- Municipal court probation form

- Lesson 1 homework practice integers and absolute value answer key form

- Stormwater plan review form

Find out other Parent Tax Non Filing Statement

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple

- eSignature Virginia Healthcare / Medical Living Will Computer

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online

- eSignature Alabama Insurance Forbearance Agreement Safe

- How Can I eSignature Arkansas Insurance LLC Operating Agreement

- Help Me With eSignature Michigan High Tech Emergency Contact Form

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now

- How Do I eSignature Mississippi Insurance Separation Agreement

- Help Me With eSignature Missouri Insurance Profit And Loss Statement

- eSignature New Hampshire High Tech Lease Agreement Template Mobile

- eSignature Montana Insurance Lease Agreement Template Online

- eSignature New Hampshire High Tech Lease Agreement Template Free

- How To eSignature Montana Insurance Emergency Contact Form