ANNUAL EXEMPTION REQUEST FORMPortland Gov 2020-2026

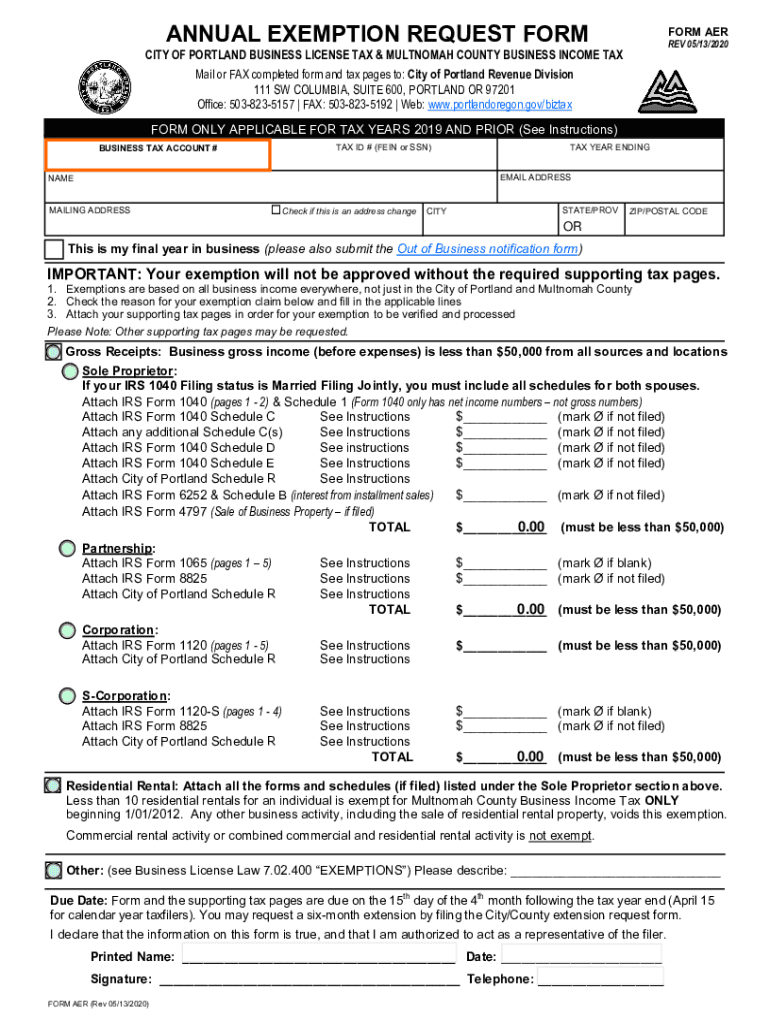

What is the Annual Exemption Request Form?

The Annual Exemption Request Form is a specific document used to apply for exemptions from certain taxes or fees in Portland. This form is essential for individuals or businesses seeking to reduce their tax burden based on qualifying criteria. It typically pertains to property tax exemptions and is designed to ensure that eligible applicants receive the financial relief they are entitled to under local laws.

How to Obtain the Annual Exemption Request Form

The Annual Exemption Request Form can be obtained directly from the official Portland government website. Users can navigate to the relevant section dedicated to tax forms or exemptions. Additionally, physical copies may be available at local government offices for those who prefer to fill out the form in person. Ensuring that you have the most current version of the form is crucial for proper submission.

Steps to Complete the Annual Exemption Request Form

Completing the Annual Exemption Request Form involves several key steps:

- Gather necessary documentation, including proof of eligibility such as income statements or property ownership records.

- Fill out the form with accurate information, ensuring that all sections are completed to avoid delays.

- Review the form for any errors or omissions before submission.

- Submit the form according to the specified method, whether online, by mail, or in person.

Eligibility Criteria for the Annual Exemption Request Form

To qualify for the exemptions offered through the Annual Exemption Request Form, applicants must meet specific eligibility criteria. These may include:

- Residency status in Portland.

- Income limits that align with local guidelines.

- Ownership of the property for which the exemption is requested.

It is important to review the detailed eligibility requirements provided by the Portland government to ensure compliance.

Form Submission Methods

Applicants have multiple options for submitting the Annual Exemption Request Form:

- Online: Many forms can be submitted electronically through the Portland government portal.

- By Mail: Completed forms can be sent to the designated tax office address.

- In-Person: Applicants may choose to deliver their forms directly to local government offices.

Key Elements of the Annual Exemption Request Form

The Annual Exemption Request Form includes several critical sections that must be completed accurately:

- Applicant Information: Personal details of the individual or business applying for the exemption.

- Property Details: Information about the property for which the exemption is requested, including address and tax identification number.

- Eligibility Information: Sections that require applicants to provide proof of eligibility, such as income verification.

Completing these sections thoroughly is essential for a successful application.

Quick guide on how to complete annual exemption request formportland gov

Complete ANNUAL EXEMPTION REQUEST FORMPortland gov effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to easily locate the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, modify, and eSign your documents promptly without hiccups. Manage ANNUAL EXEMPTION REQUEST FORMPortland gov on any device with airSlate SignNow's Android or iOS applications and enhance any document-centric workflow today.

How to modify and eSign ANNUAL EXEMPTION REQUEST FORMPortland gov without difficulty

- Locate ANNUAL EXEMPTION REQUEST FORMPortland gov and select Get Form to begin.

- Utilize the tools available to complete your document.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow specifically provides for this purpose.

- Create your signature using the Sign feature, which only takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Select your preferred method of sharing your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing fresh copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Modify and eSign ANNUAL EXEMPTION REQUEST FORMPortland gov and ensure excellent communication at any phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct annual exemption request formportland gov

Create this form in 5 minutes!

How to create an eSignature for the annual exemption request formportland gov

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the ANNUAL EXEMPTION REQUEST FORMPortland gov?

The ANNUAL EXEMPTION REQUEST FORMPortland gov is a document that allows eligible property owners in Portland to apply for an exemption on their property taxes. This form is essential for those looking to reduce their tax burden and ensure they are taking advantage of available exemptions.

-

How can airSlate SignNow help with the ANNUAL EXEMPTION REQUEST FORMPortland gov?

airSlate SignNow streamlines the process of completing and submitting the ANNUAL EXEMPTION REQUEST FORMPortland gov. With our easy-to-use platform, you can fill out, eSign, and send your form quickly, ensuring you meet all deadlines without hassle.

-

Is there a cost associated with using airSlate SignNow for the ANNUAL EXEMPTION REQUEST FORMPortland gov?

Yes, airSlate SignNow offers various pricing plans to suit different needs. Our cost-effective solutions ensure that you can manage your ANNUAL EXEMPTION REQUEST FORMPortland gov efficiently without breaking the bank.

-

What features does airSlate SignNow offer for the ANNUAL EXEMPTION REQUEST FORMPortland gov?

airSlate SignNow provides features such as customizable templates, secure eSigning, and document tracking specifically for the ANNUAL EXEMPTION REQUEST FORMPortland gov. These features enhance your experience and ensure your documents are handled professionally.

-

Can I integrate airSlate SignNow with other tools for the ANNUAL EXEMPTION REQUEST FORMPortland gov?

Absolutely! airSlate SignNow integrates seamlessly with various applications, allowing you to manage your ANNUAL EXEMPTION REQUEST FORMPortland gov alongside your other business tools. This integration helps streamline your workflow and improve efficiency.

-

What are the benefits of using airSlate SignNow for the ANNUAL EXEMPTION REQUEST FORMPortland gov?

Using airSlate SignNow for the ANNUAL EXEMPTION REQUEST FORMPortland gov offers numerous benefits, including time savings, enhanced security, and improved accuracy. Our platform ensures that your documents are processed quickly and securely, giving you peace of mind.

-

How do I get started with airSlate SignNow for the ANNUAL EXEMPTION REQUEST FORMPortland gov?

Getting started with airSlate SignNow is easy! Simply sign up for an account, choose the appropriate plan, and begin creating your ANNUAL EXEMPTION REQUEST FORMPortland gov. Our user-friendly interface guides you through the process step-by-step.

Get more for ANNUAL EXEMPTION REQUEST FORMPortland gov

Find out other ANNUAL EXEMPTION REQUEST FORMPortland gov

- eSign Michigan Car Dealer Operating Agreement Mobile

- Can I eSign Mississippi Car Dealer Resignation Letter

- eSign Missouri Car Dealer Lease Termination Letter Fast

- Help Me With eSign Kentucky Business Operations Quitclaim Deed

- eSign Nevada Car Dealer Warranty Deed Myself

- How To eSign New Hampshire Car Dealer Purchase Order Template

- eSign New Jersey Car Dealer Arbitration Agreement Myself

- eSign North Carolina Car Dealer Arbitration Agreement Now

- eSign Ohio Car Dealer Business Plan Template Online

- eSign Ohio Car Dealer Bill Of Lading Free

- How To eSign North Dakota Car Dealer Residential Lease Agreement

- How Do I eSign Ohio Car Dealer Last Will And Testament

- Sign North Dakota Courts Lease Agreement Form Free

- eSign Oregon Car Dealer Job Description Template Online

- Sign Ohio Courts LLC Operating Agreement Secure

- Can I eSign Michigan Business Operations POA

- eSign Car Dealer PDF South Dakota Computer

- eSign Car Dealer PDF South Dakota Later

- eSign Rhode Island Car Dealer Moving Checklist Simple

- eSign Tennessee Car Dealer Lease Agreement Form Now