or 20 V 2017

What is the OR 20 V?

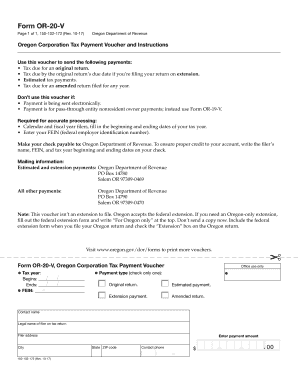

The OR 20 V is a tax form used in the state of Oregon. It is primarily designed for individuals and businesses to report specific tax-related information to the Oregon Department of Revenue. This form is essential for those who need to declare certain types of income or claim specific tax credits. Understanding the purpose of the OR 20 V can help ensure compliance with state tax regulations and facilitate accurate reporting.

How to Use the OR 20 V

Using the OR 20 V involves filling out the form accurately to report your income or claim credits. Begin by gathering all necessary financial documents, including income statements and any relevant tax documents. Carefully complete each section of the form, ensuring that all information is correct and clearly presented. After filling out the form, review it for accuracy before submission to avoid potential delays or penalties.

Steps to Complete the OR 20 V

Completing the OR 20 V requires a systematic approach:

- Gather all necessary documentation, including income records and previous tax returns.

- Fill out personal identification information at the top of the form.

- Report your income in the designated sections, ensuring accuracy.

- Claim any applicable deductions or credits as outlined in the form instructions.

- Review the completed form for errors or omissions.

- Sign and date the form before submission.

Legal Use of the OR 20 V

The OR 20 V is legally required for specific tax filings in Oregon. Failure to submit this form when necessary can result in penalties or legal repercussions. It is important to understand the legal implications of using the OR 20 V, including the requirement to report accurate information and adhere to filing deadlines. Familiarizing yourself with the legal framework surrounding this form helps ensure compliance and protects against potential issues with tax authorities.

Filing Deadlines / Important Dates

Filing deadlines for the OR 20 V are crucial to avoid penalties. Typically, the form must be submitted by the annual tax filing deadline, which is usually April fifteenth for most taxpayers. However, specific circumstances may alter this date, such as extensions or special provisions for certain taxpayers. Staying informed about these important dates can help ensure timely submissions and compliance with state tax regulations.

Required Documents

To complete the OR 20 V, you will need several key documents:

- Income statements, such as W-2s or 1099s.

- Previous tax returns for reference.

- Documentation supporting any deductions or credits claimed.

- Identification information, including Social Security numbers.

Having these documents ready will streamline the completion process and help ensure accuracy.

Quick guide on how to complete or 20 v

Manage Or 20 V seamlessly on any device

Web-based document management has gained traction among organizations and individuals. It offers a superb environmentally-friendly substitute for traditional printed and signed papers, as you can locate the proper form and securely keep it online. airSlate SignNow provides all the tools you need to create, edit, and eSign your documents rapidly without delays. Handle Or 20 V on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

The easiest method to edit and eSign Or 20 V effortlessly

- Obtain Or 20 V and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize relevant sections of the documents or conceal sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Select how you want to send your form, via email, SMS, or invitation link, or download it to your computer.

Quit worrying about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills your document management requirements in just a few clicks from the device of your choosing. Edit and eSign Or 20 V and guarantee excellent communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct or 20 v

Create this form in 5 minutes!

How to create an eSignature for the or 20 v

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow and how does it relate to 'or 20 v.'?

airSlate SignNow is a powerful eSignature solution that allows businesses to send and sign documents electronically. The term 'or 20 v.' refers to the versatility and value of our platform, which can streamline your document workflows and enhance productivity.

-

How much does airSlate SignNow cost?

Pricing for airSlate SignNow varies based on the plan you choose. Our plans are designed to be cost-effective, ensuring that you get the best value for your investment, especially when considering the benefits of 'or 20 v.' features.

-

What features does airSlate SignNow offer?

airSlate SignNow includes a range of features such as document templates, real-time collaboration, and advanced security measures. These features are designed to enhance your experience and provide the flexibility that 'or 20 v.' signifies in document management.

-

Can I integrate airSlate SignNow with other applications?

Yes, airSlate SignNow offers seamless integrations with various applications, including CRM systems and cloud storage services. This capability allows you to enhance your workflows and leverage the 'or 20 v.' advantage of interconnected tools.

-

Is airSlate SignNow secure for sensitive documents?

Absolutely! airSlate SignNow employs industry-leading security measures to protect your sensitive documents. With features like encryption and secure access, you can trust that your information is safe, aligning with the 'or 20 v.' standard of security.

-

How can airSlate SignNow benefit my business?

By using airSlate SignNow, your business can save time and reduce costs associated with traditional document signing processes. The efficiency and ease of use reflect the 'or 20 v.' philosophy, making it an ideal choice for modern businesses.

-

What types of documents can I send with airSlate SignNow?

You can send a variety of documents with airSlate SignNow, including contracts, agreements, and forms. The platform's flexibility ensures that no matter the document type, you can utilize the 'or 20 v.' capabilities to manage them effectively.

Get more for Or 20 V

Find out other Or 20 V

- eSign Utah Non-Profit LLC Operating Agreement Safe

- eSign Utah Non-Profit Rental Lease Agreement Mobile

- How To eSign Rhode Island Legal Lease Agreement

- How Do I eSign Rhode Island Legal Residential Lease Agreement

- How Can I eSign Wisconsin Non-Profit Stock Certificate

- How Do I eSign Wyoming Non-Profit Quitclaim Deed

- eSign Hawaii Orthodontists Last Will And Testament Fast

- eSign South Dakota Legal Letter Of Intent Free

- eSign Alaska Plumbing Memorandum Of Understanding Safe

- eSign Kansas Orthodontists Contract Online

- eSign Utah Legal Last Will And Testament Secure

- Help Me With eSign California Plumbing Business Associate Agreement

- eSign California Plumbing POA Mobile

- eSign Kentucky Orthodontists Living Will Mobile

- eSign Florida Plumbing Business Plan Template Now

- How To eSign Georgia Plumbing Cease And Desist Letter

- eSign Florida Plumbing Credit Memo Now

- eSign Hawaii Plumbing Contract Mobile

- eSign Florida Plumbing Credit Memo Fast

- eSign Hawaii Plumbing Claim Fast